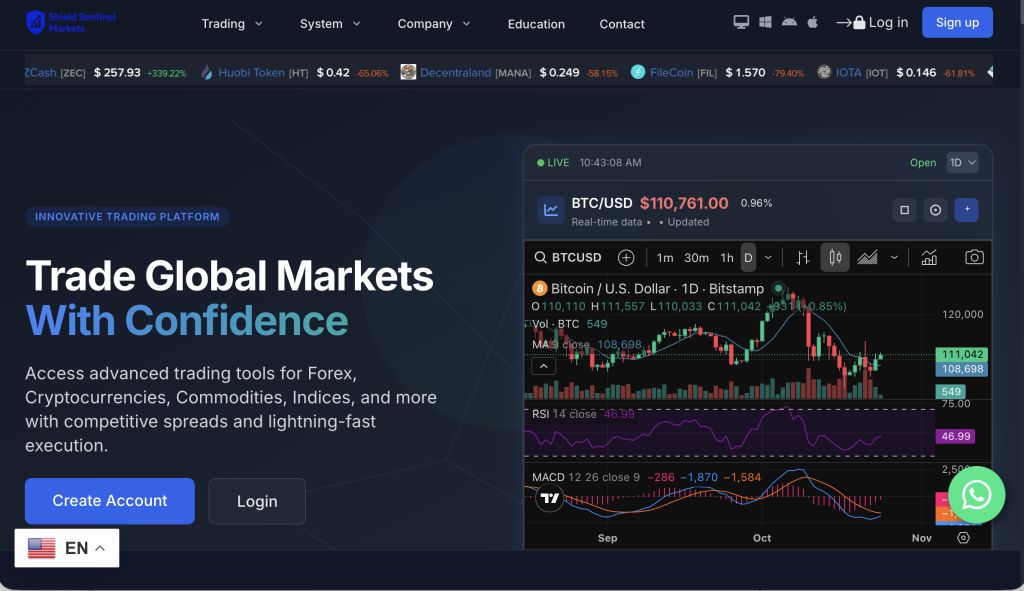

The internet is filled with platforms claiming to help investors grow their money quickly and securely. One such name that has recently attracted attention is ShieldSentinelMarket.com. On the surface, it presents itself as a professional investment and trading platform that offers lucrative opportunities in forex, cryptocurrencies, and commodities.

However, after analyzing its website, claims, and structure, several signs indicate that this platform might not be as legitimate as it appears. In this in-depth ShieldSentinelMarket.com scam review, we’ll explore what the company claims, the red flags that stand out, and the patterns that suggest caution before investing a single cent.

What ShieldSentinelMarket.com Claims to Be

According to its website, ShieldSentinelMarket.com positions itself as a “leading global investment platform” that provides access to a wide range of markets. It advertises:

Fast account setup and immediate access to trading tools.

Expert guidance and personal account managers to “help users profit faster.”

Automated trading systems that supposedly reduce risks and maximize rewards.

24/7 customer support and transparency with client funds.

At first glance, this may sound like an ideal opportunity for investors looking for convenience and accessibility. The platform uses friendly, inclusive language to attract both beginners and experienced traders, suggesting that “anyone can start trading and see results.”

Yet, when we look deeper, there are several inconsistencies and risk indicators that can’t be ignored.

Red Flags That Suggest High Risk

1. No Verifiable Company Identity

A credible trading company should clearly display its legal business name, registration number, and address. ShieldSentinelMarket.com provides vague information, often referencing a “registered investment company” without linking to an official database.

There are no signs of incorporation records or verifiable business documentation, which means investors have no way to confirm who is truly behind the operation.

2. No Recognized Financial Regulation

The website claims to operate “globally” and even hints at “UK-based compliance.” However, there is no visible license number or registration under any reputable financial authority such as the Financial Conduct Authority (FCA), CySEC, or ASIC.

Without verified regulation, a platform operates entirely outside of any investor protection laws. That means if your funds are lost, locked, or frozen, there’s no governing body to hold the company accountable.

3. Unrealistic Profit Promises

Several parts of the ShieldSentinelMarket.com website make unrealistic claims about profits and success rates. Terms like “guaranteed results,” “easy growth,” or “risk-free trading” are classic red flags in the investment world.

No legitimate financial platform guarantees returns. Markets fluctuate, and even top-tier regulated brokers include risk disclaimers on every page. The absence of such disclaimers is concerning.

4. Anonymous or Hidden Team

The website uses stock-style images for its supposed team members and offers no verifiable details about its executives, trading analysts, or financial experts.

Legitimate firms usually introduce real professionals with LinkedIn profiles, credentials, and regulatory history. The absence of real staff transparency suggests that ShieldSentinelMarket.com may be masking its operators behind a generic corporate facade.

5. Poorly Written Legal Pages

A closer look at the site’s Terms & Conditions and Privacy Policy reveals inconsistent formatting, vague language, and missing company details. Some sections appear copied from unrelated websites.

This lack of attention to legal documentation is a strong sign that the company is not following proper compliance standards required for legitimate financial services.

6. Reports of Withdrawal Problems

While the site promotes “easy withdrawals,” many unverified online discussions mention users facing long delays or additional fees when trying to withdraw their money.

Common complaints include:

Requests for extra “tax clearance” before releasing funds.

Sudden suspension of accounts after withdrawal attempts.

Lack of response from support after deposits are made.

These are frequent warning signs found across unregulated or scam-style platforms.

Typical Operation Pattern of High-Risk Trading Sites

Understanding the behavior pattern of sites like ShieldSentinelMarket.com helps explain why so many investors fall into their traps.

Initial Attraction: The platform markets heavily on social media or through ads showing luxury lifestyles and fake testimonials.

Easy Account Creation: Signing up is quick and effortless, usually requiring only a name, email, and phone number.

First Deposit Pressure: Users are contacted by “account managers” or “consultants” urging them to start small and “watch their balance grow.”

Dashboard Manipulation: The internal trading dashboard may show profits—even if no real trades are taking place.

Upsell for Bigger Deposits: As confidence builds, users are encouraged to deposit larger amounts for “premium” access or higher returns.

Withdrawal Resistance: When a user requests to withdraw, they face extra requirements—fees, ID checks, or excuses about processing delays.

Silence or Deactivation: Once users stop funding or challenge the company, responses often stop completely.

This pattern has been seen repeatedly with fraudulent trading platforms worldwide, and ShieldSentinelMarket.com shows many of the same behavioral traits.

Important Questions to Ask Before Depositing Funds

If you are still considering investing through this platform, make sure you get clear, verifiable answers to these questions first:

What is the exact legal name and registration number of the company?

Which regulator licenses the business, and can this be confirmed through the official regulator’s website?

Are funds segregated in verified accounts, or are they held in private wallets?

Are there clear withdrawal policies, and have you read the fine print about “bonus” or “tax” clauses?

What banking or payment partners does the company use, and are they reputable institutions?

Does the company have a transparent complaints process?

If any of these questions are ignored, delayed, or answered vaguely, it’s safer to assume the platform cannot guarantee your funds’ safety.

Language That Builds False Trust

ShieldSentinelMarket.com uses inclusive and reassuring language throughout its website. It repeatedly states phrases like “We care about your growth,” “Our traders are your partners,” and “We make investing accessible to everyone.”

While these lines are friendly and appealing, they are also marketing tactics designed to build emotional confidencerather than provide factual transparency. A trustworthy platform doesn’t just sound inclusive—it proves accountabilitythrough licensing, open communication, and verifiable public records.

Comparison With Legitimate Brokers

To understand the contrast, here’s how genuine trading platforms differ from questionable ones like ShieldSentinelMarket.com:

| Aspect | Legitimate Broker | ShieldSentinelMarket.com Pattern |

|---|---|---|

| Regulation | Licensed by FCA, CySEC, or ASIC | No visible or verifiable license |

| Transparency | Full company identity disclosed | Hidden ownership and vague address |

| Withdrawals | Processed within fixed timeframes | Reports of delays and “extra fees” |

| Support | Professional, traceable contacts | Unverified phone/email, scripted replies |

| Risk Disclosure | Clearly visible on every page | Absent or buried in small print |

This comparison highlights that the lack of transparency and unverifiable claims are not isolated issues—they form a pattern of systemic risk.

Final Verdict: High-Risk Platform With Multiple Red Flags

After reviewing all available details, ShieldSentinelMarket.com exhibits a classic high-risk profile:

No valid or verifiable regulation.

Hidden ownership and unverifiable contact details.

Unrealistic claims of guaranteed profits.

Complaints about blocked or delayed withdrawals.

Poor transparency in legal documentation.

These factors combined create a serious concern for anyone considering depositing funds. While the site may appear modern and professional, its lack of transparency and accountability makes it unsafe for real investment activity.

Conclusion

The financial market is full of opportunities, but also full of imitations. ShieldSentinelMarket.com presents itself as a legitimate investment portal, yet fails the most basic credibility tests that define real trading platforms.

When a company cannot prove its regulatory status, hides its identity, and makes unrealistic promises, the safest conclusion is simple: proceed with caution—or not at all.

Your investment capital deserves protection, transparency, and honesty. Always verify licenses, read every term carefully, and ensure that any platform you trust your funds with is backed by real-world accountability.

How GainRecoup.com Helps Victims of Shieldsentinelmarket.com

GainRecoup.com investigates shieldsentinelmarket.com transactions, gathers evidence, and maps payment paths. Our recovery team liaises with banks, card networks, and exchanges, files chargebacks, and escalates complaints to relevant authorities. You’ll receive a tailored action plan, clear documentation, and persistent follow-up designed to maximize fund recovery and hold shieldsentinelmarket.com accountable for victims.