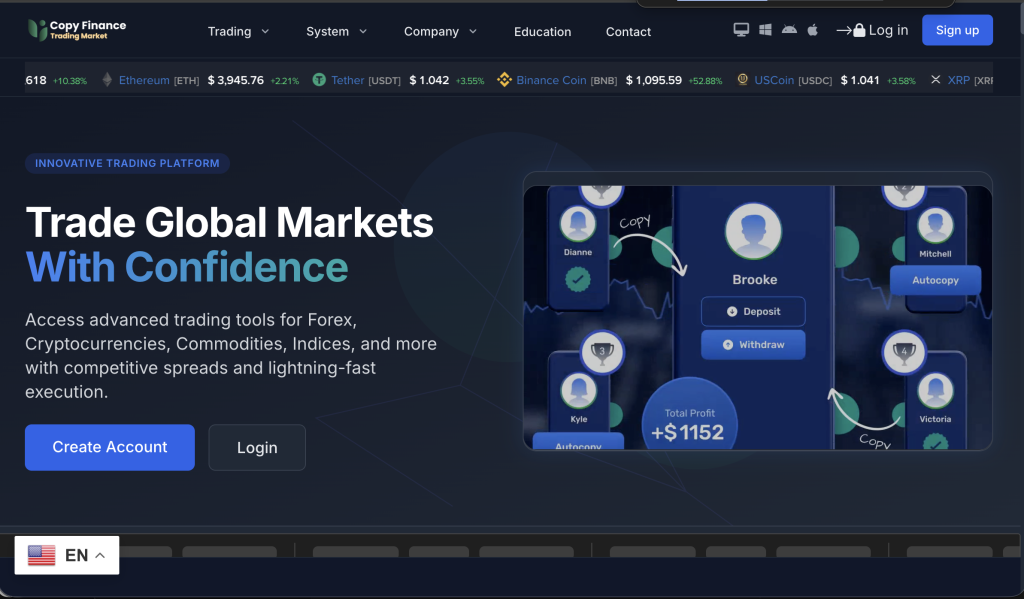

When researching new online trading or investment platforms, it’s common to come across websites that promise high returns, effortless trading, and “cutting-edge” tools. CopyFinx.com is one such name — it presents itself as a sophisticated trading platform with global reach and automated profit features.

However, beneath the polished design and persuasive marketing, several warning signs emerge. This detailed CopyFinx.com scam review examines what the platform claims to offer, where its red flags lie, and how to evaluate its legitimacy before risking any funds.

Quick takeaway: CopyFinx.com displays multiple characteristics associated with unregulated or high-risk platforms. While not every detail can confirm fraudulent intent, the evidence strongly suggests extreme caution.

What CopyFinx.com Claims to Be

CopyFinx.com promotes itself as a modern multi-asset trading and investment service offering access to forex, cryptocurrencies, stocks, commodities, and indices.

According to its promotional material, the platform supposedly offers:

Automated and copy-trading tools that allow investors to “mirror” professional traders’ strategies.

Global coverage with offices or operations in major financial regions.

Low spreads and fast execution, giving the impression of institutional-grade reliability.

AI-powered performance analytics and “real-time insights” for all account types.

It markets itself as user-friendly for beginners yet advanced enough for experienced traders. The overall message is simple — high returns made easy.

But legitimate trading isn’t “effortless,” and such claims often warrant deeper investigation.

Initial Warning Signs

Upon reviewing CopyFinx.com, multiple credibility gaps become apparent — from unverifiable licenses to lack of transparency in company ownership. Here’s what stands out:

1. No Verified Regulation or Licence

A genuine trading or investment platform must be authorised by a recognised financial regulator (such as the UK’s Financial Conduct Authority, the CySEC in Cyprus, or the ASIC in Australia).

CopyFinx.com claims to be registered and regulated in multiple jurisdictions, including Seychelles and Cyprus. Yet, no record of this entity appears in the databases of these regulators. Furthermore, the FCA (UK) has listed CopyFinx as an unauthorised firm, warning consumers that it may be providing or promoting financial services without proper permission.

This absence of regulation means investors have no guaranteed protection, no legal framework to appeal to in disputes, and no insurance for potential losses.

2. Contradictory Information About Ownership and Location

On its website, CopyFinx claims to have global operations — with mentions of offices in the UK, the United States, and offshore jurisdictions. However, independent checks show no verifiable company registration or traceable management team.

The lack of named executives, public records, or clear ownership structure raises serious questions about accountability. A credible financial institution always provides transparent leadership details and registered addresses you can verify.

3. Questionable Marketing and Unrealistic Promises

CopyFinx’s promotional style heavily focuses on simplicity, automation, and profitability — appealing especially to inexperienced investors.

Phrases such as “earn daily profits effortlessly,” “auto-trade your way to financial freedom,” and “copy top traders for instant success” are classic high-risk marketing triggers.

Authentic trading services never promise guaranteed profits or effortless returns because the financial markets inherently carry risk. Platforms using such language often rely on emotional persuasion rather than legitimate proof of performance.

4. Possible Domain & Hosting Concerns

A quick look at CopyFinx’s digital infrastructure shows that the website domain was registered relatively recently and uses privacy protection to hide ownership details. This is not inherently illegal — but combined with regulatory opacity, it deepens suspicion.

Established financial brands usually have long-standing domain histories, transparent ownership, and professional hosting structures aligned with their jurisdiction.

5. Hidden Terms and Withdrawal Restrictions

Reports and independent reviews indicate that CopyFinx may impose complex conditions on withdrawals. Some users allegedly encounter extra “verification fees” or are told to reach minimum trade volumes before withdrawals are processed.

Genuine brokers allow you to withdraw freely, except for standard banking procedures. When a platform creates barriers or introduces surprise conditions after deposit, it’s a red flag.

How Risk May Unfold in Practice

If you were to engage with CopyFinx.com, here’s a likely sequence of events — one commonly observed in similar high-risk platforms:

Smooth Onboarding: You register easily, perhaps even receive “personal assistance” via phone or chat. The interface looks legitimate.

Initial Deposit Request: You’re asked to fund your account to start trading or copying other traders. Some early users report seeing “profits” quickly — displayed on screen to build confidence.

Upselling or Upgrade Pressure: You’re encouraged to increase your deposit to “unlock premium features” or “maximize returns.”

Withdrawal Attempt Issues: When you try to withdraw your funds, you may encounter new requirements — such as needing to verify additional documents, pay fees, or reach a trading target.

Communication Breakdown: Support may become unresponsive, emails unanswered, or your account restricted.

By this stage, users often realise that the displayed profits were virtual, not actual funds accessible for withdrawal.

Evaluating CopyFinx with a Risk Checklist

If you’re still unsure whether CopyFinx.com is risky, ask yourself the following questions:

Can I verify this company’s licence on an official regulatory website?

Are there publicly known executives, business registration details, or office addresses?

Do withdrawal conditions appear transparent and standard?

Does the site or staff guarantee profits or downplay the risks of trading?

Are reviews consistent and genuine, or do they sound scripted or repetitive?

Does the platform rely on emotional urgency (“deposit today,” “limited offer”) instead of objective data?

If two or more of these raise concerns, the safest approach is to avoid depositing altogether.

What Sets Regulated Platforms Apart

To understand why regulation matters, here’s what regulated brokers do differently:

Clear identification: They list licence numbers, regulator names, and verified addresses.

Audited operations: Their financials are monitored to ensure fair dealing and client fund protection.

Segregated accounts: Client funds are held separately from company operating funds.

Accessible dispute resolution: Customers can file formal complaints through recognised channels.

Transparency in risk and fees: They disclose leverage limits, withdrawal conditions, and associated trading risks.

CopyFinx.com’s lack of these fundamentals suggests an absence of external accountability — leaving investors vulnerable.

Inclusive Advice for All Investors

Whether you’re an experienced trader or completely new to online investing, the golden rule is “trust, but verify.”

For beginners: Avoid platforms that promise easy money or instant wealth. Real trading involves risk, strategy, and patience.

For experienced users: Apply your due diligence—verify registration numbers, check regulator databases, and read actual user experiences beyond testimonials on the site itself.

For everyone: If transparency feels missing, that’s your cue to step back. A legitimate broker welcomes scrutiny; a questionable one avoids it.

No matter your background, your money deserves protection, and transparency is your first line of defense.

Final Verdict: High-Risk Platform with Multiple Red Flags

After assessing all available information, CopyFinx.com exhibits a high-risk profile due to these key issues:

Lack of verifiable licensing from any recognised regulator.

FCA warning flagging the firm as unauthorised.

Contradictory or unverifiable location and registration claims.

Unrealistic marketing promises designed to lure inexperienced investors.

Reports of withdrawal obstacles and poor customer transparency.

While CopyFinx.com presents itself as an advanced and global platform, the evidence points toward unregulated, high-risk behaviour. Investors are advised to treat it with utmost caution and avoid sending funds without independent verification of its credentials.

How GainRecoup.com Helps Victims of Copyfinx.com

GainRecoup.com investigates copyfinx.com transactions, gathers evidence, and maps payment paths. Our recovery team liaises with banks, card networks, and exchanges, files chargebacks, and escalates complaints to relevant authorities. You’ll receive a tailored action plan, clear documentation, and persistent follow-up designed to maximize fund recovery and hold copyfinx.com accountable for victims.