Overview

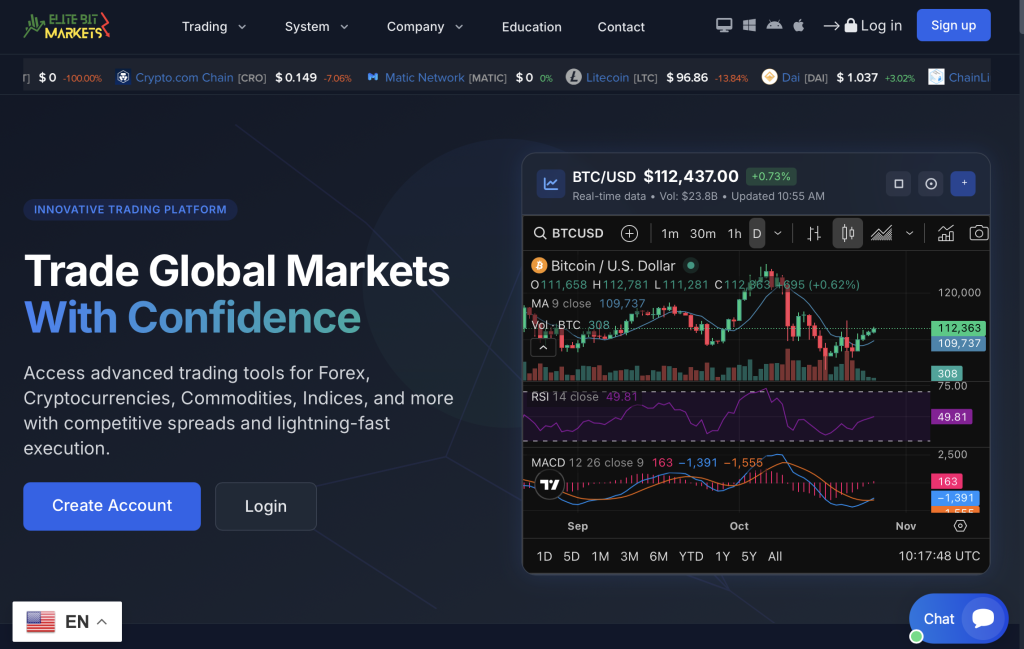

EliteBitMarkets.com presents itself as a modern, easy-to-use trading venue for cryptocurrencies, forex, commodities, and indices. The website’s pages typically emphasize fast onboarding, tight spreads, and “smart” tools designed to help new and experienced traders capture market opportunities. At first glance, the value proposition can look compelling: a sleek interface, bold performance claims, and push-button access to multiple asset classes.

However, a closer, methodical review raises a number of red flags that prospective users should weigh carefully before engaging. This article examines common patterns seen on high-risk platforms—spanning onboarding, deposits, withdrawals, support practices, fee disclosures, and regulatory posture—and explains how those patterns may apply to EliteBitMarkets.com. The goal is to give you a balanced, structured assessment that prioritizes readability, plain language, and inclusive guidance so you can make an informed decision.

Important note: This review focuses on risk indicators, transparency issues, and industry best practices. It does not provide legal conclusions. Always evaluate multiple sources of information and consider independent professional advice when needed.

First Impressions & Branding Cues

Legitimate financial services brands tend to be conservative in their promises, precise in their disclosures, and clear about who they are. When assessing EliteBitMarkets.com’s public-facing materials, several presentation choices often raise questions:

Aggressive marketing copy that leans on phrases like “guaranteed,” “proven,” or “beating the market.” Sound financial services typically avoid absolute claims and emphasize risk.

Prominent “limited-time” banners or timers nudging quick deposits. Time pressure is a known tactic to encourage rushed decisions.

Stock photography and generic identity elements in place of verifiable leadership profiles, team bios, or a transparent corporate history.

None of these items alone prove wrongdoing, but together they indicate a brand strategy designed to excite, not to inform.

Company Identity & Regulatory Posture

One of the most important questions for any online trading venue is: Who regulates it? Reputable brokers display regulator names, license numbers, and jurisdictional details plainly—and those details can be corroborated in public registers. With EliteBitMarkets.com, risk-conscious traders should watch for:

Vague or shifting corporate information. If the legal entity name, registration number, or address is incomplete, inconsistent, or hard to verify, that is a concern.

No clear regulator named. Phrases like “licensed,” “compliant,” or “approved” without precise registration data are not enough. Authentic firms show exactly which authority oversees them and under what license number.

Offshore registrations without investor protections. Some jurisdictions have light oversight. That doesn’t automatically mean a platform is unsafe, but it raises the bar for due diligence.

Why it matters: Regulation shapes client fund segregation, complaint handling, capital requirements, and audit expectations. Without it—or without clarity—users assume more counterparty risk.

Account Creation & Verification Experience

Genuine brokers balance speed with compliance. They welcome clients but follow consistent Know-Your-Customer (KYC) processes. Red flags to monitor during EliteBitMarkets.com’s sign-up flow include:

Unusually rapid acceptance with minimal identity verification before allowing larger deposits or leveraged trading.

Requests for excessive personal documents that are unrelated to typical KYC checks or are demanded at odd stages (e.g., only when you ask to withdraw).

Inconsistent communication about which documents qualify, leading to repeated re-submissions and delays.

A healthy broker explains exactly what is required, in what order, and why—well before significant funds move.

Deposits, Withdrawals, and “Verification Loops”

A frequent pain point on risky platforms is the withdrawal process. Reports in the industry often describe a cycle where deposits are effortless but withdrawals are slow, conditional, or blocked. Pay attention to these cues if you engage with EliteBitMarkets.com:

One-way friction: deposits accepted instantly via cards or crypto, while withdrawals require “extra review,” “additional trading volume,” or “tax clearance” fees that reputable brokers do not charge.

Surprise charges: unadvertised “insurance,” “liquidity,” or “compliance” fees presented only after a withdrawal request.

Verification loop: each submission triggers a new, vague requirement—e.g., “We need a better scan,” “We need proof of source of funds in a specific template”—with no end point.

Legitimate firms may request clarifying documents once, but they do not invent ad-hoc fees or tie withdrawals to unrelated hurdles.

Pricing, Spreads, and Fees

Transparent brokers publish clear fee schedules: spreads by instrument, overnight financing, inactivity fees, and deposit/withdrawal costs. In contrast, high-risk sites sometimes bury pricing in marketing copy or disclaimers. With EliteBitMarkets.com, scrutinize:

Inactivity fees that escalate quickly or appear after short periods.

Withdrawal “processing fees” that are variable and uncapped.

Slippage explanations used broadly to justify price discrepancies without detailed execution statistics.

If you cannot find a consolidated and specific pricing page, consider that an avoidable information gap.

Platform Tools & Performance Claims

Many sites promote proprietary “AI trading,” “copy strategies,” or “smart bots.” Responsible providers explain methodology, risk models, and historical backtests with clear caveats. Signs of caution include:

Backtested performance presented as typical outcomes without disclosures on assumptions, time frames, or drawdowns.

Copy trading with unverifiable leader profiles or performance metrics that reset frequently.

Odd trading conditions like inconsistent margin calls or overnight swaps that don’t align with market norms.

Robust platforms provide stable, testable environments and detailed documentation on how tools behave under stress.

Customer Support Patterns

Support quality often reveals a firm’s priorities. Common risk patterns include:

High-pressure outreach: repeated calls or messages urging larger deposits or “unlocking” new tiers.

Scripted responses: agents deflect direct questions about licenses, fees, or withdrawal timelines.

Limited channels: only webchat or messaging apps, no traceable ticketing system, and no published escalation path.

Trustworthy providers typically maintain email queues, ticket numbers, and documented SLAs.

Website Disclosures & Legal Pages

Before funding an account anywhere, review the site’s Terms and Conditions, Risk Disclosure, Privacy Policy, and Client Agreement. Red flags that frequently appear on questionable sites include:

Copy-pasted legal text that references a different company name or outdated laws.

Contradictory clauses—for example, one section promises insured accounts while another says the platform bears no responsibility for “any loss.”

Arbitration in remote jurisdictions that make dispute resolution costly and impractical.

Even if the trading interface looks polished, inconsistent legal pages can be a sign the foundation is weak.

Marketing & Social Proof

High-risk platforms may lean heavily on testimonials and social channels. A cautious approach is to treat:

Anonymous reviews without specifics as promotional.

Influencer partnerships as ads rather than objective endorsements.

“As seen in” logos without verifiable articles as decorative, not authoritative.

Real credibility is earned through audits, regulator checks, and consistent user experiences over time.

Common Risk Scenarios to Consider

The “bonus lock.” A deposit “bonus” quietly triggers volume requirements that make withdrawals difficult until you execute unrealistic amounts of trading.

The “tax/clearance fee.” You are told that your profit is “held” until you pay an upfront “tax” to the platform—something legitimate brokers do not require.

The “upgrade trap.” When you ask for a payout, you’re told to “upgrade the account” by depositing more to “verify solvency.”

The “price spike.” Unexplained spikes or off-market quotes liquidate positions, followed by a support message attributing it to “volatility.”

These scenarios appear across many high-risk sites and are worth keeping in mind when evaluating EliteBitMarkets.com or similar platforms.

Better-Practice Checklist (Before You Fund Any Account)

Regulatory verification: Can you independently confirm a license number with a recognized authority’s official register?

Company identity: Is there a full legal name, physical address, and reachable corporate contact?

Fee clarity: Is there a single, comprehensive page listing spreads, swaps, commissions, and non-trading fees?

Withdrawal policy: Are payout timelines, limits, and requirements spelled out in plain language? Are there no surprise “clearance” fees?

Platform stability: Is there a free demo, and do quotes align with reputable market data?

Support accountability: Are there ticket numbers, email confirmations, and published escalation paths?

If any item above is unclear or unverifiable, consider pausing until you can resolve it.

Verdict: High Caution Advised

Based on the risk indicators outlined—vague regulatory status, pressure-style marketing, deposit/withdrawal asymmetry, and weak disclosure practices—EliteBitMarkets.com presents multiple red flags typical of high-risk online trading platforms. While polished branding can be persuasive, the decisive factors should always be transparency, regulation, verifiable ownership, and consistent, documented behavior—especially around withdrawals.

If you are exploring online brokers, prioritize those with clear regulatory oversight, fully published fee schedules, and long-standing reputations. A platform that cannot meet basic transparency thresholds is asking you to accept unnecessary risk.

FAQ

Is EliteBitMarkets.com legit or a scam?

This review highlights multiple risk indicators commonly associated with high-risk platforms. Legitimacy depends on verifiable licensing, transparent fees, and reliable withdrawals. If those cannot be independently confirmed, proceed with extreme caution.

Does EliteBitMarkets.com have a license?

A safe practice is to confirm any stated license directly in the official register of the named regulator. If a license number is missing or unverifiable, that is a significant concern.

Why are withdrawals often delayed on risky platforms?

Some sites introduce new verification steps, volume requirements, or unexpected fees after you request a payout. Reputable brokers clearly publish withdrawal timelines and do not impose ad-hoc charges.

What fees should I look for?

Check spreads, commissions, overnight swaps, inactivity charges, and any deposit/withdrawal fees. These should be posted clearly in one place and align with industry norms.

What is the safest approach for new traders?

Favor transparent, well-regulated providers; test the platform with a small amount; and confirm at least one successful withdrawal before committing larger funds.

Final Thought

Attractive dashboards and bold headlines are not substitutes for verifiable oversight, consistent payout practices, and transparent costs. When reviewing EliteBitMarkets.com—or any broker—let evidence, not excitement, guide your decision.

How GainRecoup.com Helps Victims of Elitebitmarkets.com

GainRecoup.com investigates elitebitmarkets.com transactions, gathers evidence, and maps payment paths. Our recovery team liaises with banks, card networks, and exchanges, files chargebacks, and escalates complaints to relevant authorities. You’ll receive a tailored action plan, clear documentation, and persistent follow-up designed to maximize fund recovery and hold elitebitmarkets.com accountable for victims.