If you’ve stumbled upon SoftiTradesPro.com while searching for ways to grow your savings online, you’re not alone. New trading and “investment” websites pop up every week, each promising simple paths to high returns. This review takes a careful, plain-English look at SoftiTradesPro.com—how it presents itself, the claims it appears to make, and the typical red flags you should evaluate before handing over your money or personal data. The goal is a clear, inclusive, and practical guide you can use whether you’re brand-new to trading or already have experience.

Quick Summary (for skimmers)

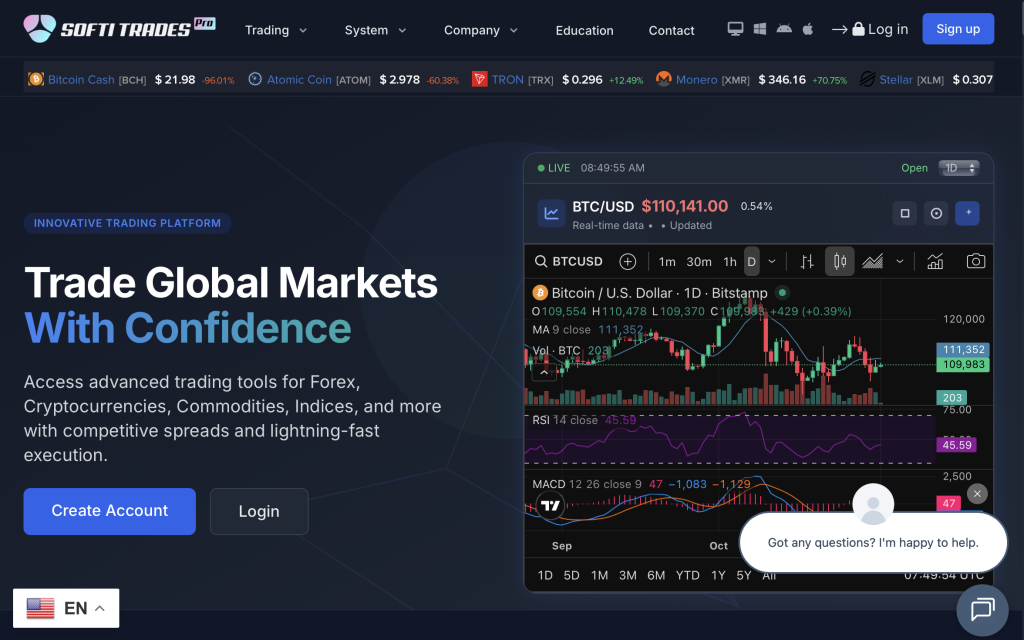

Positioning: SoftiTradesPro.com appears to market fast, high-return online trading and portfolio management.

Core concern: Marketing-level promises may not align with the level of transparency, regulation, and consumer protections that responsible investors usually expect.

Verdict: Proceed with extreme caution. Until transparent ownership, verifiable licensing, and independently auditable performance records are presented, SoftiTradesPro.com does not inspire confidence.

First Impressions: The Pitch vs. Proof

Many trading platforms lead with bold value propositions: “guaranteed profits,” “automated expert strategies,” or “quick withdrawals.” It’s understandable—these promises are attractive. However, credible investment services pair ambition with verifiable evidence. When reviewing any platform like SoftiTradesPro.com, look for:

Clear ownership: A named legal entity, physical address, and executive team with searchable, consistent histories.

Regulatory footprint: Licensing under a recognisable financial authority for the region(s) where clients are solicited.

Track record: Independent audits, verified performance statistics, and risk disclosures that match the product being sold.

Professional communication: Documentation, policies, and educational content written in precise, consistent language.

If a site offers the sizzle but not the steak—nice design but no checkable details—that gap matters.

Company Identity: Transparency Matters

A trustworthy financial service typically provides complete corporate identity upfront: registered company name, jurisdiction of incorporation, registration number, up-to-date addresses, and responsible officers. When that data is thin, vague, or scattered, it creates practical problems:

No clear escalation path if you need to dispute a trade, a fee, or a withdrawal.

Difficult legal recourse because you may not know which jurisdiction’s consumer protections apply.

Limited accountability if the people behind the platform are not identifiable.

If SoftiTradesPro.com doesn’t present that detail clearly and consistently throughout its pages, consider it a significant risk marker.

Regulation & Licensing: Why It’s Essential

Many platforms suggest they operate “globally,” but financial services are licensed locally. If a company claims to offer brokerage, portfolio management, or advisory services, check whether it states:

Which regulator oversees its activities (for example, a securities or financial conduct authority).

Which exact license it holds and the license number you can verify.

Where it’s permitted to onboard clients.

If SoftiTradesPro.com uses general phrases like “fully compliant” without a license number you can verify on a regulator’s register, that’s a red flag. Legitimate providers make verification easy.

Products, Returns, and Risk: Read the Fine Print

A common pattern on questionable sites is promising high or “guaranteed” returns, while burying or glossing over the potential for losses. Sound financial communication will:

Acknowledge market risk, volatility, and the possibility of losing capital.

Provide realistic performance ranges and explain how those results were measured.

Include transparent fee schedules (spreads, commissions, management or performance fees).

Explain withdrawal timelines and any conditions for releasing funds.

If SoftiTradesPro.com describes consistently high gains with little or no discussion of risk, or if the risk section is generic and copy-pasted, treat those claims with skepticism.

Deposits, Withdrawals, and Fees: Look for Specifics

Before funding any account, review the payments page and terms closely:

Funding methods: Are they standard (bank transfer, card) or limited to irreversible rails only?

Withdrawal process: Are timeframes clear? Are there “unlocking” fees or taxes that must be paid to access your own balance?

Additional charges: Are “maintenance,” “upgrade,” or “compliance” fees mentioned after you’ve already deposited?

One especially concerning pattern is when platforms require extra payments to “unlock” withdrawals or to “verify” an account after profits show up on a dashboard. Credible services don’t hold your funds hostage behind surprise fees.

Website Quality Check: Signals in the Details

Even non-technical readers can evaluate a site’s consistency:

Policy suite: Do Terms of Service, Risk Disclosure, Privacy Policy, Complaints Policy, and AML/KYC policy exist and agree with one another?

Language and formatting: Are there typos, contradictory time zones, or mismatched company names?

Contact channels: Is there a real business address, staffed phone line, and professional-grade support portal?

Educational content: Is it substantive and balanced, or is it thin marketing copy pushing you toward a deposit?

If SoftiTradesPro.com lacks complete policy pages, uses generic templates, or shows inconsistent names and addresses across pages, those are warning signs.

Support and Communication: How Responsive Is It?

Legitimate investment services take customer support seriously. Test the waters:

Send a non-committal inquiry and see how support responds.

Ask about regulatory status and request a license number for you to verify.

Ask for a complete fee table and exact withdrawal timelines.

Pay attention to pressure tactics such as “limited-time bonuses,” “VIP upgrade to withdraw,” or urgent reminders to deposit more.

High-pressure sales behavior is inconsistent with client-centric financial services. If SoftiTradesPro.com uses urgency or guilt to push funding, that’s another red flag.

Social Proof and Community: What Counts (and What Doesn’t)

It’s tempting to rely on testimonials or review snippets. Keep in mind:

Anonymous “success stories” without verifiable context are easy to fabricate.

Screenshots of profits inside a platform dashboard prove little; internal numbers can be edited server-side.

Third-party badges without working verification links don’t mean much.

Look for verifiable indicators instead: regulatory entries, real company filings, and consistent identities across professional networks. If SoftiTradesPro.com primarily showcases self-hosted testimonials and slick graphics, treat them as marketing, not proof.

Typical Warning Patterns Seen on High-Risk Platforms

While each website is different, the following patterns frequently appear on sites that should be treated very cautiously. If you encounter any of these on SoftiTradesPro.com, slow down:

No regulator-verifiable license number despite offering financial services.

Unrealistic return language (“guaranteed,” “risk-free,” “fixed daily profit”).

Name inconsistencies between the homepage, policies, and payment pages.

Surprise fees introduced only at the point of withdrawal.

Non-standard funding methods that are hard or impossible to reverse.

Pressure tactics from “account managers” urging larger deposits quickly.

Vague team bios with stock photos or unverifiable backgrounds.

Broken links for compliance, disclosures, or “certificates” that aren’t truly verifiable.

The more of these you observe, the more cautious you should be.

Practical Due Diligence You Can Do Today

You don’t need to be a finance professional to run sensible checks before engaging with a platform like SoftiTradesPro.com:

Verify licensing on the website of the relevant financial regulator for your country or region. Use the regulator’s search tool to check the exact entity name.

Check corporate records in the claimed country of incorporation to confirm the legal entity, directors, and filing history.

Read policies fully, not just headlines. Confirm withdrawal terms and complaint procedures.

Start small if you decide to proceed at all. Avoid large initial deposits.

Document everything—emails, chats, screenshots of terms and balances.

Use secure payment methods that include consumer protections where possible.

These steps won’t guarantee safety, but they dramatically reduce avoidable risks.

Accessibility and Inclusivity: Everyone Deserves Clarity

Financial platforms should be understandable and usable for all. Regardless of experience level, people deserve:

Plain language explanations of products and risks.

Transparent support channels with respectful, timely responses.

Accessible design that works on different devices and assistive technologies.

Non-discriminatory service that treats every client with dignity and patience.

If SoftiTradesPro.com’s materials feel confusing, incomplete, or dismissive of questions, that’s a sign the platform may not prioritize user understanding.

Final Verdict: Should You Trust SoftiTradesPro.com?

Based on the factors above—transparency of company identity, regulator-verifiable licensing, realistic risk communication, and clear withdrawal terms—SoftiTradesPro.com raises multiple concerns that are typical of high-risk online investment websites. The marketing narrative appears stronger than the verifiable facts. Until the platform provides:

A fully verifiable legal entity with matching details across the site and documents,

Regulator-verifiable licensing for the services offered and the regions where clients are solicited,

Auditable performance records and unambiguous risk disclosures,

Transparent, documented fee structures and predictable withdrawal processes,

it is reasonable to treat SoftiTradesPro.com as high-risk and avoid committing funds you cannot afford to lose.

Key Takeaways

Evidence beats promises. Always confirm licensing and company identity independently.

Watch for pressure and surprise fees. Responsible providers don’t rely on either.

Protect your information. Be careful with documents, ID images, and payment data.

If anything feels off, step back. You’re never obligated to deposit or continue.

This review is intended to help you evaluate SoftiTradesPro.com with clear eyes and practical steps. Trust is earned through transparency, consistency, and regulation—not just through polished landing pages or ambitious claims.

Empowering Victims: Taking a Stand Against Scams with GAINRECOUP.COM

If you have fallen victim to a scam, it is important to understand that you are not alone and you still have options. Scammers exploit the trust of their victims, but organizations like GAINRECOUP.COM work tirelessly to combat these frauds with integrity and expertise.