Investigating online trading or investment platforms can feel overwhelming—especially if you’re newer to this space. This detailed review of Digital EquityX (digitalequityx.com) uses clear, inclusive language and focuses on what requires your attention: transparency, regulation, marketing claims, and risk. My goal: help you evaluate the platform thoughtfully, whether you’re experienced or just getting started.

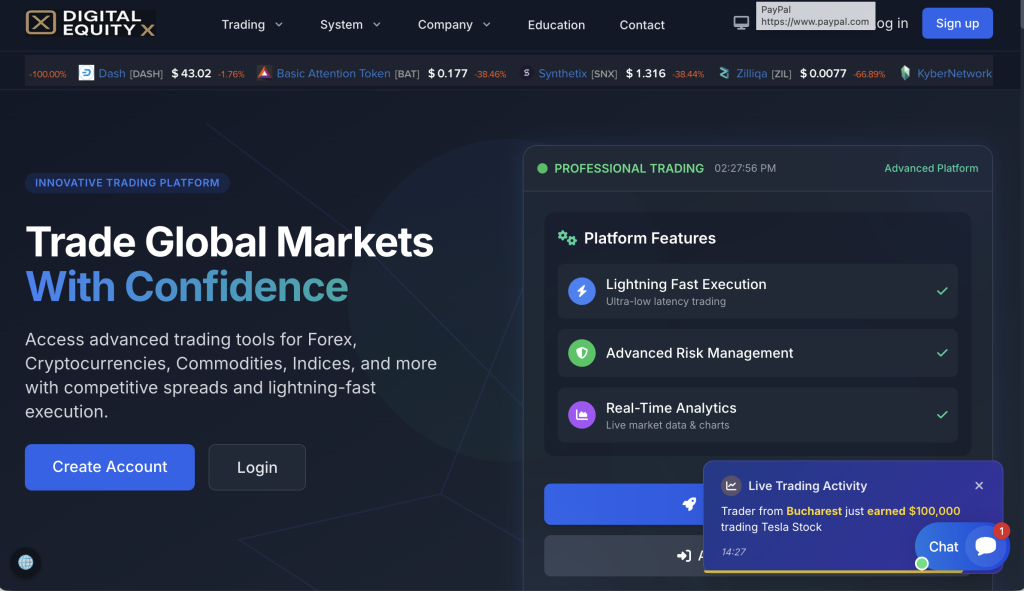

What Digital EquityX Claims to Offer

Digital EquityX presents itself as a full-service provider of trading across asset-classes. Some of the key claims include:

Access to forex, commodities (gold, oil), indices, cryptocurrencies and more. digitalequityx.com+2digitalequityx.com+2

“Globally regulated” services and “top-tier authorities” oversight. digitalequityx.com

Competitive spreads, advanced execution, and “safe funds”. digitalequityx.com

Seamless onboarding and professional account-managers.

These features appear enticing—especially if you are looking for tools that promise performance and ease of entry. But the real question is: Do these claims hold up under scrutiny? Are the rights, protections and disclosures in place that a trustworthy provider should offer?

Regulation & Transparency: Why They Matter

Regulatory Status

A fully credible trading provider typically is authorised by a recognised financial regulator (for example in the UK, US, Australia, EU). With Digital EquityX:

The Financial Conduct Authority (FCA) in the UK lists Digital EquityX as not authorised, and cautions that it may be operating without permission. FCA

Independent review sites show Digital EquityX does not hold valid licences with major regulatory bodies. scam-tracker.net+1

Corporate & Disclosure Transparency

The website claims “globally regulated” status, but without clear licence numbers or regulator names that stand up to verification.

The company address (11 Grace Avenue, STE 108, Great Neck, NY 11021) appears on the FCA warning list, with matching contact info. FCA+1

When ownership, physical premises, business registration and regulator details are vague or inconsistent, it becomes harder to assess accountability and protection of your funds.

Why This Matters

Lack of verifiable regulation means the usual protections many investors expect may not apply—such as client fund segregation, independent auditing, dispute resolution via an ombudsman, and regulatory oversight. That doesn’t automatically mean fraud—but it does mean elevated risk.

Marketing Claims vs. Actual Conditions

Strong Promises

Digital EquityX’s marketing emphasises high-access, high-speed trading, “elite” returns, and professional support. Some claims include “safe funds”, “top-tier authorities”, and “competitive spreads”. digitalequityx.com+1

Weak Disclosures

The website lacks clear audited performance data, detailed fee tables, or published independent reviews.

It claims “globally regulated” but verification is missing.

Real markets come with risk; legitimate providers emphasise that you may lose money. If that balance is missing, caution is needed.

The Pattern

When promise-language outweighs verified fact, that’s a red flag. In inclusive terms: if you feel the platform is telling you more about “how great it is” than “what you could lose”, then pause and dig deeper.

Onboarding, Deposits & Withdrawals: What to Watch

Onboarding

A typical positive user experience would include clear information, meaningful KYC (Know-Your-Customer) checks before you deposit large sums, and full explanations of account types and risk.

With Digital EquityX:

The site promises ease of entry and deposit options, but there are fewer visible safeguards spelled out upfront.

The “terms” page mentions KYC, but without transparency on how funds are protected or how withdrawals are processed. digitalequityx.com

Deposits & Upgrades

Scam-prone platforms often encourage rapid or large deposits, then make it harder to withdraw. Things to check:

Are you pressured to deposit “right now”?

Is there an “upgrade” or “premium plan” that locks in your funds?

Withdrawals

Withdrawals are the key stress-test of trust. With Digital EquityX:

Because regulation is lacking, there is no public verification of withdrawal reliability.

Reviewers suggest that unregulated firms may create conditions that delay or block withdrawals altogether. TheSafetyReviewer+1

Inclusive advice: Always test withdrawals early, with small amounts you’re comfortable risking. If any part feels opaque, treat that as a warning.

Website Footprint & User Feedback

Web Presence

Digital EquityX uses polished visuals, asset listings, and marketing copy designed to attract users. However:

The core claims about regulation and licence are not easily substantiated.

The address referenced appears in multiple regulator warnings which mention that firms using that address may be unlicensed or may move domains. BrokersView+1

User Feedback

Independent review sites highlight concerns: missing licences, minimal independent verification, and patterns consistent with unregulated or high-risk trading providers. TheSafetyReviewer+1

There are no widely published long-term verified customer success stories of smooth deposit-to-withdrawal cycles for this platform.

Trusted providers build their reputation via transparency and verifiable user outcomes. When that story is missing, risk rises.

Common Patterns of High-Risk Platforms (Inclusive Summary)

When evaluating platforms like Digital EquityX, here are recurring patterns seen in higher-risk or scam-style providers:

Statements claiming “guaranteed returns”, “zero risk” or “very high profit with little effort”.

Use of urgency language: “limited time offer”, “upgrade for more access”, “deposit to unlock”.

Lack of verified regulation or oversight.

Ownership or address details that are vague, inconsistent, or appear in multiple warning lists.

Withdrawal hurdles becoming visible only after a substantial deposit is made.

Bonus or “premium” plans that encourage more deposits rather than focusing on verifiable trading.

Marketing that emphasizes “profit”, but minimal emphasis on “loss”, “risk”, or transparent fees.

If multiple of these are present, as they are with Digital EquityX, then you’re on the higher-risk side of the spectrum.

Due-Diligence Checklist (Inclusive for Everyone)

Here’s a straightforward checklist you can use—not just for Digital EquityX but for any investment/trading platform—whether you are new or experienced:

Legal identity: Can you find the company’s full legal name, registration number, physical address, and leadership team?

Regulation check: Is the platform listed and authorised by a major regulator in your country or region? Search the regulator’s official list.

Client fund safeguards: Are client funds held in separate accounts (segregation)? Is there audit information?

Fee & withdrawal transparency: Are the fees, withdrawal conditions, minimums and lock-in terms clearly published before deposit?

Withdrawal trial: Can you deposit a small sum and withdraw it smoothly to test the system before committing more?

Marketing vs. substance: Does the site emphasise profits far more than risks? If yes, raise your caution level.

Community feedback: Are there verified reviews from independent sources, not just marketing testimonials?

Comfort level: Do you feel comfortable with the terms, the process and your level of understanding? If any part is unclear—pause.

Using this inclusive checklist helps keep the playing field level for both newer and seasoned investors.

Balanced Conclusion

In plain, inclusive language: Digital EquityX shows multiple warning signs that suggest elevated risk—and should not be treated as a low-risk or fully trustworthy provider without considerable caution.

Key concerns:

Lack of verifiable regulation and licensing under recognised authorities.

Claims of regulation and safety that are not backed by publicly documented evidence.

Marketing that emphasises profits and ease of use rather than risk, withdrawal mechanics or transparency.

Corporate disclosures and ownership details that are vague or inconsistent with what reputable firms provide.

That doesn’t definitively prove intentional wrongdoing—but it does mean that if you engage, you should proceed only with full awareness, small amounts you can afford to lose, and a test of the withdrawal process very early on.

If you are looking for a more dependable partner, focus on platforms that:

Are clearly and verifiably regulated in your region.

Offer full transparent disclosures, audit reports, and clear withdrawal processes.

Have a positive track record of small-scale users depositing and withdrawing successfully.

Emphasise risk alongside potential returns (not just “profits”).

Bottom line: For clear-minded, inclusive decision-making: If a platform lacks these protective layers, you’re taking on significantly higher risk. Approach Digital EquityX with caution.

By approaching your decisions with awareness, using inclusive language, and grounding your choices in verifiable evidence, you put yourself in a stronger position—regardless of your experience level. Your money, data and time deserve transparency and respect.

How GainRecoup.com Helps Victims of Digitalequityx.com

GainRecoup.com investigates digitalequityx.com transactions, gathers evidence, and maps payment paths. Our recovery team liaises with banks, card networks, and exchanges, files chargebacks, and escalates complaints to relevant authorities. You’ll receive a tailored action plan, clear documentation, and persistent follow-up designed to maximize fund recovery and hold digitalequityx.com accountable for victims.