Summary

This review explores OptimaTrade.pro, a platform that advertises itself as a professional online broker offering advanced trading opportunities in forex, cryptocurrency, and commodities. However, a closer look raises multiple red flags—ranging from regulatory gaps to unclear company ownership and questionable marketing tactics. We highlight the platform’s inconsistencies and provide an objective breakdown to help readers evaluate its credibility and risks before engaging.

Note: This article is for educational and informational purposes only. It examines common warning signs associated with unverified trading and investment websites.

1) First Impressions and Platform Claims

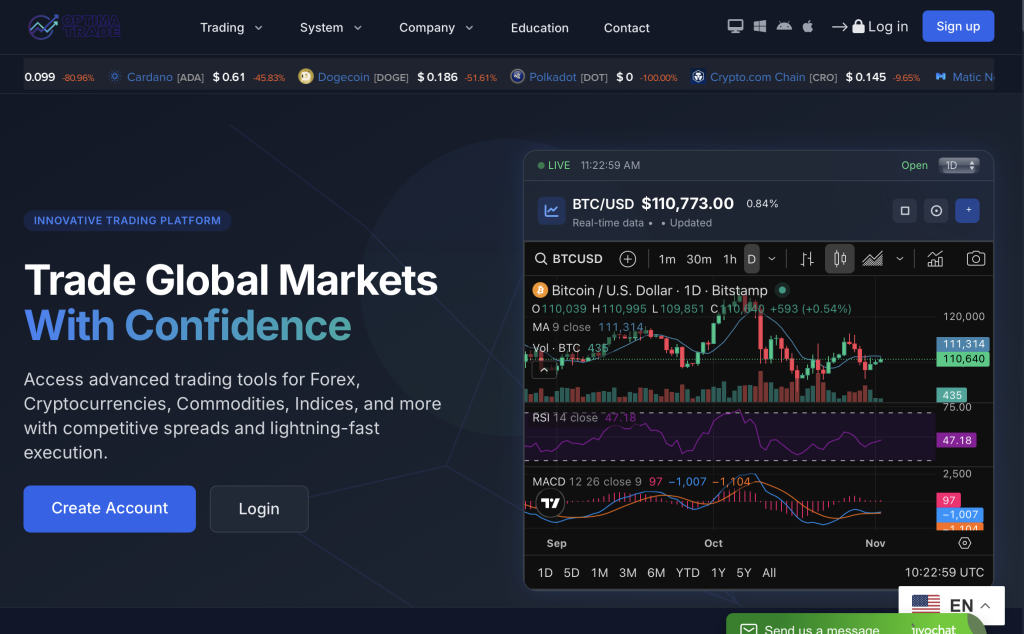

At first glance, OptimaTrade.pro presents itself as a sleek, modern brokerage platform. Its homepage features promotional banners promising quick profits, automated trading systems, and secure investments. It positions itself as a leader in “next-generation trading” with tools designed for both beginners and professionals.

Yet several aspects immediately warrant caution:

Exaggerated Profit Expectations: The site repeatedly emphasizes fast earnings and “guaranteed success.” No genuine trading platform can promise consistent, risk-free profits.

Overly Simplified Process: Claims such as “Trade smarter in three clicks” or “Start earning instantly” oversimplify what is inherently a complex, risky market.

Anonymous Operation: The site lacks clear ownership or registration details, leaving visitors uncertain about who operates the platform.

These signals suggest marketing focused on excitement and urgency rather than factual transparency.

2) Company Transparency and Ownership

Transparent ownership builds trust, especially in financial services. Unfortunately, OptimaTrade.pro provides little to no credible information about its corporate structure.

Key issues include:

No Legal Entity Information: There is no company registration number, tax ID, or business name visible in the website’s footer or “About Us” page.

Vague Location Claims: The site may list a city or country, but such details are often unverifiable and unaccompanied by contact numbers or office addresses.

No Named Management Team: Reputable platforms display leadership profiles or at least key department heads. OptimaTrade.pro lists none.

When an investment service hides its operators, accountability becomes impossible. If anything goes wrong, users have no clear legal recourse.

3) Licensing and Regulatory Oversight

One of the most crucial factors in determining whether a trading platform is trustworthy is regulation.

OptimaTrade.pro does not appear to hold a valid license from any recognized financial authority such as:

The Financial Conduct Authority (FCA) in the United Kingdom,

The Australian Securities and Investments Commission (ASIC),

Or the Cyprus Securities and Exchange Commission (CySEC).

Unregulated brokers can operate freely without adhering to consumer protection standards, segregated client accounts, or audited performance reports.

Why it matters:

Without regulation, the platform is under no obligation to follow fair-trading rules, handle complaints transparently, or protect client funds in the event of insolvency.

4) Products and Trading Conditions

OptimaTrade.pro claims to offer multi-asset trading opportunities—covering forex, cryptocurrencies, indices, commodities, and stocks. However, the platform’s details are vague or inconsistent:

No Verified Trading Platform: There’s no mention of a credible third-party system such as MetaTrader 4 / 5 or cTrader. Instead, it relies on a proprietary web interface with no proof of independent audits.

Leverage and Margin Ambiguity: Details on leverage limits, spreads, or margin requirements are unclear or missing altogether.

Fake “AI Technology” Claims: The website highlights “AI-powered algorithms” and “machine-learning signals” without explaining how these systems work or who built them.

These omissions indicate a lack of professional transparency—essential for safe and informed trading.

5) Deposit and Withdrawal Policies

Financial transparency extends beyond regulation—it includes how client funds are handled. Many complaints about unverified platforms revolve around withdrawal problems.

Typical red flags include:

Cryptocurrency-Only Deposits: Some users report being asked to deposit via Bitcoin or other crypto assets. While convenient, these transactions are irreversible.

No Clear Refund Policy: There’s often no published policy for refunds, withdrawals, or transaction reversals.

Unexpected “Verification Fees”: Users may face surprise charges or “compliance costs” before being allowed to withdraw.

Reliable brokers list their full fee schedule, withdrawal times, and refund conditions publicly. OptimaTrade.pro’s silence on these matters should raise suspicion.

6) Marketing Style and Pressure Tactics

The platform’s marketing approach mirrors that of many unregulated brokers targeting inexperienced traders:

Urgency-Based Prompts: Phrases like “limited-time investment offers” or “secure your bonus now” push quick deposits.

Aggressive Follow-Ups: After registering, users may receive frequent calls or emails from sales agents encouraging larger deposits.

High Bonus Offers: These “deposit bonuses” often come with hidden conditions that lock client funds until unrealistic trading volumes are reached.

Such tactics are designed to create emotional urgency, reducing the time investors spend researching legitimacy.

7) Website Quality and Technical Evaluation

While OptimaTrade.pro looks visually appealing, a closer inspection of its technical and content structure exposes flaws:

Recycled Design: The layout and text strongly resemble templates used by other flagged trading websites.

Grammar and Consistency Errors: Some sections contain mixed terminology or misspellings—common in hastily assembled, template-based platforms.

No SSL or Extended Verification: The basic SSL encryption is present, but there’s no extended validation or verified ownership certificate.

Technical inconsistencies may not prove misconduct, but they highlight poor attention to detail—a warning sign for any company handling financial transactions.

8) User Experiences and Independent Reviews

User experiences provide an external perspective on how the platform operates. Early reports about OptimaTrade.proindicate:

Unresponsive Customer Support: After depositing, users report slow or no replies from support teams.

Withdrawal Refusals: Some claim they could not access their profits without paying “extra fees.”

Pressure to Upgrade Accounts: Investors often receive calls suggesting higher account tiers for “priority withdrawals” or “VIP trading access.”

The consistency of these reports across various forums aligns with the behavior pattern of high-risk trading websites.

9) Major Red Flags Identified

Summarizing the findings:

Unregulated operations — No valid financial license or oversight authority.

Hidden ownership — No names, registration details, or corporate identity.

Unrealistic returns — Promises of steady profits or risk-free investing.

Opaque withdrawal process — No transparent documentation or refund structure.

Aggressive marketing — Urgency-driven sales and continuous deposit requests.

Poor external reputation — Limited credible user reviews, mostly negative feedback.

Recycled web structure — Template layout shared with other suspicious domains.

Each red flag individually might not condemn a company, but collectively they paint a concerning picture.

10) How to Evaluate Platforms Like OptimaTrade.pro

Before engaging with any investment or trading platform, follow this due-diligence checklist:

Verify licensing: Search the broker name on official regulator databases.

Research ownership: Confirm a company registration number and physical address.

Check independent reviews: Look for feedback from diverse, reputable sources.

Read terms and conditions carefully: Especially refund, withdrawal, and bonus clauses.

Avoid high-pressure deposits: No legitimate broker rushes clients into large investments.

Test withdrawals: Always start with small deposits and confirm withdrawal capability first.

Compare to regulated alternatives: Established brokers display licenses, compliance reports, and years of operation.

11) Frequently Asked Questions

Q1: Is OptimaTrade.pro a legitimate trading platform?

There is no proof of regulatory authorization, corporate identity, or verified financial reporting. These omissions make the platform high-risk and untrustworthy.

Q2: Why does the site claim “AI-powered profits”?

Marketing phrases like “AI-powered” or “automated profits” are used to attract inexperienced traders. They rarely correspond to real, verifiable systems.

Q3: Can users withdraw funds easily?

Several reports suggest withdrawal issues and unexplained additional fees. Without transparency, there’s no guarantee of access to funds.

Q4: How can I verify its license?

Check databases of major regulators (FCA, ASIC, CySEC, SEC). If the company is not listed, it is unregulated.

Q5: Are its bonuses trustworthy?

Bonuses are often traps that restrict withdrawals until unrealistic trading volumes are met. Genuine brokers rarely offer large deposit bonuses.

12) Final Analysis and Conclusion

OptimaTrade.pro markets itself as a modern, AI-driven trading platform promising effortless income. But behind the appealing design lies a web of inconsistencies—no regulatory license, hidden ownership, unclear fund policies, and questionable user feedback.

Such characteristics align with high-risk, unverified platforms known for exploiting investor enthusiasm. Without transparent credentials, audited performance data, or oversight from credible authorities, OptimaTrade.pro cannot be regarded as trustworthy.

Key Takeaways

Always confirm regulation before depositing money.

Treat high returns and AI promises skeptically unless backed by transparent audits.

Avoid platforms that hide their team, license number, or withdrawal terms.

Trading and investment require trust and accountability. OptimaTrade.pro shows neither. Until concrete proof of legitimacy emerges, potential investors should proceed with extreme caution and rely on licensed, transparent brokers only.

Empowering Victims: Taking a Stand Against Scams with GAINRECOUP.COM

If you have fallen victim to a scam, it is important to understand that you are not alone and you still have options. Scammers exploit the trust of their victims, but organizations like GAINRECOUP.COM work tirelessly to combat these frauds with integrity and expertise.