The internet is filled with trading and investment platforms claiming to help users grow their wealth effortlessly. Among these is SpacBrokerage.com, a website that presents itself as a professional brokerage firm offering global investment opportunities. At first glance, the platform’s sleek design, technical jargon, and bold promises might convince unsuspecting investors of its legitimacy. However, a closer look reveals a pattern of deception and inconsistencies that make SpacBrokerage.com a potential scam rather than a genuine investment service.

This comprehensive SpacBrokerage.com scam review examines how the site operates, what red flags it displays, and why anyone considering using it should think twice before depositing a single dollar.

What SpacBrokerage.com Claims

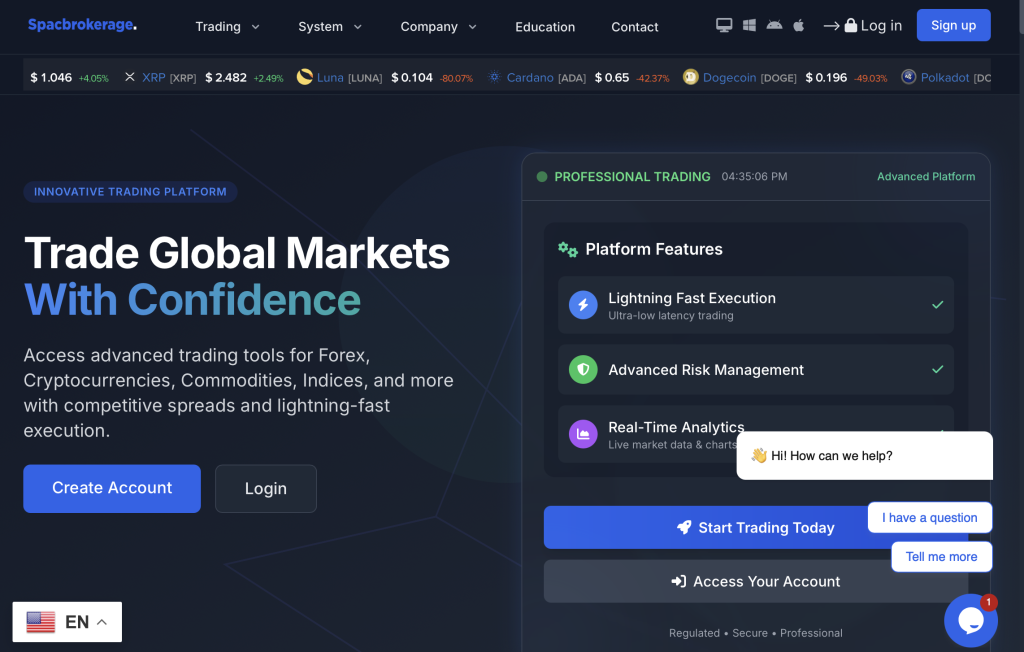

SpacBrokerage.com presents itself as a sophisticated online brokerage, supposedly providing access to financial markets, cryptocurrencies, commodities, and forex trading. The homepage features typical industry language such as:

“Expert financial guidance from experienced analysts.”

“Guaranteed returns with minimal risk.”

“Advanced AI-driven trading tools.”

“Instant withdrawals and 24/7 customer support.”

These statements are designed to build trust quickly. They imply professionalism and security, but without clear evidence or regulatory oversight, they are just marketing claims without substance. In legitimate financial environments, no broker can guarantee profits or eliminate risk entirely.

Is SpacBrokerage.com a Legitimate Platform?

A major issue arises when verifying SpacBrokerage.com’s legitimacy. Transparency is the foundation of trust in the financial world, yet the platform’s structure leaves many questions unanswered. Key indicators of a legitimate broker are missing, including:

Regulatory Licensing:

Genuine brokers list their registration numbers and the financial authority that regulates them—such as the FCA (UK), CySEC (Cyprus), or ASIC (Australia). SpacBrokerage.com offers no verifiable license information.Company Information:

The site lacks clear details about its corporate ownership, physical address, or even a phone number connected to a real office. Vague “About Us” sections are a classic hallmark of high-risk or fake investment sites.Legal Documentation:

Most brokers provide detailed legal documents, including Terms and Conditions, Risk Disclosure Statements, and Privacy Policies. SpacBrokerage.com’s documents are either missing, overly generic, or written in ways that protect the company from liability rather than the investor.Website Age and Domain Data:

Domain checks reveal that SpacBrokerage.com is a newly registered website, which aligns with the pattern of short-lived scam operations that disappear once complaints start to build up.

In summary, the absence of verified regulation, clear company identity, and transparent communication channels suggest that SpacBrokerage.com is not a legitimate broker.

How SpacBrokerage.com Operates

The platform uses a familiar formula seen in many online trading scams: attract, convince, extract, and disappear.

Step 1: The Attraction Phase

SpacBrokerage.com often reaches potential victims through social media ads, email campaigns, and fake testimonials. These ads promise guaranteed profits, easy withdrawals, and professional trading support.

Step 2: Building False Trust

Once a user signs up, they are typically assigned a “personal account manager.” This person’s job is to sound professional and friendly while guiding the victim toward making an initial deposit. The more the user invests, the more attention they receive—until withdrawal attempts begin.

Step 3: Manipulated Dashboard Data

Victims report that their dashboards show impressive profits soon after they deposit. These numbers are not real; they’re designed to create excitement and confidence, encouraging users to invest more money.

Step 4: Withdrawal Barriers

When investors try to withdraw funds, problems begin. The platform suddenly introduces “verification fees,” “taxes,” or “account upgrade requirements.” Each obstacle is a tactic to extract additional money while keeping the victim’s funds trapped.

Step 5: Silence or Disappearance

After repeated withdrawal attempts fail, communication stops. Emails bounce, chat support vanishes, and the website may even go offline temporarily. This pattern matches other investment scam lifecycles—temporary sites built to collect deposits and vanish.

Key Red Flags on SpacBrokerage.com

Here are the major warning signs that expose SpacBrokerage.com’s lack of authenticity:

No Regulatory Oversight:

There is no record of the company with any recognized financial authority.Unrealistic Profit Claims:

Promises of consistent or guaranteed profits are impossible in legitimate trading.Fake Testimonials:

Many of the reviews and success stories appear copied or fabricated using stock photos.Hidden Fees:

Withdrawals are blocked unless users pay undisclosed fees or “compliance” charges.Untraceable Contact Details:

The company’s contact page lists only email forms—no working phone lines or office address.New Domain Registration:

Scam platforms often use new domains that expire within a year to avoid detection.Pressure Tactics:

Account managers use urgency to push users into reinvesting before they can assess risks.

Each of these warning signs by itself may not confirm fraud, but together they form a strong pattern of predatory intent.

Why Users Fall for Platforms Like SpacBrokerage.com

Online scams thrive on emotional triggers. SpacBrokerage.com’s design and sales pitch appeal to:

Greed: The promise of fast profits with minimal effort.

Trust: Professional-looking websites and fake credentials mimic legitimate brokers.

Hope: Many victims believe this is their chance to recover past losses.

Fear of Missing Out: Limited-time offers or “exclusive investor groups” push quick decisions.

The psychological manipulation is intentional. By the time a user realizes the trap, it’s often too late to retrieve their funds.

Comparing SpacBrokerage.com to Real Brokers

| Feature | Real Regulated Broker | SpacBrokerage.com |

|---|---|---|

| Regulatory License | Verified and publicly listed | None found |

| Client Fund Segregation | Kept in secure accounts | No mention |

| Transparent Fees | Fully disclosed upfront | Hidden and arbitrary |

| Withdrawal Process | Straightforward and timely | Complicated, delayed, or denied |

| Support Team | Verified and accessible | Scripted, evasive, or unresponsive |

This comparison highlights why SpacBrokerage.com fails every basic trust test of a genuine investment firm.

The Illusion of Professionalism

Scammers behind SpacBrokerage.com understand that appearance matters. The website is sleek, uses financial jargon, and includes fake charts that simulate market activity. However, beneath the polish, there’s no verifiable infrastructure—no platform backend, no client fund protection, and no legitimate trading data.

Even the design language and “partner logos” displayed on the homepage are often copied from real companies to enhance the illusion of legitimacy. This deception targets beginners and those unfamiliar with how to verify brokers properly.

Common Complaints from Reported Users

People who have interacted with SpacBrokerage.com have shared common issues across various online forums:

Funds showing as “locked” or “under verification.”

Repeated requests for more deposits to “complete withdrawal processing.”

Disappearing account managers after final payments.

Fake regulatory certificates and untraceable registration numbers.

Sudden suspension of accounts when users demand withdrawals.

These are classic indicators of investment fraud designed to keep users’ money within the platform for as long as possible.

How to Identify Similar Scams

Before engaging with any new trading or investment platform, consider the following steps:

Check Regulation: Verify the broker’s license with official financial authorities.

Research Reviews: Look for genuine user feedback on neutral review platforms.

Test Withdrawals: Start small and test withdrawal efficiency before scaling deposits.

Inspect Domain Data: Scam platforms often use newly registered or private domains.

Avoid Pressure: Legitimate brokers never rush clients to deposit quickly.

Following these checks can prevent falling into the same trap that SpacBrokerage.com sets for unsuspecting users.

Final Verdict: SpacBrokerage.com Is a High-Risk, Unverified Platform

After a detailed evaluation, SpacBrokerage.com appears to exhibit nearly every trait associated with fraudulent or unsafe online brokers. From fake testimonials and unrealistic profit guarantees to withdrawal restrictions and missing regulatory details, the platform’s behavior reflects a calculated attempt to deceive.

Investors seeking secure trading opportunities should look toward regulated, transparent institutions. A genuine broker does not need to hide its identity, fabricate results, or pressure clients to deposit funds.

Until SpacBrokerage.com provides verified registration, clear corporate identity, and proof of client fund security, it should be treated as untrustworthy and high risk.

How GainRecoup.com Helps Victims of Spacbrokerage.com

GainRecoup.com investigates spacbrokerage.com transactions, gathers evidence, and maps payment paths. Our recovery team liaises with banks, card networks, and exchanges, files chargebacks, and escalates complaints to relevant authorities. You’ll receive a tailored action plan, clear documentation, and persistent follow-up designed to maximize fund recovery and hold spacbrokerage.com accountable for victims.