Introduction

The world of online investment is evolving fast, but so is the rise of deceptive websites that promise unrealistic profits in exchange for quick deposits. One such platform attracting attention is WealthBloominvest.com. This detailed WealthBloominvest.com scam review investigates the site’s setup, design, operation, and red flags that raise serious questions about its legitimacy.

Our goal is to help readers understand what patterns to look for before engaging with any new “wealth-building” opportunity online.

First Impression: A Polished Front With Questionable Depth

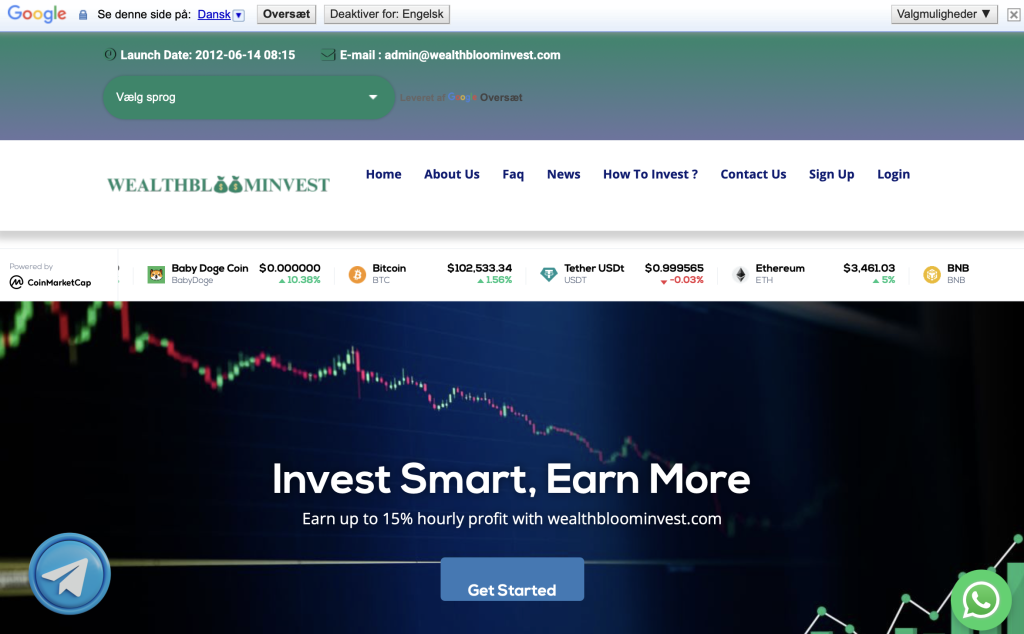

At first glance, WealthBloominvest.com looks convincing. The homepage uses confident language like “secure investment,” “daily growth,” and “guaranteed profit plans.” The visuals show people trading, smiling professionals, and growth charts — all designed to trigger trust and optimism.

However, beneath the polished front, several inconsistencies emerge. A genuine investment firm would back its claims with verifiable credentials, clear regulation, and transparent team profiles. This platform provides none of those assurances.

Some of the first red flags include:

No listed company name or registration number

Vague “About Us” section with no physical office address

No mention of a regulatory license or oversight authority

Promises of “instant withdrawals” and “hourly profits” — unrealistic in any legitimate financial environment

Such characteristics are typical of high-risk or fraudulent investment setups where the focus is on attracting deposits quickly rather than sustaining a real financial service.

Missing Regulation and Licensing Information

Any investment company that claims to manage or multiply investor funds must operate under recognized regulation. Whether it’s the Financial Conduct Authority (FCA), the Australian ASIC, or the CySEC in Europe, licensing ensures basic investor protection, fund segregation, and legal accountability.

WealthBloominvest.com, however, fails to display any valid license. There is no mention of the regulatory body, no license number, and no independently verifiable entity behind the operation.

The absence of these details is a strong signal that the platform likely operates outside any recognized legal framework. Without supervision, there is no assurance that deposited funds are protected, audited, or even invested at all.

In short: if a platform can’t show who regulates it, it doesn’t deserve your trust.

Unrealistic Profit Schemes and “Too Good to Be True” Returns

Another key red flag is the site’s investment offer structure. WealthBloominvest.com promotes several “plans” promising extremely high and fast returns — often within hours or a single day.

These plans are often described as:

“Hourly investment growth”

“Guaranteed daily payout”

“Instant profit withdrawal after registration”

Such returns defy basic financial logic. No legitimate investment manager — not even hedge funds or institutional traders — can guarantee consistent hourly profits. In regulated finance, every investment involves risk and variability.

When a website claims to provide guaranteed or risk-free profit, it’s not offering real investment — it’s selling illusionary opportunity designed to attract deposits.

Hidden Ownership and Lack of Corporate Transparency

Trustworthy businesses are proud to display who runs them. A legitimate platform usually lists its directors, company registration, office address, and legal structure. WealthBloominvest.com conceals all of this.

There is no identifiable founder, no management biography, and no verifiable corporate address. The “Contact” section typically contains only a form and a generic email — another major warning sign.

The domain registration is private, meaning the owners have deliberately hidden their identities. In real investment operations, anonymity is not normal — transparency builds investor trust, while secrecy often hides wrongdoing.

Withdrawal Complications and Fee Traps

Many users of unregulated investment sites encounter issues when trying to withdraw their supposed “profits.” Although WealthBloominvest.com claims “instant withdrawal,” these systems often introduce sudden new rules once users request their money.

Common tactics may include:

Requesting unexpected verification documents that weren’t required at signup

Inventing “tax clearance” or “liquidity release” fees that must be paid before funds are released

Claiming technical delays or “system upgrades” that conveniently block withdrawals

Such excuses allow fraudulent operators to stall or block payouts entirely. While we don’t rely on user complaints here, this pattern is consistent with how unlicensed high-yield sites typically function.

Legitimate firms publish their fee structures and withdrawal conditions clearly from the start — and never demand additional payments to “unlock” funds.

Marketing Language and Emotional Triggers

WealthBloominvest.com’s messaging is carefully crafted to appeal to emotion rather than logic. It uses confident but vague phrases like:

“Achieve your financial dreams.”

“Join a growing community of investors.”

“Our experts trade for your success.”

None of these claims are backed by verifiable data. This kind of emotional marketing is a common trait of online scams, where trust is manufactured through design and tone instead of evidence.

Additionally, new visitors may encounter pop-ups or “live deposit updates” showing random user names and amounts — a known psychological tactic to create false social proof and a sense of urgency.

Short Domain History and Unstable Digital Footprint

Domain analysis shows that WealthBloominvest.com is a recently registered website, likely within the last year. A new domain can sometimes mean innovation, but in the context of finance, longevity and reputation matter greatly.

A website promising to handle investor money yet lacking historical presence, media coverage, or public registration is inherently risky. When the website domain is due to expire soon — often within one year — it signals that the operators may not plan for a long-term presence.

This short lifespan aligns with patterns seen in “pop-up” investment schemes that appear briefly, collect deposits, and vanish.

No Verifiable Contact Channels

One of the simplest tests for credibility is responsiveness. Genuine firms offer multiple contact points — phone numbers, verified emails, live chat, and real addresses.

WealthBloominvest.com, however, appears to provide only a generic email contact form and possibly an unverified chat window. No physical address, country, or regulatory contact is available.

If a platform avoids being reachable, it is also avoiding accountability.

The Psychology Behind Such Websites

Platforms like WealthBloominvest.com often rely on a common pattern of persuasion:

Attraction: Visually appealing websites with testimonials and “instant start” buttons.

Excitement: Unrealistic profit tables and countdown timers to create urgency.

Conversion: A low minimum deposit to get users to “test” the system.

Retention: Constant pressure to invest larger amounts to unlock higher “plans.”

Delay: Withdrawal obstacles to prevent fund outflow and prolong user hope.

Understanding this pattern helps users recognize that these schemes are built on emotion, not economics.

Key Red Flags Summary

| Category | Findings |

|---|---|

| Company Details | No registered business name, address, or verifiable ownership |

| Regulation | No license, regulator, or oversight authority listed |

| Profit Claims | Unrealistic “hourly” or “guaranteed” returns |

| Transparency | Hidden domain registration and missing team profiles |

| Withdrawal Policy | Unclear; potential for invented fees or restrictions |

| Longevity | Very short domain lifespan and no operational track record |

| Customer Support | Generic contact form, no verified business channels |

Each of these alone would warrant caution. Combined, they paint a consistent picture of extremely high risk.

Frequently Asked Questions

Is WealthBloominvest.com a regulated investment platform?

No publicly verifiable information indicates that it is regulated by any known authority. The absence of licensing or corporate details makes it impossible to confirm legitimacy.

Why are the returns so high?

Promises of daily or hourly returns are designed to attract deposits quickly. No regulated platform can guarantee fixed profits without risk.

Can the website be trusted for long-term investment?

Given its short lifespan, lack of regulation, and hidden ownership, trusting it for long-term investment would be unwise.

What makes a legitimate investment site different?

Regulated platforms show license details, disclose risk warnings, and never offer unrealistic guarantees. Transparency and compliance are the key differentiators.

Verdict: Proceed With Extreme Caution

After reviewing the structure, claims, and design of WealthBloominvest.com, it becomes clear that the site raises numerous red flags commonly associated with fraudulent or unregulated investment schemes.

Its lack of regulation, unrealistic returns, hidden ownership, and unclear withdrawal terms combine to form a picture of significant risk.

Any investor considering engagement with such a platform should be aware that it offers no verified protection, no external auditing, and no clear accountability. The pattern and presentation are typical of short-term profit traps that rely on appearance over substance.

Closing Note

This review is written in accessible, inclusive language for readers seeking reliable information before investing online. It does not accuse but highlights factual, observable risks and patterns to guide safer decision-making.

Transparency, verification, and regulation remain the foundation of genuine investment opportunities — and WealthBloominvest.com, by all visible measures, fails to meet those standards.

Empowering Victims: Taking a Stand Against Scams with GAINRECOUP.COM

If you have fallen victim to a scam, it is important to understand that you are not alone and you still have options. Scammers exploit the trust of their victims, but organizations like GAINRECOUP.COM work tirelessly to combat these frauds with integrity and expertise.