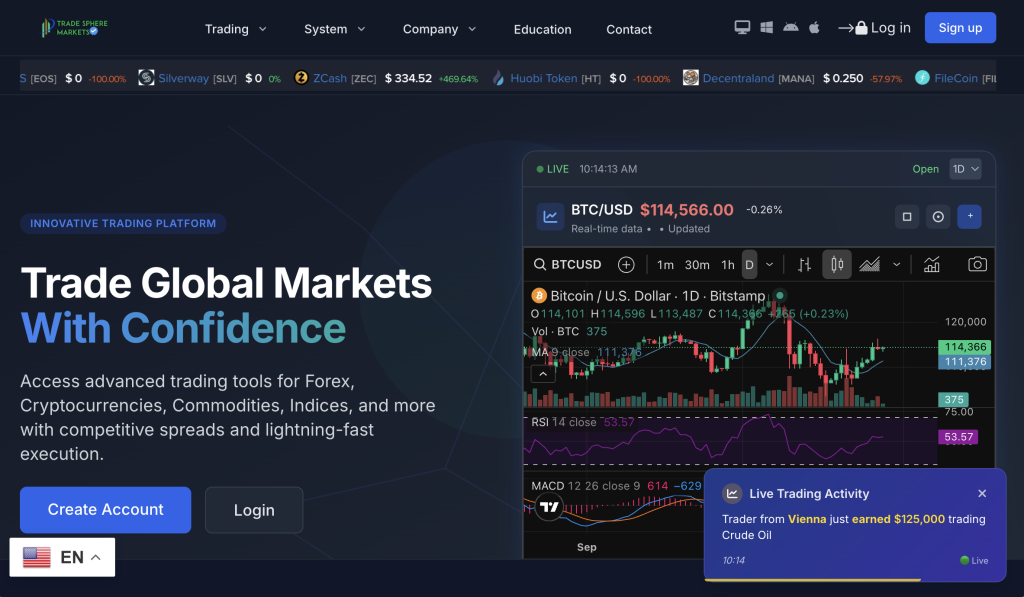

TradeSphereMarkets.com markets itself as a modern, powerful online trading platform. On its pages, you may see promises of ultra-fast execution, tight spreads, advanced tools, and “professional-grade” access to forex, crypto, stocks, indices, and commodities. Slick visuals, confident wording, and simple sign-up flows are used to create the impression of a serious and trusted broker.

However, a polished website is not the same as a trustworthy investment firm. When you look beyond the marketing and focus on structure, transparency, and behavior, TradeSphereMarkets.com starts to show the same risk pattern seen in many high-risk or outright scam platforms. This review breaks down those concerns in clear and inclusive language so you can better understand the warning signs before, during, or after engaging with a platform like this.

What TradeSphereMarkets.com Claims to Offer

Across its homepage and promotional content, TradeSphereMarkets.com typically highlights:

Multi-asset access – forex, crypto, stocks, indices, and commodities in one account.

Advanced technology – “pro” platforms, charts, signals, and trading robots or “AI tools.”

Attractive investment plans – tiered accounts with higher returns for larger deposits.

Fast and easy onboarding – register in minutes, fund your account, and “start earning.”

24/7 markets and support – global access presented as always available and always responsive.

For someone new to trading, or for anyone hoping to grow their savings quickly, these claims can seem reassuring. But what matters most is not the promise of returns—it is the platform’s regulation, transparency, and withdrawal behavior. That is where TradeSphereMarkets.com raises serious concerns.

Regulation and Licensing – The Foundation That’s Missing

A central question for any trading or investment platform is: Who regulates this company?

Legitimate brokers are supervised by recognized financial authorities. They publish:

The name of the regulator,

A licence or registration number, and

A jurisdiction where that licence is valid.

This information can be checked independently on the regulator’s official register.

With TradeSphereMarkets.com, these basics are often unclear or completely missing. The site may use vague phrases like “fully compliant,” “globally regulated,” or “operating under international standards,” but:

No regulator is clearly named.

No verifiable licence number is provided.

No direct way is offered for you to confirm oversight on an official register.

When a platform invites you to deposit funds but does not let you easily verify its regulation, you are being asked to invest based on trust alone, rather than on proof. That is a major red flag.

Company Identity and Ownership Transparency

Another crucial area is who is behind the brand. Trust grows when you can clearly see:

A registered legal entity name,

A real, verifiable business address,

Key directors or responsible officers, and

Basic information on corporate history.

TradeSphereMarkets.com instead appears to operate with minimal corporate transparency. Common issues include:

Generic or vague company descriptions with no solid, traceable identity.

Addresses that are either incomplete, inconsistent, or difficult to verify.

No visible leadership team, which makes it unclear who is accountable.

When a platform controls client funds but hides its true identity, it becomes much harder for you to understand where your money is going, who is responsible for it, and what your options are if things go wrong.

Plan-Based Returns and Unrealistic Profit Promises

TradeSphereMarkets.com, like many high-risk platforms, often focuses on plan-based investing. You may see account levels such as:

Starter, Standard, Gold, VIP, or similar labels,

Each offering fixed weekly or monthly returns,

Higher percentages for larger deposits.

Although this looks simple, it does not match how real markets work.

Financial markets move up and down. No legitimate broker can guarantee fixed returns, especially at high rates, without disclosing significant risk. Some common issues with TradeSphereMarkets.com’s style of marketing include:

Promised returns that are too high to be realistic over time.

Language that minimizes risk, suggesting “secure” or “low-risk” profits.

Psychological nudging, pushing you toward larger deposits to “unlock” better plans.

Genuine investment services acknowledge volatility, talk honestly about potential losses, and do not treat returns as automatic or guaranteed.

Deposits, Withdrawals, and Moving Your Money

A trustworthy platform is not only about how easily you can deposit funds—it is equally about how reliably you can withdraw them.

TradeSphereMarkets.com heavily emphasizes simple funding methods and fast deposits. But user experience often changes when it comes to getting money out. Typical problem patterns include:

Unclear or missing withdrawal timelines – no firm statement on how long payouts will take.

New conditions that appear only at withdrawal time – such as extra “verification,” “unlock,” or “clearance” requirements.

Unexpected fees – commissions, admin charges, or “taxes” that were never clearly explained before you deposited.

Slow or changing communication once you request a withdrawal.

If a platform makes depositing smooth but withdrawing complicated, that “friction gap” is a warning sign. You should be able to see clear withdrawal rules, fees, and timelines before you send any money.

Fees, Costs, and Hidden Charges

Every trading platform has costs, such as:

Spreads and commissions,

Overnight financing or swap fees,

Currency conversion charges,

Deposit and withdrawal fees,

Inactivity or maintenance fees.

On TradeSphereMarkets.com, fee disclosure is often vague or incomplete. Marketing may highlight “low spreads,” “zero commission,” or “no hidden fees,” but no detailed, asset-by-asset cost table is clearly presented.

Without a transparent fee schedule, it is difficult or impossible for you to:

Compare TradeSphereMarkets.com with regulated brokers,

Calculate realistic profit and loss,

Spot unfair or surprise charges.

Lack of clear cost information is another structural red flag.

Marketing Tactics and Emotional Pressure

The language used by TradeSphereMarkets.com often aims to influence your emotions and speed up your decision-making. Common tactics include:

Urgency – “Limited spots,” “act now,” or “don’t miss the opportunity.”

Social proof – unverified testimonials, exaggerated success stories, and generic “client wins.”

Lifestyle promises – suggestions of financial freedom, early retirement, or effortless wealth.

Complex jargon mixed with simple slogans, making risky products sound safe and easy.

While marketing is part of any business, platforms that lean heavily on emotional triggers and promises of fast success, while avoiding detailed risk explanations, are not acting in your best interests.

Customer Support and Communication Behavior

Quality customer support is another sign of professionalism. A trustworthy firm typically provides:

Multiple contact channels (email, chat, phone),

Clear response expectations,

Helpful and specific answers to tough questions.

In contrast, TradeSphereMarkets.com often appears more interested in sales than support. Typical patterns include:

Quick replies when you want to deposit,

Slower or vague replies when you ask about withdrawals, regulation, or fees,

Generic answers that avoid giving precise details,

No clear escalation process for unresolved issues.

When support stops being available at the exact moment you need clarity, it undermines trust.

Legal Documents and Your Rights

Legal pages may not be exciting, but they are essential. You should be able to review:

Terms and Conditions,

Client Agreement,

Risk Disclosure,

Privacy Policy, and

Details of governing law and dispute resolution.

With TradeSphereMarkets.com, these documents are often short, generic, or inconsistent. They may:

Avoid stating which country’s law applies,

Offer no clear process for handling disputes,

Say little about how client funds are held or protected.

Weak, vague, or boilerplate legal terms typically mean weak user protections.

TradeSphereMarkets.com Scam Pattern – Key Takeaways

Putting all these factors together, TradeSphereMarkets.com shows a familiar high-risk pattern:

No clear, verifiable regulation or licence.

Hidden or vague company identity and ownership.

Plan-based returns and unrealistic profit claims.

Easy deposits but unclear, delayed, or conditioned withdrawals.

Poor cost transparency and possible hidden fees.

Marketing that emphasizes profit over risk.

Weak legal documentation and limited accountability.

For most people seeking a fair and transparent trading experience, this combination of traits represents a serious risk.

How GainRecoup.com Can Help If You Lost Funds on TradeSphereMarkets.com

If you have already deposited money with TradeSphereMarkets.com and are now facing blocked withdrawals, confusing conditions, or silence from support, you may feel stressed, frustrated, or unsure where to start. This is where GainRecoup.com can be a helpful partner.

GainRecoup focuses on turning a scattered, emotional situation into a structured, documented case you can act on. Here is how they typically support individuals:

1. Case Intake and Timeline Building

GainRecoup helps you gather and organise:

Bank and card statements,

Crypto wallet records,

Screenshots of your TradeSphereMarkets.com dashboard,

Emails, chat logs, and messages with “account managers,”

Any contracts, invoices, or payment confirmations.

All of this is arranged into a clear, chronological timeline showing what happened, when, and through which channels.

2. Evidence Packaging and Claim Framing

They then help you turn that timeline into a coherent evidence package that highlights:

What TradeSphereMarkets.com promised,

What you actually experienced,

Any contradictions in the platform’s statements,

Key data points about deposits, balances, and withdrawal attempts.

This kind of organised documentation is much easier to use when approaching banks, payment providers, or other relevant parties.

3. Payment Pathway Review

Different payment methods can require different approaches. GainRecoup reviews how your money moved—card, bank transfer, e-wallet, or crypto—and helps you understand which procedural steps are realistically available for each route.

4. Structured Next-Step Guidance

Instead of leaving you to guess what to do, GainRecoup provides step-by-step guidance, so you have a plan rather than just stress. This can include suggestions on what information to share, how to present your case, and how to follow up in a clear and organised way.

5. Supportive, Non-Judgmental Approach

Many people feel embarrassed or isolated after losing money online. GainRecoup works with the understanding that anyone can be targeted by sophisticated platforms like TradeSphereMarkets.com. Their role is to provide structure, clarity, and support—not blame.

Final Thought

TradeSphereMarkets.com looks professional at first glance, but its lack of clear regulation, weak corporate transparency, unrealistic returns, and questionable withdrawal practices place it firmly in the high-risk category. Before trusting any platform with your money, it’s important to look past the design and focus on the fundamentals: regulation, disclosure, and access to your own funds.

If you already have money stuck on TradeSphereMarkets.com, you do not have to sort through the confusion alone. GainRecoup.com can help you organise your case, understand your options, and move forward with a clearer, more structured plan.