In the rapidly expanding digital world of online trading and investment platforms, accessibility has grown immensely — so has risk. One website attracting attention is FlexTrade.online (also branded simply as “FlexTrade”). While the marketing appears polished and inclusive, promising opportunity for investors of all levels, a deeper look raises a series of significant concerns. In this review, we’ll walk you through what FlexTrade.online claims, the warning signs we discovered, how platforms like this typically operate, and what inclusive investors like you should ask before committing funds.

Key takeaway: FlexTrade.online shows multiple red flags relating to licensing, transparency and withdrawal clarity. Whether you’re a new trader or an experienced investor, the information below helps you make an informed decision.

What FlexTrade.online Claims to Offer

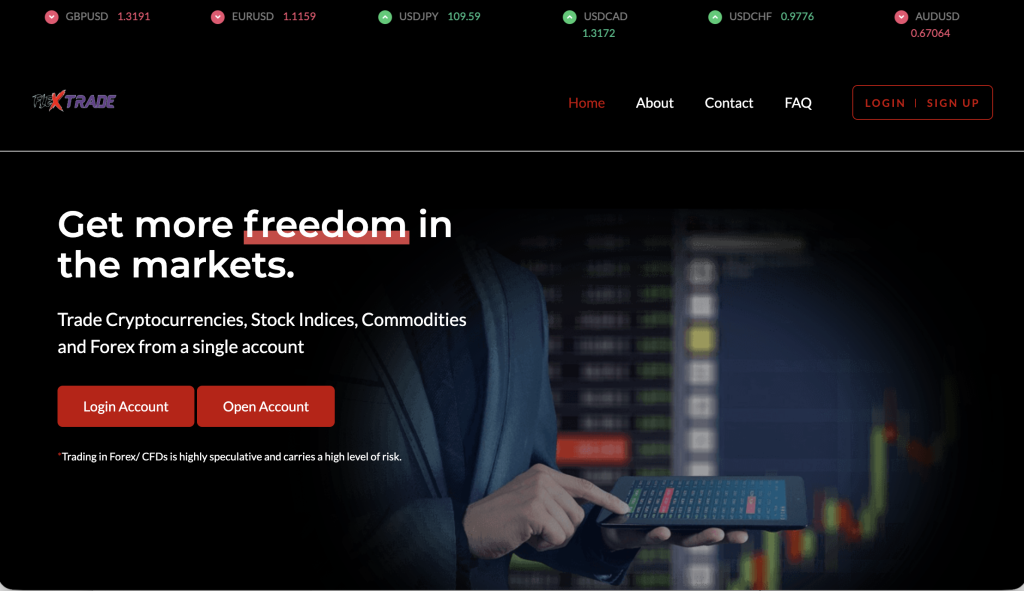

On its surface, FlexTrade.online markets itself as a modern trading platform designed for a broad audience. Some of the claims include:

Easy account creation with minimal barriers.

Access to multiple asset classes — for example cryptocurrencies, forex, indices.

Responsive customer support and user-friendly interfaces.

Inclusive language suggesting that anybody — regardless of experience level or location — can join and benefit.

Inclusive marketing is appealing: it opens doors for beginners and for seasoned investors alike. However, accessibility in promotion must be matched by accessibility of information, meaning clear disclosures about regulation, trading terms and fund safety.

Red Flags That Raise Concern

When we evaluate FlexTrade.online more closely, we identify several major warning signs that suggest higher risk:

1. Lack of Verified Regulation

One of the most vital aspects of a trustworthy platform is a clear licence from a recognised financial regulator. For FlexTrade.online, there is no credible verification that it is authorised to operate in major jurisdictions. Absence of regulation means you are operating without many of the protections that regulated platforms must provide.

2. Opaque Ownership and Corporate Identity

Reliable platforms clearly disclose legal entity names, registration numbers, physical addresses and executive details. For FlexTrade.online, these details are either missing or difficult to verify. When ownership is hidden or unclear, accountability is reduced and risk becomes higher.

3. Inclusive Promise Without Transparent Terms

While marketing emphasises that “everyone can trade” with FlexTrade.online, the website lacks detailed, publicly-accessible documentation of key aspects such as withdrawal policy, minimum deposits, trading fees, and client fund segregation. Inclusive access is positive—but without inclusive protections, it becomes promotional rather than protective.

4. Withdrawal and Fund Safeguard Ambiguities

User reports in other similar platforms highlight that making deposits may be simple, but making withdrawals often presents unexpected hurdles: delays, extra fees, or unclear conditions. In FlexTrade.online’s case, the available public documentation does not clearly define withdrawal timelines, conditions or cost. That ambiguity is a concern for all investors.

5. Marketing Over Substance

The platform’s tone emphasises speed, ease, and growth potential for all — but credible platforms balance that with clearly stated risk disclosures (such as leveraged trading risks, potential losses, and that past performance does not guarantee future results). When marketing is heavy and risk disclosure is light, the balance shifts toward caution.

How Platforms Like This Tend to Operate

Understanding the pattern of high-risk online trading sites can help you recognise danger signals earlier. Here is a common lifecycle of such operations:

Initial Attraction: A slick website appears with big promises, easy sign-up, inclusive language, and broad targeting.

Prompt Deposit Request: Shortly after registration, users may be encouraged by an “account manager” to deposit a certain amount to unlock bonus features or higher returns.

Early Gains Displayed: The dashboard or trading interface may show quick gains to build confidence — sometimes simulated.

Upsell to Larger Amounts: After initial gains, users are nudged to deposit more, take larger positions, or “unlock” higher tiers.

Withdrawal Request: When a withdrawal is attempted, new conditions may appear — verification requirements, bonus trades needed, “tax” or “processing” fees, unexplained delays.

Friction or Silent Exit: Support becomes harder to reach, funds may become inaccessible, domain changes or site disappears. Users are left without recourse.

FlexTrade.online exhibits several of the early-stage indicators: claimed inclusivity, unclear regulation, hidden identity, and ambiguous fund terms. These form the basis for elevated risk.

Inclusive Investor Perspective: Why This Matters for Everyone

Whether you are just starting your investment journey or have years of trading experience, here are key inclusive principles that matter:

Equality of information: Every investor, regardless of background or experience, deserves clear, understandable information about licensing, fees, risks and withdrawals.

Transparency is inclusive: A platform that says “join us, everyone” should also offer transparency for everyone—novices, professionals and people across regions.

Access with protection: Inclusivity means not just access to trading, but access to protections that support responsible investment for all.

If a trading platform welcomes a wide audience but does not show the same commitment to transparency and accountability, the promise of accessibility becomes less meaningful. Investors should not have to navigate hidden terms or restricted information just because they have less experience or fewer resources.

Key Questions to Ask Before Depositing

Before you engage with FlexTrade.online (or any similar platform), make sure you ask:

What is the exact legal entity name, the company registration number and the jurisdiction of incorporation?

Which regulator licenses this platform, and can you verify the licence number on the regulator’s public register?

How are client funds held? Are they segregated from company funds in recognised banks?

What are the withdrawal terms? What minimums apply, what fees exist, how long is processing time, and are there “bonus” or “locked-in” conditions?

Is there an audited performance history or independent third-party review of operations?

Who are the individuals behind the platform? Are director names, qualifications or public profiles available?

Are risk disclosures clearly displayed and easy to understand, especially for less experienced traders?

If you cannot get clear, verifiable answers to several of these questions, you are operating with elevated risk.

Final Verdict: High-Risk Platform Demanding Caution

Summarising the available evidence:

FlexTrade.online does not show clear evidence of being regulated by a major recognised authority.

Ownership and company identity are not transparently presented.

Withdrawal terms and fund protection appear to be undocumented or vague.

Marketing emphasises inclusivity and opportunity without matching operational transparency.

The pattern of statements and presentation align with known high-risk and non-verified platforms.

For investors seeking inclusive, accessible trading access with real protections, this platform currently falls short of those standards. The risk profile is significant.

Closing Thoughts

Inclusive online investing should mean more than just accessibility—it should mean automated access plus accountable safeguards. A trustworthy platform doesn’t just invite everyone—it shows everyone the rules, protections and exit routes clearly.

While FlexTrade.online markets itself as inclusive, inclusive-friendly, and accessible, the foundational elements of credibility—licensing, transparency, clear fund handling, withdrawal clarity—are either missing or unverified. Unless you can confirm these for yourself, you are entering with elevated risk.

Every investor deserves not just a seat at the table, but clear information about how the table is set. Ensure your trade-partner does more than invite you—they must also protect you.

How GainRecoup.com Helps Victims of Flextrade.online

GainRecoup.com investigates flextrade.online transactions, gathers evidence, and maps payment paths. Our recovery team liaises with banks, card networks, and exchanges, files chargebacks, and escalates complaints to relevant authorities. You’ll receive a tailored action plan, clear documentation, and persistent follow-up designed to maximize fund recovery and hold flextrade.online accountable for victims.