Summary (2-Minute Read)

EthereumProfit.org presents itself as a fast, easy path to “automated crypto wealth,” often using buzzwords around AI, algorithms, and hands-free trading. While the marketing may look polished, the overall package exhibits multiple high-risk red flags common to deceptive investment websites: unrealistic claims, vague ownership, pushy sign-up funnels, unverifiable “proof,” and unclear fees or terms. In this review, we explain how these tactics typically work, what to look for on the page, how the sign-up flow nudges for deposits, and practical steps you can take to evaluate any platform before engaging. Our aim is to give you a clear, inclusive guide so you can make informed, confident decisions.

What EthereumProfit.org Appears to Promise

Websites like EthereumProfit.org usually promise:

Automated crypto trading using “AI,” “machine learning,” or “quant strategies.”

High daily or weekly returns with minimal risk.

Beginner-friendly onboarding that takes “just a few clicks,” with no prior experience necessary.

Social proof such as testimonials, counters showing “live profits,” and pop-ups claiming recent payouts.

These claims are designed to lower skepticism and create urgency. The more the pitch centers on “easy gains with no expertise,” the more cautious you should be. Legitimate investing always includes risk, and guaranteed returns or “near-zero risk” statements are strong reasons to step back and scrutinize.

Key Red Flags to Watch For

Unrealistic performance promises

Any suggestion of fixed daily returns, guaranteed profits, or risk-free trading is a major red flag. Markets are volatile, and credible providers emphasize risk management rather than certainty.Vague company identity

If the site lacks clear business registration details, a physical address, or named leadership, that opacity makes accountability difficult. Professional financial services list verifiable corporate information.Pressure tactics

Countdown timers, “only X spots left,” or pushy sales messages are engineered to provoke quick deposits. Responsible services allow time to think, compare, and ask questions.Unverifiable testimonials

Stock photos, first-name-only quotes, or “live profit tickers” that can’t be audited are common trust-theater techniques.Opaque fees and terms

If fees, withdrawal conditions, or minimum balances are buried or missing, users may face unexpected costs or hurdles later.Unclear broker relationships

Some funnels route deposits through third-party “brokers” of uncertain standing. If those brokers are not transparent, properly supervised, or clearly identified, risk increases.

How the Funnel Typically Works

Websites like EthereumProfit.org often rely on a multi-step funnel:

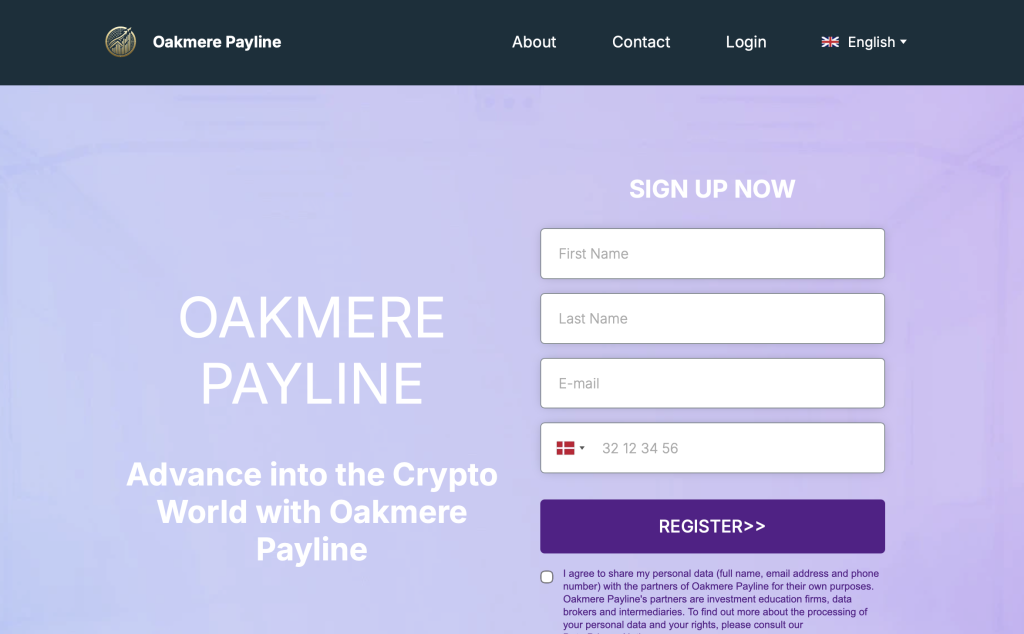

Lead capture: You provide a name, email, and phone number to “activate” your account.

High-pressure outreach: You may receive calls or messages encouraging an immediate deposit to “unlock the algorithm.”

Deposit via third parties: Funds might be directed to external wallets or brokers not clearly explained on the main site.

Dashboard theatrics: After funding, you might see dashboards that show fast “paper gains.” These numbers can be unverified and may not reflect real, withdrawable profit.

Withdrawal friction: When you attempt to withdraw, you could encounter conditions such as minimum trade volumes, unexpected “verification fees,” or new documentation requirements that delay or block access to your balance.

If you encounter moving goalposts when trying to withdraw—new fees, sudden identity checks not disclosed up front, or requests to deposit more before releasing funds—treat those as serious warning signs.

The “AI Crypto Robot” Pitch — Why It’s So Persuasive

The blending of AI and crypto creates a powerful narrative: cutting-edge technology plus a fast-moving market. However:

AI is not magic. Real algorithmic systems have drawdowns and losing periods.

Backtests can mislead. Attractive past results can be cherry-picked or over-fit.

Black-box opacity matters. When a provider won’t explain the method in basic terms (risk controls, position sizing, and when not to trade), that opacity increases risk.

A credible service typically offers transparent methodology at a high level, risk disclaimers, realistic expectations, and verifiable track records audited by independent parties.

Website Footprint Checks You Can Run

You don’t need special tools to perform a quick credibility scan:

About/Legal pages: Look for a full company name, registration number, and a verifiable address.

Terms & Conditions: Check who “the company” actually is, how your data is handled, and whether the operator accepts responsibility for statements on the site.

Contact channels: Is there a real support email, live chat with transcripts, or a non-virtual phone line?

Consistency: Ensure the business name on the homepage matches the one in the footer, privacy policy, and T&Cs.

Domain clues: Newly registered domains or frequently changing domains can be a caution signal, especially for financial services.

If these basics are missing or inconsistent, the platform’s trustworthiness is questionable.

Common Barriers Around Withdrawals

Many high-risk platforms share a similar withdrawal pattern:

Sudden “verification” costs that were not disclosed before depositing.

Arbitrary minimum trade volumes (e.g., “complete X lots before withdrawal”).

Pushbacks to “keep trading” to reach a higher tier that “unlocks” faster withdrawals.

Requests for additional deposits to “validate your account” or “cover tax/fee escrow.”

Legitimate institutions do ask for identity verification to meet compliance obligations, but they do not add surprise fees to “release” your funds. Any demand for extra deposits to withdraw is a classic red flag.

Who Is Most at Risk

High-pressure crypto sites tend to target:

New investors drawn to “beginner-friendly” claims and simple dashboards.

Time-constrained professionals who want a “hands-free” strategy.

Individuals seeking fast solutions after market volatility or personal setbacks.

Everyone deserves tools and information that respect their time and circumstances. If a service leans on urgency, shame, or intimidation, it’s not respecting your needs.

Practical Due Diligence Before You Invest Anywhere

Here are inclusive, simple steps anyone can take:

Pause and compare. Review at least three alternative services and note differences in fees, governance, and transparency.

Search the exact company name. Include “reviews,” “complaints,” and “terms.” Be cautious with affiliate blogs that earn commissions for sign-ups.

Check corporate details. Verify the legal entity, registration number, and address.

Understand the fee model. Ask for a written explanation of ALL fees: deposit, trading, spread, overnight, withdrawal, “account maintenance,” and any “performance” fees.

Ask for risk disclosures. Responsible providers put risk front and center.

Test withdrawals early. If you do proceed, start small and attempt a withdrawal before adding more funds.

Use payment methods with recourse. Methods that provide dispute channels can offer more protection than irreversible transfers.

Document everything. Keep records of emails, chats, dashboard screenshots, and any terms displayed at the time you deposited.

These steps help you stay in control and reduce the power of pressure tactics.

Frequently Asked Questions

Is EthereumProfit.org legit?

This review highlights multiple high-risk indicators commonly associated with deceptive platforms: unrealistic returns, vague corporate identity, and withdrawal friction. Treat it as high risk unless and until you can independently verify corporate credentials, fee structures, and successful withdrawals under normal conditions.

How does a site like this typically work?

It often uses a lead form, pressure outreach, initial deposits through third parties, and dashboards that present attractive but unverifiable “profits.” Barriers may appear when you try to withdraw.

Are profits guaranteed?

No reputable provider guarantees profits. Guaranteed returns or “near-zero risk” language contradicts how real markets function and should be treated as a major warning sign.

Why do I see celebrity photos or big media logos?

Unsourced celebrity endorsements and media badges are common persuasion tools. If the site cannot provide verifiable, authorized references, treat such claims as advertising rather than proof.

What are safer signs to look for in any platform?

Clear company ownership, verifiable registration, detailed risk disclosures, transparent fees, audited performance, and responsive support that answers concrete, technical questions in writing.

Bottom Line

EthereumProfit.org fits the high-risk profile seen across many AI-crypto “get started in minutes” sites. The hallmarks—grand promises, thin disclosures, pressure to deposit, and unclear withdrawal paths—all point to an elevated risk of loss or lock-in. You deserve services that respect your decisions with clarity, accountability, and proof. If a platform cannot meet that standard—by providing verifiable corporate details, audited performance, and straightforward withdrawals—the safest choice is to decline and explore options that do.

Empowering Victims: Taking a Stand Against Scams with GAINRECOUP.COM

If you have fallen victim to a scam, it is important to understand that you are not alone and you still have options. Scammers exploit the trust of their victims, but organizations like GAINRECOUP.COM work tirelessly to combat these frauds with integrity and expertise.