Introduction

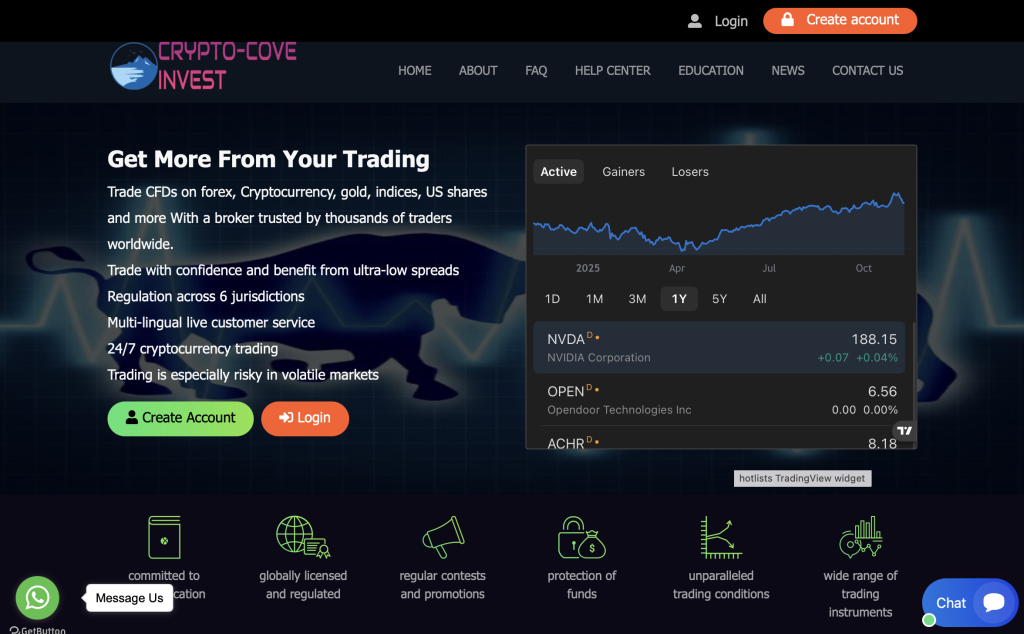

The digital investment space is expanding rapidly, with new websites appearing almost daily promising “guaranteed returns” or “automated profit systems.” Among them is CryptoCoveInvest.com, a platform that markets itself as a modern investment solution for individuals looking to grow wealth through cryptocurrency.

But behind the polished appearance, the essential question remains: Is CryptoCoveInvest.com a safe platform—or a potential scam?

This review offers a comprehensive, fact-based analysis of the website’s structure, claims, and credibility. It focuses on five key areas: company transparency, regulation, fees and plans, withdrawal processes, and user experience. The goal is to help you make an informed, careful decision before engaging with the platform.

1. First Impressions: What CryptoCoveInvest.com Promises

At first glance, the website appears sleek and well-organized. It claims to offer opportunities for investors to earn daily or weekly profits through crypto trading, mining, or investment plans managed by “experienced financial experts.”

Some of the claims made on promotional sections of the site typically include:

High daily or monthly returns on investment packages

Instant withdrawals with “secure processing”

Professional management by “experienced traders”

Guaranteed profits regardless of market volatility

While these claims sound enticing, the combination of guaranteed profits and low transparency is a strong red flag. Genuine investment services never guarantee fixed returns—especially in volatile markets like cryptocurrency.

2. Company Identity and Regulatory Standing

A reliable financial platform always provides verifiable business information. That includes:

A registered company name and corporate address

A visible license number from a recognized regulator

Names of executives or directors

Links to legal registration or regulatory databases

In the case of CryptoCoveInvest.com, none of this essential information is clear. The “About” and “Contact” pages use vague statements such as “our global investment team” and “trusted crypto analysts,” but do not reveal who runs the company or where it operates from.

This lack of corporate identity is a significant warning sign. Furthermore:

No official license number or financial regulation details appear anywhere on the site.

The domain is relatively new, which raises additional questions about the company’s credibility and longevity.

The contact email provided (if any) uses a generic email domain, not a verifiable corporate email.

Without these verifiable elements, the platform offers no accountability if things go wrong—meaning users could be left with no recourse in case of lost funds.

3. Investment Plans and Unrealistic Returns

CryptoCoveInvest.com appears to use a common high-yield investment website template. It typically offers tiered packages such as:

Starter Plan: Low entry amount, with daily returns of 5–10%

Premium Plan: Mid-level investment, with 20–30% weekly profits

VIP or Elite Plan: Large deposits promising “double” or “triple” returns in a short period

Such structures are often associated with high-yield investment programs (HYIPs)—websites that attract users with huge profit promises, only to collapse when new deposits stop.

Let’s break down why these plans are unrealistic:

The cryptocurrency market is volatile, and consistent guaranteed returns are impossible even for professional traders.

No platform can legally promise fixed profits without disclosing risk factors or regulatory supervision.

The lack of transparency about where or how the money is invested means investors cannot verify if any real trading takes place.

In short, the investment claims are mathematically unsustainable and strategically designed to attract deposits rather than generate genuine investment results.

4. Deposits, Withdrawals, and Exit Barriers

One of the biggest indicators of an illegitimate platform is the withdrawal experience. While CryptoCoveInvest.com highlights “fast withdrawals,” user reports and industry patterns suggest that similar sites often impose a range of tactics to delay or deny withdrawals.

Common withdrawal red flags include:

“Verification loops” — Users are repeatedly asked for new documents or ID scans each time they attempt a withdrawal.

Hidden fees — Unexpected “clearance,” “unlock,” or “anti-laundering” fees appear only when you request your money back.

Deposit pressure — Users are told to deposit more funds to “unlock” withdrawals or increase limits.

Communication drop-offs — Once funds are deposited, the company’s support team may become unresponsive or vague.

Genuine financial institutions handle withdrawals with clear timelines and published fee structures. If a platform repeatedly delays or blocks access to your own money, that’s a hallmark of a potential scam operation.

5. Legal Pages and Policy Gaps

Every trustworthy financial service maintains detailed legal documents, including Terms and Conditions, Risk Disclosures, and Privacy Policies.

A proper Terms of Service should specify:

The operating entity name

Governing jurisdiction

Risk factors and limitations of liability

Client rights and obligations

However, CryptoCoveInvest.com’s legal documentation (if any) is vague, inconsistent, or generic. Often, the text appears copied from unrelated websites, with placeholder sections and no clear governing law.

This absence of professional, verifiable legal documentation further reduces the site’s credibility. Without proper terms, users have no contractual protection in the event of disputes, withdrawal delays, or fund loss.

6. Communication and Customer Support

Another important test of a company’s legitimacy is how it interacts with clients. CryptoCoveInvest.com offers only limited contact options, often via online forms or messaging platforms. There’s no public support phone number, no named representatives, and no listed office address.

Typical signs of unreliable support include:

Generic, scripted responses to detailed questions

Pressure to deposit quickly rather than resolve queries

Disappearing agents after users deposit or request withdrawals

In contrast, regulated investment firms maintain verifiable addresses, clear complaint procedures, and independent dispute resolution channels—none of which appear to exist here.

7. Technical and Security Concerns

While the website may appear functional, technical indicators can reveal a lot about trustworthiness. Here’s what stands out:

HTTPS encryption is basic, but this only secures traffic—it does not prove legitimacy.

The domain is newly registered with privacy-shielded ownership details, obscuring who controls it.

No details about security practices, fund custody, or third-party audits are mentioned anywhere.

A legitimate crypto investment platform should provide clear information about wallet management, fund storage, and the security standards it uses to protect investor funds. CryptoCoveInvest.com fails to meet that standard.

8. Common Red Flags Summarized

Let’s recap the main warning signs observed with CryptoCoveInvest.com:

No verifiable company identity or corporate registration information

No financial regulator license or compliance credentials

Unrealistic, guaranteed profit claims across investment plans

Hidden or undisclosed withdrawal fees

No published legal documents or transparent risk disclosures

New, privately registered domain with minimal history

Generic communication channels and evasive support

Overly polished marketing but no real proof of trading or portfolio management

High-pressure deposit tactics and unclear exit procedures

These factors collectively point to a high-risk investment environment that prioritizes deposit collection over genuine investment returns.

9. What You Should Do Before Engaging

If you’re evaluating CryptoCoveInvest.com or any similar site, follow these safety principles before committing funds:

Verify ownership: Look up the domain registration and search for an official company name in corporate databases.

Check for licensing: All financial services must hold regulatory approval. If you can’t verify it, assume it doesn’t exist.

Ask for documentation: Request a full list of fees, terms, and withdrawal rules before depositing.

Avoid bonuses: Promotional bonuses often create lock-in conditions that prevent withdrawal.

Test customer support: Ask specific technical questions about security and licensing. The quality of the reply often reveals the truth.

Never share sensitive data like passport scans or crypto keys with unverified sites.

Taking these precautions is not paranoia—it’s protection.

10. Conclusion

CryptoCoveInvest.com markets itself as a professional crypto investment platform, but deeper analysis reveals multiple transparency and regulatory concerns. Its unrealistic profit promises, lack of identifiable operators, missing license information, and questionable withdrawal practices are all key red flags.

Legitimate investment platforms operate under strict regulation, provide verifiable ownership, and maintain transparent fee and risk disclosures. CryptoCoveInvest.com does not meet these standards.

Before trusting any platform that claims to “multiply your money quickly,” take time to verify everything. In finance, transparency is the foundation of trust, and any platform that hides its identity or legal details simply hasn’t earned that trust.

Empowering Victims: Taking a Stand Against Scams with GAINRECOUP.COM

If you have fallen victim to a scam, it is important to understand that you are not alone and you still have options. Scammers exploit the trust of their victims, but organizations like GAINRECOUP.COM work tirelessly to combat these frauds with integrity and expertise.