Quick takeaway: NobleEdgeFX.com shows multiple indicators typical of high-risk trading sites. While we can’t assert legal guilt, the mix of unverified claims, regulator warnings, and technical weaknesses suggests that interacting here comes with considerable risk.

What NobleEdgeFX Claims to Offer

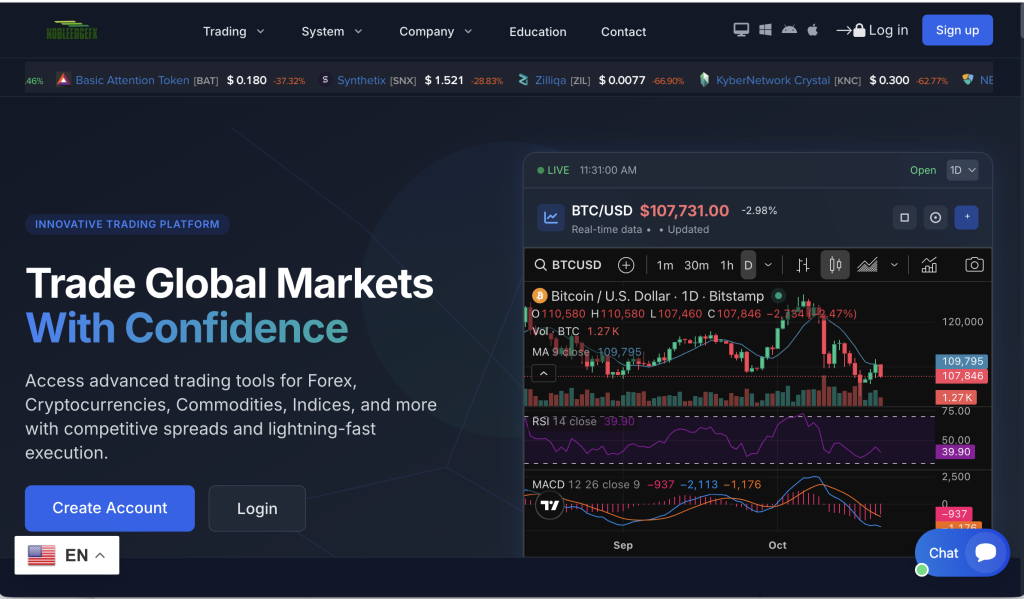

On its website, NobleEdgeFX markets itself as a modern and full-featured broker offering:

CFD trading on forex, indices, commodities, shares and cryptocurrencies. Nobleedgefx+2Nobleedgefx+2

“Ultra-tight spreads,” “lightning-fast execution” and institutional-grade trading infrastructure. Nobleedgefx

Advanced automation tools, copy-trading strategies, and “smart bots” for all levels of trader. Nobleedgefx+1

Claims of being “globally regulated,” having “40+ international awards,” “segregated client funds,” and “24/7 multilingual support.” Nobleedgefx+1

On its surface, the offer is very appealing—especially for individuals seeking opportunity via online trading. But as we’ll see, it‘s exactly those kinds of bold claims that tend to accompany high-risk platforms.

Where the Red Flags Appear

When evaluating a trading platform, the legitimate firms tend to provide transparent information, verifiable regulation, clear terms and conditions, and stable historical presence. NobleEdgeFX has several issues worth serious consideration:

1. Regulator Warning

The Financial Conduct Authority (FCA) of the UK has issued a warning that “NOBLE EDGE FX / NobleEdgeFX … may be providing or promoting financial services or products without our permission.” FCA

The FCA states:

“This firm is not authorised by us and may be targeting people in the UK.” FCA

This means if you deal with this firm in the UK, you lose key protections that come with regulated services.

2. Low Trust Score

A site-review by ScamAdviser gives NobleEdgeFX.com a very low trust score, citing indicators such as recent registration, shared hosting, potential links to other suspicious websites and high-risk financial services. ScamAdviser

In short: The technical footprint and domain history don’t match the bold claims of being a large, trusted broker.

3. Lack of Transparent Regulation / Ownership

Despite claims of being “globally regulated” and “segregated client funds,” there’s no credible regulation certificate exposed and no easy way to verify the awards or global presence. In fact, the FCA warning directly contradicts the claim of proper authorisation.

Also, the site lists a contact address and phone number—but such details can be fabricated or misleading.

4. Overly Generous Promotions / High-Risk Promises

The language on the site emphasizes “lightning execution,” “tight spreads from 0.0 pips,” “real-time data,” “proven strategies,” and “instant withdrawals.” Nobleedgefx+1

These are marketing signals typical of platforms that emphasise opportunity rather than fully transparent cost & risk disclosures.

5. Technical & Hosting Weaknesses

ScamAdviser notes that the domain was very recently registered, uses shared server hosting with other low-trust websites, and has a weak visitor ranking. ScamAdviser

Such infrastructure issues are not definitive proof of fraud, but they add to the risk profile.

What This Means in Practice

From the warning signs above, here’s how the risk may play out if someone chooses to trade with NobleEdgeFX:

You may deposit funds expecting regulated protection, but you may in fact be dealing with an unlicensed provider.

You may see the trading dashboard show profits, but withdrawing your capital (or profits) might be blocked, delayed, or conditional.

You may rely on “account managers” or automated tools promising easy gains—while underlying risk is downplayed.

If something goes wrong, you may lack recourse via recognised regulatory channels or compensation schemes.

Patterns to Watch Out For

Even if you are inclined to engage with such platforms (which always demands greater caution), here are specific patterns to monitor:

Withdrawal delays or refusals: Does the platform ask for additional fees or documents after you request withdrawal?

Unrealistic returns: Promises of consistent high returns, “free” profits or “no risk” are almost always misleading.

Pressure to deposit more: Requests to increase deposit size to “unlock special strategy” or “get VIP status” are common in high-risk schemes.

Opaque terms and conditions: Vague language around fees, spreads, bonus conditions, withdrawal eligibility.

Unverified endorsements or awards: If you can’t locate built-in proof of awards, credentials or regulator licenses, treat claims as marketing.

Hidden bonus trade volume requirements: Some platforms show “bonus credits” but then require high trade volume before you can withdraw your original deposit.

Inclusive Language / For All Readers

Whether you are new to trading or experienced, it helps to approach any platform—especially ones with bold claims—with the same fundamentals: discernment, understanding, and risk-awareness.

If you are just starting: Recognise that real trading involves risk, learning curve, losses as well as gains.

If you have some experience: Be sceptical of “too good to be true” offers and dig into regulatory status and withdrawal mechanics.

No matter your background: Prioritise clarity, documentation, independent verification—don’t rely solely on slick marketing or promises of “simple wealth”.

Final Thoughts and Summary

NobleEdgeFX.com presents itself as a sophisticated, high-performance global broker, but several warning signals considerably weaken the credibility of those claims. The regulator warning from the FCA, the low trust scoring by independent website review services, and the lack of transparent verification of credentials mean that this platform carries a high-risk profile.

If you are evaluating whether to invest with them, weigh heavy caution: the attraction of quick profits must be balanced with the possibility of funds being difficult to withdraw, lack of formal protections, and a promotional narrative that emphasises opportunity more than transparency.

In simpler terms: If you are willing to use this platform, treat any funds as at risk, start with very small amounts (if you proceed at all), check withdrawal procedures thoroughly, and document everything. A platform that claims “instant withdrawals” but doesn’t show a verifiable history of doing so is not the same as one that has public, audited, regulated proof of performance.

Empowering Victims: Taking a Stand Against Scams with GAINRECOUP.COM

If you have fallen victim to a scam, it is important to understand that you are not alone and you still have options. Scammers exploit the trust of their victims, but organizations like GAINRECOUP.COM work tirelessly to combat these frauds with integrity and expertise.