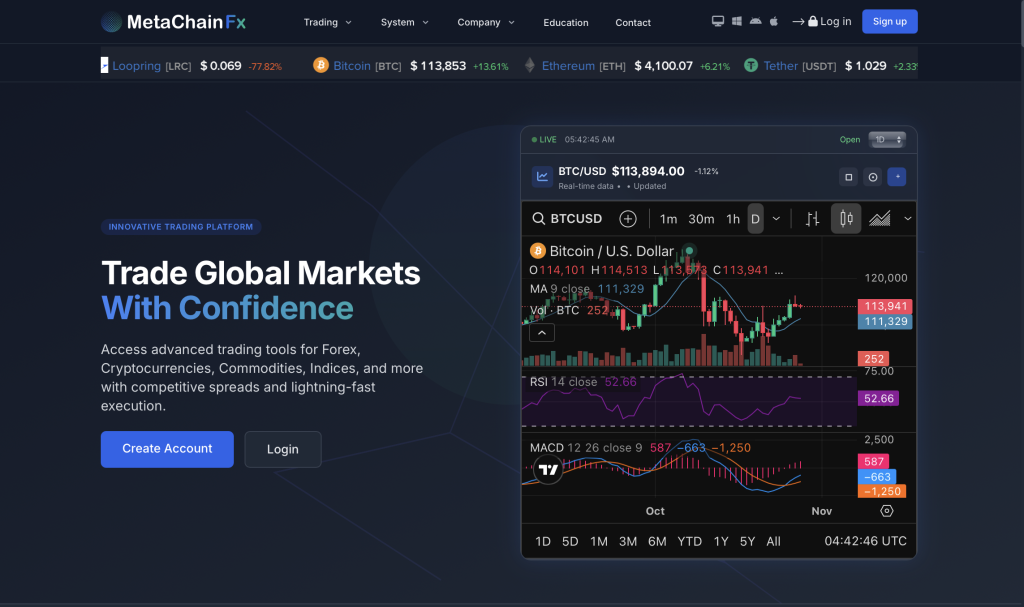

MetaChainFX.com (sometimes styled “MetaChain Fx” or “MetaChainFX / MyDigitalMarketHub”) presents itself as a modern, technology-driven investment and trading platform offering access to forex pairs, cryptocurrencies, stocks, commodities and indices. Its website features marketing claims such as “ultra-fast execution,” “spreads from 0.0 pips,” “automated trading tools,” “copy trading strategies” and “professional assets for all experience levels.” The platform aims to appeal to both beginners and more experienced traders with promises of ease, speed and high returns.

On the surface the website appears polished and convincing. However, when you look more closely into the structure, the disclaimers, the regulatory statements, and the actual patterns of withdrawal or transparency, issues emerge. This review walks through what MetaChainFX.com claims, how it operates, what is missing, and why it raises serious red flags—using inclusive, readable language meant for everyone, whether new to online investments or a seasoned trader.

What MetaChainFX.com Claims to Offer

On its website and in promotional materials, MetaChainFX.com advertises a number of attractive features:

Multi-asset trading access: From forex, crypto, stocks, commodities to indices in one account.

Advanced tools & automation: Copy-trading, bot or AI-powered strategies, click-once execution.

Low spreads / instant execution: Very small spreads touted; “spreads from 0.0 pips.”

Beginner-friendly access: “No prior experience needed,” “get started in minutes.”

Worldwide access & multilingual support: The site suggests 24/7 availability and global reach.

Tiered investment or account plans: Higher deposit levels unlock better “returns” or “premium features.”

Such propositions may seem attractive. But authentic, regulated platforms complement them with transparent regulatory info, risk disclosures, real-time performance data, clear fees and credible corporate identity. That’s where MetaChainFX.com shows its gap.

Regulation & Licensing: The Foundational Check

A responsible trading platform should clearly show its regulatory status: name of regulator, licence or registration number, jurisdiction, verification link, investor-fund protection details. In the case of MetaChainFX.com:

The site claims regulation by the “Financial Services Authority (FSA) of Seychelles” and by CySEC in Cyprus via a CIF licence in one section.

However, these claims are inconsistent and appear in self-promotional sections without independent verification. For example, a regulation page claims registration number “709718501” under Seychelles law while simultaneously stating it is a “CIF under CySEC” with a registration number HE 19818009.

Independent review sites assign a very low trust score to the website, citing its recent domain registration, hidden ownership, suspicious server setup and classification as “very high risk financial services.” ScamAdviser

These contradictions and the inability to independently verify genuine licensing raise significant concern. Without a truly verifiable regulator and licence number, client protections are weak or effectively non-existent.

Company Identity & Ownership Transparency

Trust in any investment service depends not only on what they promise, but on who they are. Key details credible platforms make visible: registered business name, physical business address, directors or responsible persons, audited financials or corporate history. With MetaChainFX.com:

The business entity name is not clearly validated beyond the website’s branding.

Address details appear vague or inconsistent across pages.

There is no clear public list of directors, leadership team, or audited past results.

Independent review flagged the domain as being only a few weeks old, registered anonymously, hosted on a shared server with other high-risk websites. ScamAdviser

When a platform’s ownership and corporate structure are hidden or vague, accountability becomes weaker. If you cannot easily establish who is behind the service, it becomes difficult to trace funds, enforce rights or pursue legitimate disputes.

Investment Plans & Return Promises

MetaChainFX.com advertises what appear to be fixed or unusually high returns:

Promises like “spreads from 0.0 pips,” “copy over 400 strategies,” “maximize profits,” suggest effortless earnings.

Tiered account types are visible (e.g., “Silver,” “Gold,” “VIP”) with implied better conditions for larger deposits.

The language emphasises ease and profit with minimal reference to risk or possible loss.

In real financial markets, returns are unpredictable, volatility is inherent, and no platform can genuinely promise fixed, guaranteed profits. Plan-based models that emphasise high returns for higher deposits often signal deposit-chasing rather than genuine sustainable trading. The presence of these elements on MetaChainFX.com must therefore be seen as a major red flag.

Deposits, Withdrawals & Access to Funds

How a platform handles your money—especially withdrawals—is a key area of trust. On MetaChainFX.com:

Signup and deposit appear straightforward, with multiple payment methods and quick access.

The website promises “fast withdrawal” or “instant access” but lacks public, verifiable withdrawal timeline, minimum or maximum payout terms.

Independent review warns of risk: “The website appears young, hosted on a shared server, offers high-risk financial services, and may be used in scam infrastructure.” ScamAdviser

Users may face additional charges, account-upgrade demands, or new verification steps only when requesting a withdrawal (though specific publicly-documented accounts may not yet be widely available).

Hidden or opaque fees may appear at withdrawal time, creating a mismatch between deposit ease and withdrawal difficulty.

This “easy in, difficult out” pattern is characteristic of risky or fraudulent platforms. A reliable service will publish clear withdrawal terms up front, including timelines, fees, currencies and limits.

Fee Transparency & Cost Disclosure

A legitimate trading platform allows you to evaluate your true net result by publishing a clear cost schedule: spreads, commissions, overnight financing, deposit/withdrawal costs, currency conversions, inactivity fees. With MetaChainFX.com:

Promotional claims emphasise “zero commissions” or “tight spreads” but do not provide a full, transparent fee breakdown.

No public table lists actual spreads for each asset class, no explicit withdrawal fee table.

Independent reviews identify the absence of detailed cost transparency as a trust issue. ScamAdviser

Without clear fee disclosure you cannot properly compare profitability, understand risk or identify hidden costs. Lack of transparency in cost structure is a structural weakness.

Marketing, Emotional Appeals & Social Proof

MetaChainFX.com uses numerous marketing tactics that mirror those found in high-risk investment offers:

Urgency messaging: “Limited spots,” “join now before door closes.”

Lifestyle-selling: Emphasis on freedom, profits, “unlock your potential,” wealth imagery.

Testimonial cues: Mention of “top traders,” “over 400 strategies,” “millions of traders” though not independently verified.

Simplified language: “No experience required,” “anyone can trade,” “get onboard today.”

While inclusive and friendly in tone, the marketing tends to emphasise outcome and ease rather than risk, strategy or transparency. Inclusive language alone doesn’t guarantee safety; what matters is consistent transparency behind the message.

Customer Support & Communication Behavior

Strong support behaviour is part of a trustworthy broker: multiple channels, clear escalation, helpful replies, transparent complaint mechanisms. In the case of MetaChainFX.com:

The website lists contact options, but external reviews highlight a mismatch: swift support in early stages (registration, deposit) and reduced responsiveness when users ask about withdrawal, verification or regulation.

There is limited publicly documented evidence of a clear complaints or escalation procedure.

Independent review warns the site shares hosting with multiple suspicious services and is very new, which often correlates with high turnover and disappearance risk. ScamAdviser

When support becomes slow, vague or unhelpful exactly when you need clarity, that suggests a shift from customer service to deposit-strategy mode.

Legal Documents & Your Rights

Legal documentation is a critical part of assessing investment services. Key documents include: Terms & Conditions, Privacy Policy, Risk Disclosure, Client Agreement, Governing Law. With MetaChainFX.com:

The site claims regulation but the Terms fail to clearly state which country’s laws apply, or which venue handles disputes.

There is limited visible reference to fund-segregation, independent audit, or investor protection schemes.

Reviewers mark the domain as very young, hosted on shared infrastructure, and offering high-risk financial services with little disclosure. ScamAdviser

Without strong, transparent legal terms you may lack clear rights, recourse options or protections if things go wrong.

Recognising the High-Risk Profile

Putting all of these pieces together, MetaChainFX.com displays many of the red-flags associated with unsafe or possibly fraudulent trading platforms:

Lack of verifiable, transparent regulation

Opaque corporate identity and ownership

High-yield or plan-based returns inconsistent with market reality

Easy deposit, unclear or potentially obstructed withdrawal

Hidden costs or unclear fee structure

Marketing heavy on promise, light on risk

New domain, shared hosting, low trust score

Support that appears strong pre-deposit, weak post-deposit

While none of these alone guarantees that you will lose money, the combination of them significantly raises your risk. Anyone considering MetaChainFX.com should exercise extreme caution, ask critical questions, verify documentation and consider alternatives.

How GainRecoup.com Can Help Individuals Who Have Lost Funds

If you have already deposited funds into MetaChainFX.com and are now experiencing difficulty withdrawing, unclear conditions, disappearing support or simply feeling stuck, GainRecoup.com provides a structured, organised approach to help you work through your options and gather the materials you may need.

1. Timeline & Evidence Building

GainRecoup assists you in collecting and organising:

Screenshots of your dashboard, account statements, trade history

Deposit receipts, payment confirmation (bank transfer, card, e-wallet)

Communication logs with the platform, support messages, chat transcripts

Promised returns, account plan descriptions, screenshots of the website at the time of joining

Everything is compiled into a coherent timeline of events—a valuable asset when you next approach your bank, payment provider, or other relevant channel.

2. Platform Claim vs Reality Analysis

They help highlight key discrepancies, such as what MetaChainFX.com promised (high returns, fast withdrawals, regulation) vs what you actually experienced (delays, unverified regulation, extra fees). Such comparisons strengthen your case and clarify what you can present.

3. Payment Pathway Review

They guide you to identify which payment methods you used (bank wire, card, crypto) and the associated options for each. For instance, card payments may offer charge-back opportunities, while crypto payments require different approaches. GainRecoup helps you understand which route suits your situation.

4. Documentation & Next-Step Guidance

GainRecoup doesn’t just gather info—they help you prepare a well-organized document pack you can use for follow-up. They also provide guidance on what to do next, how to present your case clearly, what questions to ask, how to escalate and what forms of documentation matter most.

5. Empathetic, Inclusive Support

Losing funds online can be stressful. GainRecoup approaches each case without judgement, recognising anyone can be targeted—regardless of experience level. Their support emphasises clarity, empowerment and calm organisation so you can move forward with greater confidence.

Final Thought

MetaChainFX.com might look slick, modern and inclusive—but beneath the surface is a platform exhibiting multiple patterns synonymous with high-risk trading environments: weak or unverifiable regulation, unclear corporate identity, unrealistic return promises, opaque withdrawals and cost frameworks, heavy marketing and new domain presence.

In the online investment world, credibility is built on transparency, clear regulation and account control—not just visual gloss and bold promises. If you’re evaluating MetaChainFX.com, or any platform like it, make sure you have answers to: “Who runs it? Is it regulated? Can I withdraw easily? Are the fees clear?”

If you’re already involved and feel stuck, you don’t have to navigate the uncertainty alone. GainRecoup.com can help you organise your case, document your experience and explore your options with clarity and structure.