When exploring online trading platforms—whether you’re new or experienced—the key question remains: Is the provider transparent, regulated and trustworthy? In this review of CrossMarketPro, we apply inclusive, clear-language analysis to help you understand why this platform shows multiple warning signs. It doesn’t prove wrongdoing, but it does mean you should approach with great caution.

What CrossMarketPro Claims to Offer

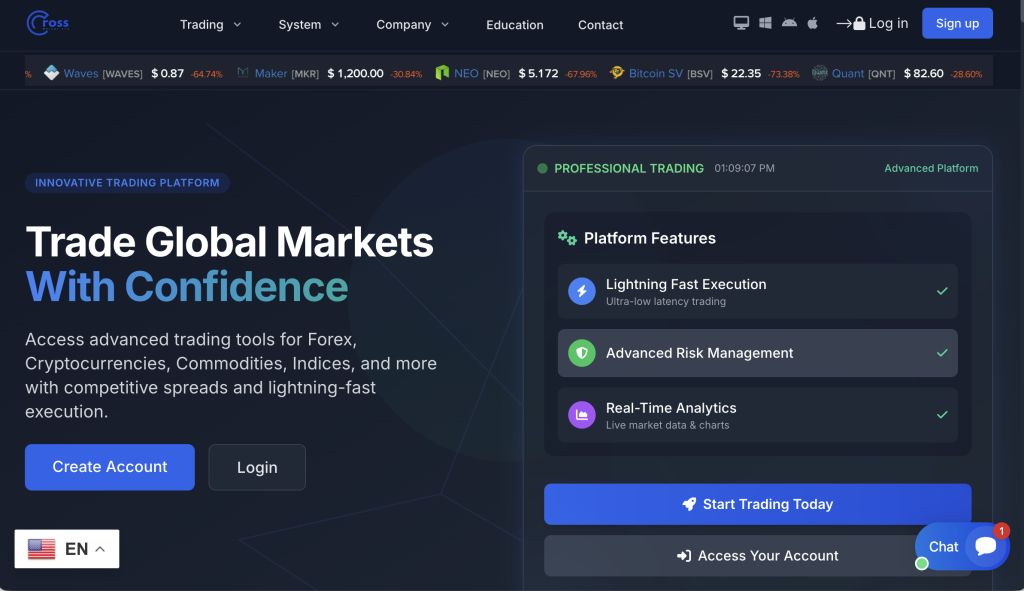

CrossMarketPro markets itself as a modern trading gateway, promising access to various markets, professional tools, and attractive returns. Typical claims include:

Access to assets such as forex, commodities, indices and perhaps cryptocurrencies.

Account tiers or “investment plans” with purported higher returns or faster growth.

“Instant” or seamless withdrawals and high-quality customer support.

Worldwide reach, multilingual support, and a sleek interface.

These features can look very appealing—but the question is whether the supporting facts are present: licensing, transparent ownership, verified performance, credible withdrawal process.

Transparency & Regulation: Red Flags

Lack of Authorisation

One of the strongest signals: the Financial Conduct Authority (FCA) in the UK lists “Cross Market Pro” as not authorised, warning that the firm “may be providing or promoting financial services or products without our permission”. FCA+1

Use of a UK address (1 Canada Square, Canary Wharf, London) is cited, but that does not equate to being regulated. FCA+1

Why This Matters

When a firm isn’t authorised:

You lose access to certain regulatory protections (e.g., complaint-resolution services) in many jurisdictions.

The firm may not be subject to required audits, client fund segregation or minimum capital requirements.

Claims of “regulation” or “global compliance” may be misleading or false.

Ownership and Business Details

There is scant verifiable information about who owns CrossMarketPro, under what entity name it operates, or under which regulator’s rules it falls. That opaque ownership is another signal for caution.

Marketing, Promises & Risk Disclosure

Promises of High Returns

From available disclosures, CrossMarketPro appears to emphasise high returns, quick profits and easy growth. However:

No credible audited track record is public.

In legitimate markets, no provider can promise consistent high returns without risk.

Where marketing emphasizes profits more than risks, the balance is off.

Risk Warnings & Fee Transparency

A reliable trading platform should clearly state: “You may lose money” (or similar), provide full fee tables (commissions, spreads, overnight financing, account maintenance, withdrawal fees) and detail conditions for bonus or plan upgrades.

In CrossMarketPro’s case:

Risk disclosure appears minimal relative to bold marketing.

Fee/withdrawal conditions are not clearly positioned upfront (based on available information).

Terms and conditions appear less prominent than the promotional claims.

When risk disclosures are weak, you’re left “assuming” rather than knowing the trade-offs.

Onboarding, Deposit & Withdrawal Process: What You Should Know

Onboarding

Often, a platform may allow fast sign-up with minimal verification before asking you to deposit. That in itself is not wrong—but a red flag arises if:

You are urged to deposit quickly, or upgrade your account tier.

You are promised special returns contingent on larger deposits or “activation”.

Verification is postponed until later, especially near withdrawal time.

Deposit and Withdrawal Flow

Key questions to ask:

Can you deposit and then withdraw a small amount easily? A credible platform will let you test this.

Are there unexpected requirements or fees when you request a withdrawal? Some platforms will impose new conditions only at withdrawal time.

What payment methods are used? Are they traceable, reputable and reversible?

For CrossMarketPro:

Given the lack of regulation and warning by the FCA, the withdrawal experience may be less reliable or transparent.

Users should assume higher risk of complications unless proven otherwise.

Website Content, User Feedback & Web Footprint

Web Content & Branding

When reviewing the website of CrossMarketPro:

Professional design and slick marketing can give a sense of legitimacy—yet design alone is not proof of legitimacy.

Are there detailed “About Us”, “Corporate”, “Regulation”, “Fees” and “Withdrawal Policy” pages clearly accessible? If not, that’s a warning.

If the address is UK/Canary Wharf but licensing is not UK-based, or the entity is not listed, that mismatch is problematic.

Independent Warnings & Public Feedback

Beyond the website:

Mention of CrossMarketPro on regulatory warning lists underscores elevated risk. FCA

The company appears on the IOSCO Alerts list for unauthorised firms. IOSCO

Independent “trust-score” sites for similar domains/brands often show very low trust ratings. Although not always about exactly this domain, they reflect patterns. ScamAdviser

Strong independent scrutiny or regulatory flags are meaningful. Absence of them is not neutral—it’s a gap.

Common Patterns in Higher-Risk Trading Platforms

To frame this inclusively for all readers:

Here are common patterns often seen in platforms that turn out to be problematic:

Big promises (“guaranteed returns”, “zero risk”, “get rich fast”) with few specifics.

Urgency or special promotion pressure (“deposit now”, “limited time upgrade”).

Lack of verifiable regulation or audit.

Hidden fees, withdrawal hurdles, or new demands when you request to get out.

Multiple variants or brand domains (suggesting churn or shifting identities).

Ownership or entity details are vague or hidden behind “service providers”.

High-polish marketing, but limited credible user testimonials or long-term track record.

Seeing many of these in one platform heightens the risk level.

Plain-Language Due-Diligence Checklist (Inclusive)

Whether you are new or experienced in trading, here is a simple checklist you can apply to CrossMarketPro or any similar platform:

Who is behind the platform? Check legal entity, registration number, physical address, leadership team.

Regulator check: Is the firm listed by your country’s regulator as authorised?

Client funds: Are your funds segregated in a recognised bank? Is there compensation protection?

Fee & withdrawal transparency: Can you find the full fee schedule and withdrawal policy upfront?

Withdrawal test: Start small and attempt a withdrawal to confirm the process.

Marketing vs. substance: If the site emphasises profits far more than risks, pause and verify.

Independent feedback: Look for reviews outside the company’s site — forums, regulators, third-party sites.

Comfort check: Do you feel comfortable? If any part seems unclear or pressure-driven, be cautious.

Using this checklist helps you stay in control, regardless of background or level of experience.

Balanced Conclusion

In inclusive and straightforward terms: CrossMarketPro shows several significant warning signs that suggest elevated risk for users.

Specifically:

Lack of clear registration with major regulator (FCA) and listing as an unauthorised firm.

Heavy promotional messaging with limited verified backing.

Opaque ownership and business structure.

Marketing style and web footprint aligned with patterns often seen in risk-heavy platforms.

That doesn’t prove irrevocable fraud, but it does mean that anyone considering using CrossMarketPro should proceed only with full awareness of these factors, and preferably only with amounts they are comfortable risking.

If you are looking for a trading partner, you may prefer those platforms that:

Are clearly and verifiably regulated in your country or region.

Offer transparent fee and fund-handling disclosures.

Support early, painless withdrawal of small amounts (to test).

Have widely documented independent user feedback and long-term reputation.

Bottom line: For most people aiming for a dependable, transparent trading experience, a platform like CrossMarketPro lacks several of the “protective layers” one would hope for. If you decide to engage, ensure you start small, verify withdrawal process, and remain fully informed.

By staying grounded in simple questions and inclusive language, you empower yourself to make decisions that align with your values, your comfort level, and your financial goals.

How GainRecoup.com Helps Victims of Crossmarketpro.live

GainRecoup.com investigates crossmarketpro.live transactions, gathers evidence, and maps payment paths. Our recovery team liaises with banks, card networks, and exchanges, files chargebacks, and escalates complaints to relevant authorities. You’ll receive a tailored action plan, clear documentation, and persistent follow-up designed to maximize fund recovery and hold crossmarketpro.live accountable for victims.