In the expanding world of online trading, websites like NexoXpert.com often appear with sophisticated designs and confident promises. They claim to offer advanced investment tools, fast withdrawals, and expert financial guidance that can turn ordinary traders into successful investors. However, not all platforms are built on genuine foundations. This review takes a deep, and inclusive look at what NexoXpert.com presents, how it operates, and the warning signs every investor should notice before getting involved.

What NexoXpert.com Claims to Offer

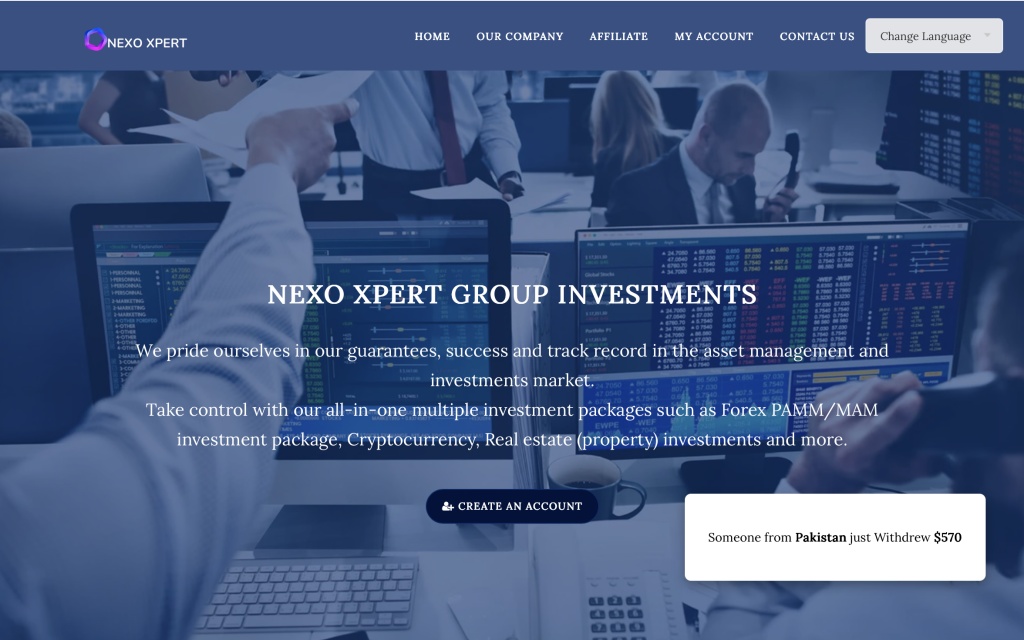

On its homepage, NexoXpert.com promotes itself as a next-generation trading and investment platform, providing users with access to multiple markets such as:

Forex and CFDs

Cryptocurrencies and digital assets

Commodities and global indices

Portfolio management and expert trading strategies

The site uses sleek visuals and persuasive text about “financial freedom” and “automated wealth solutions.” It suggests that users can benefit from “reliable profit systems,” “24/7 trading access,” and “secure global transactions.”

At first glance, NexoXpert.com’s marketing style feels convincing, especially for those new to trading. But in the financial world, presentation isn’t proof. The real question is whether there’s transparency, regulation, and evidence behind these claims.

Company Identity and Regulation

Before trusting any platform, verifying its company registration and regulation status is critical. A legitimate financial trading company will:

Disclose its legal business name and registration number.

Show a valid regulatory license under a recognised authority (such as the FCA, CySEC, ASIC, or FINRA).

Provide a real office address, contact number, and named management team.

In the case of NexoXpert.com, those essential disclosures appear vague or incomplete. Many unverified trading websites list generic addresses, often in places like London or Zurich, yet these locations rarely match their actual corporate registrations.

If a site fails to name the specific company entity operating the platform or provide a license number you can verify independently, that’s a major red flag. Regulation is not a small technicality—it’s what separates trustworthy brokers from risky, unregulated operations.

Without proper oversight, users have no guarantee of fund safety, transparent pricing, or dispute resolution.

The Promises and Red Flags

NexoXpert.com appears to rely heavily on marketing promises that sound too good to be true. Among its claims are:

“Guaranteed profits” through professional account management.

“Zero risk” investments and automated trading that “never loses.”

“Instant withdrawal processing” with “no hidden charges.”

However, any platform that offers guaranteed returns is a serious concern. Real trading, even when executed by experts, involves risk. No system—manual or automated—can consistently deliver profits without losses.

Professional financial services include clear disclaimers about risk and volatility. When a site avoids such disclaimers or hides them in fine print, it’s prioritising persuasion over honesty.

Lack of Transparency

Transparency is a key sign of credibility. Let’s look at what’s expected versus what’s found:

| Aspect | What a Legitimate Broker Provides | What NexoXpert.com Shows |

|---|---|---|

| Regulation | Licensed under a known authority with verification links | No verifiable license shown |

| Ownership | Named directors, registration documents, and address | Ambiguous or absent details |

| Client Protection | Clear fund segregation and data policy | No visible client protection terms |

| Risk Warning | Prominent disclosure of potential losses | Minimal or hidden warnings |

| Performance Proof | Verified statistics, independent audits | Unverifiable profit claims |

From this comparison, it’s clear that NexoXpert.com lacks many of the elements that legitimate platforms openly provide.

Deposit and Withdrawal Policies

A major concern with suspicious platforms is how deposits and withdrawals are handled. A trustworthy service:

Allows standard, traceable payment methods (bank cards, wire transfers).

Processes withdrawals within a defined timeframe.

Never requests extra fees or deposits before releasing your funds.

Unreliable sites often delay or deny withdrawals, citing “verification issues,” “system errors,” or “tax clearance requirements.” In some cases, users are asked to pay additional fees before accessing profits—a clear sign of manipulation.

If NexoXpert.com’s withdrawal policy isn’t transparent or appears inconsistent, it should be treated cautiously.

Marketing Tactics and User Engagement

The language and style of NexoXpert.com reveal a common trend among high-risk platforms:

Overuse of emotional keywords like trust, security, and freedom.

Excessive reliance on testimonials with generic names and stock photos.

Use of time-sensitive phrases like limited offer, join now, or exclusive access.

Such language is designed to build urgency rather than provide clarity. Genuine trading companies rely on transparency, not pressure.

Moreover, if you receive unexpected messages from supposed “account managers” or see ads claiming “zero risk,” those are signs of aggressive marketing—another red flag.

Technical and Website Observations

While NexoXpert.com may appear modern and professionally built, website design alone is not proof of legitimacy. The more important factors include:

Whether the domain is newly registered—many scam sites operate only for a few months.

Whether the content is duplicated from other trading sites.

Whether there is consistent contact information across pages.

An analysis of suspicious trading websites often shows identical templates, similar slogans, and recycled images. These are indicators that a site may be part of a network of cloned scam platforms designed to capture deposits quickly.

How Platforms Like NexoXpert.com Operate

Based on patterns seen across comparable cases, such platforms typically follow this sequence:

Attraction: Enticing ads on social media promote huge returns or “limited-time investments.”

Onboarding: Friendly “brokers” contact new users and help them open an account.

Initial Deposit: The user is encouraged to invest a small amount and may even see fake profits on the dashboard.

Reinvestment Pressure: Once trust builds, the representative pushes for a larger deposit.

Withdrawal Barriers: When the user requests a withdrawal, new “requirements” or fees appear, delaying or blocking access to funds.

By the time users realise the withdrawal issues are not temporary, communication often stops entirely.

While we cannot claim that NexoXpert.com follows this exact path, its overall presentation shares many similarities with this structure, especially in the absence of verified licensing and contact transparency.

Inclusive Advice for All Users

Financial literacy and awareness protect everyone—regardless of experience level or background.

For beginners: Only use brokers listed on reputable regulatory sites (such as FCA or ASIC). Avoid platforms that promise returns or lack verifiable details.

For experienced traders: Double-check legal documentation and licensing, even if the website appears professional.

For all investors: Always read terms and conditions thoroughly, take screenshots of every transaction, and never invest money you cannot afford to lose.

Remember: A real financial platform encourages questions, offers educational material, and provides transparent disclosures.

Final Verdict

Taking into account the lack of verified regulation, unrealistic return promises, absence of transparent ownership, and questionable withdrawal conditions, NexoXpert.com exhibits multiple red flags typical of unreliable or potentially fraudulent trading platforms.

While the website’s presentation is professional, the underlying structure raises serious doubts about its legitimacy. In online trading, credibility is everything—and without transparency, users are exposed to unnecessary risks.

For anyone considering participation with platforms like this, caution is essential. Always verify, research, and ensure the service aligns with official financial regulations before funding an account.

Key Takeaways

NexoXpert.com is not verifiably regulated. Lack of oversight means zero investor protection.

Promises of guaranteed profit are unrealistic. Real trading involves both wins and losses.

Transparency and traceability are vital. Avoid platforms that hide their company identity or legal details.

Professional appearance ≠ legitimacy. Focus on regulation, not website design.

Educate yourself before investing. Empowered investors make informed, safe decisions.

This review of NexoXpert.com aims to help readers make better decisions in the online investment space. Understanding how to assess transparency, risk, and authenticity empowers you to protect your finances and trade with confidence.

Empowering Victims: Taking a Stand Against Scams with GAINRECOUP.COM

If you have fallen victim to a scam, it is important to understand that you are not alone and you still have options. Scammers exploit the trust of their victims, but organizations like GAINRECOUP.COM work tirelessly to combat these frauds with integrity and expertise.