Introduction

In the age of digital investing, platforms promising easy profits, minimal effort, and high returns can be especially tempting. For many people seeking to grow their savings, these offers are appealing. But when a site lacks transparency, overpromises, or uses pressure tactics, it becomes a potential danger. This review looks in depth at PremierVex.org how it presents itself, how it appears to operate, and why it raises red flags. The goal is to empower you with clear information, so you can evaluate such platforms with confidence and inclusivity: any person, regardless of background or experience, deserves safe and honest financial options.

What Does PremierVex.org Claim to Be?

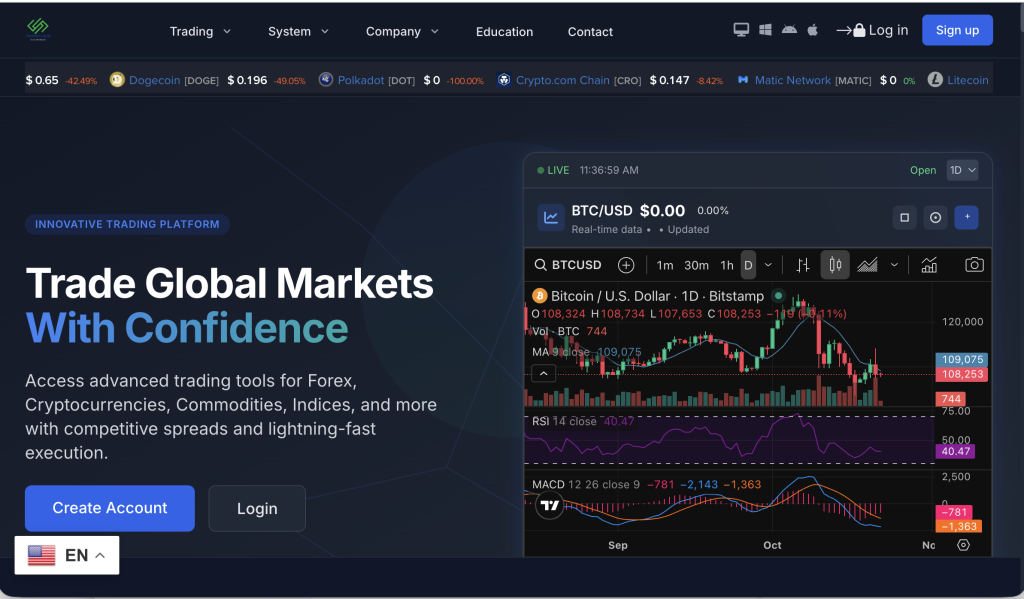

PremierVex.org positions itself as an online investment platform offering access to global markets—cryptocurrencies, forex trading, commodities, and possibly algorithmic strategies. The marketing typically speaks of high returns, professional trading teams, and easy access to funds. Key claims of the platform may include:

Fast account setup and immediate access to trading or investment “opportunities”.

Promises of high yields—sometimes daily, sometimes weekly—with minimal risk.

A dedicated “account manager” to assist every user and optimize performance.

Seemingly professional site design, live-looking charts, and a “dashboard” that suggests transparency.

Suggestion of being registered or licensed under some jurisdiction to underline legitimacy.

These features together can give the impression of a bona fide investment service. However, beneath the layers of site design and claimed credentials, there are multiple warning signs.

Lack of Clear Regulation and Transparency

A trustworthy investment service will have verifiable credentials: a clearly stated legal company name, physical headquarters, registration or licence with a reputable financial regulator, transparent terms and conditions, and accessible customer support details.

In the case of PremierVex.org, the following issues come forward:

The platform may not provide a clear company registration number or regulatory licence that you can easily confirm.

The physical address or corporate identity behind the site may be vague or absent.

The domain may be recently registered or may use privacy masking—techniques common in high-risk operations.

Marketing materials may reference a “professional team” or “institutional trading desk” without naming actual individuals or audited results.

Withdrawal and deposit terms may appear simple until you attempt to act—and then the true complexity emerges.

Because regulation and transparency are foundational to safe investing, the absence or ambiguity of those features is a serious warning sign.

How the Scam Pattern Works

While each case is unique, platforms like PremierVex.org often follow a familiar sequence of steps. Understanding this pattern helps identify deception early:

Step 1 – Attractive Entry

An advertisement, email, or social-media link invites you to register with promises of high return, little risk, and immediate access. The language suggests ease: “Start earning today,” “Professional traders working for you,” “Limited spots available.” For someone exploring investment options, this can feel like a timely opportunity.

Step 2 – Engagement Builds Trust

Once you sign up, you may be contacted by a “broker” or “account manager” who is friendly, persuasive, and eager to help. You’re guided to deposit a small amount first—sometimes positioned as a “trial” or “starter” plan. The site’s dashboard may show profits already in motion, reinforcing the idea that your money is working for you.

Step 3 – Pressure to Invest More

After a short period, you’ll often be encouraged to increase your deposit. The broker may use phrases like: “You’ve unlocked a higher tier,” “This window closes soon,” or “To withdraw your gains you need to reach the next level.” The urgency is meant to push you to act fast, reducing time for due diligence.

Step 4 – Withdrawal Obstruction

When you request to withdraw larger funds, delays begin. The site or broker might demand extra “taxes,” “verification fees,” or “unlocking bonus conditions.” Support may become less responsive. Access to your account might be restricted. Ultimately, the funds disappear or you’re continually asked for more payments under different reasons.

Red Flags Specific to PremierVex.org

Here are key warning signs to look for in PremierVex.org and similar platforms:

Guaranteed or unusually high returns – Realistic returns vary widely with market conditions. Promises of fixed or extremely high gains are unrealistic.

Lack of verifiable licensing or regulation – A genuine investment provider is registered and you can check the regulator’s database.

Anonymous or vague ownership and team – No named founders, no professional bios, no independent verification of “traders.”

Aggressive upselling and urgency – Language that pushes you to deposit more quickly or acts as though the opportunity is exclusive.

Dashboard showing profits too early – A platform that shows sizable gains before you’ve even had time to understand the process may be simulating activity.

Obscure or shifting withdrawal terms – Making withdrawal depend on unspecified conditions, extra payments, or “final deposit” demands is a classic sign of scam structure.

Domain age and reputation concerns – A newly created domain or negative trust ratings from independent site-analysis tools can indicate risk.

When multiple red flags appear together, it’s a signal to step back and evaluate.

Why People Fall for Platforms Like PremierVex.org

The psychology behind these schemes is important to understand, especially if you’re new to online investing:

Desire for easy gains: Many people hope to grow their savings quickly and with minimal effort. This desire is natural—and legitimate—but it also makes high-promise offers more seductive.

Trust in professionalism: When a website is well-designed, uses financial language, and offers a personal manager, it gives an illusion of credibility—even when little underlying evidence exists.

Fear of missing out (FOMO): Statements like “limited offer” or “only few places available” create urgency, which can override caution and make people act without full analysis.

Low financial literacy or experience: If someone is less familiar with how investing works, they may not realise the risks or how to verify credentials. Inclusive financial education means recognising that anyone, regardless of background, deserves clarity and protection.

Understanding these psychological triggers helps you approach offers with a clearer mindset and protects you from becoming a victim.

How to Verify an Investment Platform (Inclusive Guide)

Here are straightforward steps everyone can follow—whether you’re new or experienced—to verify an investment platform like PremierVex.org:

Check regulation: Visit the official financial regulator for your country. Enter the company’s exact name and see if it appears. If not, treat the platform as high risk.

Search company ownership: Use your country’s company registry to verify that the entity exists, is active, and matches the website’s information.

Request proof of audits or results: Real investment firms publish audited results, or at least explain performance transparency. If nothing is available, ask why.

Read the full terms carefully: Look for hidden fees, withdrawal restrictions, conditions you must meet before withdrawing, or unclear bonus terms.

Test with a small amount: If everything so far looks okay, start with a very small deposit that you can afford to lose. See how the process works—including deposit, trading, and withdrawal.

Compare with known regulated providers: Look at what regulated platforms offer, their terms, average market returns, and how they communicate risk. Use that as a baseline for comparison.

Take your time: If the platform insists you must act now, that’s a signal to step back. A genuine platform gives you time to decide. You don’t need to feel rushed.

By following these steps, you protect yourself and ensure you are part of an inclusive investment environment where everyone—regardless of experience—makes informed decisions.

The Broader Impact of Platforms Like PremierVex.org

When platforms offering investment opportunities operate without transparency, the impact extends beyond financial loss. These effects include:

Trust erosion: People who have a negative experience may become mistrustful of online investing as a whole—even when legitimate firms exist.

Disproportionate harm: Often those with fewer resources or less experience are more vulnerable to these schemes. Inclusive financial safety means we address this imbalance.

Psychological stress: Beyond monetary loss, unanticipated fees, blocked accounts, or disappearance of funds can cause significant anxiety and distress.

Regulatory gap: When many unregulated sites operate globally, it complicates enforcement, protection, and recourse for individuals.

This underscores why awareness, regulation, and clear communication matter—not just for one person, but for the broader community.

Summary Take-Away

PremierVex.org presents an attractive front: promising high returns, offering quick access, and seeming professional. Yet, the lack of clear regulation, ambiguous ownership, pressure to deposit more, and likely withdrawal obstacles all align with patterns of high-risk or fraudulent platforms.

If you’re exploring any investment opportunity—particularly online—your right is to require transparency, fair terms, and verifiable regulation. Inclusive investing means ensuring that everyone, regardless of background or experience, has access to legitimate, safe, and understandable options. When these foundational elements are missing, you should treat the platform with caution and look for alternatives.

How GainRecoup.com Helps Victims of Premiervex.org

GainRecoup.com investigates premiervex.org transactions, gathers evidence, and maps payment paths. Our recovery team liaises with banks, card networks, and exchanges, files chargebacks, and escalates complaints to relevant authorities. You’ll receive a tailored action plan, clear documentation, and persistent follow-up designed to maximize fund recovery and hold premiervex.org accountable for victims.