When you come across a website like centralfxchain.com, promising high-end trading, advanced tools, and quick profits, it’s tempting. Yet in the online investment world, solid credibility matters as much as flashy claims. This in-depth review is written with inclusive language. It covers what Central Fx Chain claims, why concerns are significant, and what you should look for if you’re evaluating any platform of this kind.

What Central Fx Chain Presents Itself As

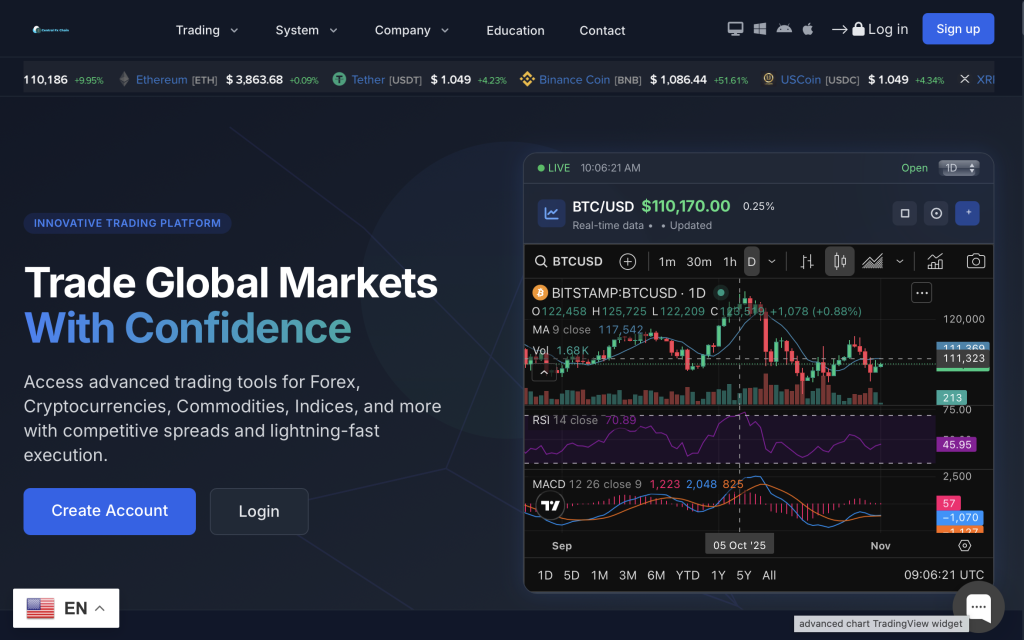

Central Fx Chain positions itself as a full-service trading platform offering:

Contracts for Difference (CFDs) on forex, indices, commodities, cryptocurrencies and stocks.

“Competitive spreads”, “cutting-edge execution”, and “innovative trading tools”.

Global access to markets, and account types designed for different levels of investor.

On the surface, it seems to cater to both new and experienced traders seeking diverse instruments. But the key question is: Do the claims match up with verifiable proof?

Company Identity & Regulation: Major Red Flags

A trustworthy financial-services provider must clearly disclose its registered legal entity, show which financial regulator authorises it, and offer transparent contact details. In the case of Central Fx Chain, several warning signs stand out:

The UK regulator Financial Conduct Authority (FCA) lists Central Fx Chain as unauthorised and unregistered.

The website claims an address of 1 Canada Square, Canary Wharf, London, E14 5AB as part of its “official” contact details. The FCA warning lists that same address – but still states the firm is not authorised.

Being unregulated means UK-based clients (and likely clients in other jurisdictions) do not have access to important protections such as compensation schemes or regulated complaint routes.

When a firm markets financial services but lacks clear legal status and regulatory backing, the risk is much higher.

Product Claims, Returns and Risk Disclosure

Legitimate trading platforms strive for a balance between opportunity and risk. They clearly state that you may lose funds and provide meaningful disclosures. Here are concerns in this case:

Central Fx Chain’s marketing emphasises broad access and “advanced tools”, yet publicly available analysis indicates no valid regulator authorisation. This gap is significant.

If a site emphasises ease of profit, wide market access, and sophisticated tools but lacks transparency on real risks or shows no verified track record, that is a warning sign.

Good platforms will publish their performance data, detail their spreads, commissions, withdrawal processes and risk profile. In this scenario, those elements are either missing or not verifiable.

Payments, Withdrawals & Hidden Terms

Part of assessing any online trading platform is understanding how you fund an account, how you extract funds, and whether there are hidden or surprising conditions.

When a company is unregulated, the protections around your deposits are diminished. For example, refund rights, dispute resolution and oversight are weaker or absent.

If Central Fx Chain requires payment via non-reversible methods or has ambiguous withdrawal policies, that adds risk. While specific payment methods weren’t publicly detailed in the sources reviewed, the lack of regulation heightens concern.

Withdrawal obstacles are a common issue seen in high-risk platforms: requests for “verification fees”, “taxes”, “unlocking charges” or delays. Without official transparent policy, users may face major hurdles.

Marketing Style, Social Proof & Website Quality

Critically evaluating the marketing and web-presence of Central Fx Chain gives further insight:

The website presents itself professionally, with typical trading-platform language and designs. This is standard and does not inherently prove legitimacy.

However, presence on the FCA Warning List is an independent, authoritative indicator that something is amiss.

Social proof (testimonials, screenshots of big profits) may exist, but when not backed by external verification, it remains untrustworthy.

Look for consistency between the “About Us”, “Terms and Conditions”, “Risk Disclosure” and “Contact” pages. Discrepancies or omissions are warning signs.

Typical Scam Patterns to Watch For

Based on industry patterns, the following behaviours frequently accompany platforms that turn out to be high-risk or fraudulent:

Cold outreach (emails, calls, social-media messages) offering “exclusive access” or “guaranteed profits”.

Very high promised returns, little discussion of losses or realistic market behaviour.

Pressuring you to deposit more money once you’ve already made an initial payment.

Withdrawing or requesting more funds before letting you access profits.

Use of unregulated payment methods (crypto-only, e-wallets with limited recourse).

Claims of regulation or licensing that cannot be independently verified.

In Central Fx Chain’s case, the “unauthorised firm” status strongly aligns with one or more of the above patterns.

Inclusive & Easy-to-Understand Language for Every Investor

Whatever your level of trading experience, here are things to ask:

If you are new to trading: Choose platforms that clearly explain the risks, let you start with low investment, show transparent policies, and offer support without high-pressure sales.

If you have moderate experience: Verify the provider’s identity, check their regulation status, confirm real user feedback, and ensure you understand the full fee and withdrawal structure.

If you’re advanced: Look for audited results, independent verification, regulatory oversight, controls on your funds, and full documentation of trading infrastructure and operations.

A platform should treat you as an informed user—not as someone to be pressured into depositing.

Final Verdict

Taking into account all available information, including the FCA’s explicit warning that Central Fx Chain is not authorised, the dark-flags around regulation, transparency and user protections—the risk associated with centralfxchain.com is high. While no review can guarantee outcome, the balance of evidence suggests this platform falls well short of what a low-risk, professional trading provider should deliver.

If you’re assessing whether to trade through this site, weigh the facts: no proper regulation, limited disclosed protections, lack of independent verification, and the typical marketing cues of “fast profit”. Until those issues are satisfactorily addressed, proceeding with caution or choosing other regulated platforms is the more prudent path.

Key Takeaways

Always check whether a firm is authorised by a recognised regulator.

High-return promises with little risk disclosure are red flags.

Transparent payment and withdrawal policies matter greatly—especially when regulation is lacking.

Marketing language alone isn’t proof of legitimacy; verify the facts.

Regardless of your experience level, you deserve clarity, respect and full disclosure from any trading platform.

This review aims to help you evaluate centralfxchain.com with clarity and independence. Use the points above as part of your decision-making process, match the platform’s statements against verifiable evidence, and ensure your own protective criteria are met before proceeding.

Empowering Victims: Taking a Stand Against Scams with GAINRECOUP.COM

If you have fallen victim to a scam, it is important to understand that you are not alone and you still have options. Scammers exploit the trust of their victims, but organizations like GAINRECOUP.COM work tirelessly to combat these frauds with integrity and expertise.