Introduction

The world of online investing is filled with sleek websites and big promises. StockFinance-Inv.com is one of those platforms that appears polished, professional, and profitable at first glance. It presents itself as a global investment company offering cutting-edge trading tools, “expert management,” and “guaranteed profits.”

But beneath the glossy surface, this site shows multiple warning signs of a scam. From false claims of legitimacy to suspicious withdrawal restrictions, StockFinance-Inv.com exhibits all the hallmarks of an unregulated and unsafe trading platform.

This detailed review breaks down what the website claims, how it operates, and the many reasons why it should be approached with extreme caution.

What StockFinance-Inv.com Claims to Be

According to its own marketing, StockFinance-Inv.com is a sophisticated trading and investment company offering access to global financial markets. The site advertises features such as:

Investment opportunities in forex, crypto, stocks, and commodities.

A “professional team” of financial analysts and market experts.

Secure transactions, instant withdrawals, and high-return investment plans.

Multi-tier account packages with higher profit margins for larger deposits.

“24/7” customer support and account management.

It sounds convincing — but every one of these points is designed to build trust through illusion. The problem isn’t what StockFinance-Inv.com says; it’s what it doesn’t prove.

1. No Verified Regulation or Licensing

The first and most important thing to check before investing in any platform is regulation.

Regulation means oversight — it’s the proof that a company operates under legal and financial rules designed to protect investors.

When researching StockFinance-Inv.com, there is no record of the company being licensed by any recognized financial authority, including:

The Financial Conduct Authority (FCA) in the UK,

The Cyprus Securities and Exchange Commission (CySEC), or

The Australian Securities and Investments Commission (ASIC).

There’s no license number, no registered company address, and no corporate transparency.

This means the people running StockFinance-Inv.com can operate freely without accountability. If your funds disappear, there’s no regulator, no support, and no legal protection.

Simply put — this platform is not authorized to handle client investments.

2. Fake Professionalism and Generic Branding

At first glance, StockFinance-Inv.com looks credible. The website uses modern layouts, stock images of professionals, and finance-related buzzwords like “AI trading,” “smart analysis,” and “market innovation.”

But once you dig deeper, it becomes clear that the entire presentation is designed to deceive.

Red flags include:

No real team members, founders, or management listed.

A “Contact Us” section with no verifiable phone number or office location.

Generic company descriptions that are copy-pasted from other sites.

A domain that was registered recently — typical for short-lived scams.

Scammers invest in slick websites because they know appearance builds confidence. Unfortunately, the design hides a hollow core: no corporate identity, no accountability, and no substance.

3. Unrealistic Profit Guarantees

One of the most dangerous aspects of StockFinance-Inv.com’s pitch is its promise of guaranteed profits. The platform boasts daily or weekly returns ranging anywhere from 10% to 30%, depending on your “investment tier.”

Let’s be clear: no legitimate financial platform can guarantee fixed returns, especially not at such high levels. The markets fluctuate every day — even professional traders with years of experience can’t ensure profit.

These exaggerated claims are a psychological trap. They’re designed to make potential investors feel safe, believing they’ve found a “risk-free” opportunity. But in reality, it’s a sales tactic that hides the truth: once you deposit money, you’ll likely never see it again.

4. Misleading “Investment Packages”

StockFinance-Inv.com uses tiered investment plans to create a false sense of structure and legitimacy. The packages often include names like “Basic,” “Premium,” and “Platinum,” with each offering higher returns for larger deposits.

This approach is meant to:

Make the company appear like a real financial institution.

Encourage investors to spend more by offering “better” profit rates.

Establish a sense of progress or loyalty — similar to reward tiers.

But these so-called packages are meaningless. They’re not tied to real financial markets or any verified trading mechanism. The only function they serve is to push investors to deposit higher amounts before realizing something’s wrong.

5. Hidden Fees and Withdrawal Barriers

The biggest frustration with scam platforms like StockFinance-Inv.com comes when investors try to withdraw their funds.

At first, deposits are accepted instantly. The platform may even display fake profits in your dashboard to build confidence. But once you attempt a withdrawal, new obstacles appear:

Requests for extra identity verification that drag on for weeks.

Claims that your account must meet a “minimum trade volume” before withdrawing.

Demands for additional “tax,” “unlock,” or “clearance” fees to release your funds.

In some cases, complete silence from the company once you ask to withdraw.

These tactics are classic in online trading scams. They’re meant to wear you down or convince you to deposit even more money in hopes of resolving the issue.

The harsh truth: no legitimate broker would ever demand fees before releasing client funds.

6. Fake Testimonials and Social Proof

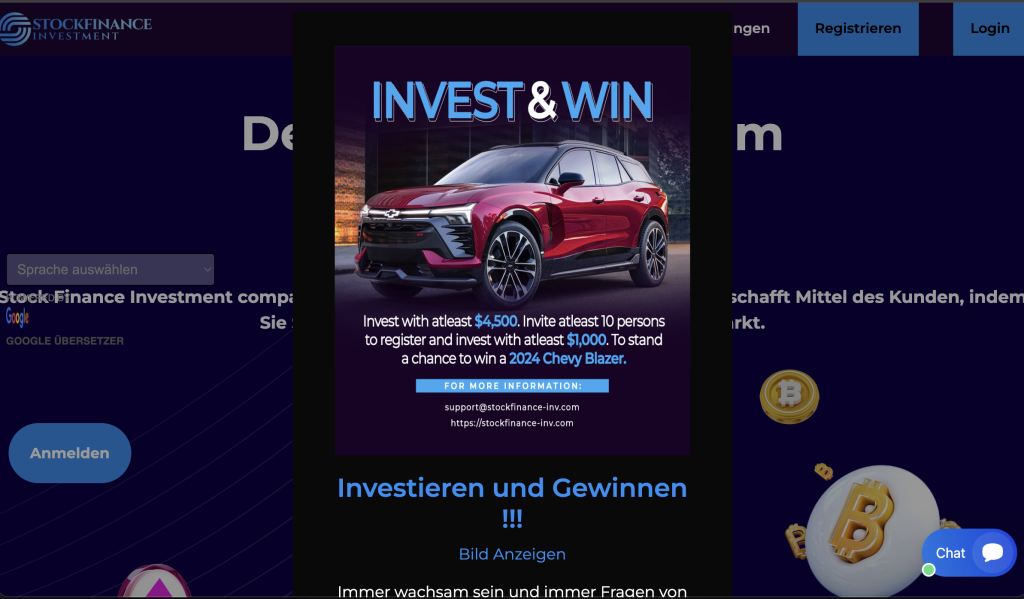

On its website and social media pages, StockFinance-Inv.com features glowing testimonials and five-star reviews. Some even include images of “happy investors” claiming to have doubled or tripled their investments.

However, these reviews are fake. The photos are often stock images or taken from unrelated sites, while the text follows repetitive patterns seen across dozens of fraudulent investment pages.

Real financial institutions rely on verified third-party reviews from independent sources. Fake brokers rely on fabricated praise to create false credibility.

7. Manipulative Account Managers

Scam platforms often assign “account managers” to each investor. These representatives usually sound helpful at first — providing advice, congratulating you on “profits,” and encouraging you to deposit more.

But behind the friendliness lies manipulation. They often:

Use emotional language to create trust.

Convince you to “upgrade” to higher plans for “better results.”

Pressure you to deposit quickly before an “opportunity expires.”

Disappear entirely once you question withdrawals or ask for verification.

This is not customer service — it’s sales psychology aimed at exploitation.

8. Lack of Legal Documents and Risk Disclosures

Legitimate trading companies are required to publish key documents like:

Terms and Conditions

Privacy Policy

Risk Disclosure Statements

Client Agreements

StockFinance-Inv.com either hides these pages or provides vague, incomplete versions filled with legal placeholders. The absence of proper documentation means users have no legal clarity about their rights, responsibilities, or the company’s obligations.

A lack of clear legal text is one of the strongest indicators that a company is operating outside regulatory frameworks.

9. Short-Lived Web Presence

Most scam platforms are temporary. They operate under one name for a few months before disappearing or rebranding under a new domain.

StockFinance-Inv.com fits this pattern. The website domain is newly registered, with no long-term online history, no press releases, and no credible mentions from real finance publications.

This short digital footprint is another major warning sign — legitimate companies have traceable online reputations, not empty archives.

10. How Fake Investment Sites Typically Operate

Here’s the typical life cycle of an operation like StockFinance-Inv.com:

Attraction: Ads or social media posts promise easy, passive income.

Onboarding: Users are directed to a sleek website and asked to deposit small amounts.

Trust Building: The dashboard shows fake profits; “managers” praise your success.

Upselling: You’re convinced to deposit larger sums for “higher returns.”

Withdrawal Block: When you request funds, excuses and fake fees appear.

Shutdown: The website eventually vanishes or rebrands under a new name.

Every stage is carefully designed to build false confidence, extract more money, and eliminate accountability.

Inclusive Reminder: Anyone Can Be Targeted

Investment scams don’t discriminate. Whether you’re new to trading or have experience, these schemes are crafted to exploit trust, emotion, and hope.

They use friendly communication, technical jargon, and professional visuals to mask their deception. Falling for a polished website doesn’t make someone careless — it shows how convincing these operations have become.

Staying informed is the best defense. Always verify regulation and research before depositing money anywhere.

Conclusion

After thorough evaluation, StockFinance-Inv.com is not a legitimate investment platform.

The evidence is overwhelming:

No verified license or regulation.

Unrealistic profit guarantees.

Fake testimonials and professional facades.

Hidden withdrawal conditions and false “bonuses.”

Total lack of transparency about ownership or company identity.

These signs confirm that StockFinance-Inv.com fits the profile of a high-risk, unregulated investment scam.

If a company refuses to prove its legitimacy or makes promises that sound too good to be true, the safest choice is not to invest at all.

Always choose transparent, regulated platforms and remember: in finance, real success comes from knowledge and patience — not false promises of overnight wealth.

Disclaimer: This article is for educational and informational purposes only. It does not constitute financial advice. Always verify a company’s regulatory status before making deposits or trading online.

Empowering Victims: Taking a Stand Against Scams with GAINRECOUP.COM

If you have fallen victim to a scam, it is important to understand that you are not alone and you still have options. Scammers exploit the trust of their victims, but organizations like GAINRECOUP.COM work tirelessly to combat these frauds with integrity and expertise.