Overview

Bitcoins-union.com presents itself as a streamlined path into crypto trading. The site’s pitch is simple and persuasive: sign up quickly, deposit a small amount, and let advanced technology—often described as “AI” or “automation”—do the heavy lifting to generate consistent gains. For anyone curious about digital assets, that message is enticing.

Yet beneath the polished tone and sleek visuals, the website raises multiple red flags common to high-risk platforms. This detailed review breaks down the structure, the claims, and the user experience cues that deserve close attention. The goal is to empower readers of all experience levels to recognize signs of risk and make thoughtful, informed decisions.

What Bitcoins-union.com Promises

Across the site’s copy and visual cues, several consistent claims appear:

Automated or AI-driven trading that “finds opportunities” for you.

High success rates or “market-leading accuracy,” presented without relevant context.

Beginner-friendly onboarding that requires no prior knowledge.

Low barrier to entry—a small initial deposit framed as “starting capital.”

On their own, these ideas are not impossible. However, the question is whether the platform provides credible, verifiable evidence to support them. In most public materials associated with Bitcoins-union.com, the proof is thin. Marketing headlines do a lot of work, while transparent details are scarce.

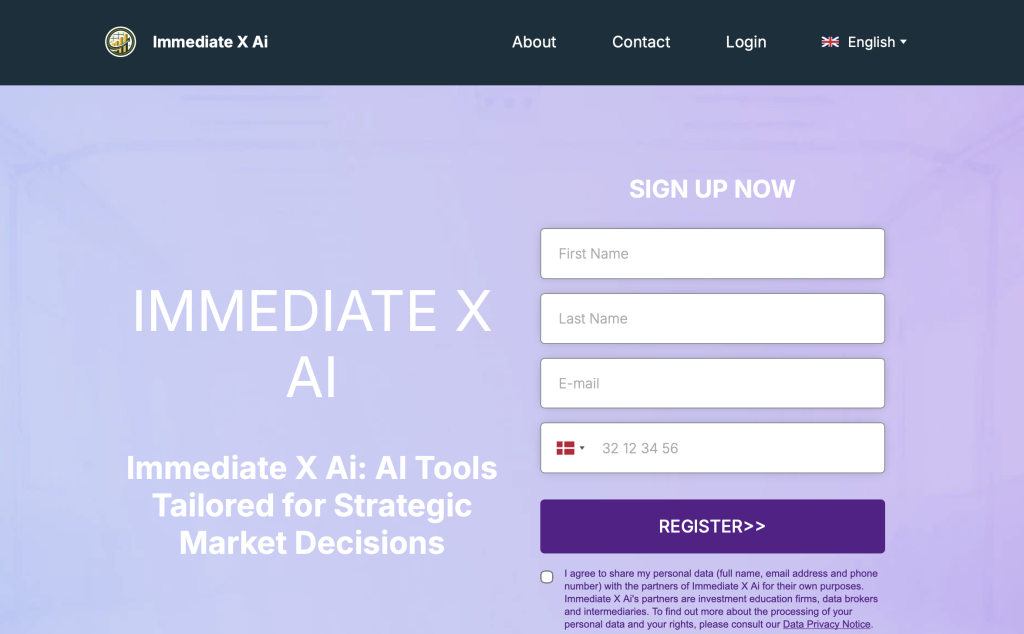

The Onboarding Funnel: Fast Registration, Early Deposit

A key pattern stands out in the user journey:

Immediate lead capture: The homepage prominently asks for name, email, and phone number very early.

Urgency cues: Language suggests limited availability or time-sensitive access to encourage quick decisions.

Deposit prompt: Soon after providing contact details, users are pushed to make an initial deposit to “activate” an account or “unlock” features.

Possible third-party handoff: The flow may introduce a “partner broker” or “account manager,” creating additional layers between the user and their money.

Thoughtful, user-centric platforms typically allow you to explore features first—via a demo or transparent documentation—before requesting funds. When deposits come first and clarity comes later, risk increases because you have less chance to evaluate what you’re actually getting.

The “AI Trading” Narrative

“AI” can be a meaningful capability in quantitative markets, but it’s also a powerful buzzword. With Bitcoins-union.com, the AI storyline is presented broadly, with limited technical substance. Important details that are not clearly explained include:

Data sources and strategy: What markets, instruments, or on-chain signals inform decisions? Are strategies momentum-based, mean-reverting, market-making, or arbitrage-driven?

Risk management controls: How are trade sizes, stop-losses, or drawdown limits handled? What safeguards exist for volatile periods?

Performance transparency: Is there a time-stamped record or independently verifiable track record? Are results audited or verified externally?

Without at least a high-level discussion of methodology and verifiable outcomes, “AI” functions more like a label than a proven capability. Experienced readers will want to see the controls around risk as much as the claims about returns.

Ownership, Licensing, and Accountability

Whenever a site is asking for deposits or implying order execution, you should be able to locate:

Clear ownership details: The legal entity, jurisdiction, and real-world points of contact.

Regulatory status: Whether the platform or its partners are licensed where they accept clients.

Complete disclosures: Terms of service, fees/commissions, withdrawal policies, and risk statements that are specific and easy to find.

When these essentials are vague, incomplete, or buried, it becomes difficult to understand who is accountable or what rules they operate under. This lack of clarity does not automatically prove wrongdoing, but it significantly elevates the risk profile.

Testimonials, Badges, and Visual Credibility

Many high-risk sites use persuasive visual elements to create quick trust:

Generic testimonials with first names and stock-style photos.

“As seen on”-type logos and media badges that imply endorsement without verifiable backing.

Sliders, counters, and countdowns that suggest urgency or social proof.

These components are marketing tools, not proof. If they appear alongside deposit-first funnels and a thin technical story, readers should treat them as presentation rather than validation.

Deposits vs. Withdrawals: The Asymmetry

A common pain point reported across similar platforms is a mismatch between deposit ease and withdrawal friction:

Deposits tend to be smooth and immediate.

Withdrawals may introduce unexpected steps, additional “verification,” or vague processing timeframes.

Upsell moments can appear just when you try to access funds (“upgrade to unlock,” “cover fees first”).

Trustworthy platforms tend to show symmetry: the same clarity and speed for withdrawals as for deposits, with unambiguous timelines and requirements. If a site emphasizes how easy it is to put money in but makes it difficult to take money out, that imbalance is itself a warning sign.

Transparency of Terms and Policies

Clear, specific policies are fundamental. Readers should be able to find and understand:

Fees and spreads: What costs apply to deposits, trades, and withdrawals?

Withdrawal rules: Timelines, thresholds, and identity requirements in plain language.

Risk disclosures: Context about market volatility, leverage (if any), and drawdown risk.

Privacy practices: How personal data and documents are collected, stored, and shared.

When terms are generic, contradictory, or incomplete, users are left guessing. Ambiguity at the policy level often correlates with friction at the account level.

Familiar Patterns Among High-Risk Sites

Bitcoins-union.com shares features seen across a cluster of high-risk websites:

Recycled layouts and copy: Similar hero sections, claims, and testimonials, with only brand names changed.

Rapid marketing cycles: Heavy emphasis on lead capture, quick deposits, and urgency triggers.

Opaque partner structure: References to “brokers” or “specialists” without clear identification or oversight.

Minimal pre-deposit transparency: Limited product access or proof before funds are requested.

Patterns matter. If the structure and funnel closely resemble known high-risk designs, the default approach should be heightened caution.

Accessibility and Inclusive Language

Financial products should communicate clearly to everyone—newcomers and experienced traders alike. Inclusive, accessible communication typically:

Uses plain language to explain benefits and risks.

Provides balanced messaging—opportunities and downsides side by side.

Avoids pressure tactics that overwhelm or rush people into decisions.

Offers educational resources or demos so people can learn before committing funds.

In the case of Bitcoins-union.com, the emphasis on effortless gains and speed may overshadow the context that many people need to make a thoughtful decision.

Frequently Asked Questions

Is Bitcoins-union.com a legitimate trading platform?

Publicly available materials do not provide sufficient evidence of transparent ownership, regulatory oversight, or verifiable performance. The burden of proof rests with the platform to substantiate its strongest claims.

Does the site’s “AI” guarantee profits?

No technology can guarantee profits in dynamic markets. Without disclosed methods, risk controls, and verified performance records, AI references should be treated as promotional claims rather than assurances.

Why is the minimum deposit highlighted as a concern?

A deposit-first funnel often indicates the platform prioritizes collecting funds over enabling informed evaluation. Responsible services usually allow deep exploration—demos, documentation, and clear policies—before asking for money.

Are the testimonials reliable?

Testimonials that are generic, untraceable, or paired with stock-style imagery should be treated as marketing, not proof of real outcomes.

What should readers look for in withdrawal policies?

Clear timelines, documented steps, accepted methods, and consistent execution. If withdrawal information is vague or changes after you deposit, that is a strong red flag.

Key Takeaways

High claims, low evidence: The site leans on bold statements about AI and success rates without transparent proof.

Deposit-first flow: The funnel encourages fast funding before meaningful discovery or demo access.

Opacity around accountability: Ownership, licensing, and policy details are not presented with the clarity you’d expect from a trusted financial service.

Familiar risk signals: Urgency cues, generic testimonials, and partner handoffs mirror patterns seen on other high-risk websites.

Withdrawal concerns: Asymmetry between easy deposits and potentially complex withdrawals is a recurring warning sign across similar platforms.

Individually, each signal might be explained away. Collectively, they form a coherent risk profile.

Conclusion

Bitcoins-union.com looks modern and confident, but the structure behind the presentation is where the truth lives. A deposit-first approach, a vague AI narrative, unclear oversight, and familiar high-pressure marketing patterns all point toward elevated risk. Readers deserve platforms that earn trust through clarity: who operates the service, how the technology works in broad strokes, what the rules are for fees and withdrawals, and where results can be independently verified.

Until those fundamentals are presented with transparency and consistency, the prudent stance is to approach Bitcoin-Union.com with caution and prioritize services that demonstrate accountability from day one.

Empowering Victims: Taking a Stand Against Scams with GAINRECOUP.COM

If you have fallen victim to a scam, it is important to understand that you are not alone and you still have options. Scammers exploit the trust of their victims, but organizations like GAINRECOUP.COM work tirelessly to combat these frauds with integrity and expertise.