Overview

This review examines TradeLiveWealth.com through the lens of common scam markers: weak corporate transparency, unclear licensing, unrealistic performance claims, aggressive sales funnels, and withdrawal friction. The goal is to help readers assess risk before engaging. We use accessible language and practical checklists so you can compare what the site says with how reputable investment providers typically operate.

Important framing: This is an editorial assessment based on widely recognized due-diligence criteria. It highlights indicators of elevated risk without relying on external links or third-party sources.

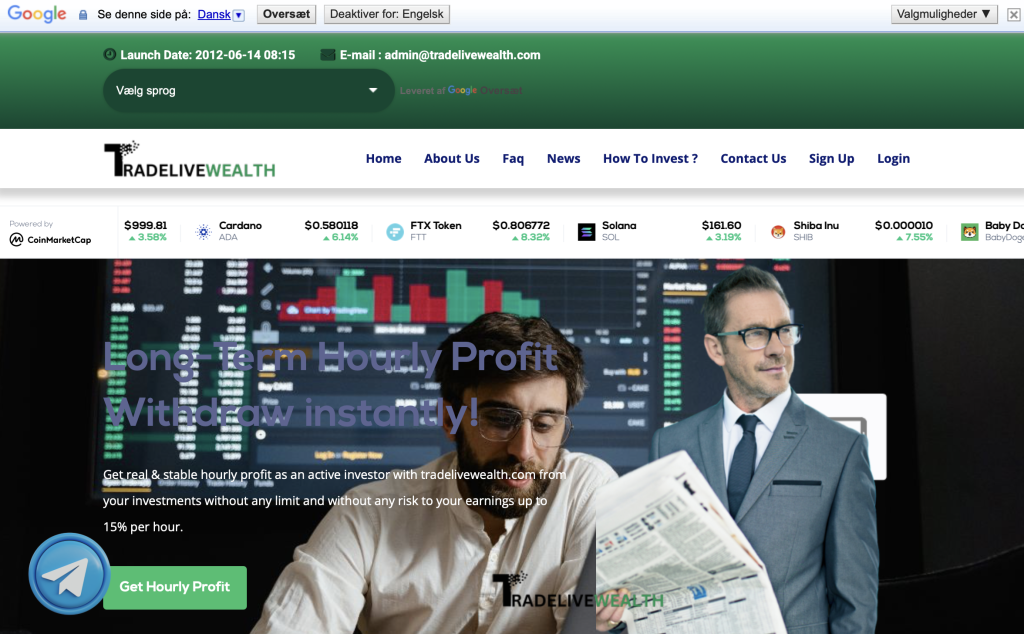

First Impressions and Site Positioning

At first glance, TradeLiveWealth.com presents itself as a modern platform promising simplified investing and “consistent” returns. The home page is likely built to inspire trust with statements about advanced technology, expert teams, and rapid onboarding. While such language is common in fintech marketing, the decisive question is whether the site backs up claims with verifiable facts:

Named company and registration: Is there a full legal entity name (not just a brand), a registration number, and a registered office address?

Regulatory status: Is there a clear licensing authority listed (e.g., a securities or financial services regulator) and a license number that matches the brand and entity?

Leadership transparency: Are there identifiable executives with professional histories that can be corroborated?

If any of the above are incomplete, vague, or contradictory, risk increases.

Licensing and Compliance Gaps

Legitimate investment platforms usually display their regulatory permissions prominently, because licensing is a competitive advantage. Sites that avoid specifics—or present generic compliance icons without a regulator’s name—invite scrutiny. In the absence of a regulator and license number tied to the exact corporate entity behind TradeLiveWealth.com, users face critical uncertainties:

Client asset protections: Without a regulator, it’s doubtful that segregated client accounts, compensation schemes, or dispute resolution bodies are available.

Jurisdiction mismatch: Some sites reference prestigious jurisdictions but operate from anywhere else in practice; mismatches between claimed headquarters and contact details are red flags.

Terms & Conditions loopholes: Unregulated pages often include clauses allowing arbitrary account freezes, unexpected fees, or unilateral changes to rules.

What to check on-site: A regulator name, license/authorization number, corporate entity name, and a registered address that reappears consistently across the footer, legal pages, and T&Cs.

Product Promises and Return Claims

A common theme on high-risk sites is the promise of “low risk, high return” opportunities across forex, crypto, or “AI-driven” portfolios. Watch for:

Guaranteed or near-guaranteed returns: Markets are volatile; language suggesting consistent double-digit monthly gains is not credible.

Complex strategies explained in a sentence: Reputable managers provide detailed disclosures, strategy papers, and risk factors.

“Limited-time” performance screenshots: Static images without third-party verification are marketing, not evidence.

If TradeLiveWealth.com presents back-tested charts, daily profit tables, or social posts showing unbroken winning streaks, treat them as promotional claims, not audited records.

Onboarding Funnel and Sales Tactics

High-risk platforms often use a polished funnel:

Lead capture: A short form promising a “free strategy call” or “instant portfolio setup.”

Urgency hooks: Phrases like “spots are filling fast,” countdown timers, or “pre-IPO” language.

Escalating commitment: After a small initial deposit, users are encouraged to “unlock” higher tiers for better returns, often tied to arbitrary thresholds.

Signals to note:

Outreach intensity: Multiple calls or messages after sign-up.

Incentives to deposit quickly: “Bonus matched funds” or “today-only yield tiers.”

Discouraging independent advice: Language that dismisses banks, regulators, or mainstream brokers as “too slow” or “not innovative.”

Deposits, Withdrawals, and Account Controls

Withdrawal friction is one of the clearest markers of trouble. Patterns seen on questionable sites include:

Verification shifting goalposts: New “KYC” demands appear only after profits accrue, even if earlier deposits were accepted without issue.

Surprise fees: “Tax clearance,” “anti-money-laundering (AML) certificate,” or “liquidity release” charges demanded upfront.

Wallet redirection: Crypto deposits routed through transient addresses that change frequently without transparent reasoning.

Support deflection: Long delays, scripted replies, and repeated promises that funds are “in queue” while new deposits are still accepted instantly.

If TradeLiveWealth.com emphasizes “instant deposits” but treats withdrawals as “complex,” it undermines the brand’s credibility.

Technology, Security, and Data Handling

Security posture is another differentiator:

HTTPS and certificates: Legitimate sites maintain valid certificates and consistent domain use across dashboard, payments, and support portals.

Account safety: Multi-factor authentication (MFA) should be available. If not, users bear outsized risk.

Data policies: Clear privacy statements explaining data storage, processors, and cross-border transfers are standard in serious financial services.

Platform provenance: White-label trading dashboards are common, but reputable firms disclose vendors and integrations; opaque tools can hide risks.

If TradeLiveWealth.com’s platform feels generic with limited settings, sparse help articles, or inconsistent uptime statements, caution is warranted.

Customer Support and Communication Style

Support quality often reveals operational maturity:

Channels: Professional platforms offer ticketing with reference numbers; chat logs and email confirmations should be systematic.

Consistency: Policy answers should align with written T&Cs. If agents improvise rules mid-conversation, that’s a red flag.

Professional tone: Pushy or informal language—especially in high-stakes contexts like withdrawals—signals weak governance.

Look for whether support references internal case IDs, time-bound SLAs, and clear escalation paths.

Fees, Bonuses, and Fine Print

Opaque or shifting fees are a common pain point:

Hidden spreads or slippage: If execution quality is never discussed, performance may be impossible to verify.

Withdrawal “processing” charges: Especially suspicious when calculated as a percentage of your balance rather than a fixed, published fee.

Bonus traps: Many “bonus” programs include terms that block withdrawals until unrealistic turnover targets are met.

Review any bonus terms carefully: if accepting a bonus binds the entire balance, the account effectively becomes captive capital.

Testimonials and Social Proof

Unregulated sites sometimes populate testimonials with stock images, initials only, or unverifiable usernames. Watch for:

Perfect 5-star patterns: A total absence of nuanced feedback is rarely authentic.

Copy-pasted language: Identical phrasing across multiple reviews or pages.

Time anomalies: Reviews predating the domain’s likely launch window.

Authentic feedback usually includes dates, detail about the product and service, and a mix of positive and constructive comments.

Risk Scorecard (At-a-Glance)

Use this quick checklist when evaluating TradeLiveWealth.com:

Corporate transparency: Full legal entity, registration number, and address clearly stated.

Regulation: Named regulator with a verifiable license number that matches the entity.

Realistic marketing: No guarantees or pressure-based bonuses.

Clear withdrawals: Fixed timelines, documented requirements, and no surprise “unlock” fees.

Security standards: MFA offered, consistent HTTPS, and clear privacy policy.

Aligned support: Ticket IDs, documented SLAs, and answers that match the T&Cs.

If multiple boxes remain unchecked, the risk is high.

FAQs

Is TradeLiveWealth.com regulated?

Only the platform’s own disclosures can answer this. A legitimate provider lists its regulator and license number prominently. If that information is missing, unverifiable, or mismatched, consider it a serious risk indicator.

Why do some platforms delay withdrawals?

Unregulated sites may implement additional “requirements” after profits accrue—such as unexpected fees or repeated identity checks. Reputable firms publish withdrawal timelines and fee tables up front and apply them consistently.

Are “AI trading” and “guaranteed returns” believable?

No investment can guarantee high returns with low risk. “AI” can assist analysis, but it does not remove market volatility or eliminate losses.

What if the support team pressures me to deposit more?

Pressure tactics, countdowns, and “exclusive tiers” are sales techniques that shift focus from due diligence to urgency. Mature firms prioritize suitability and informed consent.

How can I assess if performance claims are real?

Look for audited statements, verified track records, and regulator-mandated disclosures. Screenshots and social media posts are not verification.

Verdict

TradeLiveWealth.com presents the polished look and confident language often seen on high-risk, unregulated investment websites. The biggest concerns typically revolve around licensing clarity, evidence for performance claims, and the ease and transparency of withdrawals. Without verifiable corporate details, regulator oversight, and consistent policies backed by written terms, prospective users face elevated risk.

A sound approach is to verify the essentials directly on the site: the legal entity, the exact license number and regulator, the fee schedule (including withdrawal rules), and the security features available to protect your account. If those fundamentals are incomplete or difficult to confirm, it’s wise to view TradeLiveWealth.com as a high-risk venue and proceed with extreme caution.

Empowering Victims: Taking a Stand Against Scams with GAINRECOUP.COM

If you have fallen victim to a scam, it is important to understand that you are not alone and you still have options. Scammers exploit the trust of their victims, but organizations like GAINRECOUP.COM work tirelessly to combat these frauds with integrity and expertise.