In the digital age, investment platforms promise ease, accessibility, and growth. But not all platforms live up to those promises — some raise serious concerns around transparency, regulation, and fund protection. This review examines MarketMindsTrade.com (also known as Market Minds Trade) to help you understand its claim, its risk profile, and whether it meets the standards you deserve as an inclusive investor of any background.

Key takeaway: MarketMindsTrade registers multiple warning signs that merit caution and due diligence before you move funds or commit to its services.

What MarketMindsTrade Claims to Offer

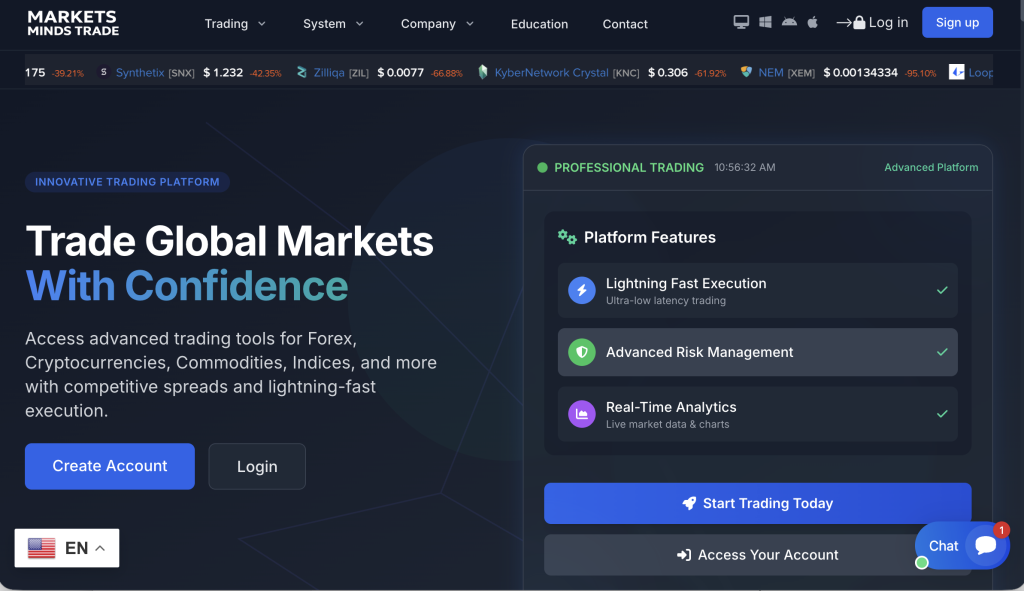

According to its website, MarketMindsTrade presents itself as a global multi-asset trading platform that allows participants to trade stocks, indices, commodities, forex, and cryptocurrencies. It emphasises:

Access to “advanced trading tools,” high-performance execution, and market analytics.

Fast account setup and inclusive access for all levels of investors—from beginners to experienced traders.

Professional support, global reach, and promises of competitive spreads and diversified asset exposure.

On the surface, the messaging is positive and inclusive: “anyone can join,” “trade with confidence,” and “grow your portfolio.” These are attractive promises, but as with any investment platform, the fine print matters.

Red Flags That Require Attention

When we examine MarketMindsTrade, several key risk indicators stand out. These don’t guarantee fraud, but they significantly raise the risk level.

1. No Valid or Verifiable Regulation

One of the most important markers of a trustworthy broker or trading platform is authorization by a recognized financial regulator. The platform lists itself with the domain marketmindstrade.com and uses names like “Market Minds Trade,” but the UK regulator, the Financial Conduct Authority (FCA) has issued a warning that the firm is not authorised or registered. FCA

Additionally, third-party reviews indicate “no valid regulatory information” for the brand. WikiFX+1

Without regulation, you may lack many protections that come with licensed entities—such as external complaint handling, fund segregation requirements, and oversight of trading practices.

2. Hidden Ownership and Short Domain History

Independent website checks show:

The domain has been registered recently. ScamAdviser+1

The registered owner is masked, using privacy services to hide identity. ScamAdviser

The server is hosted on a shared infrastructure, which is less typical for high-volume regulated brokers. ScamAdviser

These factors reduce transparency. A genuine investment platform has its company, address, directors, and regulatory information clearly available and verifiable.

3. Unrealistic or Vague Promises

MarketMindsTrade claims broad product access (stocks, commodities, forex, crypto) and supports “all investor types.” However:

There is limited credible evidence of actual trading track records or user reviews verifying performance.

The inclusive marketing style may downplay the risks associated with leveraged or derivative trading.

Review sources highlight that multiple users report deposit-only experiences and blocked or delayed withdrawals. Fund Recovery Agency+1

Inclusive language is admirable, but when used without corresponding transparency, it becomes a tool of persuasion rather than protection.

4. Withdrawal Process and Terms Are Not Transparent

One of the most consistent complaints with unverified platforms is withdrawal difficulty. While we do not dive into individual recovery stories, general reports about MarketMindsTrade include:

Users being asked for additional “verification” or “fees” before accessing funds. Fund Recovery Agency+1

No clear published schedule of deposit/withdrawal protocols or independent reviews of payouts.

Banking or crypto methods that convert funds into wallets or transfers, with limited traceability.

When a platform offers broad asset access but fails to provide clarity on how funds get back to you, the risk escalates.

How the Risk Pattern Usually Plays Out

To help you recognise the warning signs early, here’s a typical structure seen across risky platforms—one that aligns with indicators observed in the case of MarketMindsTrade:

Initial Contact & Attraction: Promises of high returns, inclusive for all backgrounds, easy registration, friendly account manager outreach.

Onboarding & Early Gains: You deposit a modest amount, may see simulated gains or a dashboard showing growth designed to build confidence.

Scaling Up: Encouragement to deposit more, “premium account” offers, broad access to multiple asset classes—all in the name of expanding opportunity.

Withdrawal Request: At this point, friction appears: identity or address verification, extra “tax” or “processing fees,” push to deposit more to unlock funds.

Access Denied or Delayed: Support becomes unresponsive, your account may be restricted, you’re requested to perform actions that don’t lead to payout.

Loss Realised: You face difficult access, and the platform might vanish or change domain. Funds previously visible may disappear or become illiquid.

MarketMindsTrade includes enough of these signals—in lack of regulation, hidden ownership, broad claims without transparency—to raise legitimate concern.

Inclusive Perspective: Why This Matters for Every Investor

Whether you’re a novice investor, a seasoned trader, or someone simply looking to grow savings, the following points are universally important:

Trust and transparency matter: Regardless of background, your funds deserve a platform that shows full disclosure—company details, licensing, audited results.

Risk is real: Multi-asset trading (stocks, commodities, derivatives, crypto) involves potential for high loss as well as high gain—even more so when leverage is involved.

Accessibility is a double-edged sword: The promise that “everyone can trade” is powerful, but it must be matched by responsible practices: clear risk warnings, fair terms, and support designed for all levels of experience.

Inclusive marketing should not mean lower standards for protection—it should ensure equal access and equal transparency.

Key Questions to Ask If You Encounter This Platform

Before depositing or engaging further with MarketMindsTrade (or any similar platform), ask yourself and the provider:

What is the legal entity name of the operator, and is it publicly searchable?

Which financial regulator licences the company, and can you find that licence number in the regulator’s register?

How are client funds held? Are they segregated in a regulated bank or collectively pooled?

What are the exact withdrawal terms? Are there minimum amounts, hidden fees, processing times, or bonus restrictions?

Is there an audited trading history or credible independent review demonstrating outcomes over time?

How openly does the platform disclose team members, physical address, directors, and corporate history?

If any one of these questions receives an evasive or incomplete answer, that alone is a good reason to pause.

Final Verdict: High-Risk Platform That Doesn’t Meet Transparency Standards

After reviewing available information, MarketMindsTrade demonstrates the following key issues:

It lacks verifiable regulation from a recognized body.

Ownership is hidden, and domain history is very new.

Broad claims of ease and access without detailed transparency.

Multiple independent alerts and review services assign a low trust score or issue official warnings.

For inclusive investors—regardless of experience level—the platform does not currently meet the standard of transparency and accountability you deserve. It should be classified as high-risk, and you should treat deposits accordingly until you can verify regulatory, operational, and fund-safety practices.

Closing Thoughts

Investing should always be empowering, not intimidating—or streamlining transparency instead of skipping it. MarketMindsTrade may promise choice, accessibility, and growth, but without the foundational elements of regulation, ownership disclosure, and consistent user outcomes, it fails to deliver what every investor should expect.

If you’re looking for a platform that truly values inclusivity, accessibility, and fair treatment, make sure you choose one that puts transparency first—not just marketing.

Your money deserves nothing less.

How GainRecoup.com Helps Victims of Marketmindstrade.com

GainRecoup.com investigates marketmindstrade.com transactions, gathers evidence, and maps payment paths. Our recovery team liaises with banks, card networks, and exchanges, files chargebacks, and escalates complaints to relevant authorities. You’ll receive a tailored action plan, clear documentation, and persistent follow-up designed to maximize fund recovery and hold marketmindstrade.com accountable for victims.