If you’ve encountered PurpleFxTrading (purplefxtrading.org) and are wondering whether it’s a reliable trading site or a high-risk scheme, this blog is here to give you a clear, inclusive breakdown. We’ll walk you through what the platform presents, the warning signs, how its mechanics often play out in practice, and what all of this means for you. Our aim is to provide readable, understandable insight—not alarmism, but practical awareness.

Quick takeaway: PurpleFxTrading shows multiple key indicators of being a high-risk trading platform. While we cannot declare it definitively a scam in the absence of legal findings, the combination of red flags means that anyone considering this platform should proceed with extreme caution.

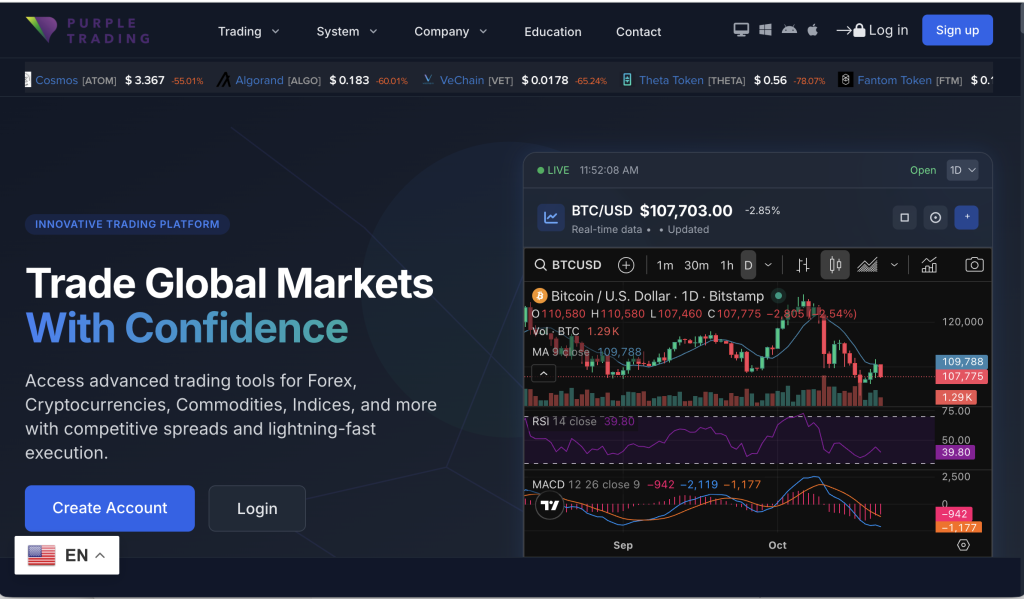

What PurpleFxTrading Claims to Offer

Here’s a summary of what the website purports to provide:

A full trading ecosystem covering assets like forex, indices, commodities, cryptocurrencies, and more.

Marketing messages such as “advanced algorithmic trading,” “tight spreads,” “automated tools for profit,” and “global support.”

An account structure implying VIP tiers, fast access to markets, and the promise of stable returns with professional-level tools.

On the surface, that may appear attractive—especially for traders looking for cutting-edge access. But the key is whether those claims are supported by legitimate regulation, transparency, and real experience. Let’s look at how PurpleFxTrading stacks up.

Where the Red Flags Appear

Here are the major warning signs that emerge when examining the platform.

1. Lack of Proper Regulation

The UK’s regulator, the Financial Conduct Authority (FCA), lists “PURPLETRADING / www.purplefxtrading.org”as a firm not authorised to provide or promote regulated financial services in the UK. The FCA states this firm “may be providing or promoting financial services or products without our permission.”

This means that if someone in the UK uses this platform, they do so without the protection of the regulator.

A review site likewise notes that PurpleFxTrading “lacks registration with any respected financial authority,” making its regulatory status highly uncertain.

2. Questionable Website Claims vs. Verification Gap

The website positions itself as a high-end global trading provider, but there is little evidence of a real licenced entity, transparent ownership, audited results, or strong regulatory footprint. Without those, the claims are largely unverified.

3. Typical High-Risk Marketing Language

Promotional language emphasising “instantly profitable strategies,” “VIP execution,” “automated bots,” and “no experience needed” are classic hallmarks of platforms that lean heavily on attracting new funds—not managing risk or transparency. While marketing alone doesn’t prove fraud, when combined with weak backing it raises concern.

4. Hosting, Domain & Trust Infrastructure Weaknesses

Independent reviewers highlight that the domain and website infrastructure show signs of newer registration and minimal verifiable legacy. The association to the FCA warning list further adds weight to the concern.

5. Multiple Addresses and Ambiguity

The website may list multiple jurisdictions or addresses (including the United Kingdom) but without credible proof of physical operations, licensing, or local oversight. Multiple addresses and global reach claims often serve to give an illusion of legitimacy.

What This Means in Practice

From the red flags above, here’s how things might play out in real-world use of PurpleFxTrading:

You may make a deposit expecting a regulated broker, but instead you’re dealing with an unlicensed provider—meaning minimal oversight if things go wrong.

You may see what looks like profits on a dashboard, but attempting to withdraw may trigger unexpected hurdles, “unlocking fees,” or account upgrade demands.

You may be encouraged to deposit more for “VIP access” or heavier strategies, which escalates risk rather than reducing it.

If the platform fails, shuts down or disappears, you may lack recourse through insurance schemes, ombudsmen or regulated compensation.

Patterns to Watch Out For

Whether or not you’re dealing with PurpleFxTrading specifically, these are common patterns on platforms with similar structures:

Limited or no external verification of licence, audited results, or regulatory listing.

Withdrawal obstacles, such as demands for extra documentation, “verification fees,” or minimum trade volume before you can withdraw.

High-pressure upselling to deposit more funds in order to access “elite” accounts or get better “returns.”

Guaranteed type returns—telling you “you will earn X% in this time” with minimal risk. Real trading rarely operates that way.

Lack of transparency on fees, spreads, margin policies, and terms of service.

Overpromising and underdelivering on tools, automation, and results.

Inclusive Language & For All Readers

This section is for everyone, regardless of your level of investing experience.

If you are new to trading: Recognise that every platform—even legitimate ones—come with risks. Learning the mechanics, fees, regulatory status and the real possibility of losses is critical.

If you are experienced: You have likely seen many platforms. Your job is to verify beyond the marketing claims: check licences, read the fine print, test withdrawal mechanics.

Regardless of background: Always ensure platforms you use are transparent about their licence, ownership, fees, and withdrawal policy. And respect your own comfort with risk—only trade capital you can afford to lose.

Final Thoughts and Summary

In summary, PurpleFxTrading.org displays a number of features commonly associated with high-risk or unregulated trading services:

It lacks clear, verifiable licensing with recognised regulators for the jurisdictions it claims to target.

It markets heavily on opportunity, automation, returns, “VIP access,” and professional tools—while showing limited transparency.

It appears on regulator warning lists, which is a strong signal that caution is warranted.

Its infrastructure, domain setup, claims of global presence and high performance are not matched by publicly verifiable credentials.

This creates a high-risk profile. It doesn’t guarantee it is fraudulent in every detail, but it means the potential for loss, difficulty withdrawing funds, and lack of protection is significantly higher than in the case of a truly regulated broker.

If you are considering PurpleFxTrading.org, ask yourself:

Do I have verifiable proof of its regulatory licence and entity?

Is the process of withdrawing funds clear, and has anyone publicly documented successful withdrawals?

Do I understand exactly what the fees, margin rules and account terms are?

Am I comfortable that I might not have the protections I would expect from a regulated broker?

If many of your answers are “uncertain” or “no,” then you are dealing with a platform where the risk may outweigh the reward.

Empowering Victims: Taking a Stand Against Scams with GAINRECOUP.COM

If you have fallen victim to a scam, it is important to understand that you are not alone and you still have options. Scammers exploit the trust of their victims, but organizations like GAINRECOUP.COM work tirelessly to combat these frauds with integrity and expertise.