If you’ve stumbled upon MarketStockGain.com and are wondering whether it’s a legitimate stock-/CFD trading service or something more questionable, this detailed review is here to guide you. In plain, inclusive language, we’ll take a look at how the site presents itself, the warning signs that emerge, typical behaviour of high-risk platforms, and what that means for you.

Quick takeaway: MarketStockGain.com shows strong indicators of being a high-risk platform. While it’s impossible to say definitively that it is a scam without legal judgement, a combination of unverified claims, regulatory warnings, and lack of transparency means caution is advisable.

What MarketStockGain.com Claims to Offer

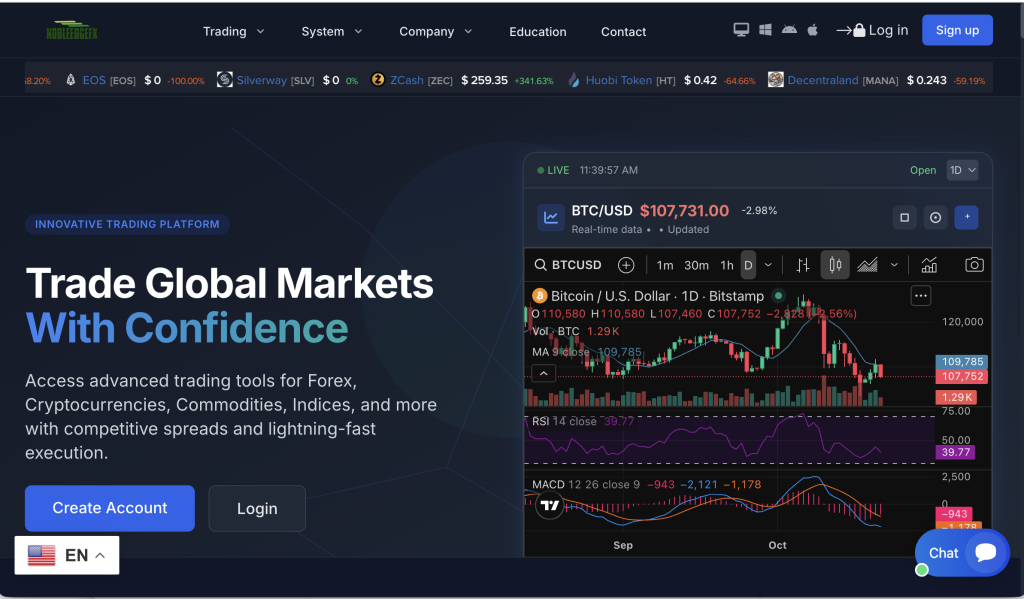

From what is publicly visible, MarketStockGain.com markets itself as a full-service trading platform with a range of features:

Trading in stocks, forex, indices, commodities and cryptocurrencies under one roof.

“Competitive spreads”, “advanced trading tools”, “instant execution” and “VIP account status” for faster profits.

Seemingly global outreach: many jurisdictions, multiple contact addresses, multilingual support.

High returns pitched via “proven strategies” and “cutting-edge algorithms”.

On the surface, such offers look appealing—especially if you’re seeking to grow investment returns. But the combination of bold promises + limited verifiable background is a common pattern in high-risk services.

Key Concerns & Red Flags

Here are the major warning signs for MarketStockGain.com, drawn from publicly available alerts and site details:

1. Lack of Authorisation with a Major Regulator

The Financial Conduct Authority (FCA) in the UK has issued a warning that “MarketStockGain (www.marketstockgain.com) … is not authorised by us and may be targeting people in the UK.” FCA

Being un-authorised means that if something goes wrong, protections you expect (such as recourse or compensation schemes) may not apply.

2. Inconsistent Contact Details & Multiple Addresses

The FCA warning lists address details for MarketStockGain including “11 Grace Avenue, STE 108, Great Neck, New York, U.S.A.” and “1 Canada Square, Canary Wharf, London, UK” . FCA

These kinds of multiple addresses may be used to create an impression of a broad global presence, but often are not backed by verifiable operations.

3. Claims vs Verification Gap

The website claims advanced tools, broad asset access, “competitive spreads,” etc. A review site notes: “A major warning sign is that MarketStockGain lacks registration with any respected financial authority. … Without a mandated supervisor to enforce rules, there is no guarantee of fair treatment or protection of client assets.” TheSafetyReviewer

In other words: The offer is strong, but the verifiable backing is weak.

4. Typical High-Risk Marketing Language

Sites like these often emphasise “lightning-fast profits,” “exclusive strategies,” “VIP accounts only for few,” and similar. While marketing isn’t proof of scam, heavy emphasis on speed and profit, without clear presentation of risk, is a flag.

5. Platform Terms and Transparency

While MarketStockGain.com has a published privacy policy and mentions the asset classes it offers (via its website) marketstockgain.com the deeper details — such as full regulation status, audited performance history, detailed fee schedule and withdrawal mechanics — are either missing or hard to independently verify.

What This Means in Practice

Given the risk indicators, here’s how involvement with a platform like MarketStockGain might play out:

You may deposit funds expecting regulatory protections (e.g., in the UK or EU), but if the platform is un-authorised, you may lack typical safeguards.

You may see a demo or live account showing “profits,” but withdrawing those profits (or even your original deposit) may face delays, contract conditions, “minimum trade volumes,” or extra fees.

You may be encouraged to upgrade to “VIP” status, deposit more, or use “insider strategies” promised for higher returns. Often, this is paired with urgency (“limited time offer”).

If something goes wrong—system goes offline, account manager disappears, withdrawal not honoured—you may find you have limited recourse, especially if the firm is abroad or un-regulated.

How to Read the Fine Print

Even when a site seems appealing, reading the terms and conditions is crucial. For a platform like MarketStockGain.com, look for:

Terms of withdrawal: Are there conditions, minimum trade volumes, bonus-linked rules?

Regulation and jurisdiction: Which country’s law applies? What regulator oversees the firm?

Fee disclosures: Are spreads, commissions, rollover/overnight fees, inactivity fees clearly shown?

Refunds and chargebacks: What happens if you want to pull out early or stop?

Dispute resolution: Where would you go to complain if things don’t work as promised?

If any of these areas are vague, absent, or contradictory, that raises the risk level considerably.

Inclusive Language & For All Readers

Whether you’re new to online trading or you’ve been doing it for years, it’s helpful to approach platforms like MarketStockGain with the same filter:

If you’re just getting started: Recognise that even good platforms require learning, understanding of risk, and only deploying capital you are comfortable with losing.

If you’re more experienced: You have additional tools to assess regulation, hosting, terms, and history—but being cautious remains important.

No matter your background: Always prioritise verification, documentation, and clarity over flashy marketing or promises of “quick profits.”

Summary and Final Thoughts

In summary, MarketStockGain.com displays a number of features associated with high-risk trading services:

Un-authorised status with at least one major regulator.

Claims of broad global access and high performance, but limited verifiable substantiation.

Multiple contact addresses and physical locations (which may not correspond to credible operations).

Strong marketing language emphasising returns, tools, VIP tiers – with less emphasis on risk or regulation.

All of this creates a high-risk profile. That doesn’t necessarily mean every element is fraudulent, but it does mean that engaging with this platform carries significant uncertainty and potential downside.

If you are evaluating MarketStockGain.com, ask yourself: “Do I have clear, independent proof of this platform’s regulatory status? Do I understand exactly how and when I can withdraw funds? Am I comfortable with the possibility that protections may be minimal?” If the answers are “no” or “I’m not sure,” then fully weigh your decision.

Empowering Victims: Taking a Stand Against Scams with GAINRECOUP.COM

If you have fallen victim to a scam, it is important to understand that you are not alone and you still have options. Scammers exploit the trust of their victims, but organizations like GAINRECOUP.COM work tirelessly to combat these frauds with integrity and expertise.