Overview

NFT-Profit.io presents itself as a fast, simple path into the world of NFTs and digital assets. The website’s tone is confident and glossy: it hints at cutting-edge technology, “intelligent” trade decisions, and quick wins even for complete beginners. The pitch is familiar—low friction, high returns, very little effort required.

Look closer, and a different story emerges. The platform’s funnel emphasizes rapid signup and a quick deposit before any clear demonstration of capability. Technical terms like “AI,” “automation,” and “smart analytics” appear repeatedly but without concrete, verifiable detail. The result is a website that feels more like a marketing engine than a transparent product.

This review breaks down the platform’s claims, onboarding flow, technology story, and credibility signals, so readers can evaluate the risk themselves—in clear, accessible language.

What NFT-Profit.io Promises

The website messaging typically includes:

“AI-powered” decision making for NFT opportunities and crypto-adjacent trades.

Beginner-friendly onboarding in minutes, no complicated steps.

High success rates implied through bold headlines and confident testimonials.

Automation that removes the need for expertise.

These points are persuasive, especially for newcomers who want a simple start. But the promises rest on claims rather than proof. There are no transparent performance audits, no verified track records, and no independent validation of the platform’s results. When performance data is missing or vague, the marketing language does the heavy lifting.

The Onboarding Funnel: Fast, Urgent, and Deposit-First

A common pattern across similar sites appears here as well:

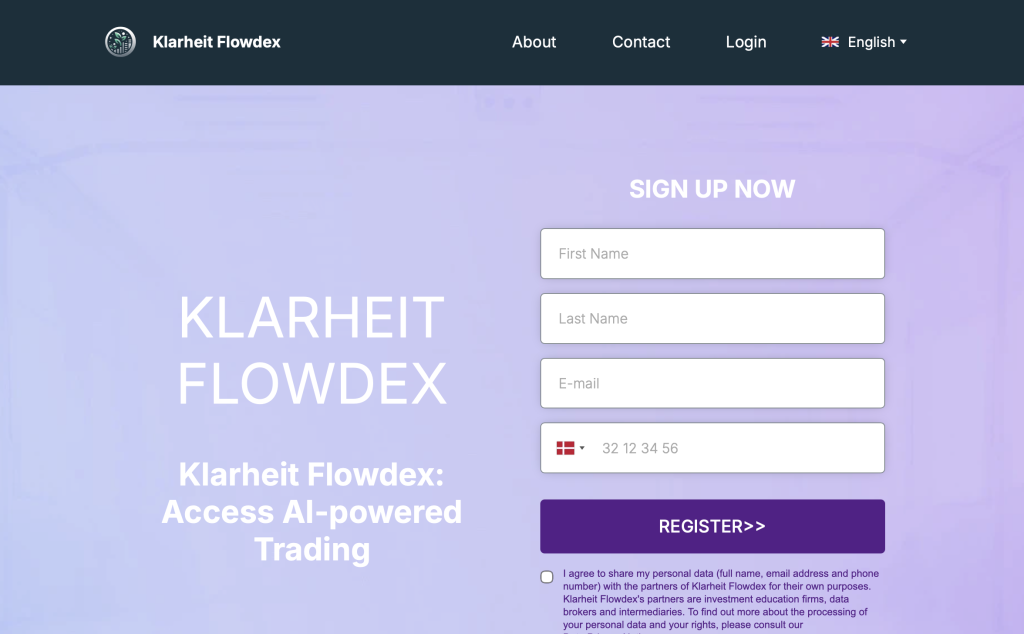

Lead Capture: The homepage invites you to enter name, email, and phone number almost immediately.

Urgency Cues: Copy suggests “limited availability” or “high demand,” nudging quick action.

Minimum Deposit Prompt: Shortly after registration, users are encouraged to place a minimum deposit to “activate” or “unlock” features.

Third-Party Hand-Off: In some flows, users are passed to a “broker partner” to hold funds or execute trades—introducing an extra layer of opacity.

Thoughtful, user-centric platforms generally allow thorough exploration before payment—think read-only demos, sample dashboards, and clear documentation. A deposit-first approach is a red flag, especially when combined with vague product disclosures.

The “AI” Story: Big Word, Little Detail

“AI” is powerful technology—and an even more powerful marketing term. NFT-Profit.io leans on it heavily, yet provides no technical transparency that informed readers would expect. Questions that remain unanswered include:

What data sources and signals are used?

What type of strategy is claimed (trend following, mean reversion, arbitrage, calendar signals, or NFT drop analytics)?

What risk controls exist (position limits, stop-loss rules, drawdown caps)?

Is there time-stamped, independently verifiable performance history?

Without high-level disclosures, “AI” reads more like a brand label than a verifiable capability.

Ownership, Licensing, and Accountability

For any platform inviting deposits or facilitating trades, three essentials should be easy to find:

Clear ownership details: legal entity, jurisdiction, and contact channels beyond a single web form.

Licensing or registration: appropriate to any financial or brokerage-like activity claimed.

Direct accountability: a physical office address or corporate presence that can be verified.

Where these details are missing, partial, or buried, the platform’s risk profile rises. If you can’t quickly identify who is behind the site and under what rules they operate, you can’t realistically assess recourse if something goes wrong.

Testimonials, Logos, and “As Seen On” Flair

Many high-risk websites use generic testimonials and a wall of media logos. Readers should watch for:

Stock-style photos attached to first names only.

Vague success stories with no specifics, dates, or verifiable context.

Media badges that suggest coverage but don’t link to confirmable features.

These signals aren’t proof of wrongdoing on their own—but when they appear alongside a deposit-first funnel and unverified “AI” claims, they strengthen a pattern of marketing over evidence.

Product Experience and UX Signals

Polished visuals can hide weak substance. Read the interface like a contract:

Overpromising: Words like “guaranteed,” “fail-proof,” or “win rate above 90%” deserve skepticism.

Inconsistent language: Switching between “platform,” “bot,” “broker,” and “partner” without clarity.

One-way communication: A contact form that collects your details, but no transparent support commitments in return.

Opaque pricing: If fees, spreads, or commissions exist, they should be clearly presented up front, not discovered when you try to withdraw.

Trustworthy services build confidence through clarity—not pressure.

Deposits, Withdrawals, and the “Unlock” Loop

A recurring complaint across look-alike sites is the asymmetry between deposits and withdrawals:

Deposits are usually seamless and immediate.

Withdrawals become complicated: additional “verification,” “clearance,” or unexpected “processing” or “tax” fees may appear.

Upsell loops emerge during withdrawal attempts (“add funds to unlock,” “cover fees to release profits”), extending the process.

A credible platform strives for symmetry—clear, consistent timelines and steps for both depositing and withdrawing, without surprise conditions.

Data Handling: Privacy and Security Considerations

If a website requests identity documents, payment details, or crypto wallet addresses, look for:

A specific, comprehensive privacy policy that explains collection, use, storage, and sharing—without boilerplate vagueness.

Data minimization: only asking for what’s truly necessary.

Secure submission paths: not generic forms that feel like simple lead capture.

When sensitive data is requested without strong, believable controls, the risk goes beyond money to identity exposure.

Why So Many Sites Look Alike

NFT-Profit.io appears to share patterns with a broader cluster of websites:

Familiar landing-page layouts, color palettes, and hero sections.

Nearly identical value propositions and minimum deposit language.

Recycled boilerplate with brand-name swaps.

This cloning signals a template ecosystem focused on aggressive lead generation rather than long-term product development. For readers, the core insight is to evaluate structure as much as slogans.

Accessibility and Inclusive Language

Financial tools should empower everyone—newcomers and experienced users alike. Strong platforms:

Explain risks in plain, respectful terms.

Avoid pressuring people into fast decisions.

Provide learning resources and demo access to help people understand features before committing funds.

When messaging leans on hype (“anyone can profit in minutes”), it can overshadow essential context and create false confidence—especially for people exploring NFTs or trading for the first time.

FAQs

Is NFT-Profit.io a legitimate platform?

The public information available is not sufficient to confirm legitimacy. The website’s strong claims are not matched by transparent ownership, licensing, or verifiable performance data.

Does “AI” in NFT-Profit.io guarantee profits?

No. Markets are dynamic, and no system can guarantee results. “AI” without disclosed methods or independently verified outcomes should be treated as a marketing claim, not a guarantee.

Why is a minimum deposit a concern?

A mandatory deposit before meaningful product access suggests the site prioritizes fund capture over user education. Responsible platforms usually allow significant exploration first.

Are the testimonials trustworthy?

Testimonials that lack detail, dates, or verifiable identities should not be considered proof. Treat them as promotional content.

What about withdrawals?

Reports around similar funnels indicate friction at withdrawal time, including extra steps or fees. A credible service publishes clear, consistent withdrawal rules and meets them.

Key Takeaways

High claims, low disclosure: Big promises around “AI” and profitability without proof.

Deposit-first design: Quick capture of contact data and funds, with limited pre-deposit transparency.

Opacity around ownership and licensing: Difficult to identify who runs the platform and under what rules.

Recycled website patterns: Similar copy, layout, and tactics seen across many high-risk sites.

Elevated risk signals: Especially around withdrawals, fees, and vague terms.

None of these indicators alone proves intent—but together, they form a coherent risk profile that readers should weigh carefully.

Conclusion

NFT-Profit.io presents a confident story about fast, automated success in NFTs and digital assets. Yet the deposit-first funnel, vague technology narrative, unclear licensing, and reliance on marketing over evidence all point in the same direction: this is a high-risk website pattern that deserves careful scrutiny.

Trust online platforms that earn it through clarity, transparency, and verifiable results—not through urgency cues, recycled design, and buzzwords. Until the fundamentals are explained and independently supported, readers have every reason to approach NFT-Profit.io with caution and to prioritize platforms that demonstrate accountability from day one.

Empowering Victims: Taking a Stand Against Scams with GAINRECOUP.COM

If you have fallen victim to a scam, it is important to understand that you are not alone and you still have options. Scammers exploit the trust of their victims, but organizations like GAINRECOUP.COM work tirelessly to combat these frauds with integrity and expertise.