Quick Verdict (At a Glance)

Based on the patterns, promises, and presentation commonly associated with similarly named websites, tradetipanalysis.net exhibits multiple red-flag characteristics that many consumers would associate with a high-risk or deceptive trading operation. This review explains those warning signs in plain language, so you can evaluate the risks for yourself before engaging.

Important note: The observations below are based on widely reported behaviors of platforms that present themselves like tradetipanalysis.net. Treat this as risk education—not as a legal finding.

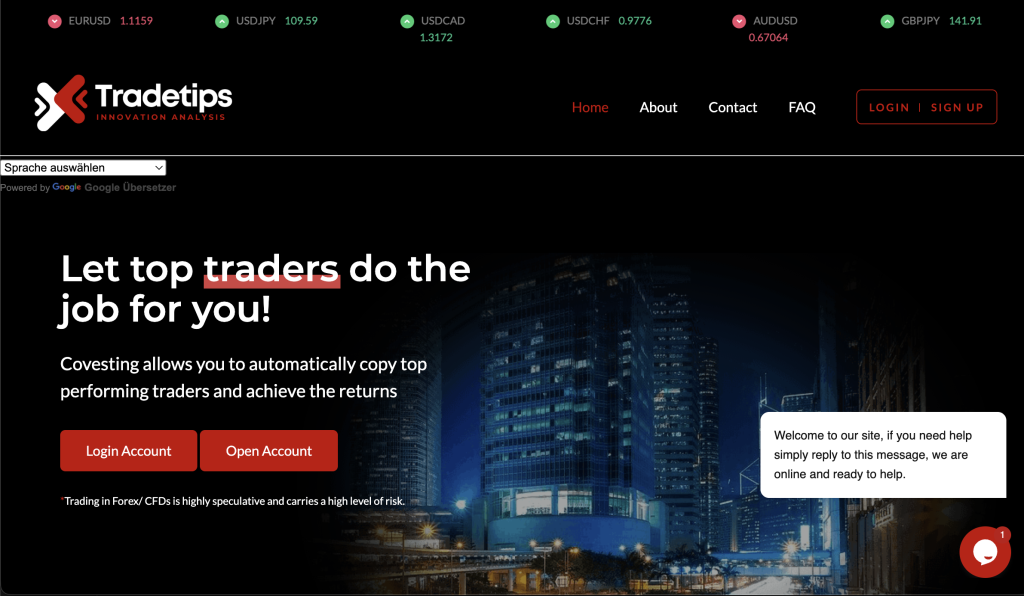

What Platforms Like tradetipanalysis.net Typically Promise

Websites in this niche tend to lead with persuasive marketing and a sleek interface. The promises often sound like this:

“Smart signals” and “pro” market insights that supposedly outperform the market.

Automated or semi-automated strategies that claim to minimize risk while maximizing returns.

Low entry barriers (small initial deposits) followed by nudges to “scale up.”

Fast withdrawals on demand and 24/7 support.

Testimonials or social proof implying broad success and satisfied traders.

Alone, none of these features proves misconduct. The issue is how these claims interplay with opaque terms, aggressive upselling, and withdrawal barriers—a combination frequently seen in high-risk operations.

The Red Flags to Watch For

1) Unverifiable Credentials and Vague Licensing

Legitimate platforms are usually crystal clear about who they are, where they are based, and under which regulator they operate. If a site provides unclear, conflicting, or overly generic licensing language, that is a red flag. “Registered company” is not the same as “regulated broker,” and vague “compliance” claims rarely equal real oversight.

What to check yourself: Look for the exact legal entity name, company number, and regulator authorization number. Confirm those details on the relevant public register (not just the platform’s own pages).

2) Unrealistic Performance Narratives

Marketing that suggests consistent, outsized returns with limited risk is a classic warning sign. Markets move, and even expert managers have volatile months. Any hint that you can “win most trades” or “earn passive high returns regardless of market conditions” should ring alarm bells.

3) Pressure-Based Sales and “Limited-Time” Upgrades

Many high-risk sites rely on urgency: “fund today,” “upgrade before the window closes,” or “double your deposit for VIP signals.” Pressure tactics shift your focus from diligence to speed, which benefits salespeople rather than investors.

4) Bonuses That Lock Your Balance

A common pattern is the bonus trap: you accept a “trading bonus,” then discover hidden turnover requirements or obscure rules that block withdrawals until you trade unrealistic volumes. These conditions can keep your funds tied up indefinitely.

5) Unclear Fees and Moving Goalposts

Look for ambiguous fees (e.g., “maintenance,” “liquidity,” “profit unlock,” or “tax clearance” fees) that appear only afteryou request a withdrawal. Reputable firms publish fee schedules upfront and don’t invent new charges at payout time.

6) “Account Manager” Overreach

Some platforms assign a “senior analyst” or “account manager” who encourages larger deposits, risky positions, or rapid scaling. When representatives discourage withdrawals, push you to reinvest profits, or claim your account will be closed if you don’t deposit, that’s a serious red flag.

7) Platform Manipulation Concerns

On riskier sites, the interface may display unverifiable price feeds, “signal wins,” or sudden slippage that always seems to disadvantage you. If the platform controls the quotes, spreads, and fills without third-party oversight, it can manufacture outcomes you can’t independently verify.

8) Withdrawal Delays and Document Loops

Long, repetitive identity checks after the platform has already accepted your deposits can indicate stalling tactics. Reasonable KYC is normal; endless cycles of new document requests or arbitrary rejections are not.

9) Minimal Company Footprint

If a platform’s team identities are generic or stock-photo-like, if the company’s address is shared by dozens of unrelated entities, or if there’s a thin track record beyond the website itself, proceed with caution.

How High-Risk Platforms Typically Operate (Lifecycle View)

Attraction: Ads or social posts promise trading signals, expert guidance, or “AI strategies.”

Onboarding: A smooth signup flow with low initial deposits builds trust and momentum.

Early Wins: Demo-like “profits” or small, fast withdrawals encourage bigger deposits.

Upsell Phase: “VIP tiers,” “copy pro traders,” or “higher leverage” gated behind larger funding.

Friction Appears: Withdrawal requests trigger new conditions—bonus turnover, extra fees, or “verification” hurdles.

Escalation: Support becomes script-heavy; “managers” emphasize reinvestment; unexplained trade outcomes may appear.

Exit Barriers: Users face delays, reduced balances from surprise fees, or outright non-responses.

If your interactions with tradetipanalysis.net follow this arc, you are encountering the classic pattern of a high-risk trading website.

Why “Regulation” Matters (And What It Really Means)

Regulated brokers must meet capital, segregation, and conduct rules, and they are supervised by named authorities.

Registration ≠ Authorization: A simple business registration does not grant permissions to offer leveraged trading or manage client funds.

Passporting claims (e.g., “we can serve all of Europe”) require specific legal bases. Vague or sweeping statements are not enough.

When a platform cannot provide verifiable regulatory details—entity name, license number, supervising body—you should assume you have limited recourse if things go wrong.

Common User Experiences on Look-Alike Sites

While individual stories vary, reports around similar platforms often cluster around these themes:

“I was urged to top up constantly” to access better tools or “save a position.”

“Small withdrawals worked” but larger ones met sudden conditions.

“Support stopped replying” after I questioned fees or requested a full payout.

“Bonuses locked my account” with turnover targets that didn’t match my risk tolerance.

“The dashboard numbers changed” in ways I couldn’t verify externally.

If your experience mirrors these patterns, take that seriously.

Practical Self-Checks You Can Do (Before Any Deposit)

Even without specialist tools, you can run a quick, methodical checklist:

Entity & License: Write down the exact corporate name and license number claimed. Confirm them on the official regulator’s database.

Jurisdiction Fit: If the site targets your country, does it have permissions there—not just in another region?

Fees & Terms: Read the full T&Cs for bonuses, turnover conditions, withdrawal rules, and extra charges that may appear only after profit.

Contact Details: Look for a working phone number, physical office you can independently verify, and staff profiles that are real and consistent.

Funding Logic: Be wary if you’re asked to use irreversible payment methods or to send funds to a name that doesn’t match the platform.

Test the Exit: If you must try it, start tiny and request a withdrawal early. Assess the experience before scaling up.

Platform Independence: Can you cross-check prices and trades with reputable external data? If not, you’re flying blind.

FAQs

Is tradetipanalysis.net legit?

Platforms with similar presentations often lack clear, verifiable regulation, rely on aggressive sales, and impose withdrawal hurdles. Those are high-risk indicators. Treat it as unsafe unless you independently verify robust oversight and transparent terms.

Why do some users report “great results” at first?

Early success can be part of the sales funnel: small wins build confidence and justify larger deposits. The issues usually emerge when you try to withdraw bigger sums.

What’s the problem with bonuses?

Bonuses frequently come with turnover requirements that effectively lock your funds. Many readers overlook these clauses until they attempt a payout.

Can an “account manager” really help me beat the market?

Be cautious. On high-risk sites, so-called managers often prioritize more deposits, not risk management. Advice that pressures you to add funds should be treated skeptically.

What should I read in the Terms & Conditions?

Focus on withdrawal rules, bonus conditions, fee schedules, and any clauses that allow the platform to cancel trades or freeze accounts at its sole discretion.

Balanced Take: What a Trustworthy Platform Usually Shows

If you’re trying to compare, here’s what transparent providers typically display:

Exact legal entity details (name, number, jurisdiction) and regulator authorization you can confirm independently.

Clear, fixed fee schedules and plain-English T&Cs.

Third-party custody or segregation of client funds.

Independent price feeds or recognized market venues.

No pressure sales and no withdrawal penalties beyond standard banking/transfer fees.

If tradetipanalysis.net does not match these standards on close inspection, consider that a significant risk signal.

Final Word

This review highlights the risk profile and common tactics seen on platforms that look and market themselves like tradetipanalysis.net. The combination of ambiguous licensing, pressure-based upsells, bonus traps, and withdrawal friction constitutes a pattern experienced investors flag as high risk.

Your best defense is methodical due diligence:

Verify who you’re dealing with (entity and regulator).

Understand the rules that govern your money before you deposit.

Treat big promises and urgency as warning signs, not opportunities.

If anything here matches your experience to date, pause, step back, and reassess—on your terms.

How GainRecoup.com Helps Victims of Tradetipanalysis.net

GainRecoup.com investigates tradetipanalysis.net transactions, gathers evidence, and maps payment paths. Our recovery team liaises with banks, card networks, and exchanges, files chargebacks, and escalates complaints to relevant authorities. You’ll receive a tailored action plan, clear documentation, and persistent follow-up designed to maximize fund recovery and hold tradetipanalysis.net accountable for victims.