Overview

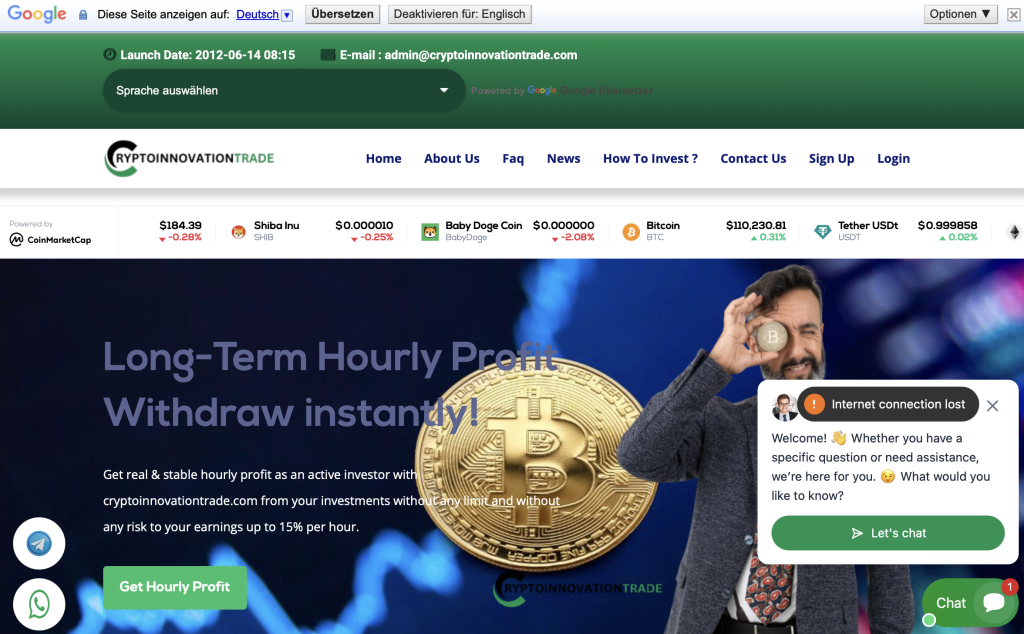

CryptoInnovationTrade.com presents itself as a modern platform for crypto and CFD trading, promising efficient execution, expert guidance, and quick withdrawals. This review examines the site’s claims against industry best practices and widely observed scam patterns. The goal is to help readers recognize red flags and make informed choices. This is not legal advice; it’s a careful assessment of warning signs that frequently accompany high-risk or untrustworthy platforms.

Key Claims vs. Typical Reality

Many suspicious trading websites deploy similar talking points: ultra-fast profits, VIP account managers, guaranteed signals, and special insurance on deposits. While persuasive, these claims rarely align with how legitimate, regulated brokers operate. In particular:

Guaranteed returns or “risk-free” trading contradict the nature of financial markets.

Bonus schemes with strings attached often lock users in and restrict withdrawals.

One-on-one “senior analyst” pressure to deposit larger sums is a common tactic on risky sites.

Urgency and time-limited offers are designed to push quick decisions without due diligence.

If any platform leans heavily on these talking points, caution is warranted.

Regulation and Licensing: The Core Issue

Regulatory oversight is the most important marker of broker quality. Regulated brokers:

Publish a verifiable license number and regulator (e.g., FCA, CySEC, ASIC).

Provide transparent client fund segregation and audited financial controls.

Maintain clear complaints and dispute resolution processes.

Are subject to sanctions if they mistreat clients.

When a website presents no verifiable license, uses vague claims (“licensed internationally,” “compliant with global standards”), or displays a regulator’s logo without a matching entry in that regulator’s public register, those are serious warning signs. Any mismatch between the brand name and the legal entity listed on the site—especially if the legal entity is missing or hidden—adds risk.

Ownership, Company Details, and Contact Transparency

Trustworthy financial services state precisely who they are:

A registered company name that matches the brand.

A physical address that can be verified (not just a mail drop or coworking desk).

Direct contact channels (telephone, email, live chat) that respond consistently.

Policies (Terms, Privacy, Risk Disclosure) that reference the same company and jurisdiction throughout.

Red flags include: shell or placeholder addresses, multiple conflicting company names across pages, typos in legal documents, and PDFs that appear to be templates with swapped logos. If an “About” page is light on real leadership details—or uses stock photos as executives—that’s another signal to pause.

Website Quality and Domain Signals

A website can reveal much about the operator’s effort and intent:

Recently registered domain with no established history raises caution.

Broken links, incomplete policy pages, or boilerplate text indicate low diligence.

Copy-paste marketing (identical paragraphs found on other questionable sites) is common in churn-and-burn schemes.

Inconsistent branding—different brand names in footers, PDFs, or dashboards—suggests repackaging of the same operation under new domains.

While none of these alone proves wrongdoing, together they build a risk profile that shouldn’t be ignored.

Account Types, Bonuses, and Fee Ambiguity

Look carefully at how accounts and fees are structured:

Tiered accounts that require large deposits for “real features” pressure users to commit beyond their comfort.

Bonuses often come with turnover requirements that effectively block withdrawals until unrealistic trading volumes are met.

Hidden fees—such as “compliance fees,” “risk insurance,” “maintenance charges,” or “anti-money-laundering clearance”—are classic last-minute obstacles used to extract more money when clients request a withdrawal.

A credible platform lists all fees upfront in plain language and does not condition withdrawals on additional payments unrelated to standard bank or blockchain network costs.

Platform and Tools: Hype vs. Substance

Risky sites often promote proprietary web terminals or “upgraded MT5 clones,” along with:

Lagging or simulated price feeds that differ from reputable sources.

Blocked stop-loss/take-profit functions or sudden “technical outages” during volatility.

Aggressive pop-ups encouraging higher leverage or fresh deposits.

Signal services and copy trading touted as near-perfect.

Any platform that discourages independent verification of prices, prevents normal order controls, or gamifies deposits rather than enabling straightforward trading deserves close scrutiny.

Deposits, Withdrawals, and KYC Flow

A major pain point with suspicious operations is the path of money out of the platform:

Smooth deposits, slow withdrawals. Funding is simple; withdrawals become complex with long delays.

Surprise KYC escalations. Extra identity steps appear only when users try to withdraw.

“Tax” or “unlock” fees. Users are asked to pay additional amounts to “release funds.”

Changing requirements. Each time a user complies, a new condition appears.

Legitimate brokers follow predictable KYC procedures before allowing trading and don’t invent fees to release a user’s own balance.

Communication Patterns and Pressure Tactics

Communication style is an overlooked yet revealing marker:

Daily calls and messaging urging larger deposits “to hit a market window.”

Guilt or shame language (“serious traders go platinum”) to push upgrades.

Secrecy instructions (“don’t tell your bank it’s for trading; say it’s a gift”)—a major sign of risk.

Switching agents; if one “manager” disappears, another steps in with a new story.

Professionals respect boundaries, provide balanced information, and never discourage transparent communication with banks or advisors.

Testimonials, Reviews, and Social Proof

Problematic sites may showcase:

Unverifiable testimonials with stock photos or first names only.

Perfect five-star ratings on obscure review pages established recently.

Threats or incentives to manipulate public reviews.

Skepticism is healthy. Real customer feedback appears across independent, established platforms and includes a mix of experiences, not just glossy praise.

Risk Assessment Summary for CryptoInnovationTrade.com

Based on widely recognized red flags seen across many high-risk trading websites, the concerns to watch for include:

Unclear or unverifiable regulation and licensing claims.

Sparse corporate identity and weak contact transparency.

Inconsistent site content (branding mismatches, legal text inconsistencies).

Bonus restrictions and unclear fees that may limit withdrawals.

Platform opacity (price discrepancies, restricted order controls).

Withdrawals delayed or conditioned on extra payments.

High-pressure sales behavior from “advisors” or “analysts.”

Over-polished testimonials without independent validation.

None of these items alone offers a definitive verdict, but together they strongly suggest heightened risk that readers should approach with care.

How to Vet Any Trading Site (A Neutral Checklist)

Use this quick checklist for any broker or exchange, not only CryptoInnovationTrade.com:

Regulatory lookup: Find the stated license and verify it on the regulator’s official website. Names, reference numbers, and jurisdictions must match exactly.

Corporate identity: Confirm the legal entity, address, and contact details. Search for that company name in official registers.

Policies: Read Terms, Risk Disclosure, and Withdrawal Policy end-to-end. Watch for bonus turnover clauses and conditional fees.

Fees and funding: Ensure deposits and withdrawals follow standard channels with transparent, pre-disclosed costs.

Platform integrity: Compare prices with a trusted data source. Test order features (stop-loss, take-profit) and execution behavior.

Communication style: Avoid pressure. Do not proceed with sites that demand secrecy with banks or insist on immediate large deposits.

Reputation over time: Look for consistent feedback across multiple, independent review sources and check domain age/history patterns.

Security and privacy: Confirm encryption, data policies, and sensible KYC flow that happens before trading begins.

Plain-Language FAQs

Is CryptoInnovationTrade.com a regulated broker?

Only the platform can state its licensing status. Always verify the claimed regulator’s public register and confirm that the brand name, legal entity, and license number match.

Why do bonuses matter?

Bonuses often come with turnover requirements that can restrict withdrawals. If you accept a bonus, read the small print carefully to understand how it affects access to your funds.

What are common withdrawal blockers?

Unexpected “tax,” “compliance,” or “insurance” fees to release funds, constantly changing documentation demands, or prolonged review periods triggered only at withdrawal time.

Do high account tiers help?

Higher tiers promising better spreads or “VIP insights” can be a sales lever to secure larger deposits. Benefits are often vague, while the risk of overexposure rises.

How can I reduce risk before funding an account?

Start small, verify the withdrawal process early, document every conversation, and compare platform behavior against reputable benchmarks.

Final Verdict

CryptoInnovationTrade.com promotes a modern trading image, yet many of the patterns associated with high-risk platforms are relevant here: ambiguous regulation, limited corporate transparency, and mechanisms that can complicate withdrawals or nudge users toward larger deposits. Readers are encouraged to verify every claim independently, scrutinize all terms—especially around bonuses and fees—and proceed only if the platform demonstrates the hallmarks of a transparent, well-regulated broker.

Empowering Victims: Taking a Stand Against Scams with GAINRECOUP.COM

If you have fallen victim to a scam, it is important to understand that you are not alone and you still have options. Scammers exploit the trust of their victims, but organizations like GAINRECOUP.COM work tirelessly to combat these frauds with integrity and expertise.