Introduction

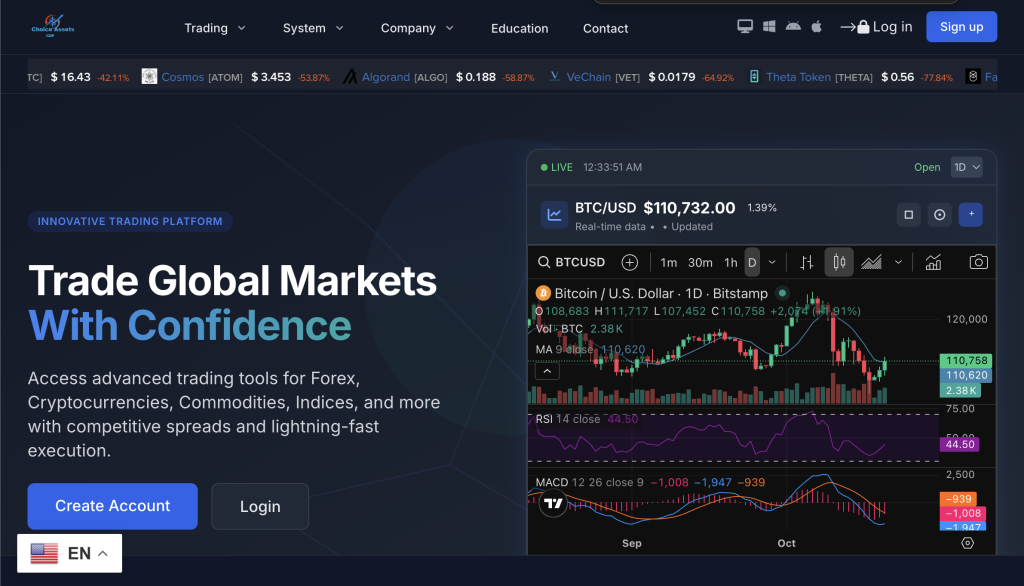

The website choiceassetscfds.live presents itself as a sleek, modern trading venue: fast sign-up, “pro” tools, and confident messaging about market expertise. For many people looking to begin trading or diversify, a platform like this can seem inviting. Yet, a closer look at how the site positions itself, what it promises, and what it withholds reveals a troubling pattern that resembles common high-risk, potentially fraudulent operations seen across the internet.

This review breaks down the platform’s claims, highlights specific warning signs, and outlines the typical lifecycle of similar sites. It is written in clear, inclusive language so that anyone—regardless of financial background—can understand the issues and make informed decisions.

What choiceassetscfds.live Appears to Promise

From the homepage onward, a few themes tend to stand out on platforms like this:

“Advanced” or “AI-powered” trading tools that supposedly improve win rates.

Multiple asset classes (CFDs on forex, crypto, indices, commodities) with tight spreads and instant execution.

Low barriers to entry, often with small minimum deposits and “starter” accounts.

Account managers or analysts who guide your trades and help you “scale up.”

Quick deposits and easy withdrawals, plus 24/7 support.

Individually, none of these features proves wrongdoing; many reputable brokers offer similar items. The problem arises when these claims sit alongside opaque ownership, unverified regulation, unrealistic returns, and a lack of independent transparency.

Red Flags to Watch Closely

1) No Verifiable Regulatory Authorization

Any platform offering leveraged trading or handling client funds should be clearly authorized by a recognized financial regulator in the region(s) it targets. When a site cannot provide a regulator name, license number, and verifiable legal entity—or buries these details in vague footers—that’s a major signal to pause. “Registered company” is not the same as “authorized to offer CFDs.”

What you can do: Write down the exact legal entity name and license number shown on the site and check them on the official register for the claimed jurisdiction. If the details don’t match—or aren’t provided—risk is high.

2) Unrealistic Return Narratives

Language implying consistently high returns, low risk, or market-beating accuracy is a hallmark of high-risk platforms. Even experienced traders have drawdowns. If performance claims sound guaranteed, it’s marketing spin at best and a serious red flag at worst.

3) Bonus Traps and Hidden Conditions

A common tactic is the “trading bonus” designed to lock your funds. The terms often require you to reach an enormous turnover before withdrawals are allowed, even on your own deposits. If a site emphasizes bonuses or “profit multipliers,” read the Terms carefully and assume those funds may be hard to access later.

4) Pressure to Deposit More

Users often report being contacted by “account managers” encouraging larger deposits to unlock special tools, save open positions, or join VIP tiers. Pressure, urgency, or guilt-framing (“you’re missing a rare window”) are sales tactics—not genuine risk management.

5) Withdrawal Friction

High-risk platforms typically accept deposits instantly but impose escalating barriers at withdrawal time: sudden “verification” loops, new “release” fees, or additional turnover requirements that were not obvious at sign-up. Reasonable KYC is normal; moving goalposts aren’t.

6) Opaque Ownership and Contact Details

Legitimate firms provide clear, verifiable details: company name, number, physical address, leadership, and complaint channels. When a site lists generic emails, vague addresses, or no named executives, accountability is limited.

7) Dubious Testimonials and Metrics

Polished dashboards and glowing reviews on the site itself are easily fabricated. Look for independent, consistent feedback over time. “Perfect” win rates, round-number profits, and recycled stock photos should be treated with caution.

How Platforms Like choiceassetscfds.live Typically Operate

Understanding the common lifecycle helps you recognize patterns early:

Attract – Ads and social posts promise “pro signals,” “AI tools,” and fast gains.

Onboard – Easy registration and a small initial deposit build momentum.

Early “Wins” – You may see dashboard gains or be allowed a tiny withdrawal to gain trust.

Upsell – An “account manager” nudges you to deposit more for VIP access or to “protect positions.”

Friction – Larger withdrawal attempts trigger bonus clauses, turnover requirements, new fees, or extended “reviews.”

Stall or Silence – Communication becomes scripted or slow; excuses multiply; funds remain out of reach.

Not every site follows every step, but when several appear together—especially alongside unverified authorization—the risk profile escalates.

Why Proper Regulation Matters

Regulation is not a brand sticker—it’s a framework of duties and safeguards. Authorized brokers must:

Keep client funds segregated from company operating accounts.

Provide clear risk disclosures and avoid misleading marketing.

Maintain capital adequacy and submit to audits.

Offer formal complaint pathways and cooperate with dispute resolution.

Without these controls, you have limited options if something goes wrong. A website’s design cannot substitute for enforceable oversight.

Due-Diligence Checklist (Do This Before Any Deposit)

Use this quick list to evaluate choiceassetscfds.live or any look-alike site:

Entity & License: Note the exact company name and claimed license number; confirm on the official regulator’s register.

Jurisdiction Fit: If the platform targets your country, do they have permissions there—not just in another region?

Terms & Fees: Read the full Terms for bonuses, turnover rules, withdrawal conditions, and invented fees like “profit unlock” or “liquidity clearance.”

Contact Reality Check: Is there a verifiable office? A working phone line? Named leadership?

Funding Logic: Be cautious if asked to use irreversible methods or to transfer to a name that doesn’t match the platform’s stated entity.

Test the Exit: If you proceed at all, start tiny and request a withdrawal early to assess how the platform behaves.

Independent Prices: Can you reconcile trade prices and fills with reputable external data sources?

Inclusive Note: Anyone Can Be Targeted

High-risk platforms are designed to appeal to everyone—newcomers and experienced traders alike. They blend confidence with simplicity, promise community, and remove friction at the start. If you’ve interacted with a site like choiceassetscfds.live and feel frustrated or embarrassed, you’re not alone—and you’re not to blame. The responsibility sits with the misleading practices and information gaps built into such operations.

FAQs

Is choiceassetscfds.live legit?

Sites with similar presentations often lack verifiable authorization and rely on aggressive sales tactics and withdrawal obstacles. Those are high-risk indicators.

Why do platforms like this talk about “bonuses”?

Bonuses usually come with turnover conditions that can effectively lock your funds. They sound generous but often prevent withdrawals.

Can “account managers” help me beat the market?

On high-risk sites, so-called managers frequently prioritize larger deposits, not risk control. Pressure to add funds is a warning sign.

What’s the biggest clue I should look for first?

Regulatory authorization you can verify independently. If it’s missing, unclear, or mismatched, treat the platform as unsafe.

Are fast sign-ups and slick dashboards a problem?

Not by themselves—but when paired with vague licensing, unrealistic returns, and bonus clauses, they amplify risk.

Balanced Comparison: What Trustworthy Brokers Display

If you’re comparing options, reputable providers typically show:

Exact legal entity details and regulator authorization you can confirm.

Plain-English T&Cs with transparent fees and no invented charges at withdrawal.

Segregated client money and clear statements about custody.

No pressure sales, no “guaranteed profits,” and no bonus traps.

Price transparency or connectivity to recognized market venues.

When a platform doesn’t look like this on close inspection, caution is warranted.

Editorial Verdict

Based on the presentation, claims, and structural warning signs common to similar domains, choiceassetscfds.live exhibits multiple red-flag characteristics associated with high-risk, unregulated trading operations. The combination of unclear authorization, pressure-driven upsells, bonus-based withdrawal barriers, and opaque ownership forms a pattern that experienced readers will recognize.

Bottom line: Treat this platform as high risk unless and until you can independently verify robust authorization, transparent terms, and real-world withdrawal success under normal conditions.

Empowering Victims: Taking a Stand Against Scams with GAINRECOUP.COM

If you have fallen victim to a scam, it is important to understand that you are not alone and you still have options. Scammers exploit the trust of their victims, but organizations like GAINRECOUP.COM work tirelessly to combat these frauds with integrity and expertise.