Introduction

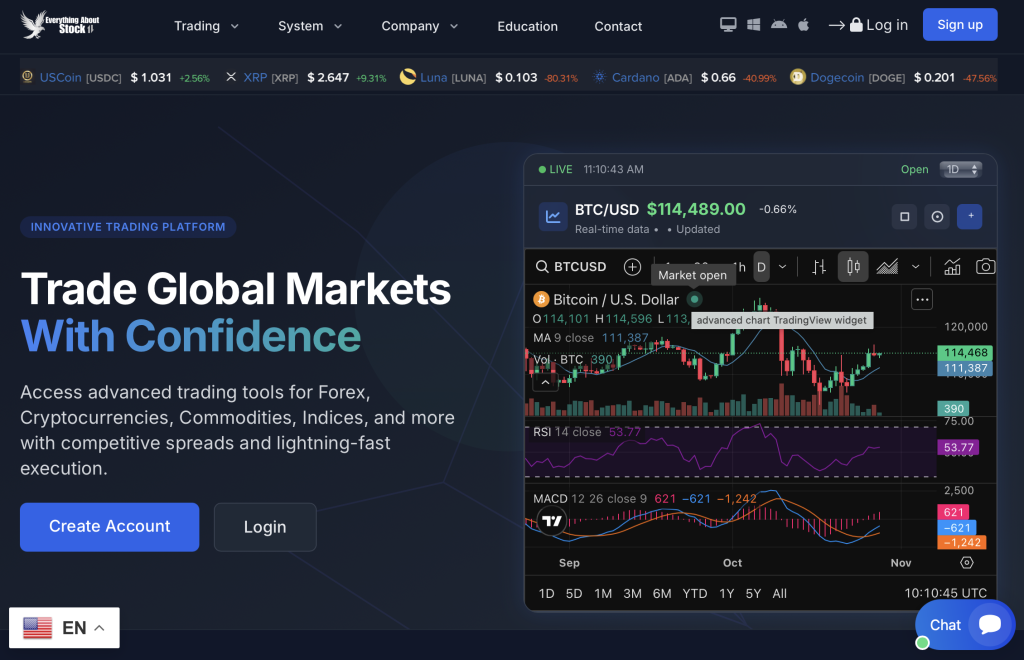

EverythingAboutStock (at everythingaboutstock.com) presents itself as a full-service trading platform offering access to stocks, gold, oil, indices and cryptocurrencies. It boasts ultra-fast execution, spreads from “0.0 pips,” AI-powered analytics, and “global regulation” with “segregated client funds.” On the surface this appears attractive—inclusive for beginners and seasoned investors alike.

However, when one reviews the details behind the claims, a number of structural issues emerge: unclear licensing, unrealistic return promises, opaque withdrawal terms and marketing that emphasizes profit over risk. This review explores the platform’s claims, operations and red flags so you can decide whether it aligns with your criteria for transparency, accountability and fund safety.

The Platform’s Promises

EverythingAboutStock’s website highlights several key features:

Access to global markets (stocks, commodities, crypto, forex) with “tight spreads” and fast execution.

A variety of “investment plans” with weekly returns, minimal entry thresholds and “instant withdrawal.”

Multilingual support, multiple payment methods, and tools for both novice and experienced traders.

The claim of “industry-leading insurance protection” for client funds.

These features may appeal strongly to those seeking easy access and promising returns. But credible investment platforms also emphasise transparency around licensing, realistic risk, and verified track records—areas where EverythingAboutStock falls short.

Licensing & Regulation: The Core Weakness

A fundamental test of any trading platform is its regulatory status. Licensed brokers are typically overseen by recognised authorities, ensuring fund protection, compliance and accountability.

EverythingAboutStock is listed by the Financial Conduct Authority (FCA) as not authorised or registered in the UK to provide financial services. This means clients in the UK (and often by extension in other regions) have no access to regulated protections or compensation schemes.

When a platform claims “global regulation” without verifiable evidence, the promise of security becomes hollow. Without an authorised regulator, clients face significantly higher risk.

Company Identity & Ownership Transparency

Transparency around ownership and corporate structure fosters trust. Credible firms list their registered business names, physical addresses, directors and audited accounts.

For EverythingAboutStock:

The website lists an address in London and claims a global operational footprint, yet no clear corporate registration, audit reports or named leadership team is publicly verifiable.

Some of the site’s promises (such as “40+ international awards,” “trusted brand,” and “global regulation”) lack independent documentation or third-party validation.

When a company behind an investment platform cannot be clearly identified, accountability becomes distant and recourse difficult.

Account Plans & Return Promises

The site advertises multiple “investment plans” with varying minimums and claimed weekly returns—for example, “2.5% weekly,” “3.1% weekly,” or even “25% per trade.” These fixed or very high yields warrant caution. In regulated investment markets, returns are volatile and never guaranteed.

Some red flags here:

Emphasis on “choose the perfect plan” and automatic “principal return on maturity” implies certainty, which is rarely realistic in financial markets.

The upward-tier progression (“beginner plan,” “standard,” “business,” “VIP”) encourages depositing more to unlock higher returns.

The pressure to pick a plan quickly and start investing may prioritise speed over verification.

Such patterns are characteristic of platforms that prioritise intake over sustainable trading operations.

Deposit, Withdrawal & Fund Access Concerns

The practicality of trading is tested most when you attempt to withdraw funds—not when you deposit them. For EverythingAboutStock:

The website claims “instant withdrawal” but does not publicly provide a clear timeline, minimum withdrawal amounts or detailed fee schedule.

The fact that the FCA says the platform is unregulated means UK clients have no formal complaint or compensation route if funds go missing.

The combination of high promised returns, low entry minimums and absence of transparency often correlates with delays, additional “verification” or even blocked withdrawals in similar cases.

Inclusive caution: Always ask for published withdrawal terms before depositing—how long, which methods, what fees, and what verification is required. If the provider fails to answer clearly, your funds are subject to elevated risk.

Fee Structure & Cost Transparency

Full disclosure of trading costs—spreads, commissions, overnight fees, inactivity fees, withdrawal charges—is a hallmark of reputable brokers. EverythingAboutStock lacks transparent and easily accessible cost tables.

Marketing emphasises “zero commission,” “tight spreads from 0.0 pips” and “minimum fees” but does not provide full disclosure across all asset classes. Without a detailed cost breakdown, traders cannot evaluate actual profitability or compare with regulated alternatives.

Hidden or shifting fees are common warning signs: deduction of funds via vague labels (“admin charge,” “liquidity adjustment”), or elevated withdrawal costs introduced after profits appear.

Marketing Tactics & Promises

The platform emphasises results: “Trade what you want, when you want,” “join millions of global traders,” “experience institutional-grade execution.” These statements place strong emphasis on benefits, but offer little on risk.

Legitimate trading firms emphasise market risk, volatility and the possibility of losses. By contrast, EverythingAboutStock’s promotions lean heavily toward guaranteed gain and simplicity of success—raising the likelihood of unrealistic expectations, especially among newer investors.

Customer Support & Communication Behaviour

Reliable firms offer multi-channel support (email, phone, live chat), public SLA disclosures, and transparent escalation for client issues. In EverythingAboutStock’s case:

While contact details are listed, there is no public track record of support handling withdrawal disputes, regulation inquiries or fee transparency.

Platforms that respond quickly to deposit inquiries but more slowly to withdrawal or compliance queries often shift from “customer service” to “lead generation” mode.

Inclusive recommendation: Before funding, test support with a withdrawal scenario question. If answers are vague, slow or deflective, regard that as a risk marker.

Legal Terms & Contractual Protection

The Terms of Service and Privacy Policy should clearly specify governing law, jurisdiction, client fund protection, dispute resolution and withdrawal eligibility. EverythingAboutStock’s legal documents are minimal and generic, lacking:

Clear statement of which country’s laws govern the contract.

Independent audit verification of segregated funds.

Public complaint or arbitration pathway.

When contract-terms are vague, rights to recourse are limited—making fund recovery in the event of issues more difficult.

Recognising the Risk Pattern

EverythingAboutStock exhibits multiple red-flag characteristics seen in high-risk investment platforms:

Unverified regulatory claims.

Promises of fixed, high weekly returns.

Low entry thresholds with up-tiered “plans” pushing larger deposits.

Deposit-easy yet withdrawal-unclear operations.

Marketing accentuating fast profit rather than risk.

Limited publicly verifiable ownership or audit credentials.

Each factor on its own suggests caution; combined, they form a strong basis to treat the platform as high-risk.

Inclusive Summary: Your Strengths vs. Their Weaknesses

Apparent strengths:

Modern, professional website and broad investment appeal.

Inclusive language aimed at new and experienced investors alike.

Promises of accessibility, low minimums and “global market” access.

Major concerns:

Without verifiable licence, operation is outside regulated frameworks.

Withdrawal transparency and fund protection are unclear or missing.

Cost structure is not transparent.

Marketing emphasises profit over risk.

Corporate identity and accountability are weak.

Inclusive viewpoint: A platform that appears inclusive and accessible should equally prioritise disclosure, regulation and investor protections. In this case, those foundational elements are missing.

Final Verdict: High-Risk Platform — Caution Advised

After reviewing EverythingAboutStock’s operations, corporate claims, regulation status, withdrawal practices and marketing, the assessment is that this platform presents a high risk. Investors seeking transparency, legal accountability and clear cost/risk disclosures will find these lacking.

If you’re considering using EverythingAboutStock.com, proceed with extreme caution. Verify regulation, request full documentation, understand fees and withdrawal terms fully before committing funds. If such verification cannot be provided, the investment exposure should be considered conditional and high-risk.

How GainRecoup.com Can Assist

For individuals who believe they may have mis-invested in platforms like EverythingAboutStock, services such as GainRecoup can provide structured assistance. GainRecoup specialises in:

Reviewing and organising your transaction history, withdrawal requests and account activity.

Verifying the provider’s regulatory status and their public claims.

Assisting in liaising with payment processors or issuing banks to trace fund flows.

Guiding you on possible steps to press your claim or seek refund channels based on evidence.

While no service can guarantee full restitution, GainRecoup helps turn fragmented information into organised actionable documents—helping you convert confusion into clarity, and giving you a framework to explore recovery options.

Final Thought

In the world of online investing, credibility is rooted in verification, regulation and transparency—not just promotional promises. EverythingAboutStock.com may look modern and inclusive, but its lack of verifiable oversight, unclear cost structure and weak withdrawal transparency make it a platform to approach with very high caution. Before giving funds to any provider, always check the fundamentals—not just the flash.