When a trading platform claims to deliver easy profits, empowered trading and “takes care of you” from day one, it’s natural to feel hopeful. But when the platform’s core legitimacy—including regulation, transparent policies and user protections—is weak or missing, you’re facing elevated risk. In this detailed ZentroxTrade scam review we’ll break out how the platform presents itself, what the warning signs are, and what questions a diligent trader should ask.

What ZentroxTrade Promises

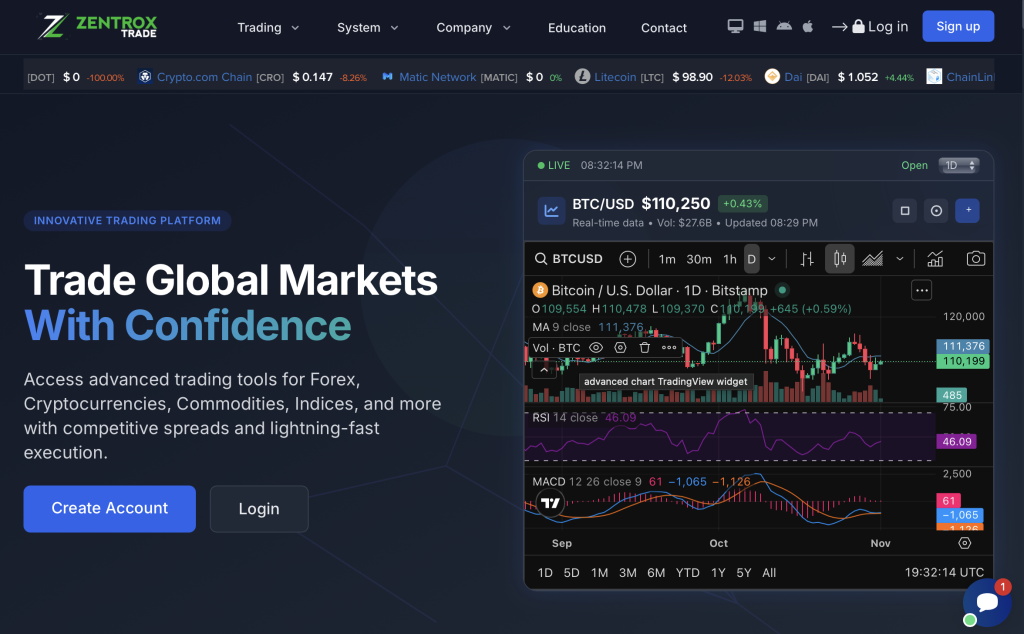

ZentroxTrade positions itself as a full-service online broker offering CFD trading across foreign exchange, commodities, indices, stocks and more. The website promotes:

“Fast account setup” and immediate trading access.

Wide instrument coverage (Forex + Equities + Commodities).

Suggested high returns or attractive spreads.

Seemingly professional branding, “rich” imagery, account managers, and special offers.

On the surface, that sounds familiar to many legitimate brokers. However, as we’ll see, the presentation doesn’t match the substance in crucial areas.

Regulation & Licensing: The First Key Filter

One of the most important tests for any broker is whether the firm is authorised and regulated by a recognised financial/regulatory body. In ZentroxTrade’s case the following emerges:

The Financial Conduct Authority (FCA) of the UK lists ZentroxTrade as not authorised or registered. FCA

Because they are not authorised in the UK, clients dealing with the firm may lack access to UK-based protections such as the Financial Services Compensation Scheme (FSCS) and the Financial Ombudsman Service. FCA

Lack of regulation means less transparency, weaker oversight, and increased risk of misconduct or withdrawal issues.

In short: the platform’s promise of wide coverage is undercut by the absence of verifiable regulation. That alone triggers a major warning flag.

Ownership, Transparency & Contact Details

Legitimate brokers typically clearly identify their operating company: name, registration number, full address, jurisdiction, legal disclosures and audited financials. With ZentroxTrade we see several concerns:

The website claims an address like “1 Canada Square, Canary Wharf, London, E14 5AB” under its FCA entry. FCA

But being listed at an address does not confirm authorised status, nor does it guarantee that the operating company is genuinely managing client funds under regulatory oversight.

The platform does not appear to provide independently verifiable evidence of company registration, audited financials, fund segregation or client fund protection.

Lack of full transparency around who exactly runs the business and under what legal regime makes the risk profile much higher.

Promotions, Bonus Offers & High-Pressure Engagement

Many questionable platforms rely on typical behavioural triggers to steer clients toward larger deposits or riskier trades. In ZentroxTrade’s case potentially risky features include:

Marketing of “fast profit opportunities” and implied guaranteed gains (which reputable firms avoid).

Use of “account manager” or “dedicated representative” language to encourage top-ups or bigger trades.

Bonus or deposit match offers tied to conditions that may hamper withdrawals (even if they are not clearly visible up front).

These features are not illegal in themselves, but they often appear in conjunction with other risk signals. When bonuses hinge on trading volume before withdrawal, or when account managers pressure clients toward high-risk trades, that tends to align with red-flag behaviour.

Deposits, Withdrawals & KYC: The “Execution” Test

Even the best-looking website can hide serious friction when it comes to putting real money in and getting it out. Key questions to ask and issues to watch for:

Does the firm clearly state deposit and withdrawal methods (bank transfer, card, e-wallet)?

Are withdrawal rules transparent (e.g., how long, any fees, what documentation is required)?

Are there “unlocking fees” or additional payments required before withdrawals are processed?

Are account verification (KYC) and anti-money-laundering (AML) policies clearly stated and sensible?

For ZentroxTrade: based on regulatory warnings and user experiences, there is elevated risk that these processes may be delayed, confusing or intentionally onerous. Absence of regulation often correlates with withdrawal obstructions.

Platform Execution, Pricing & Conditions

A legitimate broker typically offers a clean trading platform, transparent pricing/spreads, fair order execution, and meaningful reporting. For ZentroxTrade several concerns apply:

Because the firm is unregulated in key jurisdictions, order execution may not be independently audited.

If spreads, slippage or stops are opaque or disproportionately large in volatile moments, a client might face unexpectedly higher losses.

If the platform lacks downloadable statements, time-stamped transaction logs or clear reporting, transparency is diminished.

In practice, when you cannot verify how your trades are being handled, you’re accepting a higher risk of unfair practices.

User Feedback & Reputation Signals

User reviews, forum discussions and regulator warnings can provide early warning signals. For ZentroxTrade:

The FCA issued a formal unauthorised firm warning for ZentroxTrade. FCA

Negative reviews in various forums mention difficulties with withdrawals, pressure to deposit more and poor transparency.

Absence of positive, verifiable third-party audits or long-standing user satisfaction data.

While some platforms with weak regulation may still operate honestly, the combination of regulatory warning + user complaints + opaque disclosures creates a stacked risk scenario.

Key Risk Checklist for ZentroxTrade

Here’s a summary checklist you can use to review this platform (or any similar one) with inclusive language that applies to all potential clients:

✅ Are you sure the company name, registration and jurisdiction exactly match across website, terms and regulatory filings?

✅ Does the firm hold a licence from a reputable regulator (not just a registration in an offshore zone with minimal oversight)?

✅ Are deposit, withdrawal and bonus conditions clearly and consistently stated in the client agreement and not buried in fine print?

✅ Does the platform let you withdraw funds promptly without being forced to trade more or pay extra fees?

✅ Do you have downloadable statements, trade records, and a clear price feed that matches independent sources?

✅ Are you free from high-pressure outreach (calls/messages urging immediate deposits or “once-in-a-lifetime” trading windows)?

✅ Do you feel comfortable with how the firm treats your rights, your data and your funds—regardless of promises of profits?

If several of those boxes return “no” or “unclear”, your risk is significantly elevated.

Final Thoughts: Weighing the Evidence

In this ZentroxTrade scam review, the pattern of concern is clear: unverified regulation, nontransparent ownership, pressure-style marketing and withdrawal risk. For inclusive, thoughtful investors who value transparency and fairness, those factors raise serious caution.

What we see:

A broker-style website that looks polished but is not backed by recognised regulatory authorization in a key jurisdiction (UK’s FCA has issued a direct warning).

Marketing copy promoting ease and returns, but limited visible evidence of the foundational protections traders expect (licensed operations, audited accounts, client fund segregation).

Significant risk of friction when it comes to exiting the platform or accessing funds.

Who this matters for:

All traders deserve to ask “Who’s running this?”, “Where is my money held?”, “Can I get out easily?”, and “How am I protected?”.

Inclusive language means everyone — whether you’re new to trading or experienced — should apply the same scrutiny.

The size of your deposit, your trading experience or your geographic location should not exempt you from asking fundamental questions.

Summary verdict (non-legal): Given the evidence, ZentroxTrade presently exhibits strong risk indicators rather than strong integrity signals. Until the firm produces verifiable regulation, clear ownership and transparent withdrawal practices, every investor using the platform is accepting elevated exposure.

By understanding how to interpret key signals—regulation, transparency, trading conditions, user feedback—you empower yourself to make smarter decisions. Whether you’re exploring ZentroxTrade or any other broker, insist on clarity, documentation and protections.

Empowering Victims: Taking a Stand Against Scams with GAINRECOUP.COM

If you have fallen victim to a scam, it is important to understand that you are not alone and you still have options. Scammers exploit the trust of their victims, but organizations like GAINRECOUP.COM work tirelessly to combat these frauds with integrity and expertise.