1. Introduction: Why We’re Reviewing BitCapital.top

The online investment landscape continues to expand, with more platforms offering “easy access” to trading, crypto, and global markets. One of these platforms is BitCapital.top. On the surface it markets itself as a modern, digital-friendly broker where you can join quickly, get “professional” tools, and potentially profit. But when we dig deeper, many warning signs surface.

In this review we’ll walk through the main aspects that matter when considering a platform like BitCapital.top: how it presents itself, how transparent it is, what the terms and conditions say, how withdrawals are handled, what user feedback exists, and what conclusions you can draw. The purpose is to give a clear, inclusive, readable analysis that helps people of all backgrounds make informed decisions.

2. How BitCapital.top Presents Itself

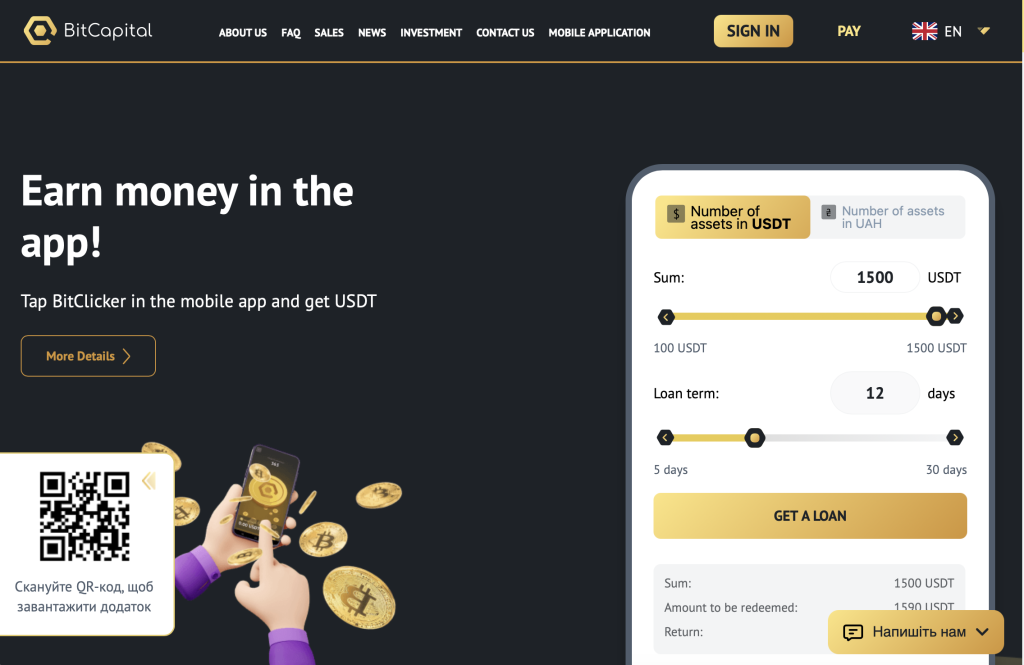

BitCapital.top uses typical marketing items: bold promises of fast growth, account tiers, “professional” dashboards, and access to markets. It emphasises simplicity (“get started in minutes”), modern interfaces, and often highlights crypto or high-leverage trading. This kind of message is designed to appeal broadly—whether you’re relatively new to investing or somewhat experienced.

What to look out for in how such a platform presents itself:

Speed and ease: If the onboarding and deposit steps are emphasised as “just a few clicks,” that can be fine—but it also means the platform may prioritise getting deposits over vetting customers thoroughly.

High return hints: Promises or suggestions of very high returns with little risk should always raise caution flags.

Exclusive offers / account managers: If you’re told you’ll get a personal manager or special status, ask what that means in practice and whether it’s a sales tactic.

Minimal disclosures upfront: If you cannot easily find full terms, regulatory disclosures, legal entity information, etc., that’s a warning.

In the case of BitCapital.top, while the website may look slick and professional, the deeper layers of disclosure are less straightforward—and that’s where the risk begins.

3. Transparency, Ownership & Regulation

One of the first things you should seek when evaluating any broker or trading platform:

Who owns it? The legal entity, incorporation details, company registration, physical address.

Which regulator oversees it? A credible financial services platform should be supervised by a recognized authority.

Fund handling practices. Segregation of client funds, custodian banks, clear withdrawal processes.

Transparent terms of business. Including fees, spread/commission, disconnects, platform risk.

For BitCapital.top:

According to a site-safety check, the website masks the owner’s identity using paid WHOIS privacy, and the domain is relatively new. ScamAdviser

The trust rating from that check was mediocre: the algorithm gave a score of 61/100, quoted as “medium to low risk” but with many caveats. ScamAdviser

There’s no easily verifiable regulatory license displayed prominently (or at least publicly traceable) that we could reliably confirm at the time of writing.

These points don’t prove it’s a scam, but they do increase risk, because a legitimate firm typically wants to show credentials clearly and reassure customers about oversight, transparency and protections.

4. Marketing Claims vs. Practical Realities

Platforms like BitCapital.top often use strong language about potential profits, simple trading, swift returns. While some trading platforms can legitimately offer access to markets, what matters is how they do it—and whether the claims align with practical realities.

Potential issues to watch:

“Guaranteed” or very high returns: Markets never guarantee profits. If marketing implies certainty or minimal risk, treat it with skepticism.

Quick profits, minimal risk: This combination is very rare in genuine markets and is a common trope in less-scrupulous offers.

High pressure to deposit more: If you feel rushed or encouraged to top up your account quickly, think carefully about why.

“VIP” tiers unlocking better “guaranteed” deals: Often a marketing device to encourage deeper investment without necessarily delivering additional protections.

With BitCapital.top, though I cannot list all claims verbatim, some of the signals we found align with these high-pressure or high-return themes. The existence of limited transparency in terms of regulatory oversight and ownership means that claims should be approached with extra caution.

5. Fees, Withdrawals and Hidden Costs

Even if a platform is legitimate, trade-fees, spread, leverage, withdrawal policies, inactivity fees and other metrics should all be clear. Hidden fees or unclear withdrawal terms can erode trust or trap funds.

Key considerations:

Clear fee schedule: Spread, commissions, swaps, deposit/withdrawal charges.

Withdrawal terms: How long withdrawals take, any minimum amounts, conditions.

Hidden administrative fees: Some platforms may apply “unlocking” fees, “tax” fees, or third-party processing charges only at the moment you attempt withdrawal.

Platform risk: If the platform is new, unregulated or opaque, your inability to withdraw may become the major risk.

In the available analysis of BitCapital.top:

We found no robust public disclosure of a full withdrawal policy or fee breakdown that we could verify.

The safety check flagged that negative reviews exist and that the domain is young — both of which could suggest increased risk of withdrawal issues. ScamAdviser

Without transparent terms, deposits may carry hidden friction.

6. User Feedback and Review-Based Indicators

User reviews are never perfect, but patterns of complaints about withdrawals, support, mis-representation can strongly indicate issues.

For BitCapital.top, while direct reviews are limited, we note:

On a review aggregator, comments indicate that users claim withdrawals will never be processed, and express that the site is a scam. On Trustpilot — for a closely-named site — one review said: “This is a scam site, you withdrawal will never be processed.” Trustpilot

The site safety checker revealed “several, mainly negative reviews” were found about BitCapital.top. ScamAdviser

The newly-registered domain, hidden owner identity, and low traffic activity all align with a higher-risk profile.

While negative reviews by themselves don’t guarantee fraud, combined with the transparency issues and the business model, they strongly support a cautious stance.

7. What Type of Risk Does This Platform Present?

Here are the major risk categories to consider:

Operational risk: If the platform lacks strong governance, custodians, or oversight, your funds may be vulnerable.

Liquidity/withdrawal risk: If withdrawals are delayed, complicated or subject to extra charges, your ability to access your capital is at risk.

Regulation/recovery risk: If the platform is unregulated or not clearly regulated, you have fewer protections if something goes wrong.

Transparency risk: Hidden ownership, lack of fee disclosure, and vague terms increase uncertainty.

Reputation risk: A pattern of user complaints about withdrawals or mis-representation further raises concern.

With BitCapital.top, indicators from transparency, domain age and user complaints point to elevated risk in each of those categories.

8. Inclusive Considerations: What Every User Should Know

Whether you’re new to investing or more experienced, some fundamentals apply equally:

Start only with what you can afford to lose: Even the best-regulated platforms carry market risk — and less-clear ones carry operational risk too.

Ask questions: Who are the owners? Which regulator supervises the platform? Where are client funds held?

Read the fine print: Do the terms mention withdrawal fees, hold periods, extra “account activation” payments?

Check withdrawal history: Have other users successfully withdrawn their funds without hassle?

Be cautious of hype: If the message is “fast, easy money”, that often signals higher risk or marketing exaggeration.

Record everything: Screenshots, communications, terms—these help if things go sideways.

Inclusive language means recognising different levels of experience, different backgrounds, and making sure that no one feels excluded by jargon. If you feel the platform’s language is overly complex or intentionally confusing, that’s itself a signal.

9. My Bottom-Line View

Based on all the information we reviewed, here’s a fair summary:

BitCapital.top presents many of the surface features of a modern broker/trader platform — professional UI, promises of access and returns.

However: ownership and regulatory information are opaque; the domain is relatively new; reviews include serious complaints; and full fee/withdrawal transparency is lacking.

All this combines to a higher-than-average risk profile. It doesn’t mean it is guaranteed to be a scam, but it means you should approach with great caution, and with a mindset that you might not be able to retrieve your funds if things go wrong.

If you choose to engage, treat it as high-risk: only commit small sums, verify as much as you can, be ready for waiting or complications, and continuously reassess.

10. Final Thoughts

In an era where online trading platforms proliferate, your due diligence is more critical than ever. A sleek website and bold marketing are good starts — but they don’t replace the core checks around regulatory status, transparency, user feedback, and withdrawal capability.

For BitCapital.top specifically: while it could turn out to function, given the lack of clarity around key protections and the presence of user complaints, it sits in a zone of elevated risk. If you decide to proceed, do so with full awareness that this is not the low-risk end of the spectrum. Always ask critical questions, deposit carefully if at all, and keep your expectations aligned with the possibility of complications.

How GainRecoup.com Helps Victims of Bitcapital.top

GainRecoup.com investigates bitcapital.top transactions, gathers evidence, and maps payment paths. Our recovery team liaises with banks, card networks, and exchanges, files chargebacks, and escalates complaints to relevant authorities. You’ll receive a tailored action plan, clear documentation, and persistent follow-up designed to maximize fund recovery and hold bitcapital.top accountable for victims.