Introduction

The rise of online trading has created countless opportunities for legitimate investors—but it has also opened the door for deceptive platforms pretending to offer professional trading services. PrimeFXGlobal.com is one such platform that presents itself as a trusted broker promising steady returns, fast withdrawals, and cutting-edge trading technology. However, behind its sleek design and confident marketing lies a range of warning signs that point to potential fraud.

This review breaks down the key elements of PrimeFXGlobal.com—how it operates, what red flags are visible, and why its structure resembles many high-risk investment traps circulating online. The purpose of this analysis is not to accuse but to help readers recognize patterns of deception and make informed, cautious decisions.

The First Impression: Professional Appearance, Problematic Depth

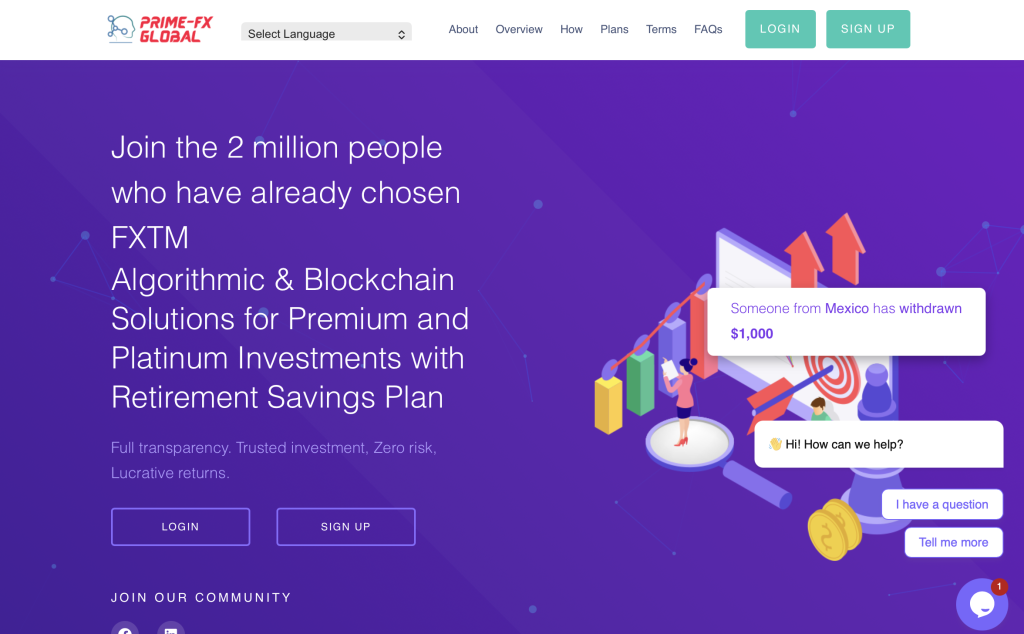

At first glance, PrimeFXGlobal.com looks convincing. Its interface is clean, the language confident, and the visuals emphasize success and simplicity. But as with many unregulated brokers, that initial impression quickly fades once you start looking deeper.

The site’s content focuses heavily on fast profits, automated trading bots, and guaranteed returns—claims that no regulated broker would ever make. What’s missing are the fundamentals:

Verified company registration or business license

Clear management or team details

Transparent risk disclosures

Verifiable physical office addresses

Instead, users are met with generic statements about “global compliance” and “AI-driven profit generation,” without any third-party validation or supporting evidence.

When a platform relies on presentation rather than proof, it’s a strong indication that the design is meant to attract, not inform.

The Regulation Problem

Regulation is what separates legitimate brokers from anonymous operators. Regulated companies must follow strict financial and consumer-protection rules, including fund segregation, audits, and dispute-resolution systems.

PrimeFXGlobal.com fails to provide any verifiable licensing information. While it might claim to be “registered” or “authorized,” there is:

No mention of a regulator’s name (like the FCA, ASIC, or CySEC).

No license number that can be verified on a public register.

No corporate entity listed that matches the trading brand.

Some questionable platforms even post a “registration certificate” as proof—but registration is not regulation. Anyone can register a company name; only licensed institutions can handle client funds under supervision.

Without regulatory oversight, there’s no authority to hold PrimeFXGlobal.com accountable for unfair practices, delayed withdrawals, or misrepresentation.

Unrealistic Profit Promises

Another red flag that stands out is the language of guaranteed success. Throughout its website, PrimeFXGlobal.com highlights effortless wealth—phrases such as “assured returns,” “AI-powered consistency,” and “risk-free profits.”

However, in real markets, no strategy can eliminate risk or guarantee results. Financial markets are inherently volatile, and any entity claiming otherwise is misleading users.

In addition, the platform’s supposed performance metrics—often displayed as dashboards showing rapid gains—are unverifiable. There’s no third-party audit, no trading history, and no mention of how the profits are generated.

A common tactic in scam operations is to simulate profits on the user’s screen to encourage larger deposits. The figures may look real, but they’re just numbers on a web interface with no connection to actual trading activity.

Deposits, Bonuses, and Withdrawals

One of the most consistent complaints across high-risk trading sites involves the deposit-withdrawal trap. PrimeFXGlobal.com appears to follow a similar pattern.

Step 1 – Easy Deposits

The platform accepts deposits quickly, often through cryptocurrency or third-party processors. These payment methods are difficult to trace or reverse, giving users no realistic path to dispute a transaction.

Step 2 – “Bonus Offers”

Bonuses are marketed as incentives, but they usually come with hidden terms—such as minimum trade volumes or “account upgrades” that prevent withdrawals until certain conditions are met.

Step 3 – Blocked Withdrawals

When investors attempt to withdraw, they often encounter surprise conditions like:

Additional verification fees

Required tax or liquidity payments

Demands to “unlock” the account by depositing more

The result is frustration, confusion, and eventual loss. Legitimate brokers never tie withdrawal access to extra payments.

The Pressure Playbook

PrimeFXGlobal.com uses the same psychological techniques seen in dozens of similar schemes:

Urgency tactics: Countdown timers, “limited slots,” and “offer expires today.”

Persistence: Frequent follow-up calls or messages from “account managers” pushing for higher investments.

Authority tone: Representatives claiming insider knowledge or government-linked approval.

Isolation: Advising clients not to “speak to banks” or “trust outside advisors.”

These manipulative tactics are designed to wear down hesitation and make people act emotionally instead of logically.

The Transparency Test

Transparency is the easiest way to test a platform’s credibility. If you can’t answer the following questions with clear, verifiable information, you’re likely dealing with a deceptive business:

Who owns the company?

Which regulator oversees it?

What is the company’s legal address?

Where are the customer funds held?

Can I withdraw at any time without extra fees?

PrimeFXGlobal.com provides vague or no answers to these. Generic claims like “our offices are in London” or “regulated under international law” are meaningless unless backed by official documentation.

Testimonials and Reviews

Fake testimonials are another common feature. Many of the “reviews” displayed on sites like PrimeFXGlobal.com use stock photos, generic names, or even AI-generated images. Comments like “I earned $10,000 in my first week!” or “This platform changed my life!” are red flags, not endorsements.

Real brokers rarely need exaggerated praise. Their reputations are built on transparency, verified audits, and customer satisfaction backed by independent review platforms—not on fabricated success stories.

Customer Support and Communication Gaps

Another indicator of deception is the inconsistency in communication. Users report that customer service is responsive before depositing, but unhelpful—or even unresponsive—once withdrawal requests are submitted.

Some platforms go further, closing accounts or cutting communication entirely after a client challenges them. Reputable brokers have clear escalation channels, complaint processes, and regulated dispute-resolution systems.

PrimeFXGlobal.com does not appear to have any of these structures in place.

Technical and Security Concerns

While the site looks sophisticated, closer inspection reveals technical inconsistencies:

No SSL certificate details confirming secure data encryption.

No verified corporate email domain (often free Gmail or Outlook addresses).

No privacy statement specifying data protection standards.

No platform audit confirming real trading technology behind its interface.

These gaps raise concerns about both financial safety and data privacy.

Red Flags Summary

| Category | Warning Sign | Why It Matters |

|---|---|---|

| Regulation | No verifiable licence or oversight | No accountability or consumer protection |

| Ownership | Anonymous entity | Hides liability and evades legal responsibility |

| Returns | Guaranteed profits | Impossible in real trading environments |

| Deposits | Crypto or untraceable methods | Difficult to recover or dispute |

| Withdrawals | Delays, fees, “unlock” conditions | Classic scam pattern |

| Communication | Pushy before deposit, silent after | Manipulative intent |

| Transparency | Missing company details | Concealment of risk and control |

Balanced Verdict

Based on the evidence, PrimeFXGlobal.com shows multiple characteristics of a high-risk and potentially fraudulent investment platform. Its lack of regulation, unrealistic return claims, hidden withdrawal conditions, and misleading marketing language collectively signal that this is not a trustworthy broker.

While the platform might appear legitimate on the surface, deeper analysis reveals too many inconsistencies for investors to feel confident or secure. Until it can provide verifiable regulation, transparent fee structures, and proven withdrawal reliability, users should consider PrimeFXGlobal.com unsafe for financial engagement.

Smart Investor Checklist

Before depositing funds with any online trading platform, always confirm:

The company’s legal entity and registration details.

The regulator’s official licence number and database listing.

The existence of a clear, public withdrawal policy.

That all fees are published upfront—no “unlock” or “upgrade” fees.

Independent third-party reviews or audits.

Secure payment channels with dispute rights.

Transparent customer support and office contact details.

If a platform fails any of these steps, it’s safer to walk away.

Frequently Asked Questions

Is PrimeFXGlobal.com a regulated broker?

There is no verifiable evidence of regulation or licensing. Any claims to the contrary appear unsubstantiated.

Can PrimeFXGlobal.com guarantee profits?

No legitimate broker can guarantee profits. Financial markets always involve risk, and “guaranteed” returns are a hallmark of deception.

Why can’t users withdraw funds?

Reports indicate withdrawal delays or additional “fees” required to release funds—tactics commonly used by unregulated platforms to stall or prevent withdrawals.

What should I look for in a genuine trading platform?

Look for proper licensing, transparent ownership, realistic profit expectations, clear withdrawal rules, and strong customer transparency.

Empowering Victims: Taking a Stand Against Scams with GAINRECOUP.COM

If you have fallen victim to a scam, it is important to understand that you are not alone and you still have options. Scammers exploit the trust of their victims, but organizations like GAINRECOUP.COM work tirelessly to combat these frauds with integrity and expertise.

Conclusion

PrimeFXGlobal.com presents itself as a modern, global trading brand, but its lack of regulatory oversight, unverified profit claims, and withdrawal complications tell a different story. Every indicator points toward a platform that prioritizes deposits over customer protection.

Investors should treat this as a high-risk operation and apply the same skepticism to any similar website promising quick, effortless profits. Legitimate investing is about verified transparency, not blind trust.

By staying informed, asking the right questions, and verifying before investing, users can protect themselves from platforms that rely on persuasion instead of proof.