If you’ve stumbled upon GlobeCoreMarket.com while searching for a place to trade, you’re probably asking the same question many people ask with new or little-known platforms: Is it legitimate—or risky? This in-depth globecoremarket.com scam review collects the most common red flags seen on high-risk trading sites and compares them to what a careful investor would expect from a trustworthy broker. The goal is to help you read the signals, evaluate risk, and make informed decisions without fear or pressure.

Snapshot: What GlobeCoreMarket.com Appears to Offer

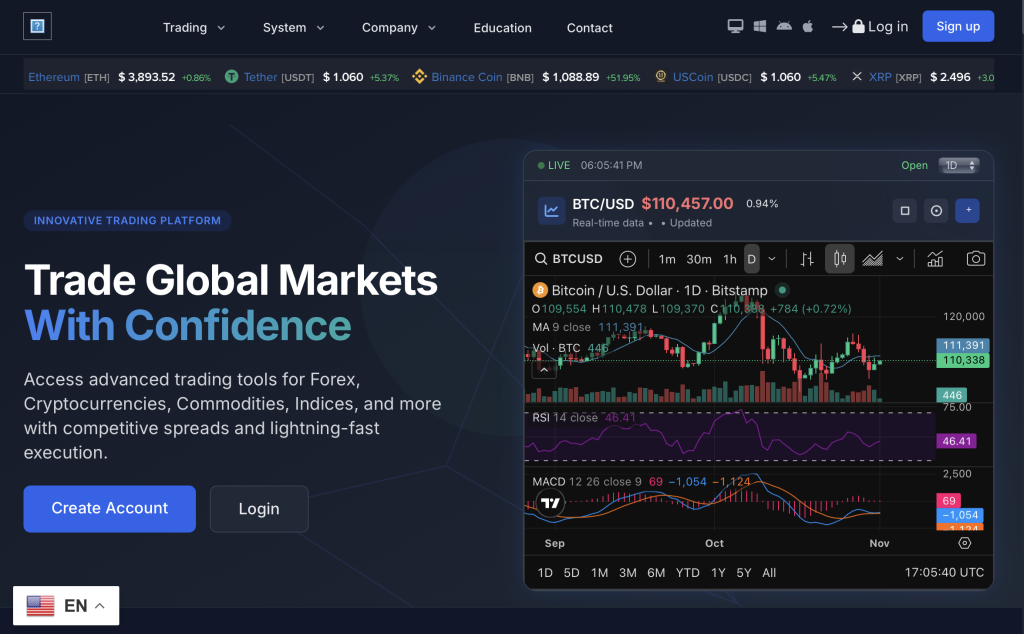

At first glance, GlobeCoreMarket.com presents itself as an all-in-one venue for online trading—often featuring currency pairs, stocks, indices, commodities, and sometimes crypto-assets. The marketing language tends to emphasize fast onboarding, tight spreads, “guaranteed” or “high” returns, sophisticated trading tools, and expert support. These are common promises across the web, and on their own they’re not proof of wrongdoing. But taken together with weaker transparency, they can become caution flags.

Key expectations a credible broker normally meets:

Clear identification of the operating company (legal name, registration number, and jurisdiction).

Verifiable regulation by a recognized financial authority.

Transparent fee schedules and funding/withdrawal rules in plain language.

Realistic risk disclosures and balanced performance claims.

A platform demo and documentation that align with industry standards.

When one or more of these are missing or vague, risk typically increases.

First Impressions & Site Transparency

A common early indicator of risk is opaque ownership. Credible brokers usually state, prominently and consistently across the site, who owns and runs the platform, where the company is incorporated, and how to contact them (including a physical address that can be independently verified). If GlobeCoreMarket.com provides only a contact form, generic emails, or a location with no verifiable presence, that’s a notable red flag.

Questions to ask yourself as you browse:

Is the company name the same across the homepage, terms, and footer?

Do you see a registered business number and regulator reference you can verify?

Are phone numbers and addresses consistent, and do they match the stated jurisdiction?

Is there a comprehensive terms of service and risk disclosure written in plain English?

Gaps, contradictions, or vague language in these areas often foreshadow friction later—especially around withdrawals.

Regulation & Licensing: The Core Legitimacy Check

Reputable brokers operate under recognized financial regulation (e.g., FCA in the UK, BaFin in Germany, ASIC in Australia, CySEC in Cyprus, etc.). That oversight dictates how client funds must be handled, what disclosures are required, and how client complaints can be escalated.

If GlobeCoreMarket.com claims to be regulated, the site should provide:

The exact regulator’s name.

The firm’s license or authorization number.

A link or reference to verify the license in the regulator’s official register.

If any “license” number cannot be found on the regulator’s website—or the license belongs to another company or a different business area—that’s a strong risk signal. Conversely, if the platform does not claim regulation at all (or references only offshore registrations without investor protections), treat any promises of safety with caution.

Products, Leverage & Promises: Reading Between the Lines

High-risk platforms often entice users with:

Very high leverage with minimal explanation of downside risk.

“Guaranteed,” “assured,” or “low-risk” returns (language reputable brokers avoid).

Bonus offers tied to trading volume or deposit thresholds that later restrict withdrawals.

It’s important to remember that bonuses and promotions sometimes come with buried conditions—like turnover requirements—that can block access to your own funds. If GlobeCoreMarket.com uses bonuses or makes outsized return claims, always look for the exact rules in writing and assess whether they’re reasonable for your situation.

Deposits, Withdrawals & Fees: The “Friction Test”

A credible broker usually spells out funding methods, withdrawal timelines, identity checks (KYC), and fees in a straightforward table or policy page. Red flags include:

Vague or shifting withdrawal conditions that change after you request a payout.

Requests for unexpected “tax,” “clearance,” or “unlock” fees before releasing funds.

Requiring additional deposits to “verify” an account or “activate” profits.

Long, unexplained delays after providing standard KYC documents.

If you see any of the above, pause and scrutinize the terms line by line. Sincere platforms conduct KYC and AML checks but don’t impose surprise, off-policy payments to release your balance.

Account Managers & Pressure Tactics

Another recurring pattern on high-risk sites is the use of high-pressure sales tactics:

Frequent calls or messages urging urgent top-ups to “catch a market opportunity.”

Emotional pressure (“Don’t miss out,” “Everyone else is increasing stakes,” “This window closes today”).

Requests to install remote-access software or to share sensitive banking/ID data via unsecured channels.

Encouragement to ignore risk warnings or skip reading the terms.

Professional brokers may offer support, but they don’t push large, rushed deposits or request that you bypass standard controls. If “support” feels like sales pressure, consider stepping back and reassessing.

Platform & Performance: What to Watch For

Even slick dashboards can mask underlying issues. During a test drive (or demo), consider:

Order execution: Do fills and quotes behave consistently, or do they lag at key moments?

Price integrity: Are prices aligned with widely available market data, or do they deviate without explanation?

Slippage & spreads: Are these transparently disclosed? Do they balloon unpredictably?

Statements & reporting: Are downloadable statements complete, timestamped, and consistent?

If a platform’s numbers look too perfect—always winning, never dipping, or instantly recovering—be cautious. Real markets are volatile and imperfect; honest reporting shows both gains and losses.

Content Quality, Policies & Legal Pages

Trustworthy firms invest in well-written, comprehensive legal pages: Terms of Service, Privacy Policy, Risk Disclosure, Cookies, Complaints Procedure, and sometimes an Order Execution Policy. Signs of haste or templating—such as mismatched company names, placeholder text, or broken links—undermine credibility. If GlobeCoreMarket.com’s legal pages are generic or inconsistent, consider that a meaningful signal in your risk assessment.

Social Proof Signals: Handle With Care

Testimonials, star ratings, and forum posts can be easily manipulated. Treat both glowing praise and angry complaints with healthy skepticism unless you can verify identities and timelines. What matters most is verifiable facts: company identity, regulation, policies, and your direct experience with transparent, documented processes. If social proof is the main substance and verifiable details are thin, recalibrate your expectations.

Risk Checklist for GlobeCoreMarket.com

Use this quick checklist as you evaluate the platform:

Company Identity: Full legal name, registration number, and verifiable address are clearly stated and consistent.

Regulation: Authorization by a recognized regulator is listed with a license number you can independently confirm.

Policies: Fees, spreads, leverage, deposit/withdrawal rules, and bonus terms are published in plain language.

Promotional Claims: No “guaranteed returns,” unrealistic profit promises, or pressure to deposit quickly.

Support Behavior: No pushy sales tactics, no requests for remote access, and no off-platform payment demands.

Platform Integrity: Quotes, charts, and statements make sense and align with real-world market conditions.

Withdrawal Experience: Reasonable timelines, clear KYC steps, and no surprise “unlock” payments.

Consistency: Names, contact details, policies, and disclosures match across all pages and documents.

If several boxes remain unchecked, consider the overall risk elevated.

How to Approach a High-Risk Broker—Calmly and Methodically

Should you decide to explore any new trading platform, proceed carefully:

Start with the smallest possible funding you can afford to test.

Complete KYC early to surface any potential friction while stakes are low.

Document everything—screenshots of dashboards, balances, chats, and emails.

Avoid bonuses that come with restrictive turnover clauses unless you fully understand the implications.

Set a personal rule for pausing deposits if withdrawal timelines aren’t met as promised.

This measured approach helps you gather your own signal—independent of marketing—about how the platform behaves when you ask for your money back.

Bottom Line: Is GlobeCoreMarket.com Legit or a Scam?

No single web page can declare a final verdict about any company, and allegations should never be made lightly. What matters is whether verifiable evidence of legitimacy outweighs the warning signs. In this globecoremarket.com scam review, the focus is on practical red flags seen widely across risky trading sites: unclear ownership, unverifiable regulation, restrictive bonus terms, pressure-based sales tactics, and withdrawal friction.

If GlobeCoreMarket.com cannot provide clear, consistent, and verifiable answers to the basics—who they are, who regulates them, and how your funds are protected—then the risk profile is high. If, on the other hand, the platform demonstrates transparent regulation, coherent policies, and smooth, documented withdrawals, that reduces (though never eliminates) the inherent risks of leveraged online trading.

Stay calm, read every line of the terms, and let verifiable details—not urgency or promises—drive your decision.

Empowering Victims: Taking a Stand Against Scams with GAINRECOUP.COM

If you have fallen victim to a scam, it is important to understand that you are not alone and you still have options. Scammers exploit the trust of their victims, but organizations like GAINRECOUP.COM work tirelessly to combat these frauds with integrity and expertise.