Online investing has become more accessible than ever. People of all backgrounds now have the chance to explore financial markets, build wealth, and participate in opportunities that were once limited to institutions. But this new accessibility has also opened the door to deceptive platforms that mimic legitimate brokers while hiding high-risk operations behind polished websites and persuasive marketing.

One such platform that raises significant concerns is ApexInvest-Trade.online, also known as Apex Investment Trade. While the website presents itself as a professional, global investment service, several warning signs suggest that it may not be operating with the transparency, regulation, or accountability that investors deserve. This review breaks down everything you should know: what the platform claims, the red flags, how these schemes typically work, and why caution is essential for anyone considering using it.

What ApexInvest-Trade.online Claims to Offer

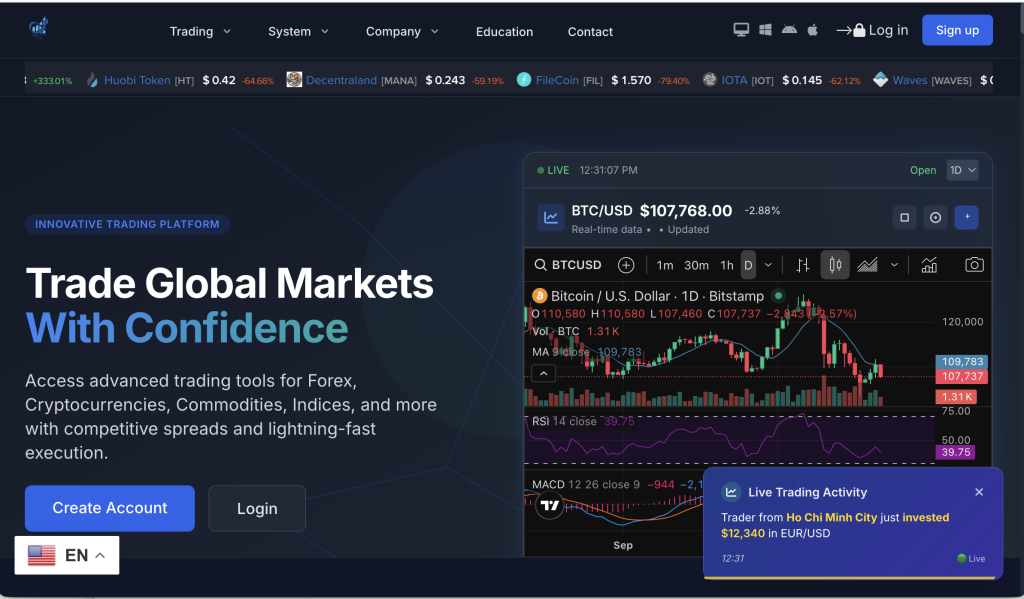

Apex Investment Trade positions itself as a full-featured trading and investment platform with access to global financial markets. The marketing is designed to appeal to both beginners and experienced traders. The platform claims to offer:

Access to forex, commodities, indices, and possibly cryptocurrencies

“Professional-level” trading dashboards and fast execution

A variety of account tiers, including “VIP” or premium plans

Global reach with high-level tools for every user

Smooth deposits and withdrawals

An address and contact details resembling those of established UK-based firms

On the surface, these features create the appearance of a well-structured, advanced broker. The language is confident and reassuring, and the website looks polished enough to inspire trust. However, as with any investment service, claims must be backed by verifiable transparency—and that’s where ApexInvest-Trade.online raises concerns.

Major Red Flags and Transparency Issues

To determine whether an investment platform is safe, several core questions should be answered clearly:

Who is behind the company?

Is it regulated?

How does it handle withdrawals?

Are its terms and identity transparent?

ApexInvest-Trade.online struggles to meet these essential criteria.

1. No Verified Authorisation From Recognized Regulators

A legitimate trading platform must be authorised by a reputable financial regulator such as those in the UK, EU, Australia, or other recognized jurisdictions. Platforms that operate without permission pose significant risks to users, who may have no protection, no dispute resolution options, and no recourse if funds become inaccessible.

ApexInvest-Trade.online presents a UK-style address, but presentation alone does not equal authorization. The lack of verifiable regulatory status is one of the most serious concerns associated with the platform.

2. Lack of Clear Company Information

Trustworthy brokers clearly list their:

Registered business name

Legal entity

Physical address

Directors or leadership team

Corporate registration details

This transparency allows users to confirm that the company exists and operates legally. ApexInvest-Trade.online provides very little traceable information. The identity of the company behind the platform remains vague, and there is no verifiable registration that aligns with the services advertised.

This lack of transparency is a major warning sign.

3. Inconsistent or Unverifiable Claims

The platform implies global operations, professional tools, and advanced trading technology. However, none of these claims can be independently verified through public corporate records, known leadership, or confirmed operations in the regions it claims to serve.

This mismatch between presentation and provable facts is common among high-risk platforms.

4. Marketing Tactics That Sound Too Good To Be True

Scam-prone platforms often use persuasive language to appeal to emotion, urgency, or excitement. Examples include:

Emphasizing high returns

Promising access to “exclusive” tools or premium trading benefits

Offering VIP accounts that supposedly guarantee better performance

Encouraging fast action through “limited time” account benefits

Such tactics aim to reduce critical thinking and accelerate deposits.

5. Potential Withdrawal Barriers

One of the biggest markers of high-risk platforms is the difficulty users face when trying to withdraw funds. While ApexInvest-Trade.online advertises easy withdrawals, platforms with similar structures often impose:

Unexpected “verification fees”

Additional deposits to “unlock” accounts

Delays due to unclear “compliance reviews”

Restrictions that appear only after funds are deposited

If a platform imposes new, unexplained steps at the point of withdrawal, that is a major red flag.

How High-Risk Investment Platforms Typically Operate

Although every platform has its own style, many unregulated investment schemes follow a predictable pattern. Understanding this pattern helps protect you from making decisions under pressure or persuasion.

Step 1: Attractive Marketing Hook

People often discover platforms like ApexInvest-Trade.online through advertisements, social media posts, or direct messages. These ads emphasize:

Easy profit

Low risk

Simple onboarding

Fast results

The messaging makes users feel they’re missing out if they don’t act.

Step 2: Friendly Onboarding and Early “Support”

Once you register, a so-called “account manager” or “broker” may reach out. They often sound knowledgeable and supportive, building trust quickly. A small initial deposit may be encouraged, and the dashboard might show instant profits—even if they aren’t real.

This illusion boosts confidence and encourages larger deposits.

Step 3: Pressure to Add More Money

Soon after, users may receive messages suggesting:

“VIP accounts”

“Premium investment windows”

“Time-sensitive trading opportunities”

These invitations can feel personalized, but they are often scripted tactics designed to push investors toward higher deposits.

Step 4: Attempting to Withdraw Funds

This is where many high-risk platforms begin to show their true structure. Users may face:

Delays

Extra fees

Additional verification steps

Requests for more deposits

Locked accounts

By the time withdrawal issues appear, the user may already feel financially and emotionally committed—making the situation even more difficult.

Step 5: Loss of Contact

After repeated withdrawal attempts, communication may slow down or stop completely. Phone numbers stop working. Emails go unanswered. Dashboards may remain active but unusable.

This is the final stage where users often realize the platform is not behaving like a legitimate broker.

Why This Matters for All Investors

Whether you are new to trading or have been investing for years, transparency and regulation are the core safeguards that protect your money. A platform’s appearance, marketing, or confidence should never replace verifiable information.

People from all walks of life deserve access to safe, fair, and honest financial services. That’s why careful research matters: it levels the playing field for everyone.

Inclusive investing means:

Giving people clear, understandable information

Ensuring they know how to verify a platform

Reducing the chance of falling into deceptive traps

Encouraging confidence grounded in safety

When platforms hide essential details, the risk increases not just for individuals—but for the trust people have in online investing in general.

Summary: Should You Trust ApexInvest-Trade.online?

Based on all available indicators, ApexInvest-Trade.online raises significant concerns:

No verified authorisation

No transparent company ownership

Unverifiable claims of global operations

Common high-risk marketing language

Likely withdrawal complications

Although only formal regulatory bodies can declare a platform to be an outright scam, the risk indicators are strong and numerous. Investors should approach platforms like this with extreme caution and prioritize transparency and regulation above all else.

How GainRecoup.com Helps Victims of ApexInvest-Trade.online

If you have already deposited money into ApexInvest-Trade.online and are facing withdrawal issues, unresponsive support, or unexpected fees, GainRecoup.com can assist.

GainRecoup.com helps individuals by:

Reviewing the transactions and communication history

Identifying where funds were sent and how they were processed

Preparing documentation that strengthens your case

Contacting banks, card issuers, or payment partners on your behalf

Providing structured next steps to pursue potential recovery

Offering guidance rooted in evidence, clarity, and professionalism

Every situation is unique, and having experts analyze the details can improve your ability to take informed action.