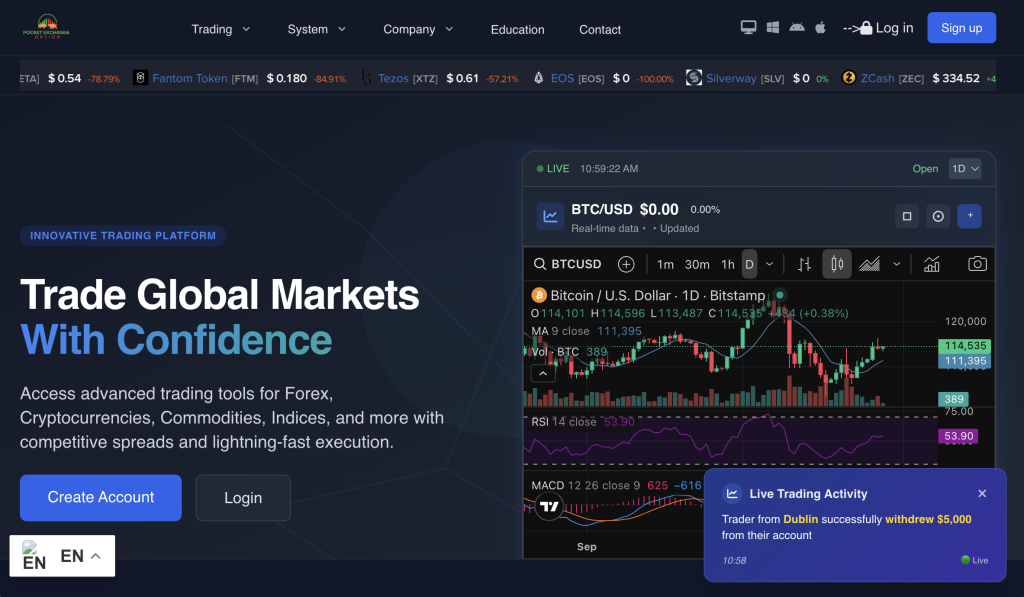

PocketExchangeOption presents itself as a professional, cutting-edge investment platform offering access to cryptocurrency, forex, commodities, indices, and automated trading tools. Its website promotes fast profits, simplified onboarding, and high-yield investment plans designed to attract a wide range of users—from beginners in digital trading to individuals looking for passive income solutions. At first glance, the platform appears polished, clean, and reassuring, using confident language and visually appealing layouts.

However, a deeper investigation reveals a pattern of troubling behavior, structural weaknesses, and misleading claims that raise serious concerns about the platform’s legitimacy. This review examines PocketExchangeOption in a clear, inclusive, and easy-to-understand format, focusing on key aspects such as regulation, transparency, withdrawal practices, fee structures, company identity, marketing tactics, and user experience. The goal is to help readers make informed decisions, understand the risks, and recognise the signs of an unsafe online investment service.

1. What PocketExchangeOption Claims to Offer

PocketExchangeOption uses persuasive marketing to present itself as a modern and accessible financial platform. Across its website and promotional material, the platform highlights:

• Access to multiple global markets

Cryptocurrency, forex, stocks, commodities, and binary options—all in one place.

• Automated and AI-powered tools

Bots, algorithmic trading systems, and signals promising high accuracy and minimal effort.

• “Guaranteed” profit plans

Tier-based investment packages offering weekly or monthly returns.

• Fast onboarding

A simple sign-up process and quick deposit methods.

• “Instant withdrawal”

A reassuring claim meant to reduce hesitation among new users.

These features may appeal to individuals seeking financial opportunities, especially those with limited experience in trading. However, when compared with industry standards, the promises made by PocketExchangeOption lean heavily toward marketing rather than transparency or verified performance.

2. Regulation & Licensing – The Most Important Factor

One of the most crucial elements of any financial platform is its regulatory status. Proper regulation serves as a safeguard, ensuring accountability, transparency, and consumer protection. In reviewing PocketExchangeOption, substantial concerns arise around regulatory legitimacy.

Red flags include:

• No confirmed regulatory licence number

A trustworthy trading platform clearly displays its licence number and regulatory authority.

• No mention of a recognized jurisdiction

Statements about “global regulation” or “licensed by leading authorities” lack specifics.

• No verification pathway

Users cannot independently confirm the platform’s oversight.

• No investor protection programs

Audited financials, fund segregation, or dispute-resolution channels are not presented.

Without a verifiable regulatory framework, individuals using PocketExchangeOption have no assurance regarding how their deposits are handled, how decisions are made, or how funds can be recovered if disputes arise. This alone places the platform in the high-risk category.

3. Company Identity – Lack of Transparency

Credible financial platforms publish clear details about their corporate identity, including:

Registered business name

Physical office address

Directors or leadership team

Corporate registration number

Legal jurisdiction

PocketExchangeOption provides none of these in a verifiable manner.

Issues include:

• Ambiguous or generic business descriptions

The platform describes itself as “globally trusted” without naming a parent entity.

• No transparent leadership

There is no visibility into who manages or operates the platform.

• Questionable addresses

Some contact information appears generic, incomplete, or unverifiable.

• No independent audit, legal disclosures, or corporate documentation

These omissions make accountability extremely difficult.

Lack of identity transparency is one of the most obvious indicators of an unsafe platform. When users do not know who they are entrusting their money to, the risk becomes significantly higher.

4. Promised Returns & Investment Plans

PocketExchangeOption heavily promotes fixed returns, regardless of market conditions. Examples include:

Weekly profit guarantees

Fixed daily gains

Tier-based investment plans with higher returns for larger deposits

Statements suggesting “zero risk” or “high certainty”

While such claims are enticing, they contradict how real financial markets function. Legitimate investments come with risk, volatility, and no guaranteed outcomes. Any platform offering predictable and unusually high profits should immediately raise concern.

Common issues observed:

• Unrealistic return rates

Some plans advertise more than 5%–15% weekly—far above traditional market performance.

• Pressure to upgrade deposits

The platform encourages users to “unlock better returns” by depositing more.

• Psychologically persuasive structures

Bright colors, reward badges, and “VIP tiers” influence users toward higher risk.

These design elements mirror patterns seen in high-risk environments that prioritise deposits rather than genuine investment performance.

5. Deposit & Withdrawal Concerns

Many individuals evaluating PocketExchangeOption raise concerns about the withdrawal process. A reliable trading platform is measured not by how easily deposits are accepted, but by how easily withdrawals are honored.

Concerning patterns include:

• Missing withdrawal timelines

The platform claims “instant withdrawals” but does not publish clear guidelines.

• Vague or shifting requirements

Users may be asked for additional verification, new fees, or unexplained upgrade demands before receiving funds.

• Poor communication around delays

Delayed responses, unclear explanations, and inconsistent messaging can frustrate users seeking access to their money.

• No published fee schedule

Users cannot predict withdrawal fees, minimum limits, or payout conditions.

These practices significantly undermine trust and reveal a lack of operational transparency.

6. Fee Structure & Cost Transparency

Trustworthy platforms provide detailed cost breakdowns, including:

Trading fees

Conversion fees

Withdrawal charges

Overnight financing

Deposit minimums

Inactivity fees

PocketExchangeOption provides none of these transparently.

Instead, the platform uses broad statements such as “zero commission” or “minimal fees,” which sound attractive but do not allow users to calculate real costs. This becomes especially problematic when hidden or unexpected fees appear later.

7. Marketing Tactics – Psychological Pressure

PocketExchangeOption uses persuasive psychological techniques to attract users, including:

• Urgency messages

“Limited investment slots available,” “Register now,” or “Offer expires soon.”

• Social proof illusions

Unverified testimonials describing rapid profits.

• Identity masking

Stock images labeled as “professional traders,” “investor testimonials,” or “top earners.”

• Overemphasis on benefits

The platform focuses on earnings, simplicity, and automation while downplaying risks and transparency.

These tactics are common in high-risk platforms designed to appeal quickly to emotionally motivated decisions.

8. Customer Support & Communication Issues

Reliable financial services maintain strong, consistent communication. In PocketExchangeOption’s case, red flags include:

No phone support

Delayed emails

Scripted or generic replies

No escalation procedure

No clear dispute-resolution channels

Users report varying levels of responsiveness, especially when inquiring about withdrawals or regulation. Quick replies during deposit discussions and slow responses thereafter is a pattern often associated with unreliable services.

9. Legal Terms & User Protections

Clear legal documentation is essential for any investment platform. PocketExchangeOption falls short in several areas:

Absence of governing law specification

No arbitration or formal dispute-resolution process

No client-fund protection policy

Minimal or generic terms and conditions

No clarity on fund segregation

These gaps leave users without contractual safeguards and no clear route for recourse.

10. Overall Risk Assessment – High Risk

Based on the issues identified—unverified regulation, unclear ownership, unrealistic returns, poor transparency, and withdrawal concerns—PocketExchangeOption displays numerous red flags associated with unsafe online investment platforms.

While the website may appear polished, the absence of essential credibility markers places the platform in a high-riskcategory.

How GainRecoup.com Can Support Individuals Who Lost Funds

For individuals who have already deposited money into PocketExchangeOption and now face challenges such as delayed withdrawals, unclear conditions, or limited communication, GainRecoup.com can offer structured support.

GainRecoup assists users by:

1. Reviewing and organising your case

Collecting transaction histories, screenshots, communication logs, and deposit records into a clear timeline.

2. Identifying inconsistencies in the platform’s claims

Comparing what the platform promised versus what was delivered.

3. Preparing structured documentation

Organising all evidence into a professional, easy-to-use format for next-step actions.

4. Analysing payment pathways

Reviewing the channels used—card, bank, crypto—and helping users understand available procedural steps.

5. Offering guided, step-by-step recommendations

Providing clarity and direction through a structured approach so users know which actions to take and in what order.

GainRecoup does not guarantee outcomes, but it provides a clear, professional process to help individuals regain control, gather the right information, and move forward with greater confidence.

Final Thought

PocketExchangeOption may appear modern and appealing, but the lack of verifiable transparency, clear licensing, realistic return structures, and dependable withdrawal processes places it in the high-risk category. Before engaging with any platform, it is essential to verify regulation, evaluate transparency, and consider long-term fund security. For individuals already affected, GainRecoup.com can offer a structured, supportive approach to help organise your case and pursue available pathways with clarity.