When exploring online investment opportunities, a name that’s recently surfaced is MGLuxembourg.cm. It markets itself as “MG Luxembourg – A Reliable Broker,” promising high returns, trading services, and professional support. But beneath that polished branding lie numerous red flags and warning signs that suggest this platform is very likely fraudulent. Here’s an in-depth look at what raises suspicion, why many consider it a scam, and what indicators to watch out for.

What MGLuxembourg.cm Claims

MGLuxembourg.cm positions itself as a financial broker or investment service, suggesting it offers:

Access to trading markets: forex, indices, or asset classes

High returns or “exclusive” profit margins

Professional dashboards, client portals, signal tools, or trading platforms

Customer support, account options, and ease of deposits

The branding leans on the name “Luxembourg” to suggest legitimacy or regulatory association with the financial reputation of Luxembourg-based firms. But a name alone doesn’t guarantee authenticity.

Key Warning Signals & Red Flags

Here’s a breakdown of the most concerning signs that MGLuxembourg.cm is likely operating as a scam rather than a legitimate broker.

1. Flagged by Reputable Institution (M&G)

One especially telling sign is that established financial institutions have publicly disavowed any connection to MGLuxembourg.cm. For example, M&G Investments has explicitly issued a fraud alert stating that MGLuxembourg.cm is not associated with M&G plc or its subsidiaries, and labeling it as fraudulent. The warning insists that any activity via MGLuxembourg is not legitimate.

Additionally, M&G confirms that MGLuxembourg does not have supervision by CSSF (Luxembourg’s financial regulator). This disassociation with a well-known institution is a strong indicator of deceptive intent.

2. Regulatory Blacklist / Warnings

The Italian securities regulator (CONSOB) has included MGLuxembourg.cm in a list of unauthorized platforms whose websites are to be blacked out in Italy. This kind of regulatory action shows that in at least one major jurisdiction, the platform is considered abusive or operating illegally.

Being blacklisted by a financial regulator often follows patterns of consumer harm or fraud complaints.

3. Lack of Licensing / Oversight

A truly credible broker or financial services provider operates under regulation. But MGLuxembourg.cm lacks any public record of licensing or registration with financial authorities. No evidence exists of oversight, audits, or compliance with recognized regulatory frameworks. Without supervision, user funds, operations, and internal processes are opaque and unaccountable.

4. Deceptive Branding & Misleading Use of Names

The platform uses branding intended to evoke trust: “Luxembourg,” “MG,” “Luxembourg cm,” etc. This is a tactic to exploit associations with regulated financial centers. But usage of a country name or mimicry of corporate branding does not equate to genuine legitimacy. It’s a common method used by fraudsters to appear credible.

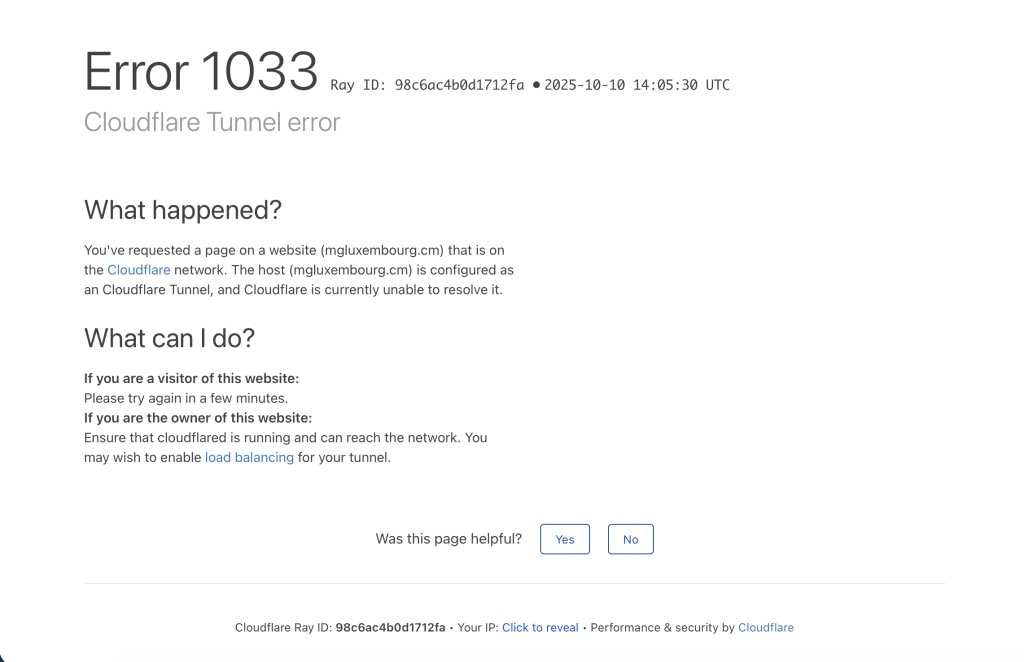

5. Domain Masking, Anonymity & Newness

Scam sites often conceal their true ownership and registration details. MGLuxembourg.cm likely uses privacy or proxy registration to mask WHOIS ownership. The relative newness of the domain and lack of past track record further compound risk.

Anonymity helps the operators avoid accountability, making it difficult to trace or hold them responsible.

6. Promises of High Returns & “Guaranteed” Profits

MGLuxembourg.cm’s promotional claims of high or consistent gains are inconsistent with real financial markets, which are volatile. When a platform claims near-guaranteed returns, minimal risk, or overperformance, that’s a red flag: real investments do not come without risk.

7. Withdrawal Issues, Hidden Fees & Obstructions

A pattern reported in many scam cases is:

Deposits accepted smoothly

When withdrawal is requested, new demands appear: “verification,” “processing fees,” or “compliance charges”

Delays, rejections, or outright refusal of withdrawals

Support becomes unresponsive or vanishes

These tactics trap funds and frustrate users trying to access their money.

8. Fake Dashboard or Simulated Activity

MGLuxembourg.cm likely uses a manipulated trading interface to show profitable trades, balances increasing, and “signal” alerts — all to persuade users that the platform works. These simulations are disconnected from real financial markets and controlled entirely by the operators.

9. Clone Sites and Name Variants

Once flagged, fraud operators often spin up alternate domains or clones under similar names in order to continue operations under a new identity. Users may be misled to trust variants thinking they are legitimate. MGLuxembourg.cm may already be part of such a network.

How the Scam Modus Operandi Probably Works

By combining common fraud patterns with the specific signals around MGLuxembourg.cm, here’s the suspected operational flow:

Recruit & Advertise

Users are drawn in through ads, social networks, affiliate promotions, or cold outreach claiming high returns.Initial Deposit

The platform encourages users to fund accounts quickly, with promises of fast returns or bonuses.Simulated Success

The platform shows fabricated profits, trades, and dashboard growth to build user confidence and prompt additional deposits.Upselling & Pressure

Users are urged to deposit more funds, upgrade accounts, or pay for “premium” features that supposedly boost returns.Withholding Withdrawals

When users try to withdraw, they get delayed, blocked, or saddled with unexpected demands or fees that block access.Support Disappears / Site Shutdown

Operators vanish, communication stops, servers go offline, or sites rebrand or disappear.

Real-World Complaints & Reports

Although detailed user complaints tied specifically to MGLuxembourg.cm are not always publicly documented, several contexts strengthen suspicion:

M&G’s own fraud alert disavows any legitimate link to MGLuxembourg, indicating that the branding is deceptive.

Regulatory blacklists (e.g. CONSOB’s) list the site among unauthorized platforms in Italy.

Reputation services that assess domain trust report low confidence due to anonymity, new domain registration, and lack of transparency.

Video reviews and domain trust checkers report that MGLuxembourg.cm has very low trust scores and users have trouble withdrawing.

These types of reports, taken together, reinforce the conclusion that the platform is not trustworthy.

Broader Impacts & Risk for Users

Platforms like MGLuxembourg.cm can cause serious harm:

Financial Loss: Investors may lose most or all of their deposited funds.

Emotional Stress: Frustration, anxiety, and regret commonly follow.

Difficulty of Recourse: Hidden operators, anonymous domain registration, and cross-border operations make accountability challenging.

Erosion of Trust in Digital Finance: Scams like this can degrade confidence in legitimate platforms.

Collateral Damage to Affiliates/Influencers: People who unwittingly promote such scams can damage their own reputations when their audience loses money.

Tips for Spotting Platforms Like MGLuxembourg.cm

While this review avoids recovery advice, here are lessons you can apply in general:

Verify regulation first — check official public registries to see if the platform is authorized.

Demand transparency — legal entity, address, audited statements, executive disclosures.

Test with small amounts — see if withdrawal works before depositing more.

Beware of guaranteed returns — real markets don’t promise them.

Search for institutional warnings — credible entities disavowing the site are strong signals.

Be cautious with branding mimicry — similarity to known names is sometimes intentional deception.

Final Assessment

MGLuxembourg.cm exhibits multiple critical warning signs:

Strong disavowal by a respected financial brand (M&G)

Inclusion in regulatory blacklists

No licensing or oversight

Deceptive naming and branding

Hidden ownership and domain anonymity

Simulated dashboards and withdrawal hurdles

Taken together, these suggest that MGLuxembourg.cm is a high-risk platform that aligns with known scam structures rather than a legitimate investment service.

If you’re evaluating an online broker or investment platform, exercise caution, demand verification, and treat any site that checks many of these red-flag boxes with skepticism. Safety in investing always starts with verifying legitimacy before depositing funds.

HOW GAINRECOUP.COM CAN HELP YOU.

Gainrecoup.com ensures peace of mind by guiding you through a secure, professional process to recover funds lost to the mgluxembourg.cm, restoring confidence and helping you reclaim what’s yours.