Online trading platforms have become increasingly common, with many promising easy profits, advanced tools, and professional guidance. AchimFin.com presents itself as one such opportunity — sleek, global, and modern. But beneath the professional appearance lies a troubling lack of transparency and multiple warning signs that potential investors should not ignore.

This in-depth review examines AchimFin.com, its structure, claims, regulatory status, and the red flags that raise serious concerns. Written in inclusive, clear, and SEO-friendly language, this guide aims to help every reader—new or experienced—understand what’s at stake.

What AchimFin.com Claims

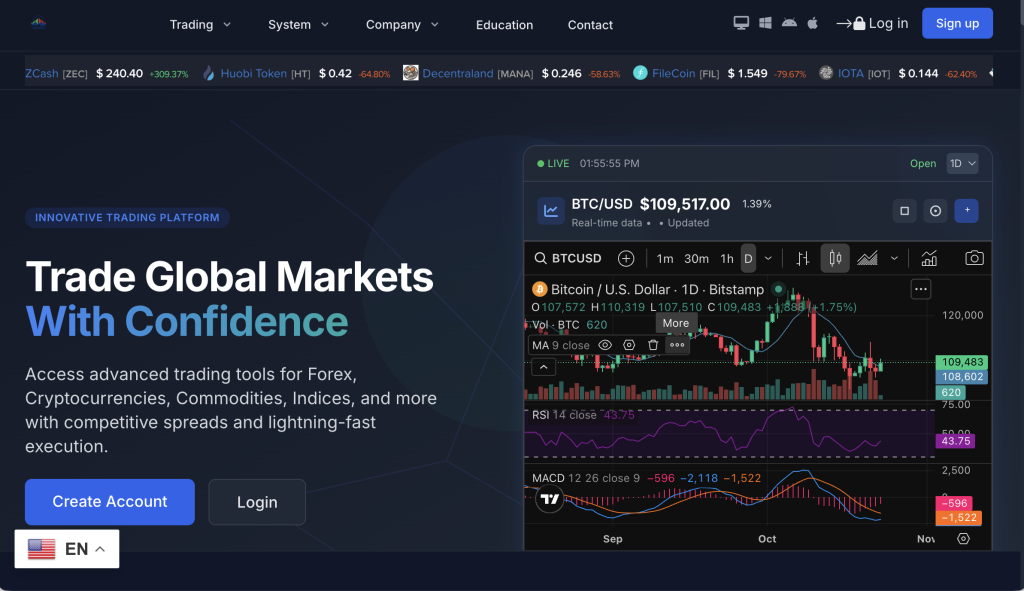

AchimFin.com markets itself as a global investment or trading platform, often using polished visuals and technical phrases to appear legitimate. Some of its key claims include:

“Advanced trading experience” with access to multiple asset classes such as forex, crypto, stocks, and commodities.

“Professional management” and “dedicated advisors” who guide clients toward success.

“Secure transactions” and “fast withdrawals.”

“High returns” on investment through smart algorithms and cutting-edge tools.

While these claims sound impressive, they’re also common among unregulated or scam platforms. Genuine financial institutions provide verifiable data—licensing, audited performance reports, and transparent ownership. AchimFin.com, by contrast, gives vague information and relies heavily on marketing language rather than factual documentation.

Transparency and Regulation: The First Red Flag

The most important test for any investment platform is regulatory clarity. A legitimate broker must be licensed and supervised by recognized authorities such as the FCA (UK), CySEC (Cyprus), or ASIC (Australia).

When investigating AchimFin.com:

There is no verifiable registration or license under the name “AchimFin” with any major regulator.

The website provides no clear physical address or registration number.

The “About Us” or “Legal” sections—if present—offer generic language without confirming which country’s laws apply.

This means AchimFin.com likely operates without official oversight, leaving users without legal protection if issues arise. In practical terms, deposits may not be safeguarded, and disputes may be impossible to resolve through legitimate financial authorities.

Tip: Always verify a company’s license on the regulator’s official website, not on the broker’s own page.

Marketing Promises vs. Real-World Evidence

AchimFin.com promises stability, profit, and reliability, yet these claims are unsupported by transparent data. Here’s how their marketing strategy contrasts with responsible business practices:

| Claim | What’s Missing |

|---|---|

| “Guaranteed or high returns” | No proof, no audited performance reports |

| “Advanced technology” | No details on tools, data security, or trading partners |

| “24/7 expert support” | Often unreachable or limited to chatbots or generic email |

| “Fast withdrawals” | No verifiable evidence of successful, consistent payouts |

These inconsistencies make it clear that AchimFin.com’s promotional tone outweighs its factual content. Genuine financial institutions emphasize risk awareness, not unrealistic success.

Ownership and Contact Details: Another Cause for Concern

A transparent company always provides identifiable leadership, contact channels, and verifiable addresses. With AchimFin.com, however:

There is no visible leadership team listed.

The “contact” section often lists only an email or chat form.

There are no real business credentials, such as company number or license ID.

In scam-prone operations, this opacity is deliberate. It makes it harder for clients to trace or hold anyone accountable once funds are deposited.

Deposit and Withdrawal: Common Problem Areas

The deposit and withdrawal process reveals a lot about a platform’s legitimacy. AchimFin.com claims that withdrawals are easy and instant, but unregulated brokers often use this as bait. Common patterns include:

Quick deposit process – Minimal checks or KYC verification before accepting money.

Aggressive deposit encouragement – “Account managers” pressure users to invest more.

Withdrawal barriers – Users are told to meet new trading conditions, pay “unlock fees,” or wait for arbitrary verification.

Unreturned funds – Emails and chats go unanswered once clients attempt withdrawal.

If a company’s withdrawal process depends on extra payments or unclear conditions, it’s a critical warning sign.

The Design of Trust: Professional Look, No Substance

Scam platforms often use sleek websites to mimic legitimate brokers. AchimFin.com fits this pattern:

Professional design and stock photos create the illusion of credibility.

Buzzwords like “blockchain,” “AI,” and “smart trading” appear frequently, but with no technical explanations.

Fake testimonials may appear to showcase satisfied “clients,” but they lack verifiable details.

A polished appearance should never replace evidence of accountability and licensing.

Red Flags Found on AchimFin.com

After reviewing the platform’s structure, content, and claims, several warning signs stand out clearly:

No regulatory license or oversight.

No clear ownership or business registration details.

Unverifiable performance claims.

Pressure to deposit funds quickly.

Unclear withdrawal terms or hidden conditions.

Possible cloned or fake addresses used for credibility.

Lack of independent audits, contact transparency, or clear jurisdiction.

Each of these alone would raise concern. Together, they form a strong pattern of risk that investors should not overlook.

Inclusive Checklist: How to Evaluate Platforms Like AchimFin.com

Whether you’re just starting or already have trading experience, here’s a universal checklist you can use to evaluate any platform safely:

Verify regulation: Always confirm a license through an official regulator database.

Check ownership: Make sure the company name, number, and address match across documents.

Read the fine print: Hidden terms often restrict withdrawals or add hidden fees.

Ask for proof: Request official documents for licensing, audits, or client fund segregation.

Test small withdrawals: Before investing large sums, try withdrawing a small amount to test their reliability.

Avoid pressure: Legitimate companies never rush deposits or promise fixed profits.

Research user feedback: Search for verified reviews across multiple independent sites.

Trust your intuition: If something feels off—delays, unclear language, or too-good-to-be-true offers—pause immediately.

This inclusive checklist empowers every user, regardless of background, to make informed and confident decisions.

Why Regulation and Transparency Matter

Regulation protects consumers by enforcing:

Capital requirements ensuring the company can cover liabilities.

Segregated accounts so client funds remain separate from operational money.

Regular audits to ensure compliance and honesty.

Clear dispute resolution channels in case of fraud or error.

Without these, clients are exposed to the risk of losing access to their money. Unregulated firms like AchimFin.com operate outside this protective structure, which is why investing with them is a gamble, not a strategy.

User Reports and Community Concerns

While public complaints about AchimFin.com are limited, the few that appear online follow consistent themes seen in many unregulated trading websites:

Withdrawal delays or denials.

Unhelpful customer support.

Sudden account freezes after requesting payouts.

High-pressure tactics to reinvest rather than withdraw.

These recurring reports—while anecdotal—fit the pattern of deceptive online investment operations.

Balanced Conclusion

In clear and inclusive terms: AchimFin.com exhibits multiple red flags that make it unsafe for investors seeking reliability and accountability.

The platform lacks verifiable regulation or licensing.

Ownership and corporate details remain hidden.

Marketing emphasizes profit but avoids transparent risk disclosure.

Patterns align with known characteristics of unregulated, high-risk trading schemes.

This doesn’t conclusively prove AchimFin.com is fraudulent, but it does mean anyone considering it should proceed with extreme caution.

If you choose to explore online investment opportunities, focus on companies that:

Are licensed by well-known regulators (FCA, ASIC, CySEC, etc.).

Provide full company details, audits, and verifiable contacts.

Offer balanced communication—emphasizing risk alongside opportunity.

Have positive, traceable user reviews and working customer service channels.

Final Thoughts

In the fast-growing online investment world, not every platform with a modern website deserves your trust. AchimFin.com’s lack of regulation, hidden details, and over-promising tone are clear reasons for concern. Before depositing a single dollar, ensure you’ve verified every detail and tested the company’s transparency.

Bottom line: A legitimate investment platform proves its trust through regulation and openness—not through fancy design or bold promises. Stay cautious, ask questions, and let facts—not advertising—guide your financial decisions.

How GainRecoup.com Helps Victims of Achimfin.com

GainRecoup.com investigates achimfin.com transactions, gathers evidence, and maps payment paths. Our recovery team liaises with banks, card networks, and exchanges, files chargebacks, and escalates complaints to relevant authorities. You’ll receive a tailored action plan, clear documentation, and persistent follow-up designed to maximize fund recovery and hold achimfin.com accountable for victims.