In the fast-moving world of online investing, new platforms appear daily with polished websites, bold promises, and reassuring language. SolidTrustsInvest.com presents itself as a modern, professional outfit that helps anyone grow wealth through crypto, forex, and diversified portfolios. Yet a closer look reveals a familiar pattern of red flags that responsible investors should not ignore. This detailed review breaks down how the platform presents itself, what warning signs to look for, and why SolidTrustsInvest.com fits the profile of a high-risk, deceptive operation rather than a transparent, trustworthy service.

Quick Summary (for readers in a hurry)

No clear, verifiable regulation or licensing is displayed in a transparent way.

Unrealistic profit claims and vague “guaranteed returns” messaging are used to hook newcomers.

Opaque company identity (unclear ownership, registration, or physical office details) raises accountability concerns.

Withdrawal obstacles reportedly appear after deposits—extra “fees,” shifting requirements, and unexplained delays.

Copy-and-paste style content (generic “team” bios, stock imagery, and templated promises) signals a marketing façade rather than a real investment operation.

If a platform looks and sounds like this, it’s safer to keep your distance.

First Impressions: Polished Surface, Hidden Depths

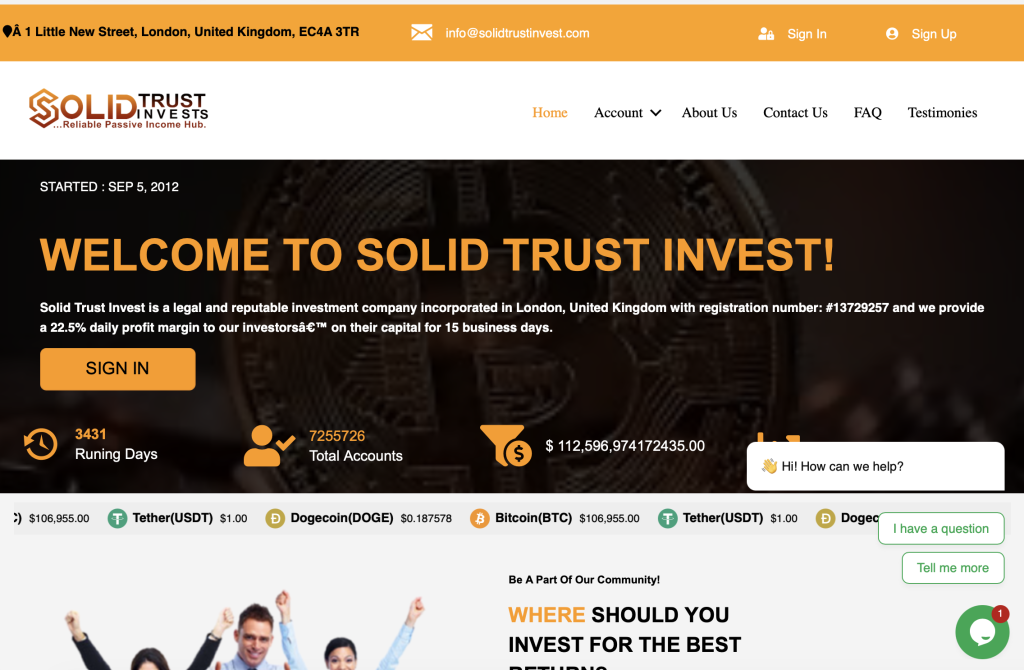

SolidTrustsInvest.com adopts a sleek, confidence-inspiring look: a clean homepage, upbeat promises, and a tone that welcomes everyone—beginners and experienced traders alike. The branding leans on words like “secure,” “trusted,” “smart,” and “professional,” and it suggests:

Automated strategies or expert managers “working for you”

“Instant” or “fast” withdrawals

Low fees with high returns

Round-the-clock customer support

On the surface, this inclusive pitch feels reassuring—who doesn’t want a platform that works for all backgrounds and levels of experience? But inclusive language must be matched by inclusive protections: real regulation, traceable accountability, and verifiable transparency. That is where SolidTrustsInvest.com falters.

The Biggest Red Flag: Where’s the Proper Licensing?

Legitimate investment firms display their regulatory permissions clearly and consistently. This usually includes:

The name of the regulator (for example, financial authorities in the region they serve)

A license/registration number you can independently verify

A registered legal entity name and physical address that can be cross-checked

With SolidTrustsInvest.com, these essentials are either missing, buried in vague wording, or presented in a way that can’t be independently validated. If you can’t easily verify who is legally responsible for holding your funds—and under which laws they operate—you are taking on an unnecessary and severe risk.

Bottom line: if the license is unclear, unverifiable, or absent, consider that a deal-breaker.

“Guaranteed Profits” and Other Unrealistic Claims

Another hallmark of risky platforms is the promise of guaranteed returns, “risk-free” profits, or “high yield with minimal risk.” Markets simply don’t work that way. Every credible broker or asset manager emphasizes the reality of riskand volatility. When a website suggests the opposite, it’s using marketing psychology, not sound investment principles.

Common phrases to watch out for:

“Daily guaranteed earnings”

“Assured returns regardless of market conditions”

“Exclusive algorithm that never loses”

“No experience required—profits on autopilot”

If SolidTrustsInvest.com leans on these promises, that’s a strong signal the platform is selling a dream rather than providing a regulated financial service.

Vague “About Us” Pages and Copycat Content

Fraud-leaning sites often rely on generic text and stock images. Team profiles may lack last names, verifiable backgrounds, or links to legitimate professional histories. The “About” section may be rich in buzzwords but thin on meaningful detail:

No audited results

No independent performance verification

No named executives with credible, checkable track records

No third-party custodianship information (i.e., who actually holds client funds and where)

If SolidTrustsInvest.com talks a lot about “vision” and “mission” but cannot point to verifiable, concrete facts, it’s marketing smoke rather than substance.

The Classic Trap: Smooth Deposits, Problematic Withdrawals

One of the most common patterns with suspicious platforms is how they handle money after you’ve deposited:

Deposits are easy and fast. The dashboard shows enticing “profits” within days—numbers that make you feel smart and encourage you to add more.

Upgrade pressure. An “account manager” nudges you to deposit larger amounts to unlock “VIP returns,” “priority signals,” or “tax-free payouts.”

Withdrawal hurdles. When you finally request a withdrawal, the story changes. Suddenly you need to:

Pay a “release” or “clearance” fee

Cover unexpected “taxes” upfront

Re-verify your identity in ways that keep moving the goalposts

Wait for “system maintenance” or “liquidity windows”

Each delay buys time and keeps your funds trapped. In some cases, accounts are even suspended when users push too hard for withdrawals. If SolidTrustsInvest.com displays this pattern, it aligns with a well-known scam playbook.

Terms and Conditions That Favor the House

Always read the fine print. On risky platforms, Terms and Conditions frequently include one-sided clauses that allow the company to:

Freeze or close accounts at its sole discretion

Void “bonuses” along with any associated profits

Introduce new fees or rules without notice

Reject withdrawals for vague reasons like “suspicious activity”

If SolidTrustsInvest.com’s terms are vague, contradictory, or heavily skewed against the user, that’s another serious red flag.

Domain and Branding Oddities

While a slick logo and a fresh domain might look modern, pay attention to details that often slip:

Very recent domain registration with little history

Inconsistent contact details (phone numbers that don’t connect, non-business email addresses, or mismatched addresses)

Multiple brand names used interchangeably across pages

Broken links or placeholder text that was never finished

These inconsistencies, taken together, can indicate a hastily assembled façade designed to harvest deposits rather than build a long-term, regulated business.

A Practical Checklist: How to Vet Platforms Like SolidTrustsInvest.com

Use this list before you fund any online platform:

Verify Regulation Yourself

Find the regulator named on the site. Search the regulator’s database for the exact company name and license number. If you can’t independently confirm it, treat the platform as unregulated.Confirm the Legal Entity

Look for a registered company name, number, and physical address that can be validated through official registers. Cross-check details across pages—consistency matters.Test Support Before Depositing

Ask specific questions about custody, banking partners, and withdrawal timelines. Vague or evasive responses are a warning sign.Start Small—Then Try Withdrawing

If you still proceed, use a minimal amount and attempt a withdrawal early. Friction at this stage is a sign to stop immediately.Read (and Save) the Terms

Screenshot or save the Terms and Conditions at sign-up. Look for clauses allowing the platform to freeze funds, change rules unilaterally, or force upfront “taxes” or “fees” before releasing withdrawals.Ignore “Guaranteed Returns”

There are none. Any platform claiming otherwise is using tactics to override your caution.Beware of Bonuses

“Bonuses” often come with strings attached that block withdrawals until arbitrary turnover targets are met.Check Content Quality

Generic, error-filled text; stock photos for the “team”; and inconsistent branding are all soft but meaningful indicators of low credibility.

Realistic Investing Principles (That Solid Investments Actually Follow)

A trustworthy platform embraces principles that keep you safe:

Risk disclosures are front-and-center, not hidden.

Fees are clear, simple, and published.

Regulatory information is specific and verifiable.

Client funds are segregated from company operating funds and held with recognized, audited custodians.

Communication is professional, consistent, and accountable—before and after you deposit.

If SolidTrustsInvest.com cannot meet these basic standards, it is not aligned with how credible investment services operate.

Final Verdict

SolidTrustsInvest.com looks like many glossy, high-promise platforms that have appeared in recent years. But the lack of verifiable regulation, the reliance on unrealistic profit claims, the opaque company identity, and the familiar pattern of deposit-easy/withdraw-hard together create a clear picture: this is a high-risk platform that should be avoided.

Great investing is not about finding a website that tells you what you want to hear. It’s about choosing partners who are regulated, transparent, and accountable—partners who earn your trust by showing their credentials, not just saying the right words.

If you value your time, money, and peace of mind, keep your distance from SolidTrustsInvest.com and choose well-established, properly licensed services that pair opportunity with genuine protection for everyone.

How GainRecoup.com Helps Victims of SolidTrustsInvest.com

GainRecoup.com investigates SolidTrustsInvest.com transactions, traces payment paths, and helps victims recover funds. Their recovery process includes:

Evidence gathering

Bank, exchange, and card-network coordination

Filing chargebacks

Regulatory reporting

Customized recovery strategies

If you’ve been affected, professional guidance increases your chances of reclaiming lost funds.