In today’s digital finance world, thousands of websites claim to help you grow your money through forex, crypto, or stock trading. Yet behind the modern designs and bold claims, many of these platforms hide deceptive operations intended to exploit investors. One name drawing increasing attention is SmartOptionFX.icu — a supposed trading and investment service that promises consistent profits with “zero risk.”

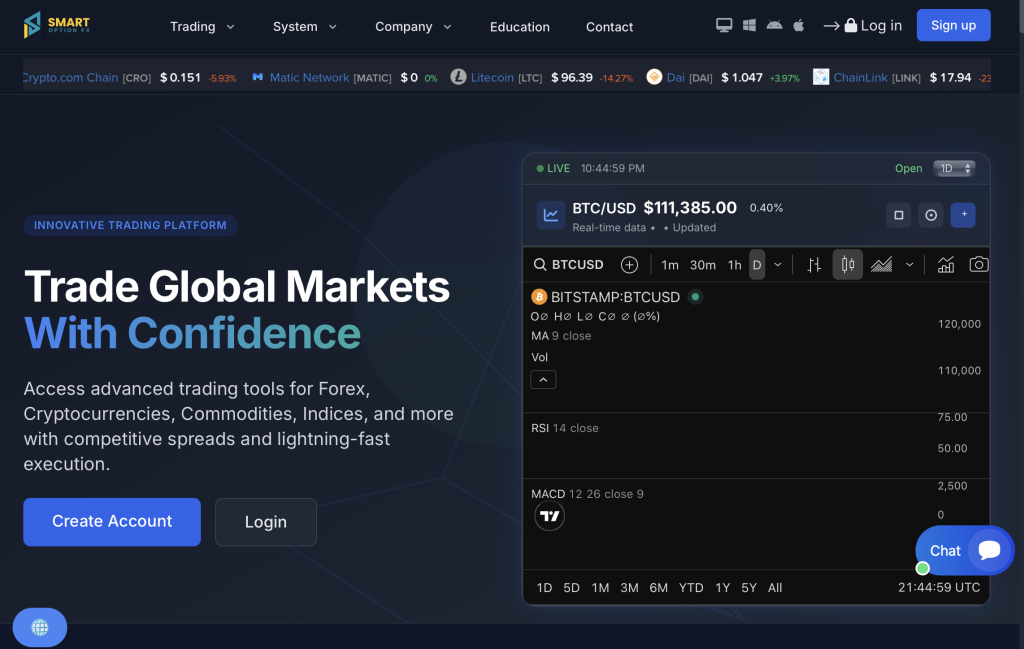

At first glance, the site looks professional: slick interface, moving charts, and confident messaging. But the closer you look, the more inconsistencies appear. This comprehensive SmartOptionFX.icu scam review exposes how the platform operates, the tactics it uses to appear legitimate, and why investors should treat it as a serious red flag in the trading industry.

The Image SmartOptionFX.icu Tries to Project

SmartOptionFX.icu introduces itself as a global financial trading company providing access to forex, crypto, and commodities markets. It claims to use AI-powered technology and professional trading teams to generate stable profits for investors worldwide.

Its homepage features:

Eye-catching slogans like “Trade Smart, Earn Fast.”

Graphs showing fake real-time trading data.

Promises of up to 10% daily profits depending on your account plan.

“Instant withdrawals” and “24/7 expert support.”

To the untrained eye, these features suggest credibility. But to anyone familiar with regulated finance, they reveal a concerning pattern: over-promising, under-proving.

The Reality: No Regulation, No Transparency, No Accountability

Every legitimate broker must operate under a recognized financial regulator. This ensures that investor funds are protected, trading data is accurate, and legal recourse is available if problems occur.

SmartOptionFX.icu claims to be “fully licensed,” but provides no evidence of regulation—no license number, no governing authority, and no registration certificate. Searches across global databases such as the Financial Conduct Authority (FCA) and CySEC return zero results.

Without oversight, SmartOptionFX.icu can:

Hold client funds without segregation.

Manipulate “trading results” displayed on dashboards.

Deny withdrawals with no legal consequences.

A company that refuses to show proof of regulation is not operating legitimately—it’s simply relying on investors not checking.

Hidden Ownership and Fake Credibility

Transparency is the cornerstone of any trustworthy business. Genuine investment platforms disclose their leadership, provide verifiable contact details, and operate from registered offices.

SmartOptionFX.icu hides everything. The site lists no directors, no corporate name, and no physical address. Even its “About Us” page is filled with generic phrases about “innovation” and “trust,” without naming a single real person.

The testimonials featured on the site are equally suspect. Reverse image searches show that the photos are stock images available freely online. This is a common trick used by fraudulent companies to build false credibility and social proof.

The SmartOptionFX.icu Operation Model — How the Scam Works

Like many deceptive investment sites, SmartOptionFX.icu follows a well-designed pattern aimed at attracting, manipulating, and eventually trapping investors.

Step 1: The Hook

The journey begins with targeted advertising—usually on social media or through email marketing. Ads promise quick profits, easy registration, and automated trading success. Some even include fake endorsements from celebrities or supposed financial analysts.

Step 2: The Fast Deposit

After signup, investors are urged to make a small initial deposit—sometimes as low as $250. The platform emphasizes crypto payments such as Bitcoin or Tether, which are untraceable and irreversible once sent.

Step 3: The Fake Dashboard

Once the funds arrive, users gain access to a dashboard showing profitable trades. In reality, these are simulated resultsprogrammed to mimic success. The illusion builds confidence and pushes users to invest larger sums.

Step 4: The Blocking Phase

When users eventually attempt to withdraw funds, SmartOptionFX.icu introduces new “procedures.” These may include:

Verification fees or tax payments that must be sent before release.

KYC delays that drag on for weeks.

Or outright account suspension once too many questions are asked.

Step 5: Silence or Disappearance

After enough deposits are collected, support stops responding. Emails bounce, chat systems close, and in some cases the domain itself goes offline. Victims are left with no refund options and no contact path.

Ten Red Flags That Prove SmartOptionFX.icu Is a Scam

No verified license or registration with any financial authority.

Anonymous team—no ownership or leadership disclosed.

Unrealistic return promises such as guaranteed 10% daily profit.

Fake testimonials using stock photos.

Crypto-only deposits, preventing chargebacks or refunds.

Hidden fees disguised as withdrawal or verification costs.

Recently registered domain with minimal online history.

Lack of risk disclosure—a requirement for any real broker.

Pressure tactics from so-called “account managers.”

No customer protection policies or independent audit reports.

These warning signs are not minor oversights—they’re the foundation of the entire operation.

Why People Still Fall for It

Even experienced traders can fall victim to such schemes because SmartOptionFX.icu uses psychology, not finance, to close the deal.

Professional presentation: The website’s design, graphs, and language create an illusion of legitimacy.

Small entry point: The minimum deposit is low enough to seem harmless.

Fake confidence: Seeing “profits” rise daily convinces users to add more money.

Urgency: Limited-time bonuses and “VIP upgrade offers” push fast decisions.

Relationship building: Representatives act friendly and persistent, gaining emotional trust before asking for larger deposits.

By the time doubt sets in, the user has already committed significant funds.

How SmartOptionFX.icu Differs from Legitimate Brokers

| Feature | Regulated Broker | SmartOptionFX.icu |

|---|---|---|

| Regulatory License | Verified by FCA, CySEC, or ASIC | None listed anywhere |

| Transparency | Clear ownership, address, and legal entity | Anonymous and hidden |

| Profit Claims | Realistic and market-based | Guaranteed daily returns |

| Withdrawals | Straightforward and secure | Delayed, blocked, or denied |

| Client Funds | Held in segregated accounts | No proof of segregation |

| Customer Support | Professional and traceable | Scripted and evasive |

This table highlights one fact: SmartOptionFX.icu fails every fundamental test of legitimacy.

Reports and Common Complaints

Across online trading communities and discussion forums, multiple investors have shared similar experiences with SmartOptionFX.icu:

Withdrawals denied or “pending” for weeks.

Additional payments requested before releasing funds.

Profit numbers manipulated to encourage reinvestment.

Customer service disappearing after the final deposit.

Phone calls from new “managers” using high-pressure tactics.

These repeated patterns confirm that the problem isn’t user error—it’s the platform’s business model.

How to Identify and Avoid Platforms Like SmartOptionFX.icu

Always verify regulation. Search for the company name or license number directly on regulator websites.

Research the domain. Use WHOIS tools to check when it was created—most scams are under one year old.

Be skeptical of guaranteed returns. Legitimate trading involves risk and transparency.

Check real reviews. Look for feedback on independent forums, not on the platform’s own site.

Test withdrawals early. Deposit the smallest amount possible and attempt a withdrawal before adding more.

Avoid crypto-only deposits. These methods are irreversible if things go wrong.

Watch for urgency. Real investment opportunities don’t pressure you to act immediately.

Performing these checks can prevent losses and help you spot red flags before sending money.

The Broader Pattern: A Network of Cloned Scams

Investigations into similar cases reveal that SmartOptionFX.icu may not be a standalone operation. It fits the template of clone scams—websites built using identical code and content under new domain names. When one domain gets flagged, another appears with slight rebranding.

This strategy helps fraudsters stay ahead of warnings, targeting new victims who haven’t seen older reports. The pattern reinforces why due diligence is essential before signing up for any “new” broker.

Final Verdict: SmartOptionFX.icu Is a High-Risk Scam Platform

After extensive analysis, it’s clear that SmartOptionFX.icu is not a legitimate trading company. Its structure, marketing style, and lack of regulation point to a deliberate attempt to deceive investors. From fake dashboards to blocked withdrawals, every element serves a single goal: collecting deposits under false pretenses.

If you are looking for safe investment options, only use licensed and verifiable brokers regulated by recognized authorities. Always confirm licenses, check real reviews, and treat any platform promising “guaranteed profits” as suspicious.

SmartOptionFX.icu may appear professional, but behind the design lies manipulation, anonymity, and risk. Investors should avoid it completely and stay alert for similar clones that might appear under new names.

How GainRecoup.com Helps Victims of Smartoptionfx.icu

GainRecoup.com investigates smartoptionfx.icu transactions, gathers evidence, and maps payment paths. Our recovery team liaises with banks, card networks, and exchanges, files chargebacks, and escalates complaints to relevant authorities. You’ll receive a tailored action plan, clear documentation, and persistent follow-up designed to maximize fund recovery and hold smartoptionfx.icu accountable for victims.