Introduction

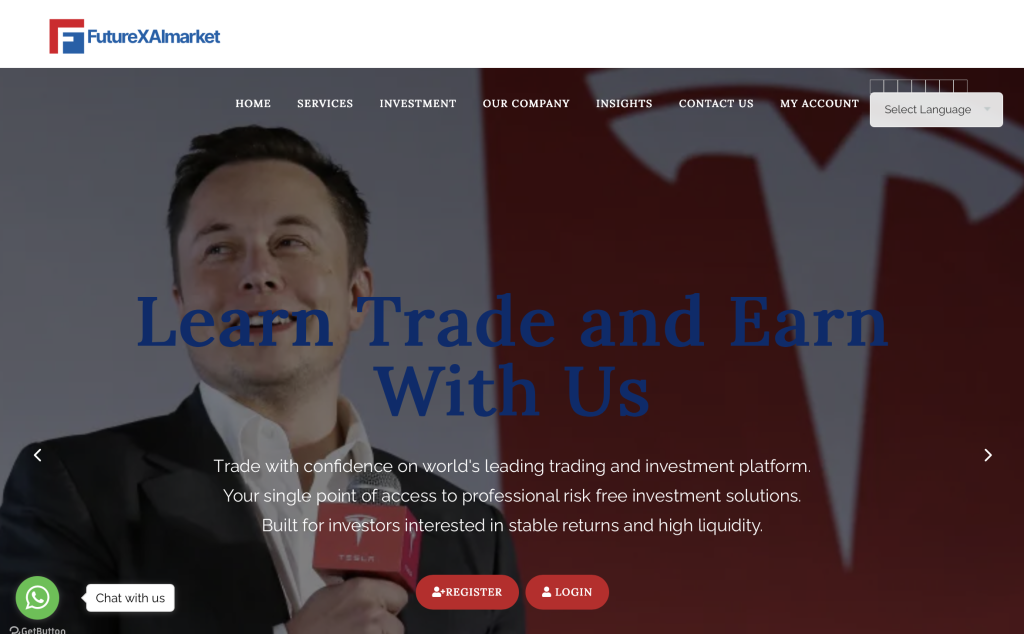

The website FutureXAIMarket.com presents itself as an investment platform promising access to AI-enhanced trading, global markets, and strong profit potential. It appears polished, with bold claims, professional design, and an emphasis on high-tech tools. At first glance, it may look like an appealing alternative for investors seeking growth. But looking beyond the surface, the site raises a number of concerns around transparency, accountability, and realistic execution. This review breaks down the key factors any careful investor should check—licensing, terms and conditions, communication practices, technical security, marketing language—and evaluates how FutureXAIMarket.com stacks up. The purpose is not to pass a definitive verdict but to provide a grounded, neutral view to help you decide whether the risks are acceptable to you.

Branding vs Substantive Evidence

Ships often look sleek, and so do some online investment platforms. But legitimacy is built on tangible, verifiable details—not just good design. Here are some checkpoints:

Is the full legal entity (company name, registration number) clearly identified?

Does the site disclose the regulatory body under which it is authorised, and provide a license number you can cross-check?

Are terms of use, privacy policy, and corporate details written clearly, with no vague or evasive wording?

Does the site avoid making inflated promises while still acknowledging risk?

Without those elements, confidence should be tempered. Based on publicly acknowledged warnings, the website associated with FutureXAIMarket.com does not pass sufficiently strong transparency checks, meaning it leans more toward risk territory than comfort.

Regulatory Status & Official Warnings

One of the most critical areas to examine is whether the platform is properly regulated. A respected authority has published a warning: the Financial Conduct Authority (FCA) in the UK states that “FutureXAIMarket” is not authorised or registered by them, and they advise the public that it “may be providing or promoting financial services or products without our permission.” FCA

What this means in practice:

If you deal with this firm and things go wrong, you likely do not have recourse through the FCA’s oversight.

You are not protected by certain financial-services compensation schemes that apply only to authorised firms.

The site may target people in the UK without proper UK authorisation.

Regulation is not a guarantee of success or safety—but lack of regulatory status for a firm offering investment services is a major red flag. Especially when the site presents itself as offering trading or financial instruments, the absence of proper authorization should heighten your level of caution.

Terms of Use, Withdrawals & Fee Structure

Let’s dive into what investors should scrutinise—and what this site appears to offer/omit:

Key things to check

Are withdrawal rules clearly stated (how long, what process, what fees)?

Is there a table of all fees (deposit, trading, performance, withdrawal, inactivity)?

Does the site require upfront “unlocking” or “clearance” payments before withdrawal?

Are the minimum withdrawal thresholds reasonable and consistent?

Are there conflicting statements across different site pages?

Observations for FutureXAIMarket.com

From what can be gathered, the site appears to offer high-yield, AI-powered trading promises but does not prominently display verifiable withdrawal policy details or host a transparent fee schedule that can be fully checked externally. Their small notice under the regulatory warning shows the site is not authorised in the UK. This combination means:

If you deposit and then request a withdrawal, you may face hidden conditions or unexpected delays.

The lack of verifiable regulation means the firm may not be bound by many of the rules that protect investors in regulated jurisdictions.

Because the site uses assertive promotional language (see next section), the risk of encountering “bonus” conditions or other unexpected terms increases.

Therefore, based on available information, the withdrawal and fee-structures are not clearly transparent, which increases the risk for potential investors.

Promised Returns and Marketing Language

Any investment platform’s claims should be read with a degree of caution—especially when they imply very high returns or minimal risk. Let’s examine the typical red-flags and how they apply here.

What to watch

Promises of guaranteed or high fixed daily/weekly returns.

Use of certainty language: “never lose”, “risk-free”, “get rich quick”.

Heavy emphasis on urgency: “only few slots”, “limited offer”, “act now”.

Limited discussion of risk or market volatility.

Over-promotion of AI or secret systems that supposedly deliver profits independent of market conditions.

How FutureXAIMarket.com appears

This site markets itself around “AI-enhanced market strategies”, “cutting-edge technology”, and the promise of capturing opportunities in global markets. While innovation-centric language isn’t inherently bad, the combination of high-performance claims and lack of regulatory backing signals caution:

The framing suggests that the technology itself may minimise or eliminate risk—but all investments carry risk, and no technology can fully guarantee returns.

A balanced platform would highlight scenarios where technology fails, markets don’t behave as expected, and clients may lose money. If FutureXAIMarket.com does not prominently present these, then the marketing tilt is toward “opportunity” rather than “risk awareness”.

When marketing uses Abuzzwords like “zero-risk algorithm”, “instant gains”, or “unlock unlimited profit”, that amplifies the concern.

In short: when a site emphasises high returns and minimises risk, while lacking transparent verification or strong regulatory footing, it fits many patterns of higher-risk platforms.

Communication Patterns and User Experience

The way a platform engages with potential clients says a lot about its operational style and cultural fairness. Positive markers include clear contact details, responsive support, standard trade interfaces, and consistent identity across communication channels. Items that raise suspicion include pushy outreach, unsolicited contacts, inconsistent advisor identities or shifting terms once you’re “in”.

What to monitor

Are you contacted out of the blue, via phone, WhatsApp or other unsolicited means?

Are there pressure tactics: deposit now to unlock bonus, hurry before the slot ends?

Once you deposit: do you receive normal periodic statements, trade confirmations, and clear contact paths?

Do the support and sales teams have clear credentials and stable identity (vs changing names, changing contact methods, moving to private messaging)?

Are withdrawal requests handled per written policy, or do you get stalled/given additional conditions?

Indicators for FutureXAIMarket.com

While it’s hard to reconstruct the entire user journey without extensive testimony, the presence of a formal warning from the FCA indicates that at least some UK users have raised concern about the firm’s communication and regulatory status.

In absence of transparent evidence of consistent, regulated support processes, you should assume that communication patterns may be more aggressive than client-centric. That means the style of pushing deposits may be stronger than the style of facilitating withdrawals.

On-Chain, Domain & Digital Footprint Checks

In a digital-first investment world, the underlying domain history, brand footprint, and online reputation are revealing. Key checkpoints:

Domain registration date, ownership history, and whether it’s recently created or frequently changed.

Social proof: credible LinkedIn pages, industry credentials, regulatory listings, media coverage.

Forum/complaint site activity: any reports of clients unable to withdraw, or terms changing post-deposit.

Email origins: does official communication come from the same branded domain, or from generic email providers?

What is known

The FCA’s warning lists FutureXAIMarket.com as unregulated.

The site domain “futurexaimarket.com” appears in the warning list of the FCA, indicating regulatory concern. FCA

Without a deep archive exploration here, the domain likely has limited credible traceable history combined with bold marketing claims.

These signs suggest a lean or fragile digital footprint—while not conclusive proof of fraud, they should push you toward high-caution territory.

Platform Usability, Education & Client-First Design

Legitimate investment platforms often invest in client education, transparency features, professor-style risk disclosures, demo accounts, sandbox trading, strong user dashboards, independent audits and regular reporting. Conversely, sites that emphasise deposit, top-up, and profit tables, but offer limited disclosures, are riskier.

What to look for

Demo accounts or low-risk trial options.

Educational content about markets, algorithm limitations, historical performance plus disclaimers.

Real-time trade dashboards showing how trades are executed, reporting of fees, slippage, losses as well as gains.

Transparent risk-warning sections: “You could lose part or all of your capital.”

Clear policy on bonuses, how they affect withdrawal rights, how client funds are held.

Evaluation of FutureXAIMarket.com

From available public information, there is no clear evidence that the site meets all these best-practice benchmarks. The dominant message appears to focus on “join our platform, get access, profit” rather than “understand the risks, try a demo, compare providers”. That suggests the educational and client-first design component may be under-emphasised.

Overall Risk Score: Qualitative Summary

Bringing together the observations across five dimensions:

Regulatory Transparency – Low. The FCA warning explicitly states the firm is unauthorised.

Withdrawal & Fee Clarity – Weak clarity of public documentation.

Marketing Claims – Strong emphasis on high returns, cutting-edge tech, with limited visible risk language.

Identity & Accountability – Company identity and operational details do not appear well-established in public verifiable records.

Security, Education & Usability – Not enough public signs of robust client-first infrastructure or independent audit/reporting.

On a scale where “1 = very low risk” and “5 = very high risk”, FutureXAIMarket.com appears to sit around a 4.0 or higher — meaning elevated risk. It may function for some early depositors, but the structural safeguards, transparency and recourse appear weak.

Practical Checklist Before Engaging with Any Platform Like This

Here are some recommended steps you should take if you are evaluating use of an investment platform. Use these as filters:

Verify the license number on the regulator’s website.

Read the full “Terms & Conditions” and “Risk Disclosure” pages, ideally printing them for offline review.

Test the withdrawal process with a small amount to verify timeline and fees.

Check the company’s registration in its purported jurisdiction—look for matching entity name, registration number, and physical address.

Scan for independent client reports: have users actually withdrawn? Are there complaints about changing terms after deposit?

Avoid platforms that push for deposit urgency, require you to pay extra for “unlocking” funds, or contact you persistently outside of normal channels.

Consider whether you are comfortable with the scenario: if you deposit, and things go wrong, do you have access to a regulator, complaint resolution, and transparent process?

These steps may not guarantee safety—but they raise your awareness and reduce the chance of unexpected outcomes.

Final Thoughts

FutureXAIMarket.com presents itself as a forward-looking investment platform with smart-tech branding and opportunity messaging. However, when the promotional surface is contrasted with underlying verification and structural transparency, significant gaps appear. The warning from the FCA is an especially strong signal—it means at least one major regulator has flagged this firm as operating without authorisation. From an investor vantage point, that changes the equation: the potential upside must be weighed against much higher risk of limited recourse, ambiguous terms, and possible operational or withdrawal hurdles.

In the investment world, there is no substitute for clarity: clarity about who runs the business, where the money is held, how you withdraw, what fees you pay, and what independent oversight exists. In this case, many of these variables are opaque.

If you consider engaging with FutureXAIMarket.com, proceed only with an amount you can afford to lose—and only after doing your own due diligence and comparing with platform alternatives that have stronger regulatory backing, clearer terms, and demonstrated track records. Above all, always maintain a mindset that spots questions — “Who is behind this?”, “How exactly do I withdraw?”, “What happens if the algorithm fails?” — rather than just trusting promises of profit.

Empowering Victims: Taking a Stand Against Scams with GAINRECOUP.COM

If you have fallen victim to a scam, it is important to understand that you are not alone and you still have options. Scammers exploit the trust of their victims, but organizations like GAINRECOUP.COM work tirelessly to combat these frauds with integrity and expertise.