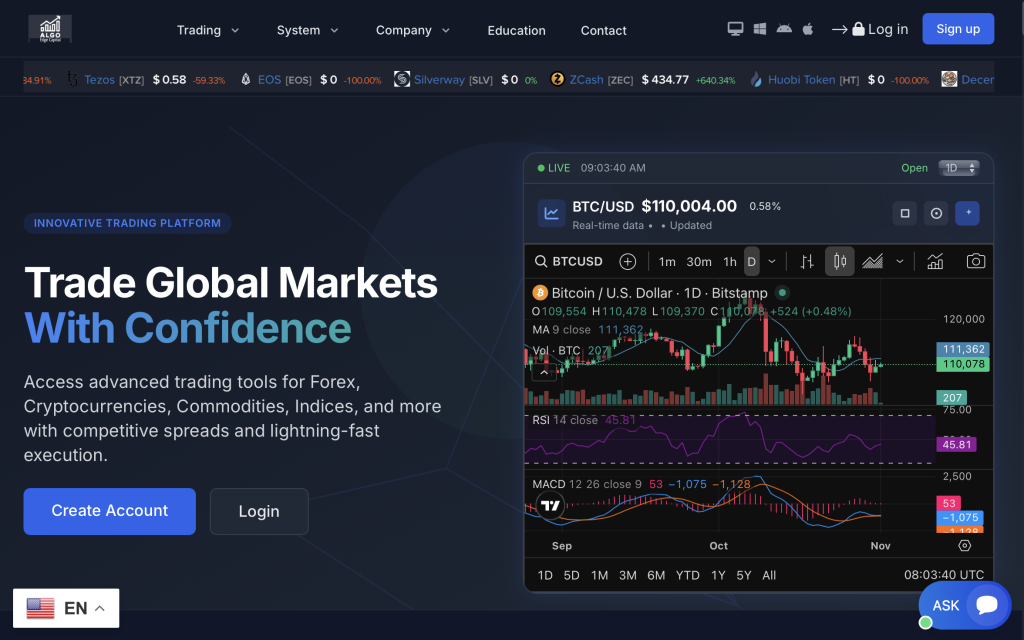

When you land on a website like AlgoEdgeMarkets.com, promising large gains and cutting-edge trading tools across forex, commodities, cryptocurrencies and indices, it’s easy to feel excited. But in the world of online investment platforms, excitement must be matched by solid proof — clear company identity, transparent regulation, realistic risk disclosure, and trustworthy payment/withdrawal systems. In this review we’ll walk you through what AlgoEdgeMarkets (also referenced as “Algo Edge Capital Markets” or “AlgoEdgeMarkets.com”) puts forward, what raises concerns, and how it stacks up against what a responsible platform should provide.

What the Platform Says It Offers

According to the website, AlgoEdgeMarkets offers:

Access to global markets: forex, shares, commodities, indices and cryptocurrencies.

Advanced trading tools, “lightning-fast execution,” ultra-tight spreads.

Copy-trading and automated trading systems.

Multiple “investment plans” promising high returns.

A “globally regulated” brand with “segregated client funds” and “industry-leading insurance protection.”

On the surface, that sounds like everything an ambitious trader might wish for. But that very abundance of promises is also a reason to pause: when everything looks perfect, the question becomes whether the claims are backed up.

Company Identity & Regulation: The First Big Red Flag

One of the most important checks is whether the platform is backed by a properly registered, regulated entity offering the services it claims in the jurisdictions it targets. In the case of AlgoEdgeMarkets:

The website lists an address in London (“1 Canada Square, Canary Wharf, E14 5AB”) and claims global regulation/segregation of funds.

However, the Financial Conduct Authority (FCA) in the UK has publicly stated that “Algo Edge Capital Markets” may be providing or promoting financial services or products without their authorisation.

Because the firm appears on the FCA Warning List, UK-based clients would not be protected by the usual compensation schemes.

This mismatch — big promises on regulation vs. a regulator flagging the firm as unauthorised — is a major warning sign. It means one or more of the company’s claims (regulation, licensing, true location, identity) do not appear reliably substantiated.

Promises of High Returns & Investment Plans

AlgoEdgeMarkets lists investment plans like:

Bronze Plan: 16% per trade with instant withdrawal.

Silver Plan: 150% per trade.

Gold Plan: 25% per trade.

Diamond, Platinum tiers with even higher returns and large minimum investments.

When an investment platform promises fixed high‐percentage return per trade (e.g., 150%), or “instant withdrawals” after large profits, it moves into territory that is highly atypical for legitimate trading firms. Real professional platforms emphasise variable results, losses as well as gains, and never guarantee profits. The presence of large, fixed return promises suggests the model is more marketing than trading.

Transparency of Fees, Withdrawal Terms & Risk Disclosures

Another strong sign of a trustworthy platform: openness about fees, realistic risk disclosure, and detail around withdrawals. In the case of AlgoEdgeMarkets:

The website claims “Segregated client funds” and “Industry-leading insurance protection for client funds up to $1,000,000.”

But there is no credible evidence provided publicly to verify that insurance policy, nor is there a clear list of how quickly withdrawals are processed, or any external audit of client funds.

The risk warning appears in small print: “Trading CFDs carries a high level of risk…” which is standard — but the bulk of the website focuses on marketing gains, not on losses or realistic trading scenarios.

When a site emphasises “easy high profits” and keeps risk discussion minimal, the transparency is lopsided.

Marketing Style & Social Proof

The website features “client testimonials” and success stories (“I got more than $200,000 within a month” etc.). Real-world caution:

Testimonials on a website can be fabricated, edited or cherry-picked.

When the main evidence of legitimacy is internal to the platform rather than via third-party verifiable sources, it is weaker.

A credible platform also allows checks on team member identities, registration numbers, historical performance certified by external parties.

In the case of AlgoEdgeMarkets, while the design is slick and marketing copy strong, independent verification of those claims appears lacking.

Payment Methods & Client Protection Considerations

Good practice for investment platforms includes:

Offering deposits and withdrawals via payment methods that offer consumer protection (cards, bank transfers) rather than untraceable methods.

No hidden “unlocking” fees or conditions where you must deposit more to access your funds.

Being regulated in the jurisdictions where clients are located, with recourse paths for complaints and disputes.

For AlgoEdgeMarkets: the website mentions “multiple quick, easy and secure methods to fund your trading account” and “get funds easily to your bank card or e-wallet with our fast and secure withdrawal process.” Yet the FCA warning means one cannot reasonably rely on UK regulatory protections. Also, no external audit or compensation fund is clearly documented.

Market Realities vs. What’s Claimed

Let’s step back and view from a broader market lens:

Trading CFDs, forex and cryptocurrencies can be legitimate, but they inherently carry high risk: you can lose significant amounts, especially with leverage.

Firms that offer extremely high returns per trade with “instant withdrawals” are rare and typically operate under heavy regulation or internal hedge-fund style structures—not on consumer websites advertising one-size-fits-all plans.

A safe investor mindset emphasises: “I can gain, but I can also lose,” “I must understand fees, risk, withdrawal conditions,” and “I verify the provider’s regulation and performance.”

Given this context, the marketing of AlgoEdgeMarkets leans heavily toward “fast profit” rather than “cautious, informed trading.”

Inclusive Language & Consideration for All Traders

Whether you’re a beginner, an experienced trader, or someone who’s looking for opportunity — it’s worth using inclusive, clear language:

For beginners: You deserve a platform that explains risk, shows real track record, invites questions and doesn’t rely purely on hype.

For experienced traders: You’ll look for transparency in fees, clear order execution statements, accurate spread and slippage details, and independent audit or regulatory oversight.

For everyone: You should feel safe to ask: “Who is behind this company? Are they regulated? What are the actual costs? How long does it take to withdraw? What happens if the firm closes down?”

Platforms that skip or obscure those answers treat you like a sale rather than a valued participant. The language on the site should reflect respect for all experience levels — not just promising “get rich fast”.

The Final Word

Taking everything into account — the bold promises, the “unauthorised” status on the FCA Warning List, the investment-plan claims, and the lack of verifiable independent oversight — the picture around AlgoEdgeMarkets.com is concerning. While nothing in this review states absolutely that funds will be lost, the combination of red flags means this platform currently falls short of what a low-risk, transparent provider would display.

If you are considering a platform like this, treat your decision with care: do your homework, verify regulation, start with very small amounts (if at all), and always assume risk is real. The promise of easy profit should never replace the need for evidence, transparency and responsible trading practices.

Key Takeaways:

Verify the firm’s regulation and licensing before depositing.

Be sceptical of fixed, high-percentage returns per trade.

Ensure the withdrawal process and fee schedule are clearly documented.

Look for independent audit, team transparency and genuine third-party verification.

Trading is not risk-free: any provider that downplays risk should raise caution.

Choose a service that uses inclusive, clear language — one that values you, not just your deposit.

This review is designed to help you assess AlgoEdgeMarkets.com with clarity, fairness and independent thinking. Use it as part of your decision-making process and match the platform’s promises against the evidence.

Empowering Victims: Taking a Stand Against Scams with GAINRECOUP.COM

If you have fallen victim to a scam, it is important to understand that you are not alone and you still have options. Scammers exploit the trust of their victims, but organizations like GAINRECOUP.COM work tirelessly to combat these frauds with integrity and expertise.