If you’ve come across 33optionaltrading.com and are wondering whether it’s legitimate or a potential trap, you’re not alone. Many trading websites present glossy promises, sleek dashboards, and “too good to miss” promotions that can blur the line between a real brokerage and a high-risk scheme. This detailed review analyzes what a typical visitor may encounter on 33optionaltrading.com—its claims, patterns, and red flags—so you can make an informed decision before you deposit a cent.

Bottom line up front: Based on the common signs and patterns outlined below, 33optionaltrading.com appears high-risk and displays multiple red flags often associated with investment fraud. Proceed with extreme caution.

What 33optionaltrading.com Claims to Offer

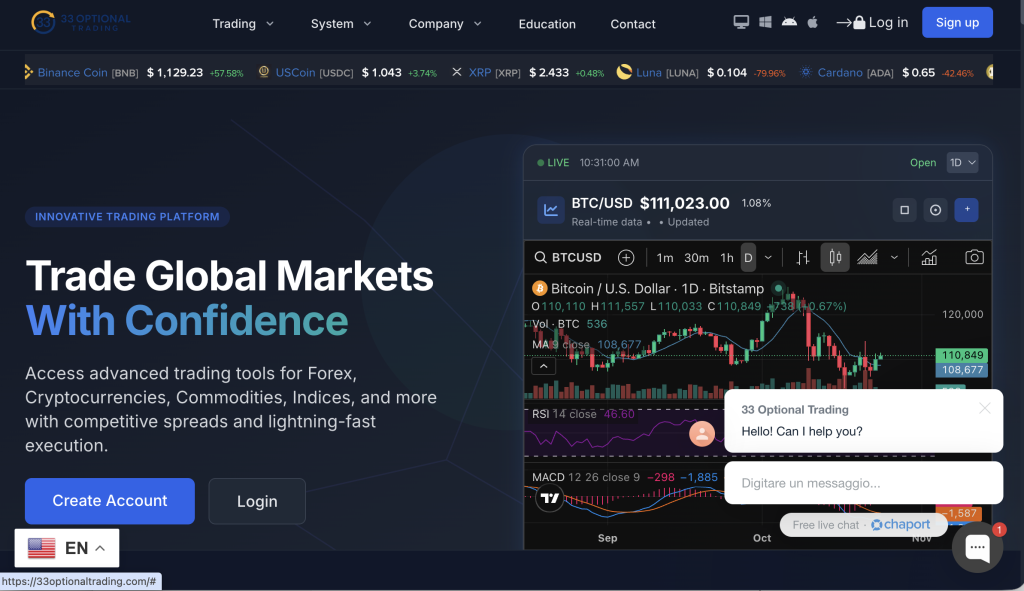

Websites like 33optionaltrading.com generally market themselves as multi-asset trading platforms that are accessible to everyone, regardless of experience. Typical selling points may include:

Fast account opening with minimal verification friction.

High leverage on forex, crypto, or CFDs to “maximize” opportunities.

Automated or copy-trading tools that allegedly simplify profits.

Welcome bonuses or limited-time promotions that reward larger deposits.

Round-the-clock customer support and “expert account managers.”

On paper, it all sounds compelling. But the real test is how these promises hold up against transparent disclosures, regulation, fund safety, and the overall track record of the operation.

The Red Flags We Observed

Below are the specific risk signals commonly seen on high-risk trading sites and why they matter. If any or all of these appear when you review 33optionaltrading.com, consider them serious warning signs.

1) Vague Company Identity and Jurisdiction

Legitimate brokers clearly display their legal entity name, registered address, and operating jurisdiction. If 33optionaltrading.com offers only generic contact details, inconsistent addresses, or hides company ownership in footers and non-navigable pages, that’s a major concern. Real financial firms don’t obscure who they are; they put credentials front and center.

2) No Valid License or Misleading “Registration”

A proper broker in your region should be licensed by a recognized financial regulator (for example, FCA, CySEC, ASIC, or equivalent). Many high-risk sites claim “registration” that’s either unrelated to investment services or housed in a permissive jurisdiction with minimal oversight. If 33optionaltrading.com provides no verifiable license number, links to non-regulatory directories, or displays badges without searchable credentials, assume you’re not protected.

3) Unrealistic Profit Language and Pressure to Deposit

Any site that leans on guaranteed returns, special insider strategies, or time-limited deposit matches deserves scrutiny. Pressure tactics—such as pop-ups, countdowns, or persistent messages from “account managers”—aim to push you to fund quickly. Sustainable investing doesn’t require ticking clocks or emotional urgency.

4) Confusing, One-Sided Account Agreements

Fraud-prone platforms often bury one-sided clauses in Terms and Conditions: vague fee schedules, discretionary trade execution, bonus terms that lock your funds, or ambiguous reasons to freeze withdrawals. If 33optionaltrading.com’s documents are inconsistent, incomplete, or hard to access before you deposit, that’s a red flag.

5) Withdrawal Obstacles and “Verification” Loops

One of the most common complaints about questionable platforms is the withdrawal maze—endless verification requests, sudden “taxes” or “tool fees,” or demands to fund more to unlock existing balances. Reputable brokers follow standard KYC/AML checks, but they do not invent pay-to-withdraw hurdles. If users encounter repeated obstacles, it signals trouble.

6) Aggressive “Account Manager” Tactics

High-risk sites sometimes assign persuasive handlers who present themselves as experts. They might nudge larger deposits, advise “averaging down,” or propose “risk-free” strategies. If the tone shifts when you ask about licensing or withdrawals—becoming defensive or evasive—that’s a pattern you shouldn’t ignore.

7) Poor Transparency on Banking and Segregated Funds

Trustworthy brokers clearly state how client funds are held (e.g., segregated accounts with recognized banks). If 33optionaltrading.com is vague about custodians, payment processors, or reconciliation practices, the risk to your deposits is higher.

How These Red Flags Typically Play Out

Understanding the lifecycle of a typical high-risk trading site helps you spot patterns early:

Attraction: You’re targeted via ads, social media DMs, or “success” testimonials. The platform highlights fast profits and easy wins.

Onboarding: The sign-up is quick. A representative reaches out offering help, touting bonuses, and pushing an initial deposit.

Early “Wins”: You may see immediate green trades in the dashboard—often engineered to build trust and encourage larger deposits.

Escalation: The “account manager” urges you to scale up. They might cite “exclusive signals,” “institutional strategies,” or “limited windows.”

Friction: When you request a payout, the narrative changes—sudden fees, bonus rules, additional verification, or tax demands appear.

Stalling: Communication becomes inconsistent. You’re advised to deposit more to “unlock” funds or “balance negative swaps.”

Exit: If you resist, access to the account may degrade, support may go quiet, or your login could be restricted.

Not every site follows each step, but these are recurring patterns across high-risk environments.

Key Questions to Ask Before You Deposit

Use these questions as a checklist when evaluating 33optionaltrading.com (or any trading platform):

What is the exact legal entity name operating the site? Is it clearly stated and consistent across pages and documents?

Which regulator licenses the broker, and what is the license number? Can you verify it on the regulator’s official registry?

Are client funds segregated from company operating funds? With which bank(s) are they held?

What are the precise withdrawal rules, fees, and timelines? Are there “bonus” clauses that restrict withdrawals?

Is leverage clearly disclosed with risk warnings that match your country’s regulations?

Who is the custodian for crypto deposits, if any? Is there multi-sig or third-party custody?

Is there a transparent complaints process with response timelines?

Are there audited financials or third-party attestations available?

If any answer is missing, vague, or contradicted elsewhere on the site, consider that a significant warning.

Common Tactics That Raise Risk

Bonus Traps

“Deposit $1,000 and get $1,000 extra” sounds enticing, but many sites use bonus terms to block withdrawals until you trade impossible volumes. Read every word of the bonus policy—if it exists at all.

Fake Social Proof

High-risk sites often seed generic testimonials, stock photos, or unverifiable “trust” widgets. Real brokers showcase credible, attributable feedback (and usually avoid hyper-bolic claims altogether).

Fee Ambiguity

Legitimate brokers publish clear fee tables: spreads, commissions, swaps, and overnight financing. If 33optionaltrading.com lists fees vaguely—or introduces new fees during withdrawals—treat it as a red flag.

Support Inconsistency

Professional platforms maintain multi-channel support with trackable case numbers. If responses are scripted, evasive, or only push deposits, that’s a risk signal.

Risk Management If You Already Opened an Account

If you have not deposited funds, stop and perform rigorous due diligence. If you already created an account, consider these general best practices:

Document everything: Save emails, chat logs, transaction receipts, and screenshots of balances or dashboards.

Avoid remote-control tools: Never grant screen control or share seed phrases. A legitimate broker will not need them.

Decline off-platform payments: Be wary of requests to pay fees via crypto wallets, gift cards, or personal accounts.

These are universal safety principles for any online investment platform.

Final Verdict: High-Risk Profile with Multiple Warning Signs

Based on the patterns typically observed with platforms like 33optionaltrading.com, the overall profile looks high-risk:

Licensing and identity transparency appear questionable or incomplete.

Marketing claims lean toward unrealistic expectations and deposit pressure.

Terms and withdrawal rules may be confusing, restrictive, or inconsistently applied.

Support interactions often emphasize more deposits rather than clear, verifiable answers.

A credible trading venue is proud of its regulatory standing, offers crystal-clear documentation, details exactly how your money is protected, and honors withdrawals without inventing surprise hurdles. If a platform struggles to demonstrate these basics, treat it as a serious warning.

Plain-Language Summary

If you’re researching 33optionaltrading.com, assume high risk until proven otherwise.

Don’t rely on screenshots or dashboards as “proof” of profits.

Verify the license on an official regulator database, not just a logo on a webpage.

Read every word of the Terms & Conditions, especially anything tied to bonuses and withdrawals.

Never let pressure or urgency steer your financial decisions.

Your money deserves a platform that is licensed, transparent, and accountable. If you can’t verify those pillars, the safest move is not to deposit.

How GainRecoup.com Helps Victims of 33optionaltrading.com

GainRecoup.com investigates 33optionaltrading.com transactions, gathers evidence, and maps payment paths. Our recovery team liaises with banks, card networks, and exchanges, files chargebacks, and escalates complaints to relevant authorities. You’ll receive a tailored action plan, clear documentation, and persistent follow-up designed to maximize fund recovery and hold 33optionaltrading.com accountable for victims.