In the growing world of online trading, every investor deserves access to platforms that are transparent, regulated and trustworthy. Unfortunately, not all services live up to that standard. The platform operating under the name BitexChainTrade.com (also trading as “Bitex Chain”) raises multiple warning signals that warrant a deeper look—especially if you’re a first-time user or someone looking for an inclusive, reliable trading experience.

In this review, we will explore what BitexChainTrade.com claims, examine the red flags we discovered, outline how platforms with these characteristics typically operate, and provide inclusive insights to help you make informed decisions, regardless of your level of experience.

Key takeaway: BitexChainTrade.com displays a succession of risk indicators—lack of verified regulation, opaque disclosures, and promotional language that over-emphasises accessibility. Approach with caution and only proceed if full transparency can be confirmed.

What BitexChainTrade.com Claims to Offer

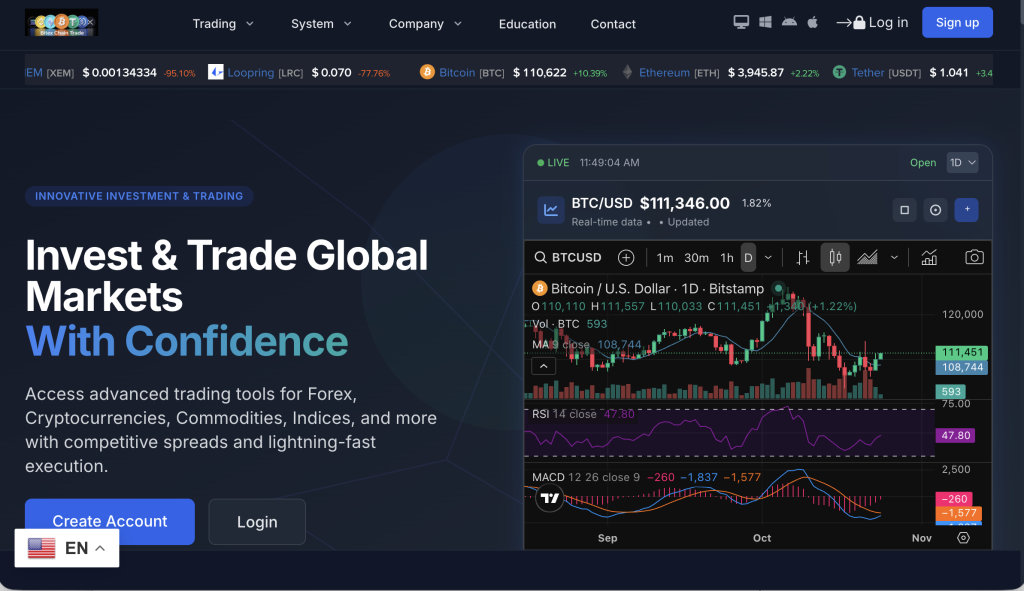

On its website, BitexChainTrade.com presents itself as a comprehensive multi-asset trading platform catering to a broad audience. Some of the key claims include:

Trading in CFDs, including stocks, gold, oil, indices, and cryptocurrencies. bitexchaintrade.com+1

Ultra-low spreads (“from 0.0 pips”) and “lightning-fast execution”. bitexchaintrade.com+1

Training materials, news, and “advanced tools” for both beginners and experienced traders. bitexchaintrade.com+1

A contact address listed as “1 Canada Square, Canary Wharf, London, E14 5AB”. FCA

Descriptions indicating that the firm is “one of the most reputable brokers in the industry”. bitexchaintrade.com+1

The inclusive tone is evident—statements suggest this is platform for “everyone” and “anyone can trade”. That is appealing for many investors, but when such inclusive language is paired with minimal verifiable credentials or oversight, it raises serious questions.

Red Flags That Suggest Elevated Risk

1. Lack of Valid, Verifiable Regulation

The most compelling issue is that regulatory authorities have listed BitexChainTrade.com (Bitex Chain) as unauthorisedin the UK. A public warning by the Financial Conduct Authority (FCA) states that this firm “may be providing or promoting financial services or products without our permission.” FCA

Without regulation, several protective mechanisms are absent: client fund segregation, fair complaint procedures, and oversight of trading practices. For investors from any background, this means elevated risk.

2. Opaque Ownership and Corporate Details

Although the website lists a “London address”, the entity behind “Bitex Chain” lacks verifiable incorporation details. The absence of transparent ownership structure, directors’ names and verifiable credentials makes it difficult to hold the business accountable. Classic high-risk platforms often obscure this information deliberately.

3. Unrealistic Promotional Language

The claims of “spreads from 0.0 pips” and “lightning-fast execution” are marketed under the notion of “elite-level trading available for all”. But in real regulated trading environments, there are clear risk disclosures, balanced marketing, and realistic outcome expectations. The fact that these appear to be missing is a strong warning.

4. Withdrawals and Terms Not Clearly Published

While the site emphasises rapid execution and broad access, it provides little publicly-accessible information on withdrawal terms, minimums, or any bonus conditions. Anecdotal user discussion suggests difficulty withdrawing funds or encountering last-minute conditions. Without clearly-documented terms upfront, you are likely entering with unseen conditions.

5. External Warning Lists & Alerts

In addition to the FCA warning, the firm appears in other international alert lists as an unauthorised or suspicious entity. IOSCO+1 When multiple jurisdictions flag a firm, it adds weight to the risk profile—it suggests pattern rather than isolated issue.

How Platforms with These Characteristics Typically Operate

Understanding the typical lifecycle of high-risk trading platforms helps you recognise danger signs earlier. Here’s how the pattern often unfolds:

Initial Attraction & Promise: The platform advertises an easy registration, big opportunity, access for all investor types.

Rapid Onboarding: Account setup is quick, deposit incentives may be offered, and early “trades” may show instant gains to build confidence.

Upsell & Pressure: After initial deposit, you may have contact from an “account manager” encouraging you to deposit more or upgrade.

Withdrawal Attempt: When you try to withdraw, you face new hurdles—extra “verification”, “taxes”, or “bonus conditions” you weren’t aware of.

Friction or Freeze: At this stage, support slows down, access may become limited, or the withdrawal may be delayed or refused.

Exit or Rebrand: The platform may disappear, change domain, or simply vanish. Users are left without recourse.

BitexChainTrade.com exhibits several early-stage indicators (lack of reg, broad promises, inclusive marketing) that align with the beginning of this pattern.

Inclusive Investor Perspective: Why This Matters for Everyone

Whether you are just starting out or have meaningful experience, you deserve a platform that delivers fairness, transparency and accountability. When a trading service uses inclusive language—“accessible to everyone”, “any skill level”—it should be matched by inclusive protections:

Clear disclosures of regulation and risk in simple language.

Transparent, understandable contract terms for all users.

Fair access to withdrawals without hidden hurdles.

Accessible support that doesn’t require insider knowledge.

BitexChainTrade.com appears to emphasise access but lacks several key protective features. For everyday investors—regardless of geography or experience level—this mismatch matters.

Key Questions to Ask Before You Deposit

If you are still considering using BitexChainTrade.com, here are questions you should demand clear and verifiable answers to:

What is the exact legal entity name, registration number and jurisdiction operating the platform?

Which financial regulator provides its licence, and can you verify this on the regulator’s website?

Are client funds segregated in recognized bank accounts, and is there an audit or review available?

What is the full withdrawal policy? Are minimums, fees, processing times, and any “bonus” clauses clearly documented?

Who are the individuals or directors managing the firm? Are their credentials public and verifiable?

Are there real user reviews that match actual experiences? Are testimonials controlled or independently verifiable?

Are the risk disclosures prominent and understandable? Are you reminded that trading carries loss as well as gain?

If even one of these remains unanswered or vague, the risk of dealing with the platform increases significantly.

Final Verdict: Elevated Risk, Limited Transparency

Summing up the evidence:

BitexChainTrade.com lacks verifiable regulation from recognised authorities.

The company behind it is opaque, with limited disclosure on ownership and operations.

Promises of ultra-low spreads and fast execution are emphasised without balanced risk communication.

Withdrawal terms appear unclear or hidden, based on user-community discussion.

Multiple regulatory alert lists identify the firm as unauthorised or suspicious.

For someone seeking inclusive, secure investment access, this platform does not currently meet the standard of transparency and protection you deserve. It should be treated as high-risk.

Closing Thoughts

In a world where online investment platforms are increasingly accessible, equality of opportunity matters—but that alone isn’t enough. True inclusive investing should combine accessibility with accountability. A broker that welcomes everyone must also treat everyone fairly—with full disclosure, fair terms, and verifiable oversight.

BitexChainTrade.com may appear modern, inclusive and promising—but it does not yet demonstrate the transparency and protection you deserve. Before you entrust any funds, seek the kind of clarity you would want if you were just starting out.

Your money deserves not only an invitation, but also the assurance of legitimacy.

How GainRecoup.com Helps Victims of Bitexchaintrade.com

GainRecoup.com investigates bitexchaintrade.com transactions, gathers evidence, and maps payment paths. Our recovery team liaises with banks, card networks, and exchanges, files chargebacks, and escalates complaints to relevant authorities. You’ll receive a tailored action plan, clear documentation, and persistent follow-up designed to maximize fund recovery and hold bitexchaintrade.com accountable for victims.