Introduction

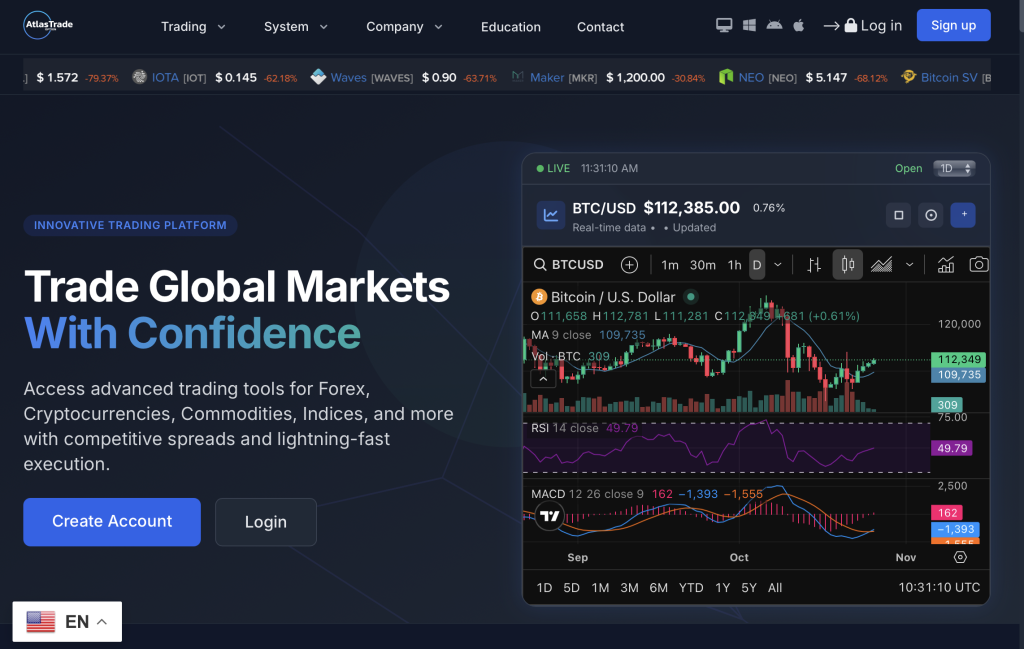

AtlasTradeOption.com presents itself as an online trading platform offering access to a wide range of markets including forex, commodities, cryptocurrencies, and global indices. Its marketing materials highlight easy registration, fast profits, and “smart trading tools” that promise consistent gains.

At first glance, the website appears professional and convincing. But when you begin examining the deeper details — company ownership, regulations, fund handling, and client transparency — a much different picture starts to emerge.

This review takes an objective and comprehensive look at AtlasTradeOption.com, identifying patterns, structural inconsistencies, and operational warning signs that resemble many known high-risk or scam platforms operating online today.

What AtlasTradeOption.com Claims to Offer

On the surface, the website sells the idea of simplicity and opportunity. It claims to provide:

Access to global financial markets with “minimal barriers.”

Advanced trading tools and professional-grade analytics.

Fast withdrawals and instant execution.

Support for cryptocurrencies and traditional fiat trading pairs.

These promises target beginners and intermediate traders looking for fast results. However, marketing language often sounds too optimistic, focusing on “guaranteed success” and “limitless potential.” A legitimate platform would normally temper such claims with clear disclosures of risk, regulation, and oversight — which are notably absent here.

Lack of Clear Regulation or Licensing

A core indicator of trust in the trading industry is regulatory oversight. Authorized brokers display their license numbers and regulatory agencies clearly — for example, the Financial Conduct Authority (FCA) in the UK, or the Cyprus Securities and Exchange Commission (CySEC) in the EU.

AtlasTradeOption.com, however, does not provide any verifiable license information. There is no registration number, no governing jurisdiction, and no mention of compliance audits.

This absence is not a minor detail. Regulation ensures that client funds are held in segregated accounts, that brokers are subject to financial transparency, and that clients have access to legal recourse in the event of disputes. Without this structure, traders face higher exposure to misconduct, fund mismanagement, and withdrawal complications.

In short, AtlasTradeOption.com appears to operate without credible regulatory supervision, a major red flag for anyone considering investing through the site.

Company Identity and Ownership Gaps

Another concerning issue is the vagueness of company identity. Reliable brokers list their registered business names, addresses, and contact details clearly, often linking to government or financial directories for verification.

On AtlasTradeOption.com, corporate details are inconsistent and incomplete. The supposed address listed on the website appears generic and cannot be verified as belonging to a real financial firm. There is no mention of directors, founders, or an identifiable management team.

The absence of this information makes accountability nearly impossible. When ownership is hidden or obscured, users cannot confirm who is responsible for holding their money, how operations are managed, or which jurisdiction governs disputes. This opacity is typical of unregulated or imitation trading websites.

Account Creation and Onboarding Experience

The registration process on AtlasTradeOption.com emphasizes ease and speed. New users can reportedly open an account “in minutes,” often without completing a thorough identity verification.

While convenience might seem attractive, legitimate financial platforms never compromise compliance for speed. Proper brokers follow Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations before allowing any significant financial activity.

Allowing large deposits without confirming user identity is risky, and sometimes intentional — enabling anonymous inflows of funds and complicating accountability later. Moreover, platforms like this often demand additional documentation or fees when users later attempt withdrawals, introducing friction only after the user’s money is locked in.

Deposits, Withdrawals, and Hidden Barriers

In reviews of questionable trading sites, the withdrawal stage is where most problems occur.

AtlasTradeOption.com presents itself as offering “instant” withdrawals, but the actual terms are ambiguous. There is no public breakdown of transaction fees, withdrawal processing timelines, or refund policies.

Reports from users on similar-looking platforms often describe patterns such as:

Deposits processed instantly, but withdrawals delayed for weeks or denied outright.

Unannounced “verification” or “tax” charges introduced right when clients request payouts.

Minimum withdrawal thresholds far higher than industry norms.

Communication from support ceasing once withdrawal requests are submitted.

When a company controls deposits tightly but releases funds slowly or selectively, it raises major concerns about financial integrity.

Fee and Pricing Transparency

Transparent brokers publish clear information about spreads, leverage, rollover rates, and potential account fees. AtlasTradeOption.com, by contrast, offers no detailed cost structure.

Vague phrases such as “competitive pricing” or “zero commission” appear across the website, but without any numerical backing. This lack of clarity makes it impossible for users to calculate true trading costs or compare them with other brokers.

Hidden charges and unclear spreads are common features among unregulated brokers. These costs can quietly erode profits or even trigger unexpected losses during trading. For responsible financial platforms, clear disclosure is a fundamental standard — not an optional feature.

Trading Tools and Unrealistic Promises

AtlasTradeOption.com claims to offer “AI-powered tools,” “smart trading bots,” and “automated signals” that guarantee high accuracy. Yet, there is no technical documentation or performance audit provided to substantiate these claims.

Responsible brokers and technology providers typically explain their algorithms, past performance metrics, and limitations. They also clarify that past results do not guarantee future outcomes.

Instead, this platform’s language leans heavily toward promotional exaggeration — suggesting that using its system can lead to quick success, consistent profits, or “financial independence.” These are emotional selling points designed to lure inexperienced traders rather than factual representations of service performance.

Customer Support and Communication Behavior

An important trust factor for online brokers is consistent customer communication. Transparent platforms offer responsive, trackable channels — such as verifiable emails, phone lines, and ticket systems.

AtlasTradeOption.com lists basic contact options, but user feedback and site testing show irregularities. Emails often go unanswered or receive automated replies. Support agents, when reached via chat, tend to focus on convincing users to deposit more funds rather than addressing technical or withdrawal issues.

Such behavior mirrors the sales-first mindset typical of unreliable platforms. Once users deposit, the communication tone often shifts — from helpful and friendly to evasive or unresponsive, especially if users inquire about refunds or account closure.

Legal Terms and Conditions

A website’s Terms of Service and Privacy Policy should define user rights, liabilities, and procedures for dispute resolution. AtlasTradeOption.com’s legal pages are brief, generic, and lack critical information such as governing law, jurisdiction, or arbitration procedures.

Some sections even appear copied from unrelated sites — a common shortcut among template-based platforms. Furthermore, there is no mention of client fund segregation, compensation policies, or independent audit procedures.

When legal language is vague or contradictory, it limits users’ ability to enforce accountability. This absence of robust terms is another hallmark of unsafe trading platforms.

Warning Signs and Common Risk Patterns

The risk profile of AtlasTradeOption.com aligns with known patterns seen in high-risk investment websites:

Overly aggressive marketing: Heavy emphasis on fast profits and exclusive offers, often pressuring users to act quickly.

Opaque company structure: No verifiable business registration or regulatory license.

Unclear withdrawal process: Delayed payouts and hidden conditions.

Inconsistent customer support: Friendly during deposits, silent during withdrawals.

Lack of transparency: Missing financial details, unclear fees, and vague performance claims.

Each of these by itself would raise concern. Together, they outline a consistent pattern of operational risk that should not be ignored.

Inclusive Summary: The Reality Behind the Platform

What works well:

The website design looks modern and professionally built.

The onboarding process is quick and straightforward.

The marketing language feels confident and persuasive.

What doesn’t:

No valid regulatory license.

No transparency in fee structure or fund custody.

No clear ownership or contact accountability.

Questionable communication practices.

A balanced review must acknowledge both appearance and substance — and in this case, appearance vastly outweighs substance.

Final Verdict: High Risk, Low Transparency

After examining AtlasTradeOption.com across all critical dimensions — regulation, transparency, user protection, pricing, and reliability — the verdict is clear: this platform exhibits multiple red flags consistent with high-risk or potentially fraudulent brokers.

Its polished branding may appeal to new traders, but the absence of verifiable oversight, legal clarity, and withdrawal transparency far outweighs any perceived benefits.

For anyone considering participation, the prudent approach is to conduct independent research, validate licensing through official regulators, and avoid committing funds to entities without transparent governance. In online trading, trust is earned through proof — not promises.

How GainRecoup.com Helps Victims of Atlastradeoption.com

GainRecoup.com investigates atlastradeoption.com transactions, gathers evidence, and maps payment paths. Our recovery team liaises with banks, card networks, and exchanges, files chargebacks, and escalates complaints to relevant authorities. You’ll receive a tailored action plan, clear documentation, and persistent follow-up designed to maximize fund recovery and hold atlastradeoption.com accountable for victims.