If you’ve recently come across Sxr922 while researching new ways to trade, invest, or “earn” online, you’re not alone. The platform’s minimalistic name, sleek visuals, and bold claims can be compelling. But when you look more closely at structure, messaging, and behavior patterns, Sxr922 displays many of the classic red flags associated with high-risk or outright fraudulent platforms. This comprehensive review explains why the warning signs matter, how schemes like this typically operate, and what practical checks you can use to evaluate any platform that resembles Sxr922. The language is inclusive and clear, and the structure is optimized for search terms such as Sxr922 scam, Sxr922 review, and is Sxr922 legit so more people can find and understand it.

The Pitch: What Sxr922 Seems to Promise

Platforms like Sxr922 tend to present a polished story:

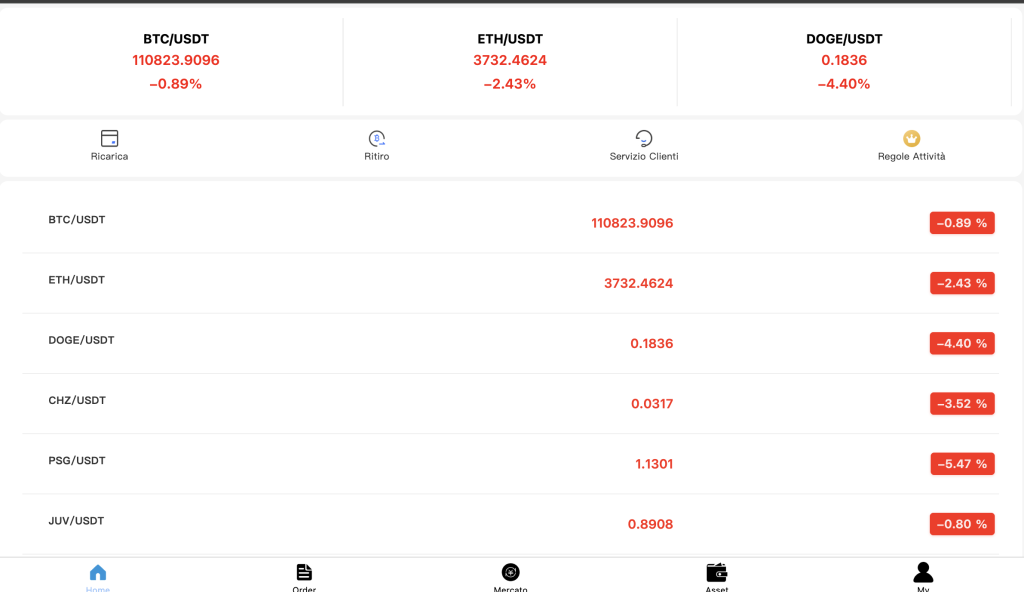

Professional dashboards with live-looking charts and balances

Easy onboarding with simple sign-up flows and quick “verification”

Confident language about safety, technology, and transparency

Bold performance claims, sometimes framed as steady or even “guaranteed” returns

Incentives and bonuses to nudge the very first deposit

The combined effect is to reduce skepticism and accelerate your first transaction. Unfortunately, a persuasive interface is not the same thing as verifiable legitimacy.

Key Red Flags That Surround Sxr922

Below are the most concerning signals that commonly appear in platforms like Sxr922. None of these red flags alone proves wrongdoing, but together they create a strong risk picture.

1) No verifiable licensing or regulator oversight

Trustworthy financial services prominently list regulation and license numbers—and those details can be confirmed in official registries. When a platform either omits licensing information or provides details you can’t independently verify, it’s a major warning sign. Without recognized oversight, there’s no external check on how client funds are handled.

2) Hidden ownership and vague corporate identity

Legitimate firms name their legal entity, executives, company number, and physical address. If Sxr922 (or any similar service) hides behind privacy shields, generic email forms, and PO boxes, accountability vanishes. Opaque ownership is one of the strongest predictors of poor user outcomes.

3) Newly minted or disposable domain patterns

While new companies exist, brand-new domains combined with financial promises are risky—especially when tied to short, alphanumeric names that can be replaced quickly. This layout supports a rinse-and-repeat cycle: collect deposits, go quiet, reappear under a slightly different name.

4) “Guaranteed” or unusually steady returns

Markets move. Real performance is lumpy. If Sxr922 implies consistent daily/weekly yields or no-risk profits, it’s clashing with how markets actually behave. Guarantees and risk-free language are hallmarks of schemes designed to recruit deposits fast.

5) Withdrawal friction and pay-to-unlock tactics

A classic pattern looks like this: deposits are instant, withdrawals are not. Users are suddenly confronted with new “compliance fees,” “unlocking charges,” fresh identity checks, or volume requirements that didn’t exist at signup. If profits only exist on a dashboard but won’t leave the platform, they’re not profits.

6) Non-stop upsells and urgency

Countdowns, “VIP tiers,” limited-time boosts, and pushy outreach are used to override caution. Reputable platforms rarely pressure you with expiring offers—especially not in exchange for a larger deposit.

7) Reputation shaped by manufactured praise

An all-positive review environment without balanced, detailed user experiences is suspicious. Beware of cookie-cutter testimonials, recycled stock photos, and vague praise that never mentions specifics like instruments, order execution quality, or slippage.

How a Scheme Like Sxr922 Typically Operates

Understanding the lifecycle helps you spot the danger earlier. Here’s the common sequence used by high-risk platforms:

Attract

Social posts, ads, cold messages, and referral pitches point you to a stylish site. The copy emphasizes safety, technology, and “community.”Onboard

Registration is seamless. The dashboard looks professional. You feel like you’ve joined a serious platform.Seed trust

Small deposits “perform.” Balances tick up. Some users may even complete a tiny withdrawal—this is deliberate to build confidence.Escalate

You’re encouraged to deposit more or upgrade to a “premium” plan to unlock higher returns or better tools.Trap the exit

The moment you request a meaningful withdrawal, the platform introduces new hurdles: identity rechecks, fees, or minimum-volume rules you never saw before.Fade out

Support stops replying, tickets loop, or accounts are frozen. The brand may then pivot or relaunch under a fresh domain.

Sxr922 vs. Legitimate Platforms: A Quick Comparison

| Area | Legitimate Provider | Sxr922-Style Risk Pattern |

|---|---|---|

| Regulation | Clear regulator + license number you can verify | Vague claims; unverified or absent regulator references |

| Ownership | Named company, directors, physical address | Masked WHOIS, generic contact form, no real-world presence |

| Returns | No guarantees; performance varies | Smooth, “daily,” or “guaranteed” yields |

| Withdrawals | Transparent timelines and fees | Delays, surprise fees, “unlocking” costs, shifting rules |

| Audits/Assurance | Independent audits, named providers | Buzzwords about security with no third-party validation |

| Reviews | Balanced feedback across multiple sources | One-note adoration or templated testimonials |

Language and Design Signals to Watch

Scam-leaning sites often use the same design vocabulary:

Tech gloss: phrases like “AI-powered,” “institutional liquidity,” and “military-grade encryption” with no independent proof

Confidence theater: live-looking tickers and charts that are just UI elements—not proof of real execution

Funnel copy: repeated nudges to “act now,” “upgrade,” or “don’t miss out”

If the only evidence you can see lives on the platform’s own pages, you’re not looking at evidence—you’re looking at marketing.

Practical, Inclusive Checklist for Evaluating Sxr922 (or Any Similar Site)

This short, plain-language checklist is designed to work for everyone—whether you’re brand new to online investing or have years of experience.

Regulatory reality check

Can you verify a license number in an official regulator registry? If you can’t, treat the platform as unregulated.Company transparency

Is there a full legal name, registered address, and a way to confirm that information independently?Audit visibility

Has a credible third party attested to security, custody, or financial statements? Real audits include the auditor’s name and date.Withdrawal logic

Are the rules and fees clear before you deposit? Surprise costs at withdrawal are a red flag.Return claims

Does the platform avoid guaranteeing performance? If it promises certainty, it’s marketing fantasy.Reputation pattern

Do reviews include specifics (instruments, order handling, actual withdrawal timelines), or are they vague and repetitive?Domain sanity

How old is the domain? Is ownership masked? Are there look-alike or sister sites with near-identical design?Support behavior

Ask hard questions before depositing. If you get canned responses or pressure to deposit, step back.

Why Sxr922’s Structure Is Especially Concerning

Opacity is a feature, not a bug: Hidden ownership and unverifiable claims block accountability.

The interface is the product: The platform’s main deliverable is a convincing dashboard, not verifiable results.

Risk is one-way: The platform bears no risk. Users bear all of it—from frozen balances to identity exposure.

Speed and urgency are strategic: The faster you move from sign-up to deposit, the less time you spend verifying.

Clear Examples of Red-Flag Phrases

“Guaranteed daily profits” — No professional platform can promise that.

“Unlock higher yields by upgrading today” — Paywalls for “better” returns are a pressure tactic.

“Immediate compliance fee required to withdraw” — Legit providers publish their fee schedule in advance.

“Taxes must be paid upfront to release funds” — Tax handling is not conducted this way on reputable platforms.

“Our regulator is global” — There is no such thing as a generic “global” regulator.

Final Verdict: Why Sxr922 Looks Like a Scam

Everything that builds durable trust—verifiable regulation, transparent ownership, credible third-party audits, and consistent, documented withdrawals—is either missing, unclear, or replaced by interface theatrics and pushy conversion tactics. A platform’s dashboard can look perfect while telling you nothing true about custody, liquidity, or real trade execution.

Sxr922 fits the risk profile of a high-risk, unregulated platform: rapid onboarding, polished but unverifiable claims, upsells to larger deposits, and obstacles when you try to leave. Until a service can demonstrate real oversight and reproducible, user-verified withdrawals on stated terms—not just promises on a web page—the safest, most reasonable conclusion is that Sxr922 is not a trustworthy platform.

Use the checklist above whenever a new site promises effortless returns. Scams repeat the same patterns because those patterns work. Recognizing the signals early is your best defense.

HOW GAINRECOUP.COM CAN HELP YOU.

Gainrecoup.com ensures peace of mind by guiding you through a secure, professional process to recover funds lost to the Sxr922, restoring confidence and helping you reclaim what’s yours.