Introduction

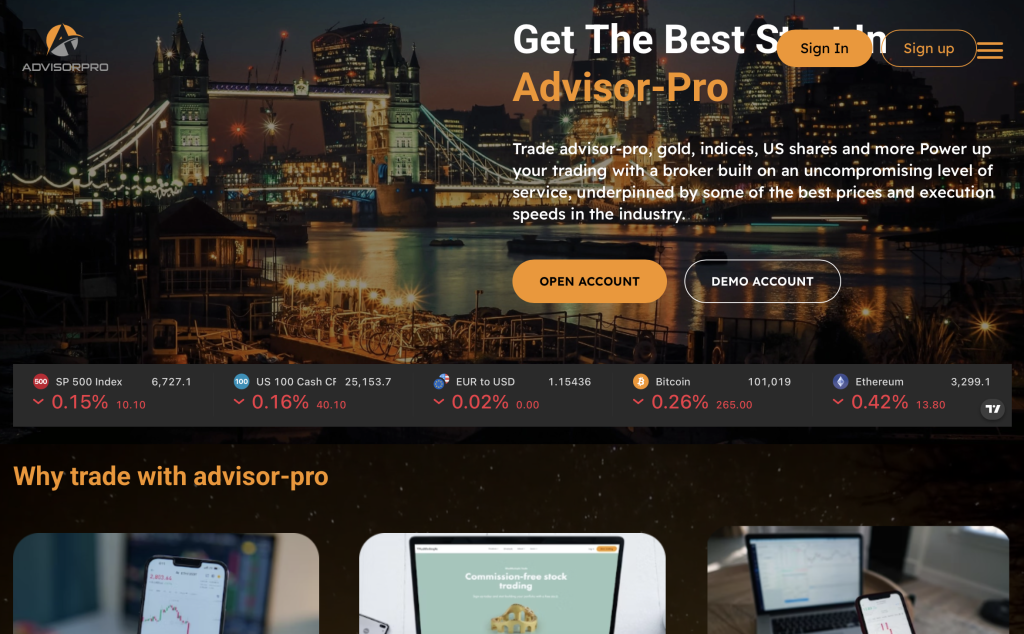

Advisor-Pro.co markets itself as a full-service global trading platform. It claims broad investment access, professional grade trading tools, “trusted broker” status and world-class support. At first sight, it has a polished website and appealing language. But beneath the marketing there are several indicators that merit caution. This review walks through the claims, the evidence, the concerns and what to ask before engaging.

What Advisor-Pro.co Claims to Provide

According to the website, the features include:

Access to 7,000+ financial instruments across asset classes like stocks, crypto, derivatives and more.

Use of the popular charting/trading interface TradingView (web, mobile, desktop) for active traders.

Funds held in “Tier 1 banks” and suggestion of FDIC-style protection (for cash balances).

Multilingual 24/5 client support and multiple account tiers depending on experience and deposit size.

A brokerage history “since 2010/15 years” and a global footprint of “portfolio management for governments, pension funds, insurers.”

On paper, these sound like desirable features for traders and investors of many backgrounds.

Key Red Flags & Critical Concerns

Below are a number of aspects that raise questions—and it’s helpful if anyone (regardless of their experience level) works through these before proceeding.

Regulation & Transparency

One of the strongest indicators of a trustworthy trading platform is clear regulation: the legal entity name, the jurisdiction it’s licensed in, the regulator’s public register link, and consistency of that information across pages and documents.

With Advisor-Pro.co, several concerns show up:

A review of the domain shows it was registered recently (within months) and uses a privacy-protected WHOIS disclosure (owner details hidden).

Independent trust-rating sites show a low trust score for the website due to its newness, hidden ownership and domain registration patterns commonly used by high-risk sites.

The website’s “About Us” materially claims long history and institutional client base but lacks detailed, verifiable evidence of regulatory CPAs, audited reports or a credible legal entity name linked with those claims.

When a platform’s regulatory status is unclear or unverifiable, the risk of unaccountability rises.

Promises That Might Be Too Good to Be True

Some of the website’s language includes guarantees of access to large asset classes, rapid trading tools, and “trusted broker” status. In markets, high-quality returns are tied with risk; platforms that imply minimal risk or highly elevated returns are a concern.

For inclusive readability: if someone promises “you can deposit, trade, and withdraw easily with unlimited upside,” it’s important to ask: what are the fees, what leverage is used, what happens when markets move against you? The absence of strong answers here is a warning.

Deposit & Withdrawal Clarity

Transparent platforms clearly explain how you deposit funds, how you withdraw them, what fees apply, what waiting times exist, and any conditions on conversion or hold periods. With Advisor-Pro.co, the public website emphasises “add funds quickly and securely” but does not prominently publish comprehensive withdrawal policy, minimum holding period, or a detailed fee schedule visible without logging in.

In inclusive language: if a site makes it easy to add money but you can’t easily see how you’d get money out, that’s something to take extra time to review.

Corporate Identity, Address & Historical Track

The site lists a few addresses, but often does not appear to link those to easily verifiable company registrations in major jurisdictions.

The domain’s very recent age (just a few months) reduces the time-track record available for public scrutiny.

The connection between statements (“we manage billions”, “we work with pension funds”) and any independently verifiable data (e.g., audited accounts, regulatory filings) is weak or absent.

Inclusive note: If you’re new to trading or investing, lack of long standing history means you have fewer public signals or user-feedback to lean on.

Why All This Matters

Let’s explain in clear, inclusive plain language:

You want a trading firm where your rights are clear and you can ask questions, get honest answers, and inspect documents. Weak regulation or hidden ownership means there’s less protection if problems arise.

When deposit-and-trade sounds super easy but withdrawal rules are hidden, the risk is you could be stuck or unable to access funds easily.

Big promises without supporting facts often rely on marketing more than substance. Real investment involves risk. A fair platform will show you potential losses as well as gains.

For anyone—whether experienced or just starting—taking time to vet a platform boosts your clarity and gives you confidence. Platforms with minimal transparency require that effort to assess risk.

Checklist: What to Verify Before Engaging

Here are points to ask or check—it’s inclusive for everyone whether experienced or new to investing:

Legal entity & regulator: What is the full legal company name? What jurisdiction? Which regulator grants the licence? Can you find the licence number in a public register?

Audit & performance data: Are there audited financial statements, or at least third-party verification of performance claims? Are terms of trading clearly explained (leverage, margin rules, risk warnings)?

Fee schedule & withdrawal policy: How much does it cost to deposit? What fees apply to trade? What conditions apply to withdrawal (minimum time, documentation, volume requirement)?

Support & communication transparency: Is the support physical address, contact number, and email clearly listed and consistent with the company name? Are you being pressured to act quickly?

Domain age & ownership: How long has the website been live? Are ownership details hidden? High-risk platforms often rotate domains, hide ownership, or exist only briefly before shifting.

Marketing versus substance: Are the “guaranteed returns” or “institutional clients” backed with verifiable facts? If something sounds too good to be true, it very often is.

Frequently Asked Questions (Inclusive Language)

Q: Can I use Advisor-Pro.co if I’m new to investing?

Yes, you can use almost any platform—but being new means you may have less experience spotting or responding to red flags. It’s especially important in that case to focus on transparency, ask lots of questions, and proceed cautiously.

Q: The site lists 7,000+ instruments—does that mean it’s safe?

Not automatically. The number of instruments offered is only one dimension. What matters more is how they are executed, what protections are in place, how trading and fees work, how you withdraw, and how risk is managed.

Q: What is “trusted broker” status?

“Trusted broker” is a marketing phrase unless backed by actual regulatory classification and public verification. A licensed broker under a recognised regulator gives additional reassurance compared to an unverified claim.

Q: What if the platform blocks or delays a withdrawal?

If you face delays or are asked for extra fees or documentation beyond normal KYC/AML then you should raise serious questions. A transparent platform will publish its policy clearly and treat withdrawals with consistent process.

Final Thoughts

In summary: Advisor-Pro.co presents with many attributes that look like a high-end trading platform—wide instrument access, advanced interface, professional language, global style marketing. But it also shows strong signal-flags that warrant caution: recent domain, hidden ownership, low trust scores on independent checks, unclear regulatory standing and insufficient publicly-verifiable evidence of institutional backing.

For any user—whether seasoned or new to trading—the decision to engage with any platform should be guided by clarity, transparency, and independent verification. The absence of those traits doesn’t necessarily mean guaranteed failure, but it does increase the uncertainty and risk you’re taking on.

If you’re evaluating Advisor-Pro.co (or similar platforms), it’s wise to take your time, ask concrete questions, compare alternative platforms, and only proceed when you feel comfortable with how everything checks out. The inclusive takeaway: whatever your level of investing experience, you deserve clear answers, consistent protections and the ability to make your own informed decision with confidence.

Inclusive closing note:

This review is written for anyone—no matter your background, professional status, or investment history—to understand what to look for and what to question. Whether you’re beginning to explore trading ecosystems or have many years behind you, transparency and clarity matter. Use this guide to evaluate, compare and make the decision that fits your comfort zone and goals.

Empowering Victims: Taking a Stand Against Scams with GAINRECOUP.COM

If you have fallen victim to a scam, it is important to understand that you are not alone and you still have options. Scammers exploit the trust of their victims, but organizations like GAINRECOUP.COM work tirelessly to combat these frauds with integrity and expertise.