When you come across a platform like CapitalXPressHub.com, it’s understandable to feel hopeful: the website makes promise of seamless investment access, impressive returns and expert-like guidance. But upon closer inspection—through an inclusive and accessible lens, mindful of anyone from beginner to experienced investor—it’s clear there are serious concerns. This review breaks down what the platform claims, what it doesn’t clearly show, the warning signals, and how to approach any platform like this with caution.

What CapitalXPressHub Claims to Offer

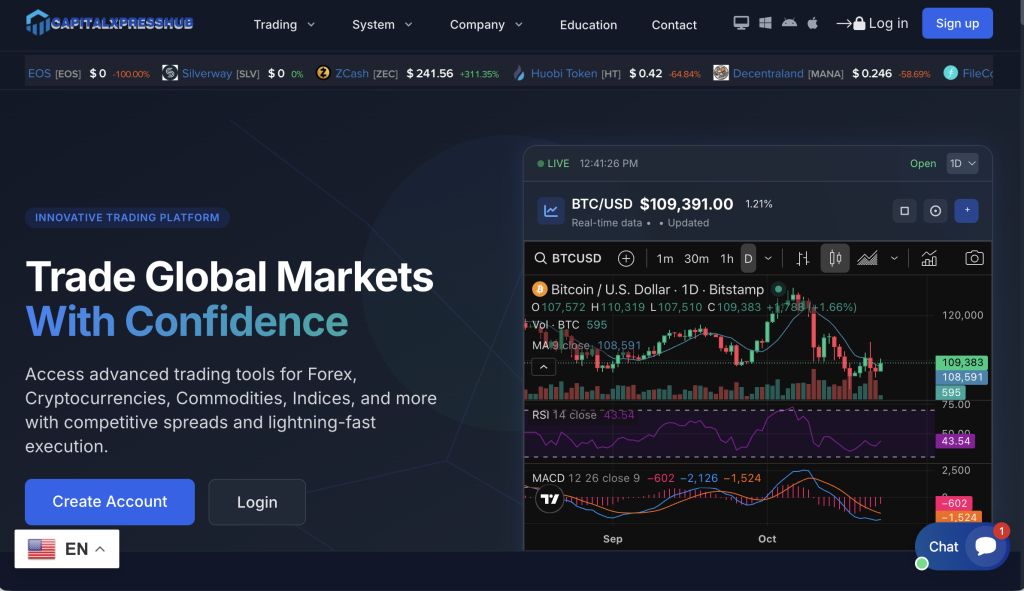

On the surface, Capital X Press Hub positions itself as a modern online finance or trading platform. Some of the typical claims include:

Easy registration and access to trading or investment opportunities.

Promises (implicitly or explicitly) of attractive returns, perhaps via “investment plans,” “trading tools” or “automated strategies.”

Support, account-managers, “exclusive” offers or guidance meant to reassure new investors.

Low perceived barriers: “Join now”, “start trading today”, and so on.

If you’re newer to online investing, these types of messages can feel empowering. But the key question is: Does the platform back those claims with transparent evidence, clear regulation, and verifiable track record?

Ownership, Licensing and Transparency: What We Find

One major piece of diligence for any platform is verifying the ownership, how the service is regulated (if at all), where it is based, how it holds client funds, and whether users can trust its legal underpinning. For Capital X Press Hub:

The platform advertises an address: 11 Grace Avenue, Ste 108, Great Neck, New York, 11021 USA. TheSafetyReviewer+1

But multiple independent checks show that the platform does not appear to be registered with reputable financial authorities or regulators. One regulator‐check platform indicates: “No valid regulatory information.” WikiFX+1

Because the platform lacks transparent regulation, there is no known formal oversight verifying how client funds are handled, how risks are managed, or how complaints are resolved.

In short: if a platform telling you that it is legitimate doesn’t easily show up on regulator registers or disclose a clear company/enforcement history, that absence alone is a strong caution signal.

Marketing, Promises and Risk Disclosure

When reviewing Capital X Press Hub, another area of concern is how marketing and disclosures align (or mis-align). Important aspects:

Does the site clearly state risk warnings? In investing and trading, losses are possible; a good provider always emphasizes that.

Does it show fees, commissions, account types, withdrawal rules, conditions for “bonuses” or “plans”? If these are hidden or vague, users can be exposed.

Does it promise “guaranteed returns”, “fixed profits”, or “zero risk”? If so, that is a red flag. Real markets don’t allow guaranteed returns.

For this platform, given the lack of documented regulation and missing transparent fee/disclosure materials, the marketing messages should be treated with extra caution—especially if they emphasise ease of profit without describing the trade-off of risk.

Onboarding, Deposit and Withdrawal Process

A typical operation of risk-heavy platforms often follows this pattern:

Quick signup: minimal checks before deposit.

Encouragement (or pressure) to deposit quickly and sometimes deposit large amounts or “upgrade your tier.”

Once deposit is made, everything looks functional—but when you attempt withdrawal you hit unexpected barriers: extra fees, “verification” requests, step-ups, or orders to deposit more to unlock funds.

In the case of Capital X Press Hub:

Without verified regulation and transparent client-fund structures, there is little evidence to indicate standard protections such as segregated funds or audited process.

Independent review sources categorize the platform as “high risk” because of this lack of regulatory registration. WikiFX+1

Because of the above, users considering this type of platform should assume that the withdrawal path may not be straightforward.

User Feedback, Web Footprint and Trust Indicators

Beyond what the platform claims, the wider web footprint and user feedback are important. With Capital X Press Hub:

The platform has been flagged by platforms that track broker regulation / trustworthiness as unregulated and not recommended. WikiFX+1

There are no easily found, credible audited third-party reviews showing long-term user satisfaction, easily verifiable withdrawals, or robust regulatory oversight.

When many of the trust indicators are weak—lack of regulation, lack of independent corroboration, minimal transparency—then the overall trust environment is compromised.

Common Patterns in Risky / Scam-Like Investment Platforms

While each case is unique, there are recurring patterns in platforms with higher risk:

Promises of large or “easy” returns with minimal explanation of how those returns are generated.

Pressure or urgency: “act now”, “limited time”, “exclusive offer”.

Little or no visible regulation, licensing, or oversight authority.

Bonus or “upgrade” incentives that tie to additional deposits or unclear withdrawal conditions.

Withdrawal difficulties: extra fees, need for “unlocking funds”, verification creep.

Anonymous or hidden ownership, vague or non-existent leadership teams.

Marketing via social media or cold outreach rather than organic user referral or transparent track record.

With Capital X Press Hub, many of these signals appear, which suggests caution is justified.

Practical Checklist to Assess Platforms (Inclusive Language for All Users)

Whether you are new to online investing or experienced, here is a simple inclusive checklist you can use to analyse any platform (including Capital X Press Hub) before you commit funds.

Checklist:

Legal identity: Can you find the company’s full legal name, registration number, physical address, country of registration, and leadership?

Regulation: Is the company supervised by a reputable financial regulator in your country or jurisdiction? Can you verify a licence number?

Client fund protection: Are user funds held in segregated accounts? Is there insurance or compensation scheme?

Transparent fees and risks: Are the fees, commission, or costs clearly listed? Does the platform state the risks of investing/trading?

Deposit & withdrawal clarity: Are the deposit and withdrawal methods clearly explained? Are there limits or conditions you weren’t told initially?

Marketing vs. reality: If the platform promises “guaranteed high returns”, “no risk”, or “get rich quick”, that is a red flag.

User reviews & track record: Do independent sources corroborate good performance and successful withdrawals? Or are there complaints?

Support & communication: Can you easily contact support via working email, phone, live chat? Are they transparent and helpful?

Personal comfort: Do you feel comfortable about the platform? Would you prefer to start with a small amount you are comfortable risking?

Using this checklist helps you treat every opportunity with equanimity, ensuring your decisions are intentional and informed.

Balanced Conclusion

In inclusive, straightforward terms: Capital X Press Hub does not currently demonstrate the level of regulatory transparency, independent review, or trust indicators that many safer, established platforms show. That doesn’t necessarily prove illegal intent—but it does raise the risk considerably.

If you are considering depositing there, you should weigh:

The lack of verifiable regulation is a major concern.

The absence of clear track record or broad independent user testimonials undermines confidence.

The promise of returns without matching disclosure puts you on the less-certain side of the risk spectrum.

If you decide to proceed, do so only with an amount you can afford to lose, start small, and ensure you test withdrawal early. Or, you might choose instead to go with platforms that have demonstrated oversight, audited performance, and strong reputations in your region.

Bottom line: For most people seeking a trustworthy investment/trading partner, a platform like Capital X Press Hub lacks several of the “protective layers” you would want in place. Bringing your awareness and diligence fully into play is the best way to protect your time, effort, and funds as you explore online financial opportunities.

How GainRecoup.com Helps Victims of Capitalxpresshub.com

GainRecoup.com investigates capitalxpresshub.com transactions, gathers evidence, and maps payment paths. Our recovery team liaises with banks, card networks, and exchanges, files chargebacks, and escalates complaints to relevant authorities. You’ll receive a tailored action plan, clear documentation, and persistent follow-up designed to maximize fund recovery and hold capitalxpresshub.com accountable for victims.