Introduction

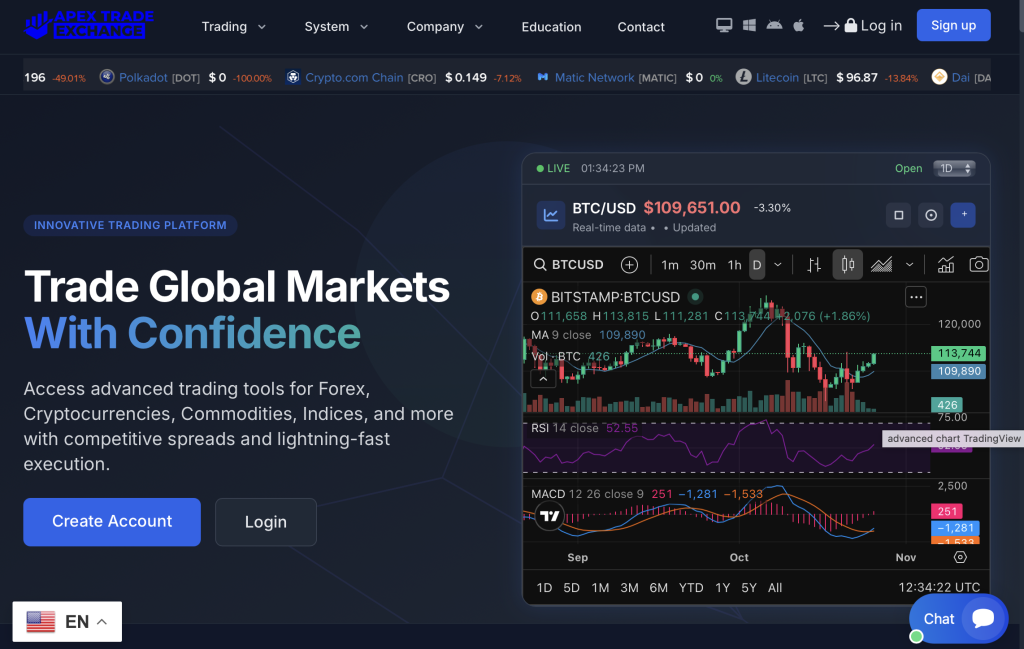

APEX TRADE EXCHANGE presents itself as a modern, global trading platform offering access to forex, commodities, cryptocurrencies, indices and “smart investment plans.” On the surface it appears polished: slick website, bold promises of quick profits, accessible trading tools. But when you dig a little deeper, a number of serious concerns emerge around regulation, transparency, fees and fund control. This review gives you a clear, detailed assessment of APEX TRADE EXCHANGE so you can decide whether it aligns with your standards of trust, transparency and realistic outcomes.

What APEX TRADE EXCHANGE Claims to Offer

According to its promotional material, the platform promises:

Rapid account setup and quick access to multiple asset classes.

“Advanced trading tools” and “pro-level analytics” meant to boost performance.

Investment or trade-plans with fixed returns or elevated returns.

24/7 support and seamless withdrawals.

A global presence with “licensed operations” (although the details are vague).

The language used is designed to appeal to newcomers as well as experienced traders who want more activity and less friction. While accessibility is good, the key question is whether the underlying operation meets the same standard for transparency and accountability.

Regulatory & Licensing Status – A Major Red Flag

One of the most important trust indicators for any trading platform is clear regulation. A regulated broker will list the licensing authority, licence number, and jurisdiction so users can verify.

In the case of APEX TRADE EXCHANGE, an official warning lists the firm as unauthorised in the UK, meaning it may be operating without the required regulatory permission. This alone raises significant concern.

Without verifiable regulation:

Clients may not have access to official complaint or compensation schemes.

Investor funds may not be protected or segregated according to regulated standards.

The platform may not be subject to independent audit or oversight.

In inclusive terms: if you cannot readily find a regulator name and licence you can validate, you are lacking one of the foundational protections you should expect before placing funds.

Company Identity & Transparency of Ownership

Transparency of company structure fosters accountability. A reliable broker will list its registered entity name, address, directors, history, and business registration.

For APEX TRADE EXCHANGE, the posted address may be at a well-known business location—however, that alone does not confirm legitimacy. There are no clearly published details of who runs the platform, where exactly it is incorporated and how it is audited.

When a firm hides or omits key corporate information, accountability becomes much weaker. Inclusive best practice suggests you should ask: Who owns the platform? Which legal entity am I entering into agreement with? Under which laws and protections? When answers are vague or missing, that increases risk.

Account Onboarding, Plans & Promises

The user journey as marketed by APEX TRADE EXCHANGE is designed for simplicity: within minutes you reportedly can deposit, choose a plan, start trading or investing. There are investment plans with fixed returns and trade-packages promising elevated yields.

But there are warning aspects:

Promising fixed or high returns is inconsistent with the realities of market risk. Legitimate trading always emphasises that past results are not predictive.

If onboarding is too fast and verification is minimal, that may serve convenience—but at the cost of compliance and fund protection.

Package-type models (selecting a plan, promised return) often shift focus away from transparent costing, and may lock you into obligations or limits you did not fully realise.

Inclusive advice: Always read the fine print before selecting a package, clarify verification steps, eligibility for withdrawals, and recognise that no platform can guarantee consistent returns without risk.

Deposits, Withdrawals & Fund Control

One of the weakest areas for many high-risk platforms is the withdrawal process. With APEX TRADE EXCHANGE:

The marketing claims instant or seamless withdrawals—but there is no transparent public policy listing processing times, fees, or eligibility conditions.

If a platform lacks verification of its regulatory standing, the promise of fast payouts becomes much less reliable.

In many reported cases from similar platforms, funds go in smoothly but come out only with delay, additional “verification” steps, extra deposits or vague excuses.

For inclusive clarity: If you are thinking of depositing, assume withdrawals may face friction unless you can verify in advance the published process, proof of past user pay-out experience and documented fund-protection measures.

Fee Structure & Pricing Transparency

Responsible brokers outline clear list of costs: spreads, commissions, overnight financing, withdrawal or deposit fees, inactivity fees.

With APEX TRADE EXCHANGE, you may find marketing phrases like “tight spreads”, “zero commission”, “bonus enhancements”—but you will very likely not find a detailed, easily accessible fee table with all conditions.

When pricing is opaque:

You are unable to compare the true trading cost against other platforms.

Hidden charges may reduce potential profits.

Ambiguous language may mean you incur surprise fees later.

Inclusive recommendation: Before depositing, request or find and save the full cost disclosure (preferably in writing). If you cannot locate it, the cost risk remains unclear.

Marketing Claims & Performance Messages

APEX TRADE EXCHANGE uses aspirational language: “unlock your trading potential”, “become financially independent”, “high returns, low risk”. They show polished images, possibly testimonials (real or produced) and emphasise ease.

Cautions include:

Big-promise marketing (fast profits, minimal risk) is often adopted by higher-risk or unregulated operations.

Lack of clear performance data or independent verification means promotions may be aspirational rather than factual.

Legitimate providers always emphasise the inherent risk of trading. If that message is minimal or buried, the balance is missing.

Inclusive insight: Promotions like “guaranteed income”, “expert tools”, “instant success” should be treated as signals to dig deeper—not as proof of reliability.

Customer Support & Service Patterns

Quality platforms provide documented, responsive customer support: verified email addresses, phone numbers, support ticketing, published escalation procedures.

In APEX TRADE EXCHANGE’s case:

Contact details may be given, but user feedback and the lack of regulatory oversight call into question how easily issues (especially around withdrawals) can be resolved.

When support is more focused on deposit encouragement rather than independent help for account closure, withdrawal or dispute resolution, trust weakens.

Inclusive best practice: Test customer support before committing large funds (e.g., ask a verification question, request withdrawal terms) and evaluate responsiveness. If you get minimal or evasive replies, treat that as a risk factor.

Legal Terms & User Agreements

The Terms & Conditions, Privacy Policy and legal disclosures are critical: they define your rights, jurisdiction, fund protection, liability and dispute mechanisms.

Some concerns with how APEX TRADE EXCHANGE appears:

Lack of clear governing law or jurisdiction for disputes.

No visible documentation of client fund segregation or audit rights.

Promises of “licensed operations” without specifying the licence or regulator.

Risk disclosures are minimal or overshadowed by marketing text.

Inclusive advice: Before you deposit, read the terms and make sure you understand under which laws your contract falls, how you can raise a complaint, and whether your funds have protection. If terms are vague or generic, the risk is higher.

Recognising Common Risk Scenarios

Based on the patterns observed with APEX TRADE EXCHANGE and comparable platforms, here are typical risk scenarios:

Smooth deposit, rocky withdrawal: Funds go in easily, but when you request a payout you’re told you must “upgrade”, “wait for verification” or “meet trading volume”.

High-return trading packages: You’re offered attractive returns, but then locked into conditions, minimum trading quotas or restricted access to your own funds.

Withdrawal delay or denial without transparent reason: The platform introduces vague fees, “tax clearance”, or platform “maintenance” when you ask to cash out.

Opaque company structure + unverified “award” claims: Marketing highlights awards or global offices but you cannot verify them independently.

Minimal regulation disclosure + busy marketing: When a firm emphasizes marketing and growth but gives minimal regulatory or audit information, it often prioritises lead generation over client protection.

Inclusive takeaway: Use these scenarios as warning lights—not as proof of wrongdoing—but as triggers for deeper scrutiny.

Inclusive Summary: Key Strengths vs Weaknesses

What looks positive:

Modern, easily navigable website design, targeting both newcomers and experienced traders.

Wide asset coverage (forex, crypto, commodities, indices) creating the impression of flexibility.

Fast-onboarding and promotional ease creating impression of accessibility.

What creates concern:

Missing verifiable regulation or licence information.

Limited transparency around fees, fund protection and corporate ownership.

Marketing heavy on promise, light on risk and independent proof.

Withdrawal process and fund control not clearly documented.

Customer support and service processes not evidently robust or independently verified.

Inclusive conclusion: The surface appeal is strong, but the structural foundation is weak. If you value accountability, transparency and independent protections, many of those appear missing here.

Final Verdict: High Caution Advised

After evaluating APEX TRADE EXCHANGE across critical dimensions—regulation, transparency, user protection, marketing and operational clarity—the overall risk profile is high. The firm does not appear to meet the transparency, accountability or regulatory clarity you’d expect from a mature, trustworthy trading provider.

If you are considering using APEX TRADE EXCHANGE, the inclusive approach is: ask for proof (licence number, regulation authority, audit certificate, historic payouts), compare with regulated alternatives, and if doubt remains, consider that you are exposing yourself to a significant trust gap. In online trading, credibility is built on evidence—not on promises alone.

FAQ

Is APEX TRADE EXCHANGE legit or a scam?

While “scam” is a strong assertion, this platform is flagged by credible regulator(s) for operating without authorisation. That means it lacks key protections, oversight and transparency. Proceeding means accepting higher risk.

Can you withdraw funds from APEX TRADE EXCHANGE?

The platform claims fast withdrawals, but there is no independent verification of the process. Without published payout track records or verified user experiences, assume potential frictions exist.

What should I check before using a trading platform like this?

Verify the licence and regulatory authority.

Read the full terms and fee schedule.

Confirm the withdrawal policy and history of successful payout stories.

Evaluate customer support responsiveness.

Ensure you understand where your funds are held and under what legal jurisdiction.

Final Thought

Even though APEX TRADE EXCHANGE offers the appearance of an accessible, feature-rich trading platform, the deeper indicators point toward elevated risk: missing regulatory clarity, unclear fee structure, opaque ownership and withdrawal uncertainty. If you prioritise transparency, control and verified track record—opt for platforms where you can independently verify licensing, fund protection and payout history. In trading, your capital deserves platforms built on trust, not just slick marketing.

How GainRecoup.com Helps Victims of Apextradeexchange.com

GainRecoup.com investigates apextradeexchange.com transactions, gathers evidence, and maps payment paths. Our recovery team liaises with banks, card networks, and exchanges, files chargebacks, and escalates complaints to relevant authorities. You’ll receive a tailored action plan, clear documentation, and persistent follow-up designed to maximize fund recovery and hold apextradeexchange.com accountable for victims.