When you come across a platform like Cipher Trade Markets, it’s understandable to feel hopeful: slick marketing, promises of high returns, advanced tools, and global access. But if you’re approaching the world of online trading and investment—whether you’re a complete beginner or someone with experience—it’s important to take a step back and evaluate the platform carefully. This review uses inclusive language so that everyone—regardless of background—can understand the issues and decide wisely.

What Cipher Trade Markets Claims

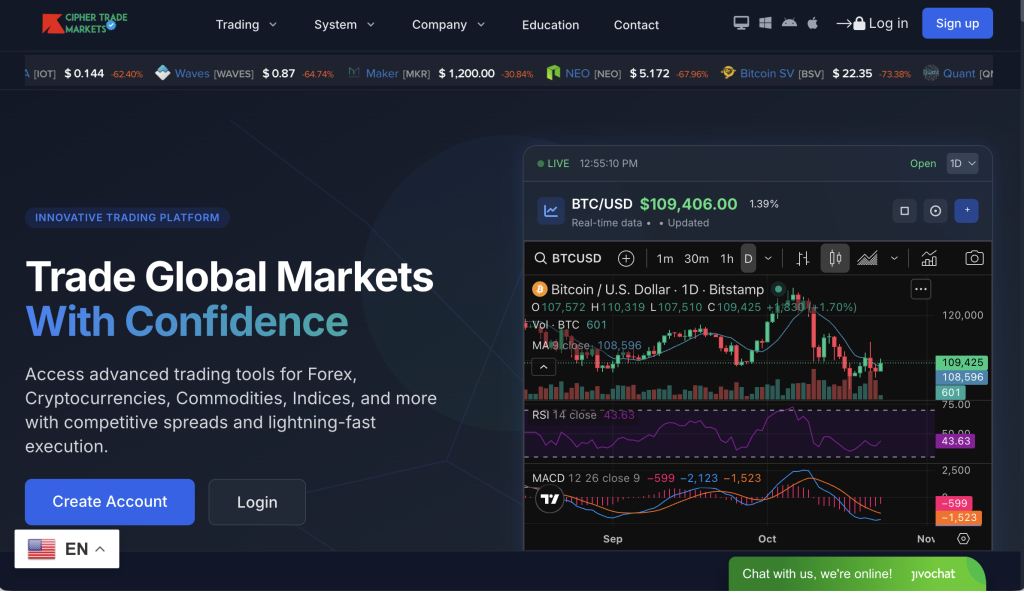

On the face of it, Cipher Trade Markets presents itself as a modern, full-service broker or trading provider. Some of the key claims include:

Access to multiple asset classes: forex, cryptocurrencies, indices, commodities, equities.

Advanced tools: custom platforms, fast execution, copy-trading, automated strategies.

Professional support: account-managers, multilingual customer service, global reach.

Strong branding: “globally regulated”, “segregated client funds”, “industry awards”, “trusted by professionals”.

These are attractive features—especially for someone looking to enter trading with confidence. However, what matters more is whether these claims match verifiable reality: legal licensing, independent oversight, transparency around fees and withdrawals, and consistent user experiences.

Licensing, Regulation & Transparency: What We Found

Regulation Issues

One of the clearest red flags: the Financial Conduct Authority (FCA) in the UK has explicitly stated that Cipher Trade Markets is not authorised by them and is flagged as an unauthorised firm. FCA

A firm operating without proper authorisation in a jurisdiction where it solicits clients means those clients lack many of the safeguards typical in regulated environments.

What the Site Says

On its own website, Cipher Trade Markets claims registration in Seychelles and Cyprus (via a “tradename”) and asserts licensing by the Cyprus Securities and Exchange Commission (CySEC) under MiFID II rules. Cipher Trade Markets+1

However, claims of regulation need independent verification. A platform stating regulation is not enough—if you cannot find it in regulator registers, risk remains high.

Transparency of Corporate Identity

The website features a lot of high-level branding language: “one of the most reputable brokers”, “industry-leading insurance protection”, “40+ international awards”. Cipher Trade Markets+1

But when major claims are made without corresponding documented proof that users can easily verify (for example, actual regulator licence numbers, full audit reports, real past performance), then the marketing becomes gold plating rather than substance.

Marketing vs. Reality: What to Question

When reviewing platforms, particularly ones promising strong returns or easy access, it’s wise to ask whether the marketing matches the fine print.

Guaranteed or high returns: If a platform implies “returns from 2% to 15% per trade” (as Cipher Trade Markets does via “plans” on its website) that is a major red flag. Real markets don’t offer guaranteed returns by default. Cipher Trade Markets

Risk transparency: Does the platform clearly disclose that trading (especially CFDs, derivatives, crypto) comes with a high risk of loss? The site does include a risk warning, but the prominence and context are weak relative to the marketing size. Cipher Trade Markets

Withdrawal and deposit clarity: If a platform emphasises “instant withdrawal” and huge returns but provides minimal concrete details about how you withdraw and what steps may be required, this mismatch is concerning. The plans interface claims “instant withdrawal” but without clearly stated conditions. Cipher Trade Markets

When the “promise” messaging significantly outweighs the “disclosure” messaging, the imbalance suggests a higher risk to the user.

On-boarding, Deposit and Withdrawal Process: Things to Check

Considering the typical user journey is important:

Easy sign-up: Many platforms make registration quick, asking only for basic info initially. That in itself can be fine—but the key is what happens next.

Deposit encouragement: If the platform pushes you to deposit quickly or upgrade to access special returns, that is a signal to proceed slowly.

Withdrawal friction: One of the common issues in higher-risk platforms is that when you request a withdrawal, additional conditions appear—verification, extra fees, required “volume of trades”, or even deposit increases.

With Cipher Trade Markets, because of its regulatory status and marketing claims, users should assume that withdrawal may not be as straightforward as the site suggests. That doesn’t prove wrongdoing, but it sets a higher risk baseline.

Web Footprint & Trust Indicators

Beyond the website claims and regulatory checks, a broader footprint is helpful.

The FCA’s warning list (for UK consumers) explicitly flags this firm as not authorised and possibly a scam. FCA

The brand website uses marketing heavy language such as “elite investor”, “make money quickly”, “award-winning”, and user testimonials that appear generic. This pattern is common in weaker platforms.

A truly robust provider will have clear independent audit reports, long-term user testimonials including verified withdrawal stories, and clear licence numbers visible on regulator sites. Cipher Trade Markets lacks publicly easy-to-find, thoroughly verifiable information of this nature.

Common Patterns in High-Risk Trading Platforms

To help you assess this platform (and others) with an inclusive mindset, here are patterns often seen when risk is higher:

Marketing emphasises high returns with little mention of losses.

Ownership or corporate details are vague, or use offshore jurisdictions with fewer oversight controls.

Site claims “globally regulated” but actual verification is weak or inconsistent.

Withdrawal hurdles arise in practice: extra fees, “unlocking funds”, trading volume conditions, or depositations to withdraw.

Bonus or “plans” structure that ties return to deposit size or upgrade, rather than true trading performance.

Reviews or testimonials appear overly positive, lack detail, and are not independent.

When multiple of these appear together, the risk that the platform may not meet expectations—or could even be operating with fraudulent intent—increases.

Accessible Due-Diligence Checklist (Inclusive for All Users)

Whether you are new to investing or have experience, using a plain-language checklist is helpful:

Who runs it and where? Is there a transparent legal entity name, address, registration number, and leadership team you can verify?

What is the licensing / regulation? Can you find the firm on a regulator register in your country?

How are client funds held? Are funds in segregated accounts? Are there independent audits or transparent fund-protection measures?

What are the fees and terms? Are deposit and withdrawal terms easy to locate and compare? Is the risk of loss clearly stated?

Are withdrawal practices realistic and documented? Can you withdraw a small amount easily before locking in large sums?

What’s the marketing like? Are there claims of “guaranteed returns” or “instant profits”? If yes, treat those with skepticism.

What do independent users say? Are there verified reviews, preferably on independent forums or regulator-warnings?

Do you feel comfortable? If any part of the process or wording feels rushed or unclear, pause and reconsider.

By applying these questions, you ensure your decision-making stays grounded, inclusive and empowering.

Balanced Summary and Final Thoughts

In inclusive terms: Cipher Trade Markets exhibits multiple red flags that recommend caution for anyone considering using it as a trading platform. The fact that a major regulator (FCA) warns it is unauthorised should be taken seriously. The site’s marketing promises are strong—but the independent evidence of regulation, user withdrawal experience, and corporate transparency is weak or not easily verifiable.

That doesn’t mean it is guaranteed to be a scam, but it does mean the risk of unexpected problems—loss of funds, inability to withdraw, lack of recourse—is substantially higher than with well-regulated, transparent providers.

If you are considering depositing with this kind of platform, you may want to:

Begin with a small amount you can afford to lose.

Verify with a small withdrawal test early on.

Prefer platforms with clear regulation in your jurisdiction, transparent fee structures, and a strong independent reputation.

Recognize that no legitimate trading platform can guarantee consistent profits without risk.

Bottom line: For most people seeking a dependable, transparent trading partner, platforms like Cipher Trade Markets lack several of the “protective layers” you’d want in place before making a significant commitment. Approach with caution, ask questions, and keep control of your financial decisions.

By reviewing platforms critically, using inclusive language and simple checkpoints, you ensure you’re making an informed decision—no matter your level of experience or background. Your time, money and data deserve full respect and careful handling.

How GainRecoup.com Helps Victims of Ciphertrademarkets.com

GainRecoup.com investigates ciphertrademarkets.com transactions, gathers evidence, and maps payment paths. Our recovery team liaises with banks, card networks, and exchanges, files chargebacks, and escalates complaints to relevant authorities. You’ll receive a tailored action plan, clear documentation, and persistent follow-up designed to maximize fund recovery and hold ciphertrademarkets.com accountable for victims.