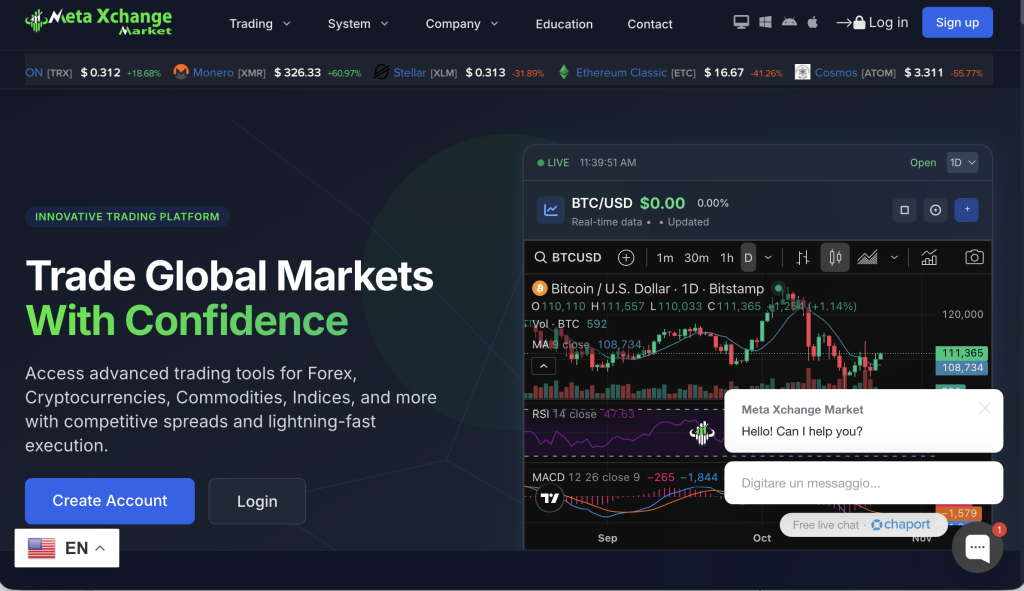

The promise of accessible, high-reward online investing has never been more alluring. Platforms offering swift entry into markets like forex, crypto or commodities often target a broad global audience, appealing to beginners and professionals alike. One such platform making waves is Meta Xchange Market, operating through the domain metaxchangemarket.com. While the website projects a modern, inclusive vibe and suggests “anyone can get started,” a closer examination reveals numerous warning signs that suggest this platform may be high-risk.

In this in-depth review we’ll explore what Meta Xchange Market claims, highlight the red flags we found, outline how typical high-risk platforms operate, and provide key questions to ask before you entrust any funds. The goal: to help you make an informed decision with clarity and confidence.

Key takeaway: Meta Xchange Market displays many of the classic attributes associated with unregulated or risky investment platforms. Unless you can verify its regulation, transparency and fund-safety mechanisms, you should treat it with caution.

What Meta Xchange Market Claims to Offer

Meta Xchange Market presents itself as a global investment and trading hub, offering access to multiple asset classes—from cryptocurrencies and forex to commodities and indices. Its marketing emphasizes:

“Fast, accessible registration for all investor levels.”

“Cutting-edge tools and analytics to empower your trades.”

“Inclusive support and dedicated account managers to guide your journey.”

“Opportunity to grow your portfolio with confidence and convenience.”

The tone is inclusive and aspirational: whether you are a first-time investor or seasoned trader, the message suggests you can participate effortlessly. In principle, accessible investing is excellent—but the real test lies in how the platform backs up these promises with transparent, verifiable practices.

Red Flags That Suggest Elevated Risk

Here are detailed risk markers that stand out when we examine Meta Xchange Market:

1) Lack of Verifiable Regulation

One of the most reliable indicators of risk is the absence of recognised financial regulation. Reviews of Meta Xchange Market claim it is not authorised by major regulatory bodies such as the UK’s Financial Conduct Authority, Australia’s ASIC, or similar agencies. Without legitimate licensing, the platform may operate outside investor-protection frameworks, leaving users with little recourse if issues arise.

2) Hidden Ownership and Short Domain Life

Effective platforms clearly disclose the legal entity, company registration, leadership team, and jurisdiction. Meta Xchange Market appears to obscure many of these details: ownership is vague, the domain is relatively new, and many standard disclosure elements are missing. A short domain lifespan combined with anonymity increases risk, as such sites often vanish or alter terms unexpectedly.

3) Broad Claims with Minimal Proof

Meta Xchange Market talks about “professional tools,” “dedicated support,” and “inclusive opportunity,” which sound appealing. But when such claims are not supported by concrete evidence—such as audited results, verifiable trading track records, real-world testimonials with identity verification—they become promotional rather than substantive. Inclusive language is positive but cannot replace operational transparency.

4) Withdrawal and Term Conditions Are Ambiguous

Many platforms that raise concern allow deposits easily but introduce significant friction when users attempt withdrawal. Although we are not giving recovery instructions, reports suggest Meta Xchange Market does not clearly publishwithdrawal timelines, fee tables, or minimum trade/turnover requirements upfront. If withdrawal conditions are hidden or ambiguous, it signals elevated risk.

5) Marketing Pressure and Unrealistic Promises

The inclusive appeal—“you can start now,” “everyone can trade and win”—may downplay the real volatility and risk of trading. Any platform that implies guaranteed performance or overly smooth wins deserves caution. Meta Xchange Market uses marketing language that suggests ease and broad access, without matching the full transparency and risk disclosures expected from regulated platforms.

How These Patterns Typically Play Out

While each platform is unique, the following sequence is common among high-risk investment sites. Meta X change Market displays many of these traits:

Initial Attraction: You are drawn in via online ads, social media promotions or unsolicited messages offering “great trading opportunities.”

Quick Registration & Deposit: Account creation is fast, then you are encouraged to deposit funds with minimal verification.

Early “Success” Displayed: The platform may show gains on your dashboard or highlight “winning trades” to build trust.

Upsell Encouragement: A manager or support contact encourages you to increase your deposit to gain “premium features” or “better returns.”

Withdrawal Challenge: When you seek to withdraw, you are asked to meet complex conditions, pay additional fees, or submit extensive documentation.

Support Degradation or Silent Exit: Communication may slow, you may be blocked from accessing funds, or the platform could vanish or rebrand quickly.

If Meta X change Market follows this playbook—or any variant of it—it presents a significant risk profile for any investor.

Questions to Ask Before Engaging with Meta Xchange Market

Before you deposit any funds into Meta Xchange Market (or any similar platform), consider asking:

What is the legal entity name, registration number and jurisdiction of operation?

Which financial regulator licences the platform? Can you verify the licence number publicly?

How are client funds held? Are they segregated in a trusted bank, or pooled without protection?

What are the exact withdrawal terms, including minimums, fees, delays and trading/volume requirements?

Is there an audited financial statement, third-party review or independent verification of performance?

Who are the executives and team members? Do they have verifiable credentials and transparent profiles?

Are there robust risk disclosures and clear communication about the possibility of loss?

If any of these questions are answered vaguely or not at all, that alone justifies extreme caution.

Why Inclusive Language Doesn’t Mitigate the Risk

Meta X change Market’s marketing emphasises inclusivity—“everyone can trade,” “invest regardless of experience,” “our tools make it simple.” On one level, inclusive language is commendable because it invites diverse participants and removes elitist barriers.

However, inclusive marketing must be paired with inclusive protections: full transparency, fair terms, clear communication, and verified safeguards. Without these, inclusivity becomes a marketing veneer that may entice vulnerable or under-informed investors into high-risk positions without full understanding of the consequences.

For truly inclusive investing, you deserve both access and accountability.

Counters to the Common Defense Arguments

Some platforms invoke certain defenses when questioned about their legitimacy. Here are a few you may hear and how to interpret them with caution:

“We are a technology startup, we will seek regulation soon.”

Startups operate under higher risk. Until regulation is in place and live, funds may be exposed.“We show user testimonials and successful clients.”

Testimonials can be staged or cherry-picked. Real protection lies in regulation and transparency, not just happy screenshots.“We serve international clients; regulation depends on region.”

While global operations are not inherently bad, they increase complexity and often shift away from regulated jurisdictions into weaker oversight areas.“We offer high leverage and high returns because we use sophisticated tools.”

High leverage equals high risk. Any promise of smooth, high returns is unrealistic based on how financial markets function.

Final Verdict: Elevated Risk, Inadequate Transparency

Based on the evidence available:

No verifiable licence from recognised regulators.

Ownership and registration details appear obscure.

Marketing promises are broad, inclusive, and lacking in tangible proof.

Withdrawal terms and fund protection mechanisms are not clearly documented.

The narrative aligns with many patterns seen in high-risk, unverified platforms.

Hence, Meta X change Market should be considered a high-risk platform, especially if you are planning to deposit money before performing full due diligence.

For inclusive investors—whether new or experienced—the fundamental expectation is transparency, clarity, and protection. The platform currently falls short of those standards.

Closing Thoughts

The world of online trading and investing offers tremendous potential—but also significant risk. Platforms like Meta X change Market may appear polished, fast-moving, and inclusive—but that does not guarantee legitimacy. A genuine investment platform will not just invite everyone—it will protect everyone with open disclosure, regulated operations, and clear client safeguards.

Before proceeding with any new platform, especially those promising accessibility and high returns, take the time to verify credentials, ask tough questions, and align your decision with your risk tolerance and values.

Your investment deserves more than an inclusive invitation—it deserves full transparency and real accountability.

How GainRecoup.com Helps Victims of Metaxchangemarket.com

GainRecoup.com investigates metaxchangemarket.com transactions, gathers evidence, and maps payment paths. Our recovery team liaises with banks, card networks, and exchanges, files chargebacks, and escalates complaints to relevant authorities. You’ll receive a tailored action plan, clear documentation, and persistent follow-up designed to maximize fund recovery and hold metaxchangemarket.com accountable for victims.